Brazil Coffee Bean production cut Global Market supply tight Arabica Futures prices rise to four-year highs

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style)

According to OLAM, an international coffee trader, the drought in Brazil's coffee producing areas last year was a decline in Brazilian Arabica coffee bean production this year, and the world may have the biggest shortage of Arabica coffee beans in 20 years. OLAM expects Arabica production to be 35.5 million bags (60 kg / bag) this year.

At the same time of the decline in coffee bean production, some countries are slowly getting rid of COVID-19 to begin their economic recovery, the consumer demand for coffee is also increasing, the balance between global coffee supply and demand has become extremely fragile, and the supply market has begun to have strong concerns.

The chairman of CECAFE said that the current level of coffee stocks in Brazil is very low, which means that the market is difficult to withstand the impact of large-scale production cuts. Due to the shortage of supply, many coffee traders predict that the price of coffee will rise because of the shortage this year.

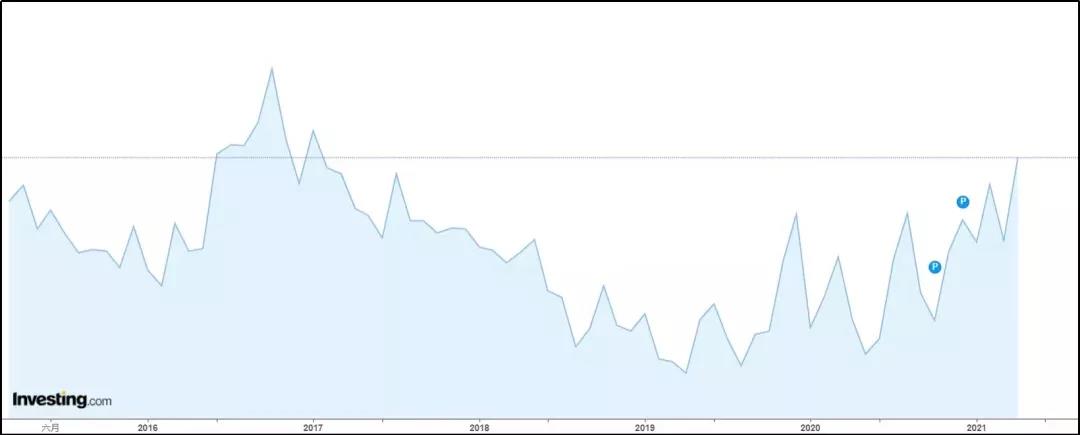

Last year, the benchmark price of international coffee futures was between 90 and 110 cents per pound, but this year it began to rise, showing 120 cents, then fluctuated between 120 and 140 cents, and is now back close to 140 cents. OLAM said tensions over coffee shortages will continue to push up coffee prices until 2022.

The July futures contract for Arabica coffee closed at 145.90 cents / lb on Thursday, April 28, US time, the second highest closing price since February 2017, when the highest closing price was 167.65 cents / lb, Reuters reported.

(Arabica futures price trend since 2015)

The rise was mainly due to strong concerns caused by coffee supply shortages and the recent strengthening of the Brazilian currency, the real. Brazil's currency, the real, rose to its highest level in nearly two and a half months on April 28. This appreciation has reduced the idea of coffee growers and traders selling coffee beans, thus boosting the price of Arabica.

For more boutique coffee beans, please add private Qianjie coffee on Wechat. WeChat account: kaixinguoguo0925

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Starbucks releases Q2 results for fiscal year 2021 Starbucks ready-to-drink coffee market share

Starbucks, the world's largest coffee chain, handed over another proud report card on April 28. Starbucks released its results for the second quarter of fiscal year 2021 ended March 28,2021. Starbucks 'net revenue for the second quarter was $6.668 billion, up 11.2% year-on-year, and net profit was $659.4 million, up 100.8% year-on-year, according to the earnings report. In terms of regional revenue,

- Next

Luckin Coffee, who has just raised money, is again sued for the development of Luckin Coffee Company.

I thought Luckin Coffee was about to turn around, but the next second Luckin Coffee was sued by US stock investors on April 29th. A lawyer revealed to the media that Luckin Coffee, who had just completed a new round of financing, was facing domestic litigation by investors. Dong Yizhi, a lawyer from Shanghai Zhengze Law firm, told the media that entrusted by Luckin Coffee's US stock investors, the legal team submitted to the Shanghai Financial Court

Related

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?

- How to make butter American/butter latte/butter Dirty coffee? Is hand-brewed coffee good with butter?

- Is Dirty the cold version of Australian White? What is the difference between dirty coffee/decent coffee and Australian white espresso?

- Relationship between brewing time and coffee extraction parameters How to make the brewing time fall to 2 minutes?

- Got entangled?! Lucky opens a new store, Mixue Ice City, and pursues it as a neighbor!