The world's largest coffee exporter is going to import coffee. What's going on?

Mention Brazil, samba, carnival and, of course, coffee.

With its unique geographical location and natural conditions, coupled with hundreds of years of coffee cultivation history and traditional skills, Brazil has always occupied the top export position in the world coffee market. But now that things have changed, they are also thinking about importing coffee.

The export volume of Brazilian coffee has always been unmatched by other regions. For 2016 alone, the top five exporters were Brazil, Vietnam, Colombia, Indonesia and Honduras. Among them, Brazil accounts for 15% of the world's coffee exports.

Exports are based on production, and Brazil also leads the world in coffee production. The top five countries in global coffee production in 2016 are in line with their exports, with Brazil and Vietnam firmly in the top two.

Now, Brazil wants to import coffee, and the preferred source is Vietnam. Brazilian coffee companies hope to import coffee beans from Vietnam to meet their production needs. Vietnamese coffee is good and cheap, and more importantly, it has a stable production, and the variety is in line with the shortage of Brazilian coffee varieties: Robusta.

Robusta and Arabica are the two major varieties of coffee in the world, and the ratio of them has been stable at about 4:6 for a long time. The main difference between the two lies in particle size and growth position. Arabica is a variety of Starbucks raw materials with high mountain beans, small grains and low caffeine content; Robusta is low mountain beans, medium grains, high caffeine content and "strong". It is also the raw material variety of Nestl é instant coffee and many coffee products manufacturers in Brazil.

In Brazil, both varieties of coffee are grown, with Arabica growing over a larger area along the south-eastern coast of Brazil, while Robusta is mainly concentrated in ESP í rito Santo and Rond ô nia. The Alabica growing area is in good weather this year, but the Robusta growing area is not so lucky.

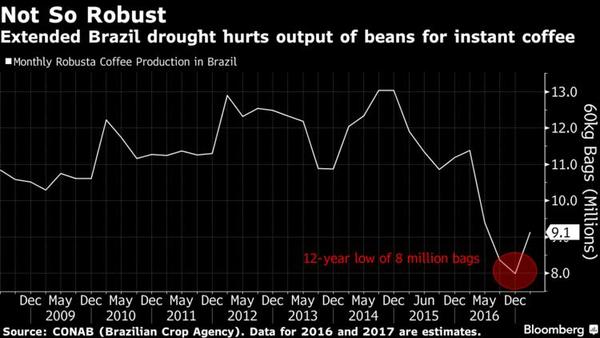

Production of Brazil's Robusta has fallen sharply recently because of days of drought. And this is not a short-term phenomenon. Brazil's Robusta coffee production has also experienced an overall decline in recent years. Since 2009, production has peaked at 1300 million bags (60 kg bags). In a normal year, Robusta's production has been stable at around 1100 million bags, while at the end of 2016, Brazil's Robusta production reached its lowest level in 12 years, producing only 8 million bags, which is difficult to meet demand, resulting in a continued rise in the price of raw beans in Brazil.

According to the official forecast of the Brazilian government, Robusta's annual production this year will maintain an annual growth rate of 21%, but the total production will still be below the all-time high. As a result, Temer's government intends to introduce foreign coffee, which has also caused different voices in Brazil.

Brazilian coffee product processors welcome Vietnamese coffee. For a long time, they are subject to local protection policies and can only use local Robusta as raw materials to make instant coffee. Now, once they liberalize the import of coffee raw materials, they have more choices. The use of lower-priced Vietnamese raw materials can also save costs.

But Brazil's local Robusta growers have expressed their dissatisfaction through various channels, saying repeatedly that they can complete the annual production as planned and will guarantee "the same price as Vietnamese coffee."

In a report earlier this year, Evair Vieira de Mello, a member of the Brazilian House of Commons representing ESP í rito Santo, the main producer of Robusta, told the Financial Times that the government's forecast of the inventory of Robusta in Brazil (less than 2 million bags) was wrong and that the actual inventory was 4.4 million bags, enough to supply the market.

The exchange of voices has intensified, and the Temer government, which is in a whirlpool of government trust, has not yet made a final decision. But there is a precedent for similar incidents. Last year, the Brazilian government granted a small authorization to buy coffee beans from neighboring Peru, but quickly cancelled it under pressure from local growers.

What will happen this time will only be revealed in time.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

The store is small, but it is enough to keep you from moving.

Don't like Xing Dad's fast food consumption pattern, just like that kind of small literature and art, occasionally can install a forced coffee shop, order a cup of coffee and a few plates of snacks, as if you can sit forever. There are many Keqiao coffee shops, but the style similarity is too high. In the vast coffee shop, fennel beans finally found their favorite coffee shop, Autumn Rain Coffee, which is small enough for me to move.

- Next

Inheriting a hundred years of quality and creating Yunnan Classics

Because of its romantic and unique fragrance, coffee is listed as one of the three drinks in the world and is loved by the world. Although coffee is imported, it is widely grown in Yunnan. At present, coffee growing areas in the province have spread all over nine prefectures, cities and 35 counties and districts, including Dali, Pu'er, Baoshan, Dehong, Lincang, Wenshan, and Xishuangbanna, accounting for more than 99 percent of the country's output and about 1 percent of the world's total output.

Related

- Can lightly roasted coffee beans be used to extract espresso? How finely should you grind high-quality coffee beans to make Italian latte?

- What is the difference between the world's top rose summer coffee and Yejia Shefi? What are the flavor characteristics of Yega Shefi coffee and Panama rose summer?

- The ceremony is full! Starbucks starts to cut the ribbon at a complimentary coffee station?!

- A whole Michelin meal?! Lucky launches the new "Small Butter Apple Crispy Latte"

- Three tips for adjusting espresso on rainy days! Quickly find the right water temperature, powder, and grinding ratio for espresso!

- How much hot water does it take to brew hanging ear coffee? How does it taste best? Can hot water from the water dispenser be used to make ear drip coffee?

- What grade does Jamaica Blue Mountain No. 1 coffee belong to and how to drink it better? What is the highest grade of Blue Mountain coffee for coffee aristocrats?

- What are the flavor characteristics of the world-famous coffee Blue Mountain No. 1 Golden Mantelin? What are the characteristics of deep-roasted bitter coffee?

- Can I make coffee a second time in an Italian hand-brewed mocha pot? Why can't coffee be brewed several times like tea leaves?

- Hand-brewed coffee flows with a knife and a tornado. How to brew it? What is the proportion of grinding water and water temperature divided into?