Sumitagawa Coffee CMO Leaving Consumer Complaints Sumitagawa Coffee Sales

As early as February 10, there was news that Wu Zhen, CMO of Sumida River Coffee, resigned. Some market personage points out, Wu Zhen is in charge of the company marketing business plate, behind the departure, is the sales volume of the last Tianchuan coffee is not ideal, at present faces a lot of inventory pressure.

Before that, Lin Hao, founder of Yutianchuan Coffee, said at the offline sales team mobilization conference in 2023,"The goal is to become China's largest retail coffee brand." He plans to spend three years to achieve a revenue of more than 1 billion yuan from the offline channels of Yutian River. According to retail business financial reports, a visit to a supermarket in Xuancheng, Anhui Province in March found that the Sutianchuan bag coffee, which usually occupies one shelf, has now been moved to the special price area and posted 9.9 yuan/box. This batch of coffee is only 5 months away from the shelf life. Supermarket owner said that in the past six months, the sales volume of coffee in Sumida River was not good, and he did not plan to purchase any more after that.

Sutianchuan Coffee was founded in 2015 and sells ear-hanging coffee and capsule coffee. Initially, Japan's "lock fresh" technology and production in cooperation with Japanese factories (made in Japan) as selling points, and in the name and packaging are easy to mistake for Japanese brands. Online sales have achieved good results. By the end of 2020, Tmall's ear-hanging coffee and coffee solution ranked first in sales volume, with a cumulative sales volume of 3 cups.

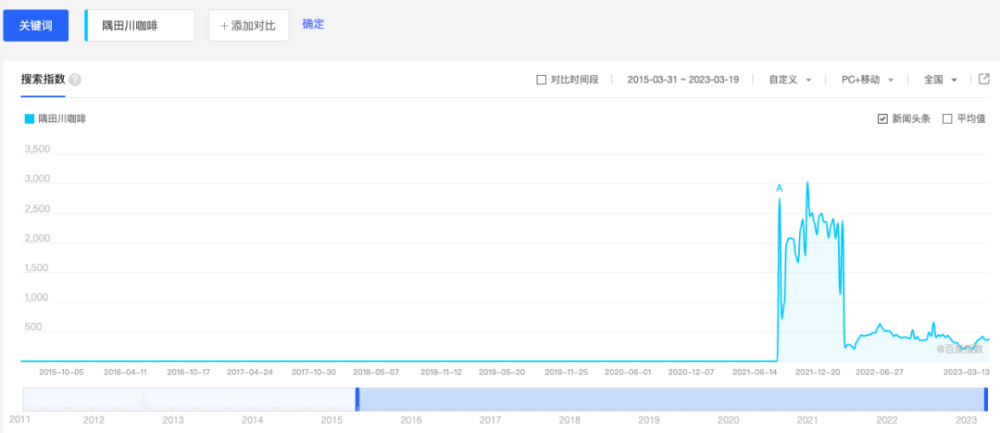

Although Sumida River has achieved such good results in 2020, in fact, this brand will not attract everyone's attention until 2021. According to Baidu Index data, the search index for "Sumida River Coffee" reached an unprecedented high in the second half of 2021.

Correspondingly, in 2021, Yutianchuan did four things in brand marketing. After obtaining 300 million yuan of Series B financing in March, it announced that it would become the official designated coffee of Hangzhou 2022 Asian Games in April; announced the signing of Xiao Zhan as the global brand spokesperson in June; announced that the ear-hanging coffee production factory invested and built in China was officially put into production in August; and updated the Logo design in October.

The first two things are to let more people know about the "Sumida River" coffee brand, and the last two things are Sumida River's desire to get rid of the dependence on "Japanese brand". By the end of 2021, the sales volume of ear-hanging coffee, coffee solution and coffee powder of Tianmao ranked first, with a cumulative sales volume of 600 million cups. According to the consultation statistics, the sales volume of Tmall Flagship Store in Yutianchuan in the past year ended August 2021 was 244 million yuan, ranking second.

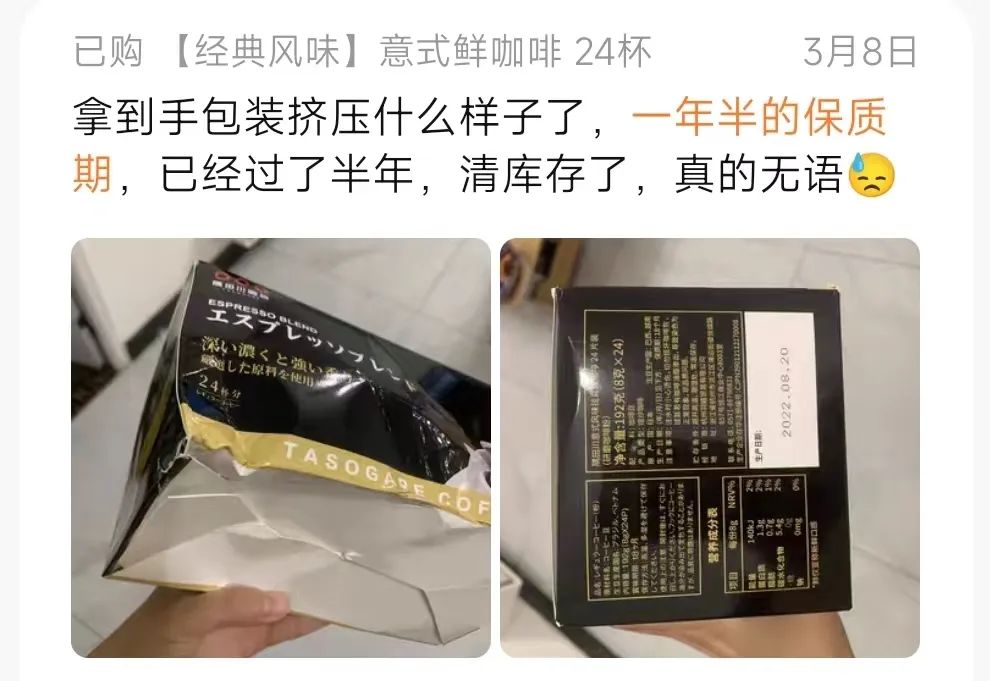

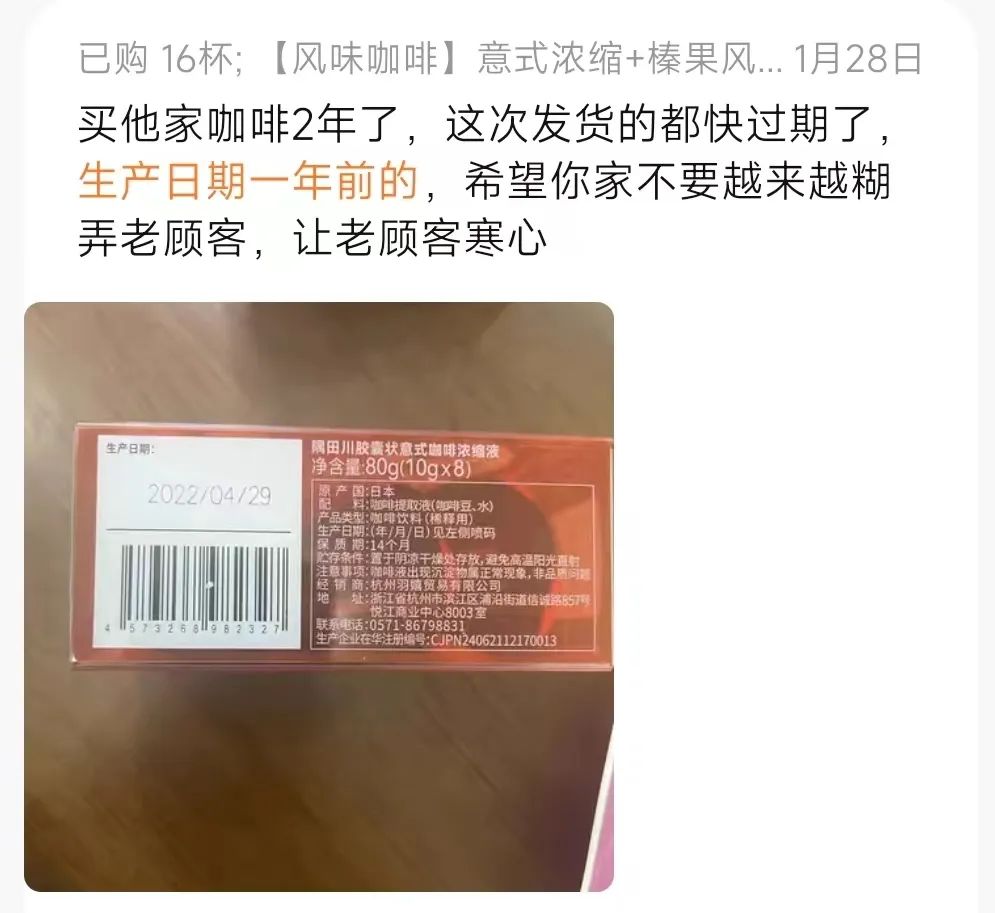

In the first half of this year, many consumers received sumida river coffee has passed more than half of the shelf life.

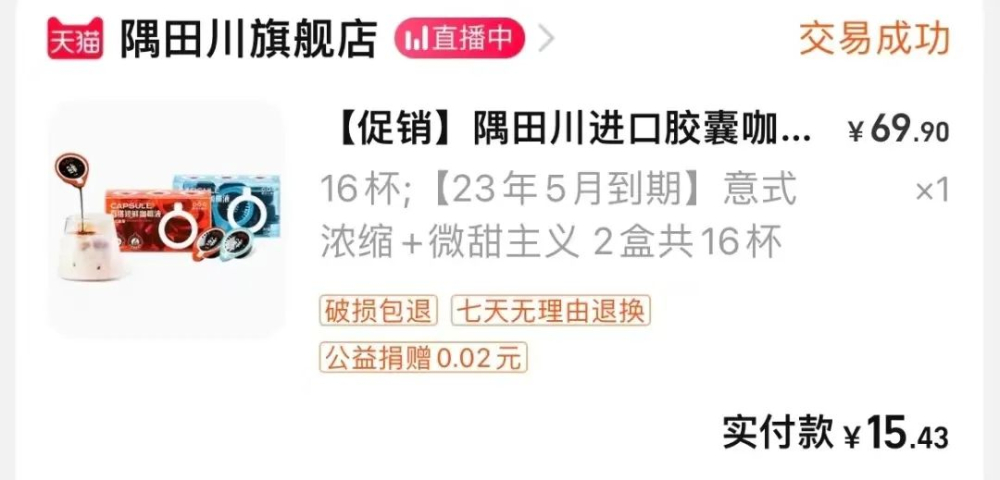

At the flagship store in Sumida River, products that are ready for sale are sometimes sold at low prices, but they are marked with special labels. In other channels, Yutianchuan is also actively destocking, for example, in Li Jiaqi direct broadcast room, the same quantity of positive price coffee liquid coffee sold for 19.5 yuan, only 13.9 yuan can be bought.

However, some consumers said that there was no difference in the shelf life of products bought at the original price and products bought at a low price on promotion.

The recent appearance of so many temporary products also confirms the fact that Sumida River faces difficult inventory pressure, and there may be signs of "selling". In addition to online sales, Yutianchuan started offline business as early as 2020. On the online market, emerging fast-selling coffee brands can easily squeeze out the share of traditional coffee brands, but Nestle still occupies 60% of the online fast-selling market. On the shelves of Shangchao, the price of Nestle's single package of instant solution is in the range of 1-1.5 yuan, while the price of single package of Sumida River is in the range of 2-5 yuan, so it is difficult to form offline advantage in price and brand.

In the past, Sumida River maintained a growth rate of 200-300%. Perhaps the production index was also set according to the growth rate index. Although the sales volume of Sumida River increased year-on-year until the end of 2022, the growth rate slowed down, resulting in domino effect. Source: Retail Business Finance, Solution Consulting, Network

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Digging baristas to rob franchisees... Lu Zhengyao is accused of tearing down the corner of Ruixing wall.

A few days ago, time Finance reported that the "hand-to-hand combat" between the founder of Lu Zhengyao's Coffee Coffee and Luckin Coffee has become increasingly fierce and has now spread to the competition for personnel. According to the report, some potential businessmen who originally intended to join Ruixing were attracted by the name of the "former founder of Ruixing" and the considerable joining policy.

- Next

With so much celebrity coffee on the Internet, why is only Dirty left on the permanent menu?

Dirty, once known as "online celebrity coffee", has not lost its popularity, but is still active frequently on everyone's social platform, acting as an artifact for taking pictures. If you search for "Dirty" on Little Red Book, you can find 200000 + notes, most of which are clocking in, and there are also a lot of information about

Related

- The ceremony is full! Starbucks starts to cut the ribbon at a complimentary coffee station?!

- A whole Michelin meal?! Lucky launches the new "Small Butter Apple Crispy Latte"

- Three tips for adjusting espresso on rainy days! Quickly find the right water temperature, powder, and grinding ratio for espresso!

- How much hot water does it take to brew hanging ear coffee? How does it taste best? Can hot water from the water dispenser be used to make ear drip coffee?

- What grade does Jamaica Blue Mountain No. 1 coffee belong to and how to drink it better? What is the highest grade of Blue Mountain coffee for coffee aristocrats?

- What are the flavor characteristics of the world-famous coffee Blue Mountain No. 1 Golden Mantelin? What are the characteristics of deep-roasted bitter coffee?

- Can I make coffee a second time in an Italian hand-brewed mocha pot? Why can't coffee be brewed several times like tea leaves?

- Hand-brewed coffee flows with a knife and a tornado. How to brew it? What is the proportion of grinding water and water temperature divided into?

- What is the difference between Indonesian Sumatra Mantinin coffee and gold Mantinin? How to distinguish between real and fake golden Mantelin coffee?

- What does bypass mean in coffee? Why can hand-brewed coffee and water make it better?