Coffee brand Copper Cow Coffee received $8.5 million in financing! A Collection of Coffee financing events

On May 5th, another coffee brand in the coffee industry received financing.

The brand comes from Copper Cow Coffee, a Vietnamese coffee brand.

Vietnamese coffee brand Copper Cow Coffee announced that it has received $8.5 million in round A financing, which is led by Cultivian Sandbox and Arborview Capital, followed by Siddhi Capital, Silverton Partners and other institutions.

It is understood that the financing funds will be used to support distribution expansion and product innovation.

Data show that Copper Cow Coffee is headquartered in Los Angeles, the founder of Vietnamese-American Debbie Wei Mullin, as a Vietnamese coffee brand focused on sustainable development, Copper Cow Coffee's main products are hanging-ear coffee and condensed milk, mainly sold to consumers throughout the country through retailers such as Wal-Mart.

The brand practices organic agriculture and processing on its farms in Vietnam and says it will continue to purchase sustainably. in addition, the founder combines the love of Vietnamese coffee culture with the concept of sustainable development into entrepreneurial ideas.

At present, Copper Cow Coffee also provides subscription services, such as the choice of a variety of natural flavors of coffee.

According to relevant reports, Copper Cow Coffee's revenue has tripled every year since the launch of the brand, and its fastest growing business channel is subscription services, where users can rotate to choose natural flavor coffee products.

After introducing the Copper Cow Coffee coffee brand, back to the beginning, the first sentence used "again", because in the past year or two, there have been a lot of new players in the coffee industry, and at the same time, there are not a few coffee brands that have received financing.

So far, there have been eight financing incidents in the coffee market this year.

M Stand, a local coffee chain founded in 2017, completed a round of financing of 100 million yuan on January 15.

(the portal pokes here: another local boutique coffee chain brand has completed 100 million yuan financing! )

On February 26th, Canadian coffee brand P "Tim Hortons" received the second round of financing led by Sequoia Capital China Fund, increased holdings by Tencent and followed by Zhong Ding Capital.

(the portal pokes here: re-financing, Tim Hortons plans to add 200 stores! )

On March 3, the new coffee brand "Shijie SECRE" completed tens of millions of yuan A + round financing.

(the portal pokes here: in less than a year, the coffee brand has once again completed tens of millions of yuan of A + round financing.)

On March 4th, domestic boutique chain brands completed A+ round financing on behalf of "MANNER".

(poke here at the portal: coffee brand MANNER is getting a new round of financing, and the coffee market is getting bigger and stronger! )

On March 31, the head brand of domestic hanging-ear coffee "Sumida Kawa Coffee" completed nearly 300 million yuan B round financing.

(the portal is poked here: Sumida, the head brand of hanging-ear coffee, has received another capital support to complete 300 million financing! )

On April 15, when Luckin Coffee received its first round of financing after the financial scandal, Luckin Coffee agreed a new round of financing totaling 250 million US dollars with Dawei Capital and pleasure Capital.

(the portal pokes here: 250 million US dollars of financing is easy to get, Luckin Coffee can be saved? )

On April 17th, the new sharp coffee chain brand "algebraist coffee Coffee" announced that it had completed tens of millions of yuan A round financing by the end of 2020.

(the portal pokes here: another new coffee brand gets tens of millions of yuan A round financing! )

Looking back to 2020, according to statistics, the sales of China's coffee market exceeded 11.5 billion US dollars in 2020. In addition, more than 10 coffee brands received financing events.

Judging from the course of the above financing development, the competition in the coffee market is becoming more and more fierce. previously, people in the industry expected that the scale of the domestic coffee market would exceed 100 billion yuan in 2021.

It is worth noting that since Luckin Coffee fell from the altar last year, new coffee brands in the coffee industry, such as Sandun, Yongpu, Shizui, Sumida, and chain coffee brand manner, have announced large amounts of financing, and some coffee brands have also raised two or three rounds of investment, while Starbucks, Tim Hortons and Peet's Coffee have also been favored by capital in terms of big brands. Starbucks and Sequoia continued to work together last year. Tim Hortons China has announced that it has received investment from Tencent, raising tens of millions of yuan, and Peet's Coffee has partnered with Hillhouse Capital to enter the Chinese coffee market.

So, what exactly does capital have in mind about coffee?

On the one hand, coffee has always been the darling of capital.

In the case of Luckin Coffee, Luckin Coffee is regarded as "Luckin Coffee" who is "ripe" by capital. from the initial establishment of Ruixing to its listing, he has obtained wave after wave of financing. At the same time, not long ago, Luckin Coffee also returned to the capital line of vision. Access to 250 million dollars of financing from Dawei Capital and pleasure Capital, although the news of Ruixing's financial fraud shocked the capital market, the capital never left. On the contrary, it is more active to enter the coffee market, which can also be known in addition to Luckin Coffee, multiple rounds of financing from MANNER and Tencent's investment of hundreds of millions of dollars in Tim Hortons China.

On the other hand, the coffee market is still profitable.

Today, the coffee market still has a lot of room for development and is in a period of rapid development. The data show that the size of the domestic coffee market will exceed 100 billion yuan in 2021, implying that a new coffee market is brewing, coupled with the low threshold for entry into the coffee industry, which also attracts a strong increase in capital.

Now driven by capital, what kind of competition the coffee market will usher in, we might as well wait and see.

* Image source: Internet

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

How about Shanghai Robot Cafe? coffee brewing time in fully automatic intelligent coffee shop

The unmanned cafe is back. During the recent May Day event, a "mobile intelligent cafe" appeared in the Shanghai International Fashion Center. It is said that this coffee shop is also an unmanned coffee shop, so it has attracted the attention of many consumers. The barista in the store is a mechanical arm made of steel. Consumers scan the QR code to enter a smart cafe called Botai Mobile to Xiao Cheng.

- Next

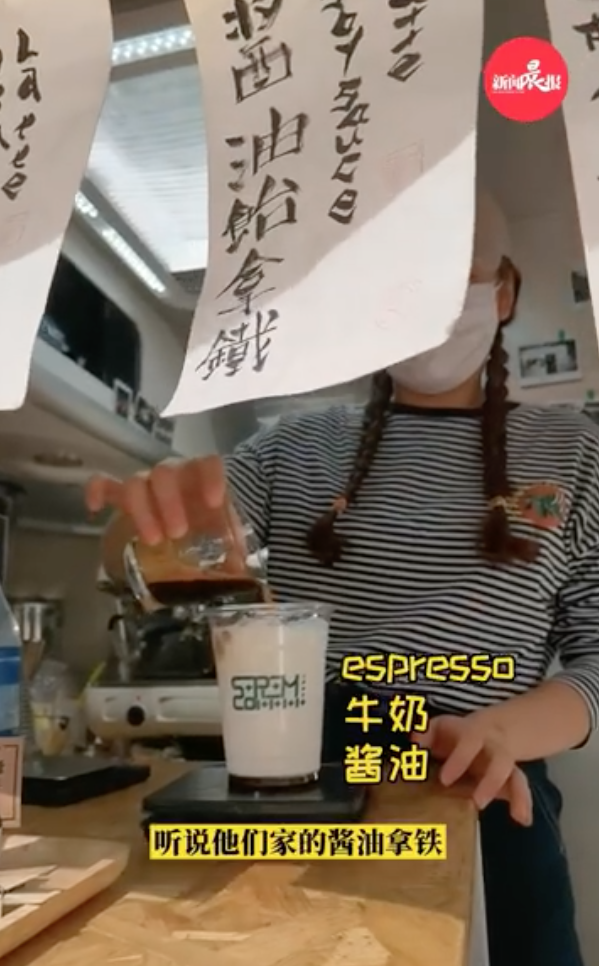

What's the taste of coffee made with soy sauce?! Coffee brand Shanghai Shitengjia soy sauce Yee latte tastes good

During May Day this year, the first Sinan Coffee Life Festival ushered in a number of boutique coffee brands, among which there is an interesting topic on Weibo: Shanghainese use soy sauce to make coffee. As we all know, spicy soy sauce is a major specialty of Shanghai, but it is really wonderful to use soy sauce to make coffee. According to reports, people who use soy sauce to make coffee

Related

- What is the difference between Indonesian Sumatra Mantinin coffee and gold Mantinin? How to distinguish between real and fake golden Mantelin coffee?

- What does bypass mean in coffee? Why can hand-brewed coffee and water make it better?

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?

- How to make butter American/butter latte/butter Dirty coffee? Is hand-brewed coffee good with butter?

- Is Dirty the cold version of Australian White? What is the difference between dirty coffee/decent coffee and Australian white espresso?