Coffee beans are cheaper, why are Starbucks prices still rising?

Starbucks is not a place to drink cheap coffee. It sells experiences, not goods.

For a long time, Starbucks' marketing strategy has been very successful, attracting thousands of customers and giving its stock a steady return. But this summer, the company's strategy put it in an awkward position: the price of coffee beans fell in the global futures market, while most of Starbucks' retail coffee prices were rising against the market.

Once upon a time, a long time ago, coffee shops were the trading centers of the world's financial markets. If you want to know the latest price of a product, just walk into a London coffee shop and have a drink. But if you still use the information you heard in Starbucks as a source of first-hand commodity information, you can only say that the current bull market is really awesome.

On the other hand, this is indeed the case. Coffee prices are in a downward cycle, which was made worse last week when China, its main consumer, announced a devaluation of its currency. Coffee prices in Malaysia, Indonesia, Russia, Colombia and Brazil, the main producers of coffee, as well as oil and steel, have been falling for months.

Workers pour coffee beans at a Starbucks in Seattle.

On July 6th Starbucks said its costs had risen and the price of most of its coffee products would rise by 5-20 cents.

At Starbucks, which I often visit in downtown Manhattan, the super cup (20 ounces) is up 10 cents, the current price is $2.55 before tax, and the price of the medium cup (12 ounces) stays at $1.95. Company spokesman Jim Olsen (Jim Olson) said the price of "medium Cup" has gone up elsewhere. The price of food has not changed at present. Overall, Starbucks says customers are expected to spend 1% more on their bills.

Another spokeswoman, Lisa Passe, said in a statement that Starbucks was trying to "strike a balance between providing value to loyal customers and attracting new customers while making a profit."

Starbucks may be able to strike a balance, but as a customer who keeps a close eye on financial markets, it is shocked that Starbucks' decisions are completely out of touch with global price fluctuations. Coffee is getting cheaper and cheaper. Why should I spend more money on coffee at Starbucks?

The price volatility in the global coffee market is staggering. The futures price of Arabica beans, which represents premium coffee, peaked in October last year and fell 44% by July 6, the day Starbucks announced the price increase. As a result, many companies have responded by cutting prices. J. M. Smucker announced at the end of June that supermarket retail prices of its Folgers and Dunkin' Donuts brands of coffee fell by an average of 6 percent. The price of Starbucks' bagged coffee beans remains the same, but overall store revenue is increasing.

Starbucks' ability to raise prices against the market has cheered the stock market. Starbucks shares have risen 5.4% since July 6, compared with 1.3% for the s & p 500. And its long-term performance is also quite good. Last year, when dividends are included, the s & p 500 is up 9% and Starbucks is up 51%; in the past five years, the s & p 500 is up 115% and Starbucks shares are up 412%.

Starbucks experienced a period of rapid and efficient growth, which was able to expand while balancing its income and expenditure. In a conference call with investors on July 23, Starbucks executives revealed that the company had settled the price for 80% of its coffee supply next year.

Hamish Hamish Smith, a commodity economist at Capital Economics in London, said in an interview that companies like Starbucks "can't afford a coffee supply crunch or a sudden higher-than-expected price increase."

As can be seen from Starbucks' financial statements, it tries not to jump into the quagmire of currency or product volatility through some hedging or pre-purchase. Starbucks' operating costs fell in the last fiscal year that ended September 28 last year due to lower commodity costs, mainly coffee, according to the company's annual report.

But when coffee prices fall as unexpectedly as this year, these early strategies will have some short-term negative effects: it is likely that Starbucks will pay a higher price for coffee reserves than the spot market price. this will also have an impact on later financial statements.

This is one of the reasons why Starbucks is not at the same time as the big market.

Another reason, Olson said, is that the cost of coffee accounts for less than 10 percent of Starbucks' total cost. Starbucks also has to take into account rent, labor and a large number of employee benefits, equipment, distribution and marketing, he said.

Maybe there's another reason. Howard Schultz, chief executive of Starbucks, told investigators during a conference call last month that "20 per cent of in-store transactions in US stores are done through mobile payments, twice as much as two years ago". Recently, I use the iPhone app to pay, and it's easy to transfer money, but I don't pay attention to how much money is spent.

Starbucks assumes that consumers think the new price is reasonable-if you think the past price is reasonable, maybe the current price is also reasonable. In 1994, when Starbucks opened a store in Manhattan, the small cup was $1.25-just eight ounces, which they called "stuffy." Regardless of the price factor, it is equivalent to the current $2.01, but also a small cup, which now sells for only $1.85 in Manhattan stores. So you have to be specific; the small cup is no longer on the menu. If you are more careful, you will find that even after the recent price adjustment, you actually spend less than you did in 1994.

At the same time, Starbucks is also generating revenue. Even if its price is out of sync with the product market, it can be timely in the stock market and become an opportunity for appreciation.

Source: China Food Science and Technology Network

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

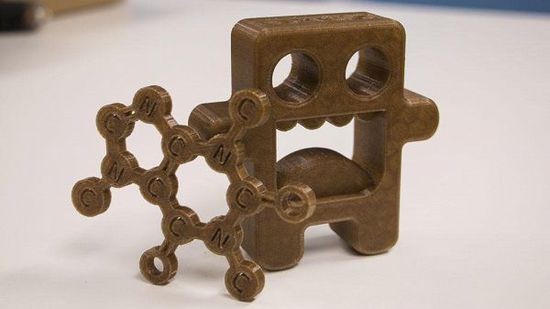

3D printing raw materials converted from coffee waste

The waste after brewing coffee has a new use. Although it is difficult for many people to associate it with 3D printing, a manufacturer called 3Dom USA has come up with a good idea with C2renew, a biocomposites company, to turn it into a raw material (filament) suitable for 3D printers. The history of Wound Up is inextricably linked to caffeine because

- Next

The steampunk ice drop coffee machine has a Gothic flavor.

The Gothic style of the Dutch laboratory is a complex and aesthetic device that uses ice droplets to make coffee. The Dutch laboratory has previously invented many steampunk-themed products, such as the original steampunk and Eiffel. The project continues to adopt the theme of steampunk. Each structure is built in Korea, using anodic aluminum plating components, laser cutting, brass tuning

Related

- The ceremony is full! Starbucks starts to cut the ribbon at a complimentary coffee station?!

- A whole Michelin meal?! Lucky launches the new "Small Butter Apple Crispy Latte"

- Three tips for adjusting espresso on rainy days! Quickly find the right water temperature, powder, and grinding ratio for espresso!

- How much hot water does it take to brew hanging ear coffee? How does it taste best? Can hot water from the water dispenser be used to make ear drip coffee?

- What grade does Jamaica Blue Mountain No. 1 coffee belong to and how to drink it better? What is the highest grade of Blue Mountain coffee for coffee aristocrats?

- What are the flavor characteristics of the world-famous coffee Blue Mountain No. 1 Golden Mantelin? What are the characteristics of deep-roasted bitter coffee?

- Can I make coffee a second time in an Italian hand-brewed mocha pot? Why can't coffee be brewed several times like tea leaves?

- Hand-brewed coffee flows with a knife and a tornado. How to brew it? What is the proportion of grinding water and water temperature divided into?

- What is the difference between Indonesian Sumatra Mantinin coffee and gold Mantinin? How to distinguish between real and fake golden Mantelin coffee?

- What does bypass mean in coffee? Why can hand-brewed coffee and water make it better?