Luckin Coffee's latest news: Lucky released its 2020 results and settled the US securities class action lawsuit.

A week ago, we released an article entitled "Luckin Coffee's turnaround", which mentioned that if the problem of debt restructuring can be resolved as soon as possible, perhaps as industry experts put it earlier: "do not rule out the possibility of its re-listing."

A week later, Luckin Coffee made another big move about the "financial fraud of 2.2 billion".

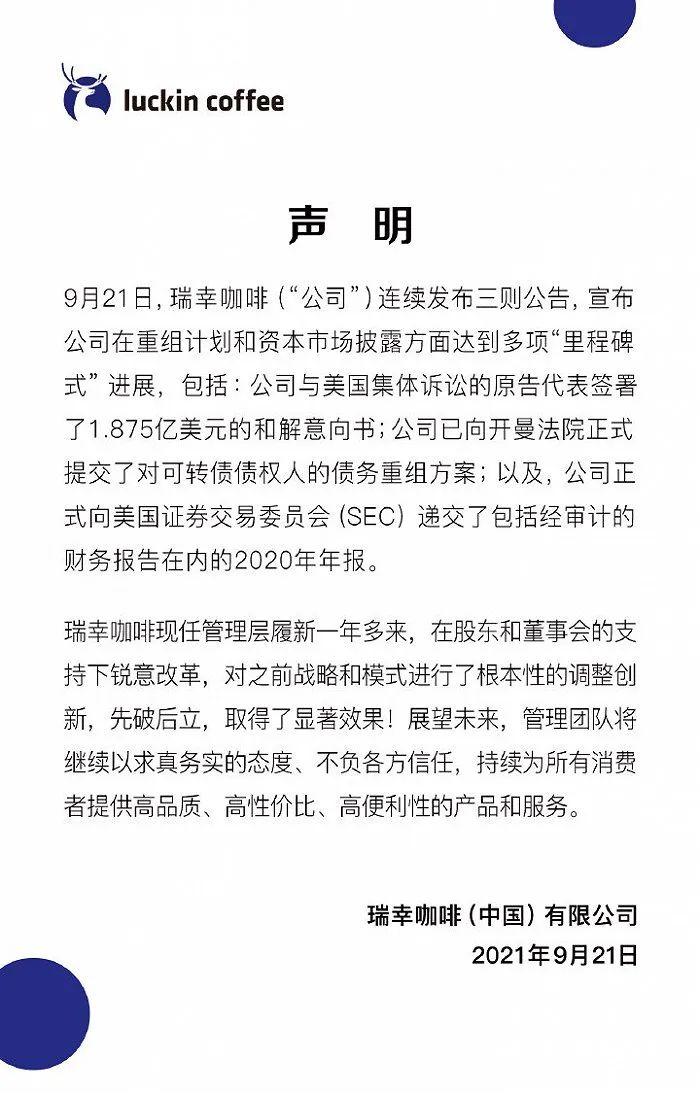

Luckin Coffee issued a statement on his official Weibo on the evening of Sept. 21.

Luckin Coffee issued three announcements announcing that the company had achieved a number of "milestones" in its restructuring plan and capital market disclosure, including:

1. The company signed a $187.5 million settlement letter of intent with the plaintiff's representative in the US class action.

2. The company has formally submitted a debt restructuring plan for convertible bond creditors to the Cayman court.

3. The company formally submitted its 2020 annual report, including audited financial reports, to the Securities and Exchange Commission (SEC).

In the statement, the first two deals with investor class action and corporate debt settlement, respectively, and the first three are annual reports for 2020.

Luckin Coffee also said that since the current management took office more than a year ago, it has made fundamental adjustments and innovations to the previous strategies and models, and achieved remarkable results.

Full text of Luckin Coffee's statement

On the issue of class action in the United States, Luckin Coffee made a further solution.

Luckin Coffee said: the company signed a $187.5 million settlement letter of intent with the plaintiff representatives of the US class action and will reach a settlement with the US securities class action.

In response, Guo Jinyi, chairman and CEO of Luckin Coffee, also said: "with final approval, this solution will resolve significant contingent liabilities and enable Luckin Coffee to focus more on our operations and the implementation of our strategic plan. We are working to reach a formal settlement agreement and obtain the necessary court approval."

According to media reports, Luckin Coffee has reached a comprehensive settlement plan of 187.5 million US dollars with ADS holders of US class action lawsuits, and the final valid report will be submitted to the US court by October 8 this year.

After the US Securities Regulatory Commission (SEC) filed a complaint against Luckin Coffee at the end of 2020, alleging his financial fraud, Luckin Coffee was fined $180 million (1.175 billion yuan) on December 17 last year. The nearly 1.2 billion-day fine was mainly used to settle with SEC over some former employees suspected of financial fraud, but the settlement did not come into effect. It was not until the evening of Feb. 8 this year that the court agreed to Luckin Coffee's settlement with SEC with a compensation of 180 million US dollars, a decision that largely allowed Luckin Coffee to avoid punishment from the administrative authorities and maintain the normal operation of the company at the lowest cost.

However, industry insiders pointed out at that time that Luckin Coffee reached a $180 million settlement agreement with the US Securities and Exchange Commission, which was only part of the lawsuit Luckin Coffee faced.

When the news of Luckin Coffee's fraud was first revealed, Luckin Coffee faced collective complaints from several law firms, including GPM and Schall in California, Gross, Faruqi, Rosen and Pomerantz in New York. In addition, according to relevant media reports, US professional class action service Bronstein,Gewirtz & Grossman issued a notice saying that it had filed a class action against Luckin Coffee and his senior management on behalf of investors.

Industry insiders said at the time that after nearly 1.2 billion days of fines, Luckin Coffee still had to face securities class action by investors (civil action) and charges against senior executives by the US Department of Justice (criminal proceedings), which could take at least 2 to 3 years. Criminal cases may be longer.

In addition, in December, a lawyer predicted that Luckin Coffee could face a total of about $11.2 billion in investor litigation damages, and it is believed that Luckin Coffee may not be able to pay huge class action fines for investors in the face of a huge fine of $11.2 billion.

Now, Luckin Coffee has reached a comprehensive settlement plan of $187.5 million with ADS holders of class action in the United States, and the relevant lawyers pointed out that the amount of $187.5 million is much lower than the market forecast.

The settlement is negligible compared with the hefty fine of $11.2 billion that Ruixing paid to SEC to settle accounting fraud charges and the actual cost of paying investors $187.5 million to settle class-action lawsuits.

It should be noted, however, that the $187.5 million comprehensive settlement plan reached between Luckin Coffee and ADS holders of US class action lawsuits still needs to be reviewed by the court before reaching a final conclusion.

On the issue of submitting the debt restructuring plan for convertible bond creditors to the Cayman Court, Luckin Coffee issued the third report of the Joint Provisional Liquidator to the Grand Court of the Cayman Islands on the evening of September 7.

Luckin Coffee issued a statement on Sept. 2: the deadline has been extended to Sept. 22 for the two milestones in the previously announced restructuring support Agreement (RSA), which submitted a petition to the Cayman court to approve the RSA plan and instructed to hold a meeting of relevant creditors on the plan. Now this incident has also been carried out as scheduled.

In addition, during the same period of time, Luckin Coffee also released the 2020 financial report.

In the 2020 annual financial report, data show that net revenue in 2020 is 4.033 billion yuan, an increase of 33.3% over the same period last year.

As of December 31, 2020, Luckin Coffee's cumulative number of trading customers exceeded 64.9 million, compared with 40.6 million in the same period last year. As of December 31, 2020, there are 3929 self-operated stores and 874 cooperative stores in 56 cities across the country.

Reviewing the annual financial report in 2019, Luckin Coffee lost nearly 3.2 billion yuan in 2019. Luckin Coffee's total expenditure in 2019 was 6.237 billion yuan and net revenue was 3.025 billion yuan. The financial report pointed out that net revenue in 2019 was exaggerated by about 2.12 billion yuan during previous fraud, and costs and expenses were also exaggerated by 1.34 billion yuan.

Luckin Coffee accumulated 40.61 million trading users in 2019. In the latest news released by Ruixing, Luckin Coffee's cumulative trading users exceeded 75 million by the end of June 2021.

Last.

Again, no matter what Luckin Coffee does at the moment, Rui still has to pay for her mistakes.

* Image source: Internet

For more information about coffee beans, please follow the coffee workshop (Wechat official account cafe_style)

For professional coffee knowledge exchange, please add Wechat account kaixinguoguo0925.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Where is the largest purple sand teapot market in Yixing? How much can Yixing purple sand teapot buy really?

In the process of making Yixing teapot, the clay is first rolled out and then cut into upper and lower parts. Next, the craftsman cut out the edges with purple clay and rolled them into a ribbon. Then the edge is carved into the desired shape. Put it on top, then on the bottom. The artist then smoothed and shaped the teapot to eliminate cracks and holes. The lid opening is shaped and reshaped to ensure that the lid fits. According to

- Next

Is Darjeeling black tea or green tea? How to choose the best summer black tea for Royal Darjeeling?

If you have read a little black tea, you may have heard of Darjeeling Tea. Like Assam tea, it is one of the most popular black teas in India. The uniqueness of this black tea lies in the taste of its unique musk wine. Here, you can learn more about Darjeeling Tea, including different tea types and cultivation.

Related

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?

- How to make butter American/butter latte/butter Dirty coffee? Is hand-brewed coffee good with butter?

- Is Dirty the cold version of Australian White? What is the difference between dirty coffee/decent coffee and Australian white espresso?

- Relationship between brewing time and coffee extraction parameters How to make the brewing time fall to 2 minutes?

- Got entangled?! Lucky opens a new store, Mixue Ice City, and pursues it as a neighbor!