Colombian coffee prices rise due to tight supply of Colombian caffeine

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style)

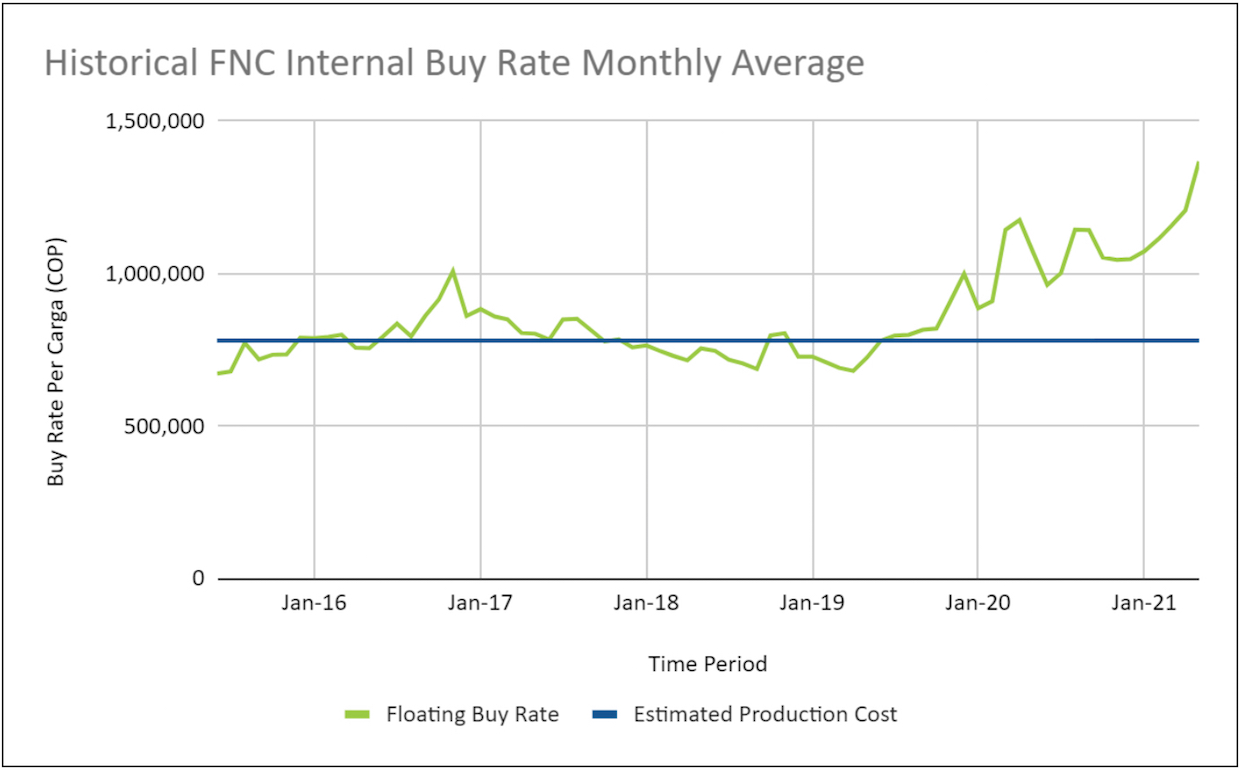

Since the outbreak of COVID-19 at the end of 2019, the price of coffee in Colombia has taken people by surprise.

In March 2020, international oil prices suddenly plummeted, and the Colombian peso depreciated by nearly 25% against the dollar. Since coffee beans usually use US dollars as the trading currency in the international market, the coffee industry can benefit from exchange rate arbitrage. However, even as the Colombian peso has rebounded against the dollar, coffee prices have remained high over the past 14 months.

With large-scale protests over tax reforms in Colombia, domestic transportation has been disrupted, supply chains have been severely disrupted and prices have soared again. Although the protests were later suspended, FNC had said it would take three to four months to fully resume coffee exports. In early May, FNC broke the ceiling, offering coffee growers a high price of 1.44 million pesos ($386a carga), up 34 per cent from the start of the year.

Before that, however, the Colombian coffee industry had been struggling financially, with growers struggling to make a living, or even giving up growing coffee altogether. This has strengthened the determination of the Colombian authorities to intervene in the market. A coffee price stabilization fund with a budget of 218 billion Colombian pesos (about US $64 million) was launched in March 2020 to protect hundreds of thousands of coffee growers in Colombia from commodity market volatility.

However, due to the continued record prices, the fund has not been affected since its inception.

Internal price and stabilization fund

There are more than 500000 small coffee farms called "fincas" in Colombia, which are scattered across the map. Most small coffee farms do not produce enough to supply private buyers directly, so they can only seek help from intermediaries. For example, the Colombian growers' Union (FNC), or the local cooperative.

Both FNC and local cooperatives offer fluctuating internal purchase prices to producers. In addition to the relationship between supply and demand, there are many factors that can affect prices. These include: the exchange rate of the Colombian peso (COP) to the dollar (USD), as well as futures contracts.

However, because the price is often lower than the cost of planting, it has made it difficult for small coffee farms across Colombia to survive the second five years of the previous decade.

Data from: Federacion Nacional de Cafereros de Colombia

The $64 million fund launched by the Colombian government in March 2020 serves as a support when the price is below cost, ensuring that growers can always sell their products at prices above cost. so that growers can focus more on improving the quality of coffee to attract the premium boutique coffee market.

An unexpected 14 months

From mid-2019, internal purchase prices exceeded the estimated cost of production, and prices began to pick up. In the early days of the outbreak, however, prices began to soar. At the end of March 2020, Colombian coffee prices even unexpectedly broke the ceiling of 1 million Colombian pesos, reaching 1.315 million Colombian pesos ($352), up 35 per cent from the beginning of January 2020.

In addition to the depreciation of the Colombian peso against the dollar, the harsh weather led to a decline in coffee production in Brazil and a decline in exports from Central America, resulting in tight supply in the region, leading to a surge in prices in 2020.

Now, the internal purchase price of FNC is rising again. Prices have risen 34% since the beginning of the year, reaching a high of 1.44 million pesos ($386) per carga (about 275lbs or 125kg).

Initially, prices rose as a result of La Nina. La Nina began in September last year and was expected to last until mid-2021.

However, since the end of April this year, the domestic situation in Colombia has been volatile, pushing internal purchase prices to an all-time high. Transportation has been disrupted in some parts of Colombia, suppliers are worried that they will not be able to fulfill orders, coffee supply has declined and coffee prices have risen.

Prospect

The situation in Colombia is not yet stable and the damage in Buenaventura is serious. Buenaventura is one of the most important Pacific seaports in the Americas, accounting for 60 per cent of Colombia's maritime exports. Many highways are still blocked, meaning that the export of coffee is still restricted. The short-and medium-term outlook is uncertain.

If the situation continues and traffic is blocked, it will collide during the harvest season in some parts of Colombia in June and July, when prices may rise further and even break through the 1.5 million peso mark. In addition, coffee prices have remained high since the beginning of last year, with growers reaping a windfall. Some people worry that if internal purchase prices remain high for a long time, growers will be complacent.

Abnormally high prices will discourage growers from turning to higher-value crops, which is FNC's stated development goal.

Growers' incomes can still be hurt by many factors, and if the market experiences a sudden drop in prices, they have little to rely on. Although the Colombian government's price stabilization fund provides it with a security guarantee, the effectiveness of this mechanism remains to be tested.

As of June 18, Colombian spot coffee was 1.415 million pesos per 125kg, according to Coffee Finance Network.

Data from: coffee Finance Network

For more boutique coffee beans, please add private Qianjie coffee on Wechat. WeChat account: kaixinguoguo0925

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

NaiXue tea announced IPO market value of more than 30 billion NaiXue tea can become the world's first tea

This morning, the new tea drink NaiXue tea because of the public offering topic rushed to the micro bo list. The topic has generated 85.467 million views and 3377 discussions. It is understood that Naixue tea completed the listing process as scheduled in mid-June, and the approach to listing means that Naixue tea is only one step away from the first global tea drink. On the evening of June 17, Naixue's tea was in Hong Kong.

- Next

China's "northernmost" Starbucks store Hulunbuir Starbucks store Star Frappuccino is good

Starbucks welcomed the northernmost store in China, the Hulunbuir Starbucks store, Starbucks announced on its official Weibo on June 18. According to Starbucks, China's northernmost Starbucks store is located in Ishidan Shopping Mall, Hailar District, Hulunbuir City, Inner Mongolia, which is only 110 kilometers from the nearest Sino-Russian border. This store is currently Starbucks' northernmost store in China.

Related

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?

- How to make butter American/butter latte/butter Dirty coffee? Is hand-brewed coffee good with butter?

- Is Dirty the cold version of Australian White? What is the difference between dirty coffee/decent coffee and Australian white espresso?

- Relationship between brewing time and coffee extraction parameters How to make the brewing time fall to 2 minutes?

- Got entangled?! Lucky opens a new store, Mixue Ice City, and pursues it as a neighbor!