Luckin Coffee is like a "virus". He doesn't know where he came from, but he blossoms everywhere.

Professional coffee knowledge exchange More coffee bean information Please pay attention to coffee workshop (Weixin Official Accounts cafe_style)

It's only a year and a half at most since you heard the name "Little Blue Cup." I believe you should be familiar with the four words "Ruixing Coffee" in the last year. Even overseas Chinese can see Ruixing Coffee, which claims to "defeat Starbucks and become China's first chain coffee shop" in 2020, from time to time on foreign media across the strait.

An average of 5.5 hours to open a new store, Ruixing Coffee burns money to fight "subsidy war"

At the beginning of April 2019, Ruixing Coffee obtained RMB 45 million in cash with hundreds of "money-making tools" such as coffee machines and milk boxes as collateral, which caused an uproar in the market and questioned whether the unicorn coffee shop, which claims to operate under the "technology-driven new retail model", has come to an end. Just as supporters and skeptics were deadlocked, on May 17,2019, Ruixing Coffee officially listed on the New York Stock Exchange after an initial public offering valuing the company at about $4 billion, rising 20% on its first day of trading.

Whether Ruixing Coffee really focuses on "short-term speculation" as Starbucks CEO Kevin Johnson describes it, or "Ruixing Coffee is just a financial project that uses coffee chain as props," as many business reviews describe it, the Timeline from Ruixing's founding to listing shows that Ruixing Coffee is really powerful.

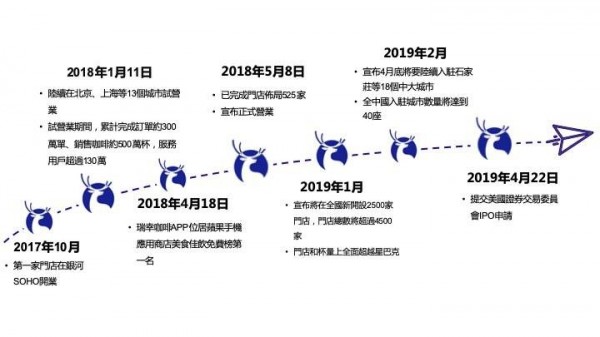

Registered in June 2017, Ruixing Coffee only opened its first store in October 2017 and started trial operation in January 2018; it opened more than 2,000 stores in just one year, with 2,370 stores (equivalent to one store every 5.5 hours) by the end of March 2019 and an estimated 4,500 stores by the end of 2019. By contrast, Starbucks, which has been in the Chinese market for 20 years, currently has about 3,700 stores in more than 150 cities in China, while Costa from the UK has less than 500 stores.

However, judging from the financial figures, Lucky Coffee is not so strong. In order to achieve a perfect balance between product, price and convenience, Ruixing Coffee takes advantage of the core idea of "unlimited scenario", uses the way of big two subsidies and App ordering delivery, more than 2,000 stores have served more than 10 million consumers in a short time, selling more than 80 million cups of coffee in total; It is not known for sure whether consumers who drink their first cup of Ruixing coffee at a relatively low price because of subsidies will "buy back".

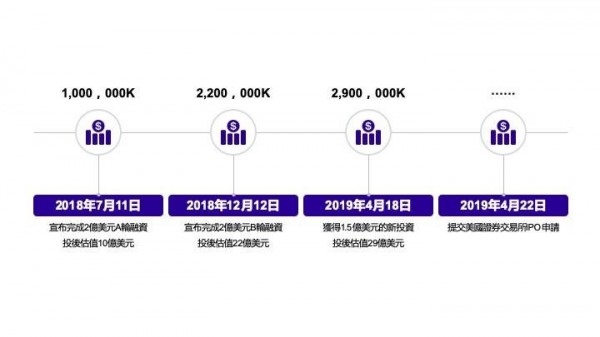

What you can know is the amazing figures that have been shown on the application for a US IPO: Ruixing Coffee's net revenue in 2018 was Rmb840m, compared with a net loss of Rmb1.62bn; net revenue for the year ended March 31 in 2019 was Rmb480m, compared with a net loss of Rmb550m. In other words, from January 2018 to now, Ruixing Coffee has "burned" more than RMB 2.2 billion; although Ruixing Coffee has been valued at US $2.9 billion after BlackRock's investment of US $125 million, it is a necessary way to obtain more "bullets" through open market issuance under great financial pressure.

China's coffee market has unlimited potential

Seeing such terrible numbers, should we worry that Ruixing Coffee, which has burned a lot of money, will eventually become a thing of the past like the "shared bike" of the past? The author is quite optimistic in this regard, and the following points are provided for consideration:

1. Qian Zhiya, founder and CEO of Ruixing Coffee, used to be the chief operating officer of "Shenzhou Youche," and Yang Fei, co-founder and CMO, was the promoter of flow pool theory; Liu Zhengyao, the earliest angel investor of Ruixing Coffee, was not only the largest individual shareholder of Ruixing Coffee, but also Qian Zhiya's superior and master in Shenzhou Youche in the past; Dazheng Capital, Pleasure Capital, Singapore Government Investment Company and Junyi Capital participated in Series A financing and had cooperative relationship with Liu Zhengyao during the period of Shenzhou Automobile; Ding Wei, president of CICC Capital who participated in Round B, is also an independent director of China Car Rental. In other words, Ruixing Coffee is a "typical Chinese-style capital-supported company". With these "insiders" mentioned above and the "experience of China" that has seized the market through substantial subsidies in the past, Ruixing Coffee's operation team is actually not unaware of the risks that may arise from its high subsidies.

2. Some people also saw BlackRock, which holds 80.8 million shares of Starbucks, join Ruixing Coffee's B+ round of financing, and began to worry about whether BlackRock, which fully supported Starbucks in the past, would change its mind? Don't worry! BlackRock's participation has two meanings: first, according to Frost & Sullivan's report, the average number of coffee cups consumed by Chinese people per year in 2018 was 6.2 cups, which is expected to grow to 10.8 cups by 2023, compared with 867.4 cups in Germany, 383.3 cups in the United States and 249.5 cups in Hong Kong; In other words, there will only be more people drinking coffee in China in the future, as long as BlackRock continues to hold shares in Starbucks and Luckin Coffee, he will make money wherever Chinese consumers go (BlackRock invests in "racetracks" rather than "racers")! However, it is unclear whether the ultimate beneficiary and winner will be Ruixing Coffee or Starbucks when the market size grows several times. Second, because Ruixing Coffee finally chooses to IPO in the United States, the biggest role of BlackRock's participation is to help Ruixing Coffee obtain the endorsement of mainstream investors in the United States, which will be of great help to the follow-up development of IPO; only, a new round of trade war between China and the United States begins, whether Ruixing Coffee's calculation can come true or not remains to be tested.

3. Based on the success of Shenzhou Youche in using "fission and innovation" and "high subsidies","Ruixing Coffee" initially attracted consumers who "may not have developed the habit of drinking coffee" in this way. However, as described in the "Leaky Bucket Theory" in relationship marketing,"fission and new" and "high subsidies" can only make the faucet filled with water at the top (i.e. new customers) fill more water into the bucket. If Ruixing Coffee cannot make the hole at the bottom of the bucket smaller (i.e. customers who have drunk Ruixing Coffee with ultra-low amount but have not continuously purchased), the water level of the bucket is still impossible to rise. At present, the successful listing of Ruixing Coffee can be regarded as successfully turning on the faucet, and basically can ensure that the faucet flows continuously, as for how to "fill the hole" in the future depends on the wisdom of the management team.

4. Is there any way for the "catering industry" like "Ruixing Coffee" to "monopolize the market" through high subsidies? Will one day, a more powerful subsidy of "small lucky coffee" born, lucky coffee hard to lay down the market, this hand? The author believes that, to a certain extent, Ruixing Coffee now uses all the means of "fission and innovation", one of which aims to "create the illusion that the market is crowded". Through such an illusion, competitors who want to enter the market for a share may give up because the "cost" and "risk" they need to bear are too high; of course, such a situation has to come true under the condition that Ruixing Coffee has "deep pockets".

So the next big question for Lucky is how to start making money. Once the discount is cancelled, will customers who like Lucky's discounted coffee be willing to pay full price?

END

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Starbucks officially opened its first sign language store in Guangzhou today.

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style) May 19 is the 29th national day of helping the disabled. On the same day, Starbucks China's first sign language store opened in Guangzhou. In this store, hearing impaired baristas work side by side with ordinary baristas. Starbucks has more than 3800 stores in China, which is probably the most

- Next

How does the origin of coffee affect the chemical composition and traceability of coffee beans?

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style) do you have a favorite coffee producing area? Brazil, Kenya, Ethiopia? Why do you need to care which country the coffee comes from? The most important reason is that even the same variety of coffee will produce different chemical composition depending on where it is planted.

Related

- What is the difference between Indonesian Sumatra Mantinin coffee and gold Mantinin? How to distinguish between real and fake golden Mantelin coffee?

- What does bypass mean in coffee? Why can hand-brewed coffee and water make it better?

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?

- How to make butter American/butter latte/butter Dirty coffee? Is hand-brewed coffee good with butter?

- Is Dirty the cold version of Australian White? What is the difference between dirty coffee/decent coffee and Australian white espresso?