Loss of 64%! Behind Tims's listing in China, there are huge capital losses.

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style)

For more boutique coffee beans, please add private Qianjie coffee on Wechat. WeChat account: qjcoffeex

Today, it has been a month since Tims listed on Nasdaq in China. But so far, the coffee company, which is trying to become a second Starbucks, seems to have performed poorly in the US stock market.

On September 29th, 2022, the global coffee chain Tim Hortons China Business (referred to as Tims China) was listed on NASDAQ in the United States under the stock code "THCH". This is the second Chinese coffee company listed on NASDAQ after Ruixing. It was broken as soon as it went public in Tims China, and its closing price on the first day of the offering was down 8.76 per cent. The first day is already a downward trend, after the listing is also stumbling.

Tims China (THCH) was trading at $3.55 on Oct. 28, a discount of about 64% compared with the $10 listed SPAC shell company, according to Sina Finance. This magnitude of the decline, I am afraid to disappoint not only ordinary market investors, but also the capital behind Tims China-Descartes Capital Group.

Tim Hortons was founded in Canada in 1964. In 2018, Tim Hortons parent company RBI and Descartes Capital jointly established Tims China, and the largest shareholder is Descartes Capital Group. In 2019, Tim Hortons officially entered China and opened its first store in Shanghai's people's Square. Yes, just when Lucky was having a hot relationship with Starbucks China, Tims China just got the ticket.

Tims does not have a 3. 8 discount coupon, and a small red cup printed with maple leaves with a bagel covered with cheese has attracted a large number of young people. Some consumers think that Tims is a coffee shop, but it is more like a bakery because its bagel tastes much better than coffee. In the Little Red Book, some netizens even commented: "it is always for breakfast every day. I usually go to Tims to buy bagels and Manner to buy coffee."

According to network data, from 2019 to 2021, Tims China's revenue was 57.257 million yuan, 210 million yuan and 640 million yuan respectively, mainly from product sales of self-operated stores, franchise fees, other franchise business and e-commerce business. In 2021, the four major businesses accounted for 95.9%, 0.3%, 1.5% and 2.2% of revenue, respectively.

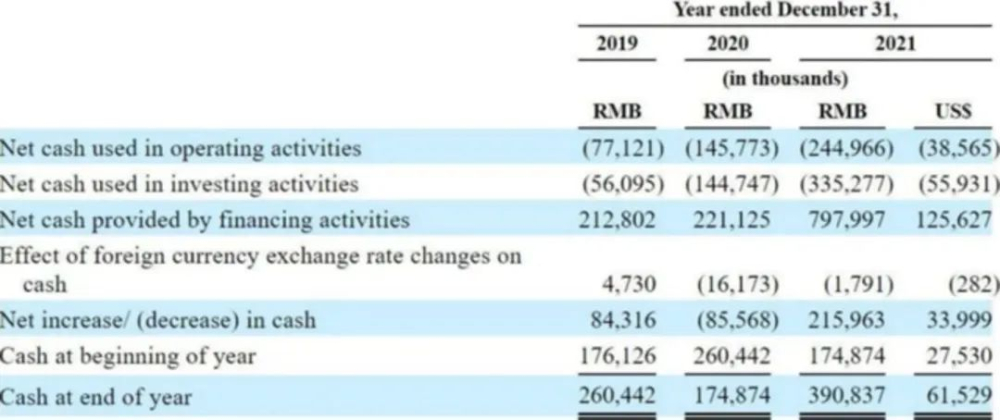

As can be seen from the above data, 2021 will be the fastest growing year for Tims China, with revenue surging 203%, more than triple that of 2020. However, the net loss has also doubled. From 2019 to 2021, the net loss of Tims China was 87.828 million yuan, 140 million yuan and 380 million yuan respectively. The net loss in 2021 was more than twice that of 2020, and the total loss in three years was more than 600 million yuan.

This situation is similar to that of a new tea brand-the more shops you open, the greater the loss. With regard to the problem of serious losses, Tims China explained that this was due to the rise in raw materials and the impact of the epidemic. Indeed, the establishment of Tims China coincided with the continuous rise in global coffee bean prices, especially this year due to the impact of weather epidemics and so on.

In the state of continuing losses, Tims China is still "burning money" to change its scale, and according to the plan of Lu Yongchen, head of Tims China Marketing, it will continue to sink to second-and third-tier cities, and it is expected that the number of Tims stores will increase to 2750 by 2026, which may not fail to make a more efficient strategic layout.

At the moment, Tims, with 500 stores, is far from taking advantage of scale. Listing is only the beginning, and there is no need to be too pessimistic about Tims, which suffered frequent declines in the stock market as soon as it was listed. After all, in this hot Chinese coffee market, it is possible for anyone to come to the end.

Photo Source: Internet

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Why do baristas like tattoos? Coffee tattoos recommended

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style) more boutique coffee beans please add private Wechat Qianjie coffee, WeChat: qjcoffeex recently in the coffee shop saw a scene that many baristas can not help but bleed: a customer

- Next

Coffee shop bar design suggestions recommend coffee shop bar decoration matters needing attention

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style) more boutique coffee beans please add private Wechat Qianjie coffee, WeChat: the soul of a coffee shop in qjcoffeex is the design of the bar. The bar is for guests to stay.

Related

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?

- How to make butter American/butter latte/butter Dirty coffee? Is hand-brewed coffee good with butter?

- Is Dirty the cold version of Australian White? What is the difference between dirty coffee/decent coffee and Australian white espresso?

- Relationship between brewing time and coffee extraction parameters How to make the brewing time fall to 2 minutes?

- Got entangled?! Lucky opens a new store, Mixue Ice City, and pursues it as a neighbor!