Chinese mainland is the largest acquisition in the company's history, and the Starbucks market will be fully and directly operated.

Follow the caf é (Wechat official account vdailycom) and found that Beautiful Cafe opened a small shop of its own.

How much is a Starbucks store worth?

On the evening of the 27th, Starbucks broke the news that it would buy the remaining 50% of Starbucks' joint venture in East China market for about $1.3 billion in cash. Take 100% ownership of about 1300 stores in Jiangsu, Zhejiang and Shanghai, that is, the Chinese mainland market will be fully directly operated.

one

Starbucks Coffee (Nasdaq: SBUX) announced a formal acquisition agreement with its longtime joint venture partners Uni-President Enterprise Co., Ltd. ("Uni-President") and Uni-President Superstore Co., Ltd. ("Uni-President").

The remaining 50 per cent of Starbucks' joint venture in eastern China will be acquired for about $1.3 billion in cash. Take 100% ownership of about 1300 stores in Jiangsu, Zhejiang and Shanghai, and operate and manage the entire Chinese mainland market.

This is Starbucks's largest acquisition to date. Uni-President's withdrawal means that Chinese mainland will have nearly 2800 Starbucks stores.

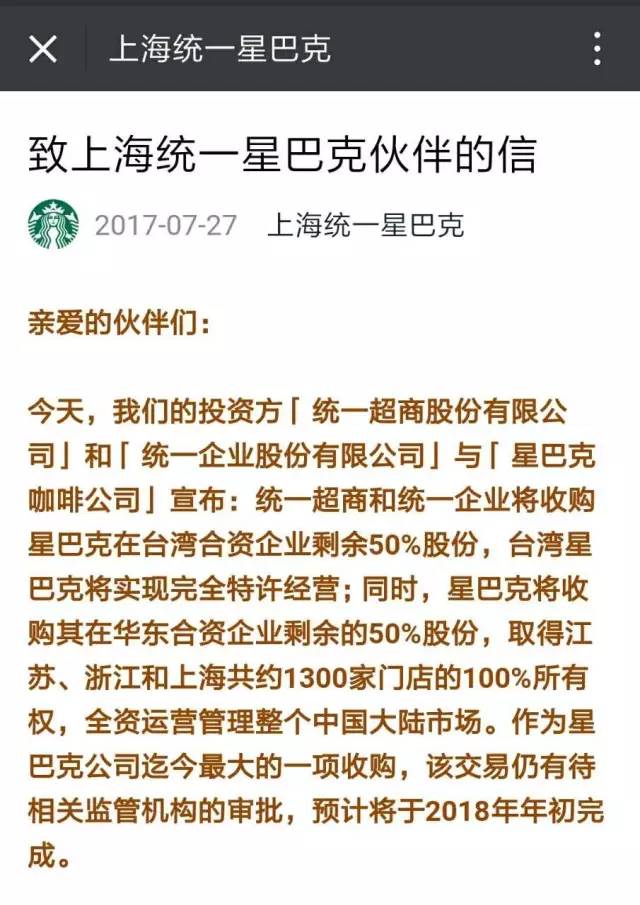

▲ official message from Shanghai Unified Starbucks to its partners

"the overall direct management of the entire Chinese mainland market has deeply fulfilled our commitment to this market and demonstrated our confidence in the local management team." Kevin Johnson, president and CEO of Starbucks Coffee, said he reiterated his goal of increasing the number of stores to 5000 by 2021.

The announcement also shows that Uni-President and Uni-President will acquire the remaining 50 per cent of Taiwan's Uni-President Starbucks ("Taiwan Starbucks") for about $175 million, thus owning 100 per cent of Starbucks' operating rights in the Chinese Taiwan market. Starbucks in Taiwan was founded in 1997 and currently has about 410 stores in the Taiwan market.

The deal is still subject to regulatory approval and is expected to be completed in early 2018.

two

This is not the first time Starbucks has acquired a store from a partner.

It is understood that Starbucks' layout in China initially adopted the model of granting agency rights and joint ventures.

The agency authority of Hong Kong and Guangdong has been granted to Hong Kong Meixin Group; Taiwan and Jiangsu, Zhejiang and Shanghai have adopted the mode of joint venture with Taiwan Unification Group; the agency in northern China, mainly Beijing and Tianjin, has been granted to Handing Asia-Pacific Investment Company and Beijing Sanyuan Group (now Shounong Group), and the two sides have jointly established Beijing Meida Coffee Co., Ltd.

As early as 2006, Starbucks announced that it had acquired a 90% stake in Meida Coffee from Handing Asia Pacific; in 2007, Sanyuan Group, which holds a 10% stake, also withdrew, thus completing the direct operation of Beijing, Tianjin and other North China markets.

Starbucks bought a stake in Meixin's stores in southern China in 2011 as part of a plan to increase the number of stores in mainland China to 1500 by 2015.

▲ is constantly working hard to achieve direct marketing.

The acquisition of stores in Jiangsu, Zhejiang and Shanghai from Uni-President is an extremely important step for Starbucks.

East China is a very important market for Starbucks in China. Shanghai has nearly 600 Starbucks stores, which is currently the city with the largest number of Starbucks stores in the global market.

This opens an exciting new chapter for Starbucks China. The comprehensive direct marketing model will enable us to fully rely on the existing strong business foundation to provide customers with higher quality coffee, third-space experience and digital innovation, and further enhance the career development of our partners. " Wang Jingying, chief executive of Starbucks China, said.

"We are eagerly looking forward to extending Starbucks' outstanding talent development program to the entire Chinese market, and continue to increase investment to help Chinese market partners realize their personal and professional dreams."

three

Chinese mainland is constantly betting on the Starbucks market to meet the opportunities and challenges that are coming.

On the one hand, according to Starbucks 2017Q2, profits in China / Asia Pacific grew by 36%, much faster than in the Americas and EMEA (Europe, Middle East, Africa) markets.

Obviously, Starbucks has high hopes for this market to become a new source of profit growth. The vision of operating more than 5000 stores on Chinese mainland in 2021 is a case in point. Starbucks Board Executive Chairman Howard Schultz once said: "in the future, Starbucks China is likely to overtake the United States to become Starbucks' largest market in the world."

On the other hand, the tide of new tea and boutique coffee is also surging in this land. New tea and coffee brands are trying to snatch young consumers who want to enter Starbucks. Starbucks is speeding up its upgrade and evolution--

For example, deep ploughing product power, represented by "air-cooled cold extract coffee", shows the R & D strength of both professionalism and investment, leading the market popularity.

Air-cooled extraction of ▲ Starbucks

For example, open more selected stores. While taking the experience a step further, consumers are encouraged to sit at the bar and taste a cup of flavored coffee in communication with their partners. Of course, there is also a huge project with a total floor area of 2700 square meters, which will be opened in Shanghai at the end of the year.

This acquisition will help it to make market decisions consistent and respond more quickly.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

From Beethoven to David Lynch, how do coffee-obsessed geniuses drink coffee

There are all kinds of legends about coffee addicts, perhaps the most famous being Balzac, who said he drank tens of thousands of cups of coffee when he wrote "Human Comedy," which adds up to 50 cups a day. There is a saying that if a person drinks 80-100 cups of coffee in a row, it will be fatal. I hope no one will try it in person. [1] Bach once wrote a short music about the coffee craze.

- Next

What does it mean for Unification that Starbucks wants to take back control?

Follow Kaipai (Wechat official account vdailycom) found that Beautiful Cafe opened a small shop of its own on July 27, that is, last night, Starbucks announced that it had formally reached its largest acquisition agreement to date with its long-time joint venture partners Uni-President Enterprise Co., Ltd. (unified Enterprise) and Uni-President Superstore Co., Ltd. (unified superstore), at a price of US $1.3 billion.

Related

- Workers collapse! Lucky suspects that it will introduce freshly cut fruits?!

- 1-point subsidy recipients wear thousand-yuan watches?! Local response: For low-income households

- Can lightly roasted coffee beans be used to extract espresso? How finely should you grind high-quality coffee beans to make Italian latte?

- What is the difference between the world's top rose summer coffee and Yejia Shefi? What are the flavor characteristics of Yega Shefi coffee and Panama rose summer?

- The ceremony is full! Starbucks starts to cut the ribbon at a complimentary coffee station?!

- A whole Michelin meal?! Lucky launches the new "Small Butter Apple Crispy Latte"

- Three tips for adjusting espresso on rainy days! Quickly find the right water temperature, powder, and grinding ratio for espresso!

- How much hot water does it take to brew hanging ear coffee? How does it taste best? Can hot water from the water dispenser be used to make ear drip coffee?

- What grade does Jamaica Blue Mountain No. 1 coffee belong to and how to drink it better? What is the highest grade of Blue Mountain coffee for coffee aristocrats?

- What are the flavor characteristics of the world-famous coffee Blue Mountain No. 1 Golden Mantelin? What are the characteristics of deep-roasted bitter coffee?