Exports are strong! Brazil exports nearly 4.3 million bags of coffee in March

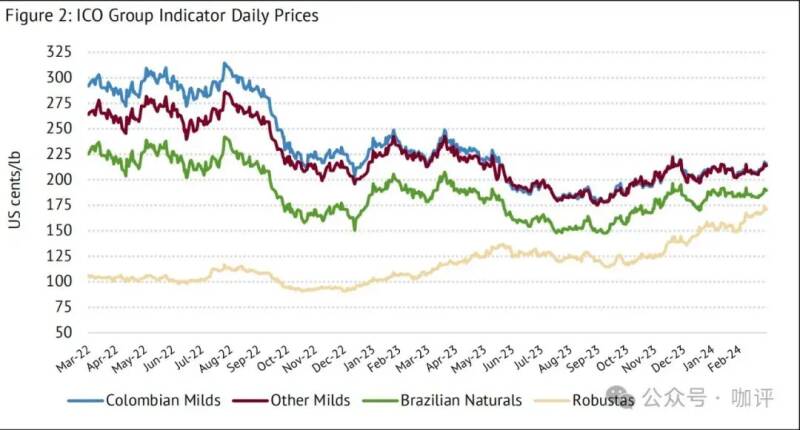

Recently, the rise in international coffee futures prices has also led to the spot price of domestic coffee in many countries, of which Robusta has reached the highest level since October 1994. as a result, Vietnam's local price industry has risen to 101 million to 104 million dong / ton (29200-30,000 yuan). In addition, Brazil has also risen sharply.

In the state of Minas Gerais, Brazil's largest coffee producing region, the spot price of Good Cup Arabica is 1125 reais per bag (about 1606 yuan, US $222) per bag, up 5.6% from 1065 reais last year and close to the price after production was cut in 2022 due to frost and drought.

The rise in prices has attracted many coffee growers to sell coffee beans, not only in existing stocks, but also in pre-sale of new seasonal beans, the pre-sale price in Arabica in September is between 1105 and 1115 reais per bag of 60 kg (1580 yuan, US $219). In addition, the spot price of Robusta coffee in Brazil broke through an all-time high, breaking through the thousand yuan mark for the first time, reaching 1025 reais per bag of 60 kilograms (1463 yuan, US $202).

Moreover, Brazilian exports have performed well recently, with Brazilian coffee exports totaling 4.293 million bags of 60kg coffee in March 2024, an increase of 37.8 per cent compared with the same period last year, according to March export records released by Cecafe. Between January and March this year, Arabica coffee exports reached 9.19 million bags of 60 kilograms, an increase of 27.8 percent over the first quarter of last year, while Robusta exported 1.872 million bags of 60 kilograms, an increase of 591.9 percent over the same period in 2023.

Robusta's high growth rate is due to reduced production in Robusta producing countries in the Asian region. According to local reports in Indonesia, El Ni ñ o has a greater impact on the country's production. In addition, Indonesia's domestic coffee consumption has increased, leading to a reduction in exports. In addition, Mexican imports increased, jumping to ninth place in Brazil's top 10 imports, importing 317360 bags of Brazilian coffee, an increase of 721.5% compared with the first quarter of 2023, most of which are robusta beans. Mexico is mainly used to make instant coffee.

However, at present, Brazilian coffee exports are still affected by the port, and the delay rate of Santos Port, the largest coffee port, is still as high as 80%. In addition, there is a labor shortage in Brazil, which is mainly due to the dengue fever epidemic in Brazil. According to data released by the Brazilian Ministry of Health, the number of deaths from dengue fever in Brazil has risen to 1116 in 2024, and another 1807 are being verified. and the death has exceeded the number of deaths in previous years, while the number of dengue cases has exceeded 2 million, 19% higher than the record for the whole of 2023. This has also led to labour shortages in many places, due to tight foreign vaccine capacity and supply, and currently only one vaccine from Japan has been approved to enter Brazil, waiting for vaccines developed by Brazilian research institutes.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Indonesia| Introduction to the Sumatra Region

Indonesia Indonesia In Southeast Asia, there is a country with the reputation of "land of ten thousand islands", that is Indonesia (Republic of Indonesia), or Indonesia for short. The country is the world's largest archipelago country, consisting of 8 islands,

- Next

Costa Rican coffee beans| Introduction to the entry selection series of washed coffee beans in Talazhu production area

Costa Rica Costa Rica In Latin America, there is a country in the world that is the first country without a military, but the country has a stable society and a prosperous economy. It is also known as the Switzerland of Central America. This country is Costa Rica (The Republic of Costa Rica

Related

- What grade does Jamaica Blue Mountain No. 1 coffee belong to and how to drink it better? What is the highest grade of Blue Mountain coffee for coffee aristocrats?

- What are the flavor characteristics of the world-famous coffee Blue Mountain No. 1 Golden Mantelin? What are the characteristics of deep-roasted bitter coffee?

- Can I make coffee a second time in an Italian hand-brewed mocha pot? Why can't coffee be brewed several times like tea leaves?

- Hand-brewed coffee flows with a knife and a tornado. How to brew it? What is the proportion of grinding water and water temperature divided into?

- What is the difference between Indonesian Sumatra Mantinin coffee and gold Mantinin? How to distinguish between real and fake golden Mantelin coffee?

- What does bypass mean in coffee? Why can hand-brewed coffee and water make it better?

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!