The cash on the account is expected to be burned up by the end of September! Luckin Coffee submitted a prospectus for listing

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style)

Luckin Coffee is really going to go public.

Today, Luckin Coffee formally submitted a prospectus to the US Securities and Exchange Commission, intending to land on NASDAQ to raise US $100m. Lucky IPO, who has been stuck in the stage of rumors and speculation, finally got hammered.

In order to survive, or if private shareholders seek to unlock the trap, many companies that have accumulated a certain popularity will decide to list publicly in the capital market and raise funds from the public through the sale of equity. The US and Hong Kong stocks with lower thresholds will become the best targets.

As early as November 2018, Reuters reported that Luckin Coffee has put IPO on the agenda and is in preliminary discussions with overseas investment banks, eventually listing in 2019, most likely in Hong Kong or New York. In mid-January 2019, it was reported that Luckin Coffee planned to go to Hong Kong for IPO. Although repeated rumors have not been officially confirmed, the credibility of this category is usually very high, in addition to internal staff outflow, many of them are deliberately used to test the popularity of the market.

Therefore, Luckin Coffee's action is to be expected.

It can be called the "miracle" of the domestic coffee industry, financing wave after wave.

With the two magic weapons of "new retail" and "money burning" sweeping to 36 domestic cities in more than a year, Luckin Coffee, a "unicorn" emerging enterprise, can be described as a "miracle" of the domestic coffee market. Lucky's own public data also show that it wants to replace Luckin Coffee to become the largest chain coffee shop in China. As of December 2018, Starbucks has reached 12.54 million consumers, sold more than 89.68 million cups of coffee, and the repurchase rate within three months is more than 50%. The overall favorable rate is more than 99.6%, the average delivery time is only about 16 minutes, and the timeout rate is only 0.4%. The rapid growth of Ruixing made Starbucks, which has an unshakable position for more than 20 years, also looked at it, and had to join hands with Alibaba to launch a delivery service.

Ruixing mainly relies on money-burning subsidies to get new users, and active financing is also a reflection of its startup pedigree. In July 2018, Ruixing round A raised US $200m, and in less than half a year, it raised US $200m in round B financing in December, with the participation of pleasure Capital, Daishi Capital, GIC (GIC) and China International Capital Corporation. On this basis, Ruixing announced in April this year that it received a total of $150 million in new investment. The private equity fund managed by BlackRock, Starbucks' largest investor, invested $125 million.

The prospectus released today also revealed that Louis Dreyfus, the world's third-largest grain exporter and France's first grain exporter, reached an agreement with Lucky to set up a joint venture to build and operate a coffee roasting plant in China. As a prerequisite to the completion of this cooperation, after Luckin Coffee completes the initial public offering, Louis Dreyfus will buy a total of $50 million of Class A common shares at a price equivalent to the public offering price.

From the speed of financing, we can see that the capital is more optimistic about the future of Lucky. Lucky has also risen from an initial valuation of $1 billion to $2.9 billion today.

Burning money is not terrible, what is terrible is that there may be no future to make money.

Lucky's momentum looks good, but its losses are equally eye-catching. The astonishing "loss of 800 million in nine months" is still fresh in everyone's mind. In fact, Ruixing had a net income of 840 million yuan last year, compared with 479 million yuan in the first quarter of this year, an increase of nearly 36 times over the previous quarter. In spite of this, Ruixing, which made a net loss of 1.619 billion yuan last year, made a net loss of about 552 million yuan in the first quarter of this year, more than four times that of the previous quarter.

Once, Qian Zhiya thought that "every penny burned out can be exchanged for users. I want to let users know luckincoffee, experience luckincoffee, and like luckincoffee. I want to create a lot of opportunities for him." So it's worth it for us. " However, Ruixing lost 2.2 billion in its 18 months, and even proud user growth began to show weakness.

The prospectus used for listing can be said to be a promotional manual, which must describe the "highlights" of the issuing company in order to attract investors. But it is the data in this document that shows signs of stagnant growth in Lucky's income. The revenue in the first quarter of this year mentioned above was 479 million yuan, almost no increase compared with 465 million yuan in the fourth quarter of 2018. In terms of revenue from key coffee and beverages, the revenue in the first quarter of this year was 361 million yuan, compared with 347 million yuan in the fourth quarter of 2018.

In addition to income, the decline in consumer customers in the quarter also exposed Lucky's problems. The number of consumer transactions in the first quarter of this year was 43.42 million, down from 65.452 million in the fourth quarter of 2018, a drop of more than 30 per cent.

Lucky's number of new trading users shrank sharply this quarter. Photo Source: Silicon Man

Each cup of coffee sold on a loss of 18 yuan-now with a lot of subsidies are not enough to maintain the upward momentum, lucky how to turn the market to make a profit in the future?

If the listing is not successful, how much money can be burned?

Lucky CMO Yang Fei said: at present, the company's cash flow does not have any problems, it can remain unprofitable for 3 to 5 years, so it does not worry about the shortage of capital chain, and it will not become the next ofo. However, the above data released from the prospectus make people have to think that Ruixing is blowing an unrealistic "coffee dream".

As of March 31, 2019, the prospectus shows that Lucky's cash and cash equivalents have a total value of 1.159 billion yuan. What does that mean? In other words, at the current rate of burning money (2500 new stores will be opened this year! Lucky will burn all the cash in the account by the end of September this year.

It was exposed that the coffee machine was mortgaged to guarantee 45 million of the debt.

If the listing is unsuccessful, Ruixing faces various medium-and long-term debt pressures that make it even worse. The prospectus shows that it needs to pay as much as 812 million yuan in capital within a year, including 475 million yuan in operating lease commitments, 24 million yuan in decoration commitments, 66 million yuan in short-term bank loans, 147 million yuan in long-term loans, and 100 million yuan in coffee machine purchases.

Of course, it is not impossible to successfully go public with huge losses. If you look at the path taken by the older Uber, Ruixing is not without opportunities. In the past few years, the economy has improved. In order to compete with each other for international funds, exchanges have gradually relaxed the listing conditions, and many businesses can be listed even if they are losing money. But by 2019, when the Fed raises interest rates and tightens funding, coupled with changes in government policies, investors become conservative and financing may no longer be so easy to get.

In order to ensure the continuous chain of funds, listing is unstoppable. At that time, the Hong Kong media said that Ruixing was not good enough for the Hong Kong Stock Exchange, so will it succeed in going to the United States this time?

The picture is from: Silicon Man, Internet

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Global oversupply continues to drive down prices, with Arabica coffee changing from rising to falling

ICE Arabica coffee futures fell on Monday as technology weakness and global oversupply continued to weigh on the market, earlier climbing to their highest level in 10 days as technology weakness and global oversupply continued to weigh on the market. Cocoa and raw sugar prices also fell in New York. London

- Next

Prices plummet Latin American coffee industry is in crisis Colombian farmers switch to cocoa beans

Professional coffee knowledge exchange more coffee bean information Please pay attention to the coffee workshop (Wechat official account cafe_style) International coffee bean prices have fallen to a 13-year low, prompting many disappointed farmers in Central and South American countries to give up cultivation, triggering fears that the coffee industry will fall into crisis. Experts pointed out that the outlook for coffee bean prices will depend on the exchange rate trend of Brazil's Lille. New York

Related

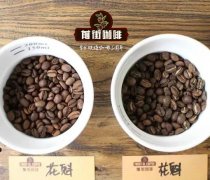

- What is the difference between Indonesian Sumatra Mantinin coffee and gold Mantinin? How to distinguish between real and fake golden Mantelin coffee?

- What does bypass mean in coffee? Why can hand-brewed coffee and water make it better?

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?

- How to make butter American/butter latte/butter Dirty coffee? Is hand-brewed coffee good with butter?

- Is Dirty the cold version of Australian White? What is the difference between dirty coffee/decent coffee and Australian white espresso?