Is Ruixing still in normal operation? what is the current situation of Lucky's annual report analyzing a loss of 5.6 billion in 2020?

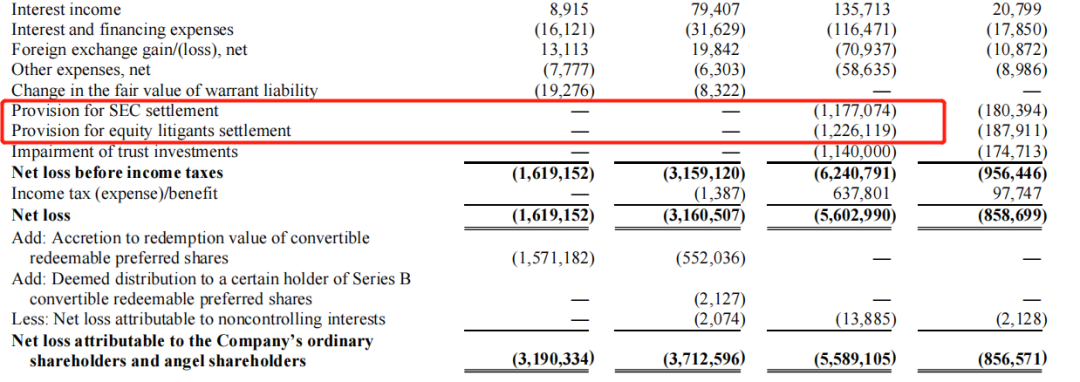

Luckin Coffee issued three announcements on the night of the Mid-Autumn Festival, the most eye-catching of which was Luckin Coffee's decision to once again spend 187.5 million US dollars (about 1.21228 billion yuan) on the settlement.

Luckin Coffee said: the company and the plaintiff representatives of the US class action have signed a letter of intent of 187.5 million US dollars (about RMB 1.21228 billion) to settle with the US securities class action.

If nothing happens, the final valid report on the settlement plan will be submitted to the US courts by October 8th next month, and once approved by the Cayman Court and the US courts, it means that another big trouble in Luckin Coffee's "financial fraud" scandal is about to be resolved (lucky salted fish has made a comeback).

According to Luckin Coffee's previous announcement, the object of compensation this time is for investors who bought Ruixing shares and offered compensation from the listing of Ruixing to July 15, 2020.

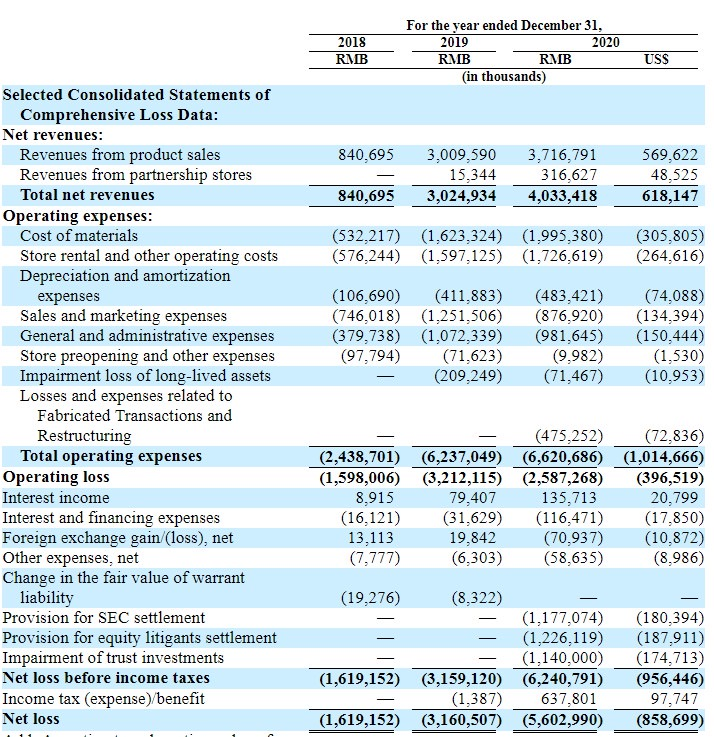

In addition, in the latest financial report for 2020, Luckin Coffee's net income in 2020 was 4.0334 billion yuan ($618.1 million), an increase of 33.3% over 2019.

As to why there has been such a change, Luckin Coffee said: revenue growth benefited from the increase in the average selling price of products. According to media reports, Luckin Coffee made a continuous profit in May and June this year, with a profit of tens of millions of yuan. the main reason for the profit was also due to the increase in customer unit price and single explosive product (lucky salted fish made a big turnaround + 1).

By the end of June this year, relevant data showed that the number of Luckin Coffee stores across the country had exceeded 5200, and the cumulative consumer users had exceeded 75 million. In drinks, the monthly sales of the raw coconut series listed this year exceeded 10 million cups, setting a new sales record for Lucky's new products. from this level, it also shows that Luckin Coffee has returned to the vision of consumers.

The financial report also shows that Lucky lost 5.603 billion yuan in fiscal year 2020.

Photo Source: screenshot of Luckin Coffee Annual report

However, some media pointed out that although the net profit loss of Ruixing was close to 5.6 billion yuan, the financial report showed that the loss included a settlement reserve of 2.41 billion yuan (SEC+ public shareholders). If you exclude this part of the expenditure, in fact, Lucky's net loss is shrinking compared with 2019 (Lucky salted fish turnaround + 1 / 1 / 1).

Another major concern is that Luckin Coffee continued to trade in the pink market after delisting on NASDAQ, and Ruixing's share price rose nearly 10-fold in a year.

According to relevant media statistics, Luckin Coffee is currently listed on the pink market with a market capitalization of US $3.8 billion, which is more than 10 times higher than when it was delisted.

For Luckin Coffee, the above news is actually a sign that Lucky is releasing signs for the better. At present, the market still seems to approve Rui's performance, and the capital has re-chosen to believe in Rui. On April 15 this year, Luckin Coffee has received investment from Dawei Capital and pleasure Capital, raising up to 250 million US dollars. This can be said to be a very important part of Ruixing's great cause of reconstruction (Lucky c turn around + 1 + 1 + 1).

According to insiders, Luckin Coffee's current plan is to end the impact of financial fraud, then reorganize in the Cayman, and finally return to A-shares. If you follow this line of thinking, insiders say: it is not impossible to achieve profit growth between 2021 and 2022.

At present, Ruixing, which has been stumbled by a financial scandal, has also returned to its regular business model. In fact, Ruixing has been "turning around" since it was caught up in the scandal. This "salted fish turnaround war" has also brought better development for Lucky, but it still takes more time for Ruixing to fully realize its overall profits or whether it will be able to make a comeback and re-list.

* Image source: Internet

For more information about coffee beans, please follow the coffee workshop (Wechat official account cafe_style)

For professional coffee knowledge exchange, please add Wechat account kaixinguoguo0925.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Where can I buy grade A tea of authentic Chinese Keemun Black Tea? Which brand of first-class black tea is better in Qimen?

The difference between Chinese Keemun Black Tea and Indian black tea is that Indian black tea is made from Assam big-leaf varieties, while Chinese black tea is made from small-leaf varieties. These tea trees have been planted in China for hundreds of years.

- Next

What kind of equipment does the new coffee shop need? Hot mom, does the coffee machine work? How about EK43 bean grinder?

There may be many people who want to open a coffee shop because they want to choose their own state of life and achieve [freedom of time], but actually want to experience a new role [as a boss] (do not accept rebuttal) is to do business? Or a dream? Everyone has a dream of opening a shop. In TV idol plays, it is always customary to write about the life of the owner of the cafe as leisurely, romantic and fragrant coffee.

Related

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?

- How to make butter American/butter latte/butter Dirty coffee? Is hand-brewed coffee good with butter?

- Is Dirty the cold version of Australian White? What is the difference between dirty coffee/decent coffee and Australian white espresso?

- Relationship between brewing time and coffee extraction parameters How to make the brewing time fall to 2 minutes?

- Got entangled?! Lucky opens a new store, Mixue Ice City, and pursues it as a neighbor!