Ruixing Coffee is currently in a situation where Ruixing Coffee has reached a restructuring support agreement with creditors after bankruptcy

At the end of 2020, the US Securities Regulatory Commission (SEC) filed a complaint against Luckin Coffee, alleging that his financial affairs were fraudulent. In retrospect, it has been nearly a year since the initial outbreak of Luckin Coffee's case. Although Lucky continues to make up for the negative impact caused by fabricated transactions, the matter has not been finally resolved.

After Luckin Coffee filed for bankruptcy, another major incident occurred on the evening of March 16. Luckin Coffee announced on his website that he was conducting exclusive negotiations with investors on financing of at least 250 million US dollars.

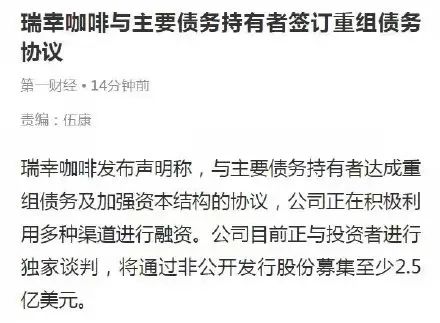

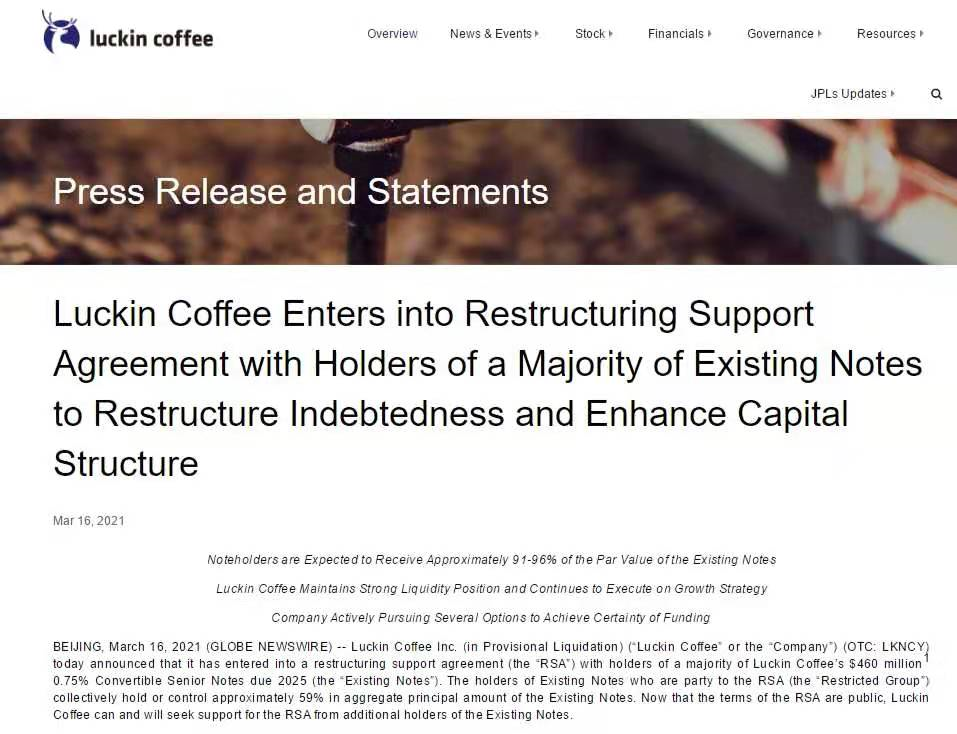

Luckin Coffee has reached agreements with major debt holders to restructure debt and strengthen the capital structure, according to China Finance and Finance. Most of the holders who hold 10.75% of their $460 million of convertible preferred notes due in 2025 have signed restructuring support agreements, which are expected to receive 91-96% of the face value of existing bills.

At the same time, the announcement also disclosed a suspected debt-to-equity swap plan.

According to the announcement, if Lucky is able to raise $50 million or more of equity before the effective date of the restructuring, each holder of existing instruments will have the option to replace the principal amount of $50 million of new note A for every $230new note An in the form of American depositary shares or note B and / or cash, subject to a top-up mechanism that guarantees a recovery rate of 150 per cent of the conversion amount.

Lucky also indicated that as of February 28, 2021, the Company's unaudited consolidated cash balance (excluding restricted cash and illiquid investments) was approximately $775 million.

Luckin Coffee also said in a statement: the company is actively using a variety of channels for financing and is currently conducting 30 days of exclusive internal discussions with a reliable investor with a view to raising at least $250 million in equity financing through private financing.

In addition, in the near future, Luckin Coffee will also start the application process related to reducing the registered capital and remittance of companies in China in accordance with Chinese law, and the reduced funds will be used to fulfill the debt obligations under the agreement.

Luckin Coffee's official website

With regard to the above news, Ruixing said that the restructuring support agreement will not affect cooperation with existing suppliers and partners, and Ruixing Coffee will fulfill its payment obligations to suppliers on time. Luckin Coffee Chairman and CEO Guo Jinyi said, "Lucky's board of directors and management team agree that restructuring the support agreement is a win-win result, and the company will continue to take positive measures to improve its capital structure in the future. At the same time, we continue to provide customers with excellent products and services. "

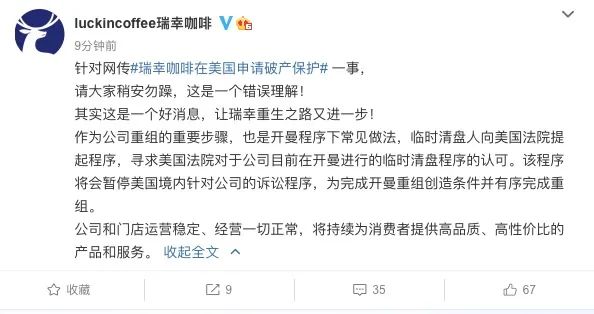

On February 5, 2021, Luckin Coffee suddenly filed for bankruptcy protection, coupled with the fact that there had been infighting among senior staff before, which made everyone think that Luckin Coffee was going to get cold, but soon, Luckin Coffee responded by releasing a message on the official Weibo: applying for bankruptcy protection is good news. At the same time, Luckin Coffee also stressed that the company and stores operate stably and everything is normal. Will continue to provide consumers with high-quality, cost-effective products and services, this does not make everyone panic.

In addition, Luckin Coffee spent $180 million (1.175 billion yuan) on the "scandal" on December 17 last year, mainly to settle with SEC over suspected financial fraud of some former employees, but the settlement had not yet taken effect. It was not until the evening of February 8 this year that the court agreed to Luckin Coffee's settlement with SEC with compensation of 180 million US dollars. To a large extent, the court's decision allowed Luckin Coffee to avoid administrative punishment and maintain the normal operation of the company at the lowest cost. However, after the fine of nearly 1.2 billion days, Luckin Coffee still faces securities class action by investors (civil lawsuit) and charges against senior executives by the US Department of Justice (criminal lawsuit), which may take at least 2 to 3 years, while criminal cases may take longer.

When on earth will Luckin Coffee's "scandal" subside?

* Image source: Internet

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Is tea famous? Xicha Wandian palm face recognition monitoring official response did not illegally collect information

On the morning of March 16, Xi Tea quickly entered the hot search list of Weibo for the topic of "using Wandian palm camera". March 15 is the annual 315 International Consumer Rights Day. At the 315th evening, CCTV exposed a number of well-known brands using face recognition cameras of Suzhou Wandian Network Technology Co., Ltd.

- Next

Robusta coffee beans prices of Robusta coffee beans in Vietnam continue to rise

According to Simexco, coffee production in Vietnam is expected to decrease by 10 to 27 million bags compared with the 30 million bags produced by 2020 Lexi 22. The decline in production means that the price of robusta coffee beans in Vietnam will continue to rise. According to foreign media reports, the price of Vietnamese curry rose from 3.18 to 32300 dong per kilogram last week to 3.21 to 32800 dong. A Vietnamese coffee

Related

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?

- How to make butter American/butter latte/butter Dirty coffee? Is hand-brewed coffee good with butter?

- Is Dirty the cold version of Australian White? What is the difference between dirty coffee/decent coffee and Australian white espresso?

- Relationship between brewing time and coffee extraction parameters How to make the brewing time fall to 2 minutes?

- Got entangled?! Lucky opens a new store, Mixue Ice City, and pursues it as a neighbor!