Instant Coffee Market Growth Slows, Nestle Lacks High Growth Potential

What about the world's largest food retailer, which is slowing down the instant coffee market, lacks brands with high growth potential and struggles to integrate with local companies?

Nestle, the world's largest food company, has tasted the bitter taste of coffee in the Chinese market.

Five years later, Nestle replaced the full package of instant coffee. The classic coffee color was replaced by a bright red, and salesmen piled the new products into hills in supermarkets and displayed the usual promotional signs.

In conjunction with the packaging change, Nestle hired star Angelababy as a new spokesperson and shot four video advertisements. Unlike in the past, these ads don't appear on TV media-you can only see them on Social networks and video sites.

To coincide with the launch of the new product, Nestle also destroyed 400 tons of instant coffee at its coffee factory in Dongguan."About 30% of the coffee was recycled for packaging change." A former employee of Nestle told reporters. This happened in March of this year.

Nestle may have realized that it had set too high a sales target when it launched a new product. Most of the 4 million tons of coffee destroyed were sold by sales staff to meet performance targets.

In the warehouse of a large Nestle seller in China, there is also a backlog of more than 20 million yuan of Nestle coffee gift boxes, which are specially customized for this year's Spring Festival sales. "The Nestle pile in the supermarket is very beautiful, but the performance has not changed much." The dealer's employee said.

According to the estimated sales cycle, this batch of goods should have been produced in the middle of last year. The sales department places orders with the factory based on sales estimates, usually 4 months in advance, and can increase or decrease the quota for adjustment in the next month. The final order is made on the basis of sales estimates that are "sellable."

A former Nestlé salesman told reporters that this is a common situation in the retail industry, usually because sales are underselling channels--dealers--when making orders. "If the boss gave me a target of 10 million yuan, I can actually only do 5 million yuan, then what about the remaining 5 million yuan? For the bonus, I will also choose to put the other 5 million yuan into the channel."

Nestlé is stuck in China

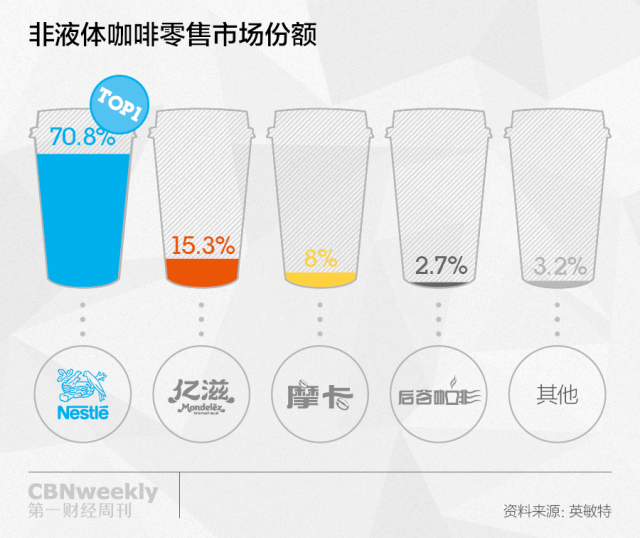

More troubling for Nestle than inventories is that growth in the instant coffee market is slowing significantly. According to Mintel Consulting, the CAGR of instant coffee has been only 13.5% in the past five years, and the market share has dropped from 80.7% in 2009 to 71.8% in 2014. This trend will continue in the future, and by 2019, Mintel predicts that the market share of instant coffee will drop to 66%. In 2013, Nescafe instant coffee sales accounted for 70.8% of the instant coffee market at the time.

Yes, Nestle was the initiator of the coffee market in China,"Tastes great" flashing in the burgeoning commercial world of the 1980s. But Starbucks has since introduced freshly ground coffee on this basis, which in turn has spawned a cafe culture. The segment has grown at a compound annual rate of 38.6 per cent over the past five years-and Chinese consumers hungry for novelty clearly see Starbucks as representing a more global lifestyle.

Not only instant coffee, but also ready-to-drink coffee, chocolate wafer, candy, cooking supplies, pet food, as well as the acquisition of Yinlu and Xu Fuji and other Nestle businesses in China, have experienced varying degrees of decline. In the fast-changing consumer goods market, Nestlé failed to foresee the rapid expansion of consumer vision and shopping radius by e-commerce.

Nestlé's performance already reflects this passivity. In 2014, its sales in China were 660 million Swiss francs (about 4.448 billion yuan), up 0.3% from a year earlier, compared with 29% the previous year.

The performance of the Chinese market even affected the overall performance. According to Nestlé's first quarter 2015 earnings report, organic revenue fell 0.2% and real internal growth fell 2.3% in Asia, Oceania and Sub-Saharan Africa, where Greater China is located. The report said this was mainly due to "slow" growth in China.

Most of the foreign-funded consumer goods giants who cultivated the Chinese market in the early days suffered similar experiences. Procter & Gamble and Unilever also failed in the face of accelerated consumption upgrading and diversified brand demand.

Nestlé is clearly aware of the problems encountered in its China operations. In its 2014 earnings report, Nestlé specifically mentioned that "in China, we need to readjust our product line to accommodate the fickle Chinese consumer." For a large, century-old European company, this is not easy.

Financial companies are not suitable for the Chinese market

Nestle from Switzerland is a "financial" company. In order to ensure sufficient profits to return to shareholders, Nestle will calculate financial returns and profit margins in detail for every strategic layout and every new product launch. This approach is commendable in mature markets, where it has a centuries-old brand foundation in Europe, but it is passive in China, where new brands emerge one after another, price wars are good and consumer loyalty to brands is low.

Nestle has launched a price of 1.9 yuan boxed milk, and bright similar products at the same price. Later, due to rising costs, Nestle had to adjust the price to 2.2 yuan and 2.9 yuan successively, while the price of Guangming has not changed. The price difference gradually led to the difference in sales volume, and Nestle milk finally withdrew from the market. "Nestle has high gross margin requirements for brands, and European companies can't understand China's small profits but quick turnover." Nestle, a former salesman told me. "But Nestle's products are not luxury goods, and consumers are unlikely to accept such a high price difference."

Roland Decorvet, Nestlé's former chief executive for Greater China, expanded the proportion of expatriates in middle and senior management during his tenure, adding to labor costs. Chinese employees mainly work in the sales team, while management and other functional departments are mainly expatriates. In addition to high salaries, these foreign managers enjoy company-provided housing, private cars and international schools for their children-the market average for a foreign executive above director level costs Rmb3 million to Rmb4 million a year, equivalent to the salaries of 10 to 20 front-line sales.

However, it is almost impossible for a European to understand the Chinese market and the subtle psychology of consumers in two or three years. "FMCG needs consumer insight most, and the most valuable insights come from conversations in local life situations such as elevators and bus stops, rather than gathering a group of consumers in a room and asking pre-designed questions." The above-mentioned resigned person said.

In this way, Nestle underestimated the aging rate of existing brands-instant coffee, ice cream and chocolate candy-which were once considered fashionable by Chinese consumers and are now mostly classified as "unhealthy food". Especially in the last five years, Chinese consumers have shown great enthusiasm for healthy food and high-end imported new brands.

The original distribution system makes Nestle gradually distance from consumers.

For more than a decade, Nestlé has been an aggressive introducer of fresh categories: deciding when to introduce products to China is usually based on experience in other markets. Kit Kat is one of them. This delicious chocolate wafer is popular in Japan, but it has experienced ups and downs in China.

Many times, Nestle has a bad time to launch. In the 1990s, Nestlé introduced Kit Kat for the first time, setting a sales target of several million yuan for China. However, Chinese consumers at that time had limited acceptance of high-priced Qiqiao, and Qiqiao withdrew from the Chinese market due to poor sales volume. A few years later, Nestlé launched Kit Kat for the second time,"opening several production lines," but still failed again because sales did not meet expectations. "At that time, Nestle would apply the successful template of foreign countries to calculate how much production should be invested and sold at the beginning, etc. This set of practices was not localized enough in China and would not work." The dealer said.

Misjudgment of the market was the beginning of Kit Kat's failure, and Nestle's constant distributor-dependent sales system slowed its perception of market change.

Dealer system is a common distribution mode in retail industry. FMCG companies such as Nestle and Procter & Gamble manage channels in this way. When the market is in the seller's market, that is, when supply is less than demand, Nestle can smoothly make the products reach consumers through large distributors and next-level distributors without having to build its own distribution system. Nestlé frees up costs and energy to do more research and development, marketing, nurturing new brands and so on.

But as the market expanded, Nestle gradually lost its keen sense of the market in the longer chain formed by outsourcing distribution methods.

For Nestlé, retailers and distributors have different collection times and bargaining power. To Wal-Mart this kind of retailer supply, there is about 3 months account period, whether can receive the payment on time, depends on whether the retailer's funds are sufficient at that time, whether the allocation is appropriate. However, it is different to supply to distributors, who need to settle accounts with Nestlé immediately upon purchase.

Therefore, the dealer system not only means savings in upfront distribution costs, but also generates cash flow. This is a factor that financial companies value more.

About a decade ago, fast-moving consumer goods companies such as Procter & Gamble and Unilever changed their channel strategies and adopted a direct supply strategy to large retailers such as Walmart to grasp first-hand terminal data and leave only small sales channels to dealers. Nestlé did not follow through on this change.

No one dared to shake up nestle's distribution system easily, and its ceos all needed a good earnings report. Channel reform means bad debts that cannot be returned, as well as an increase in employment costs. With Nestlé's size in China, similar changes may require a team of 10 people to directly interface with Wal-Mart, replacing dealers to complete procurement management, logistics distribution, sales negotiation, bill settlement, etc. for Wal-Mart. In addition, nearly dozens of sales representatives are needed to manage Wal-Mart stores distributed throughout the country.

Self-managed sales teams are better able to execute in-store at the terminal than dealers, and they can also feed back consumers 'voices to the company faster.

Nestle's "financial first" business philosophy reinforces the original distribution system, but it also makes Nestle gradually alienated from consumers. At the same time, the absence of rivals for a long time has also worn down Nestle's sense of competition. In the instant coffee category, Nestle has long left Maxwell far behind and firmly ranked first. After Maxwell was spun off by parent company Moniz International at the end of 2014, Nestle's sales team lost momentum. "If Maxwell is still a competitor, Nestle will definitely follow suit to do brand and channel promotion." Nestle's dealer said. Without an equal opponent, it is difficult to assess whether a regional salesperson has invested enough energy in a low-tier city, which also increases the market education cost of the instant category.

Nestle's dilemma was exacerbated by poor product launch and acquisition integration

For large multi-brand companies, independent brand operation can also maintain direct communication channels between brands and consumers. Nestle is not without experience in this area. Due to different sales channels, a few brands such as Wyeth, Professional Catering and Nespresso report directly to the global headquarters, and the sales system also operates independently.

However, for other brands, especially non-global brands acquired by Nestle, they are accommodated in Nestle China's sales system. The system assigns instant coffee, cereal, candy, pet food, etc. as dry goods to a sales team, and allocates a sales team to professional catering, office buildings, etc.

This is a cost-of-sales approach, but brands with small sales volumes, especially new brands, are also difficult to grow. "Coffee is a $10 billion business, why would I bother with a $100 million cereal business?" As salespeople, sales mean bonuses.

Pet food brand PeopleU was one of Nestle's most successful business units in China. Liu Qianzong, then head of China business from Taiwan, developed differentiated strategies for Mars, such as focusing more on emerging segments such as pet stores. In 2007, pet you sales in china reached 300 million yuan, higher than mars pet food market share.

But then, the executive was replaced by a foreigner who thought Nestle's dry food was so good that it should be "backed by trees to enjoy the cool" and merge the spoiled sales system into the dry food system. At that time, the sales volume of spoiled goods accounted for only 1% of Nestle's dry goods sales volume, and the sales personnel of dry goods did not have the energy to take care of spoiled goods at all, and the competitive advantage gradually disappeared. Today, Nestle has been semi-withdrawn from the pet, and the annual sales of the brand have dropped to tens of millions of yuan.

Instead of introducing successful new brands, Nestlé expanded through localized M & As-as it has done in global markets. Since 2011, Nestle has acquired local beverage brand Yinlu and candy brand Xu Fuji successively. In China, however, integration has not been smooth. In the future, Nestle's overall revenue, in addition to instant coffee, is mainly Yinlu and Xu Fuji these two businesses.

The slump in Xu Fuji and Yinlu was blamed by Nestle on "a slowdown in consumption in China's gift market"-most of their business took place in third-and fourth-tier cities, and the sales period was mainly concentrated in the Spring Festival market.

In 2014, silver heron sales declined. The shelf life should be one month, that is, the products sold on the shelf this month should be the products with the production date of the previous month. However, at the end of last year, Yinlu sold products produced in August and September of that year in Beijing market. It was not until the beginning of 2015 that the Shandong factory stopped production for half a month that Yinlu gradually digested the inventory during the crisis.

Yinlu first made achievements in the segment of peanut milk, but because the beverage category had higher profits than the food category and a large volume, competitors including Master Kong, Dali Garden and Jinmailang followed up and forced the market to open at a very low price plus some extra admission fees.

At the terminal, Yinlu can only increase the promotion efforts to fight back. At the wholesale market, the original 41.5 yuan a box of peanut milk reduced to 40.5 yuan or 40 yuan, Nestle sacrificed about 1 yuan per box of junk disposal fees.

Competition in this market segment is increasing. More imported commodities and regional commodities have joined the national market with the help of networks. This does not include successful new brands based on e-commerce platforms. A sales representative at Yinlu North Market said his sales target for this year was lowered by 200,000 yuan, but it was still difficult to meet.

Nestle launched its e-commerce platform in 2012, but its focus was on transferring its offline products to e-commerce platforms rather than trying to launch new products through this platform-which obviously did not fully utilize the opportunities presented by e-commerce.

In fact, after being acquired, Yinlu and Xu Fuji's autonomy in marketing was weakened. In addition to connecting its IT system and supply chain, Nestlé also manages according to Nestlé's production process and quality standards, and sends brand management personnel. Brand input expenses also comply with Nestlé standards.

Nestlé strives to strike a balance between maintaining the independence of the acquired brand and managing it effectively. After acquiring Wyeth in 2012, there was no integration of Wyeth, even though Nestle also had a milk powder business. Because Nestle headquarters believes that "Wyeth can do today's business because of its own corporate DNA", Nestle is a calm European culture, Wyeth's culture is American: aggressive, results-oriented.

These two milk powder businesses are still in competition, except for high-level communication, ordinary employees are not even allowed to call each other's companies. As a result, Wyeth's performance climbed from fourth place in the milk powder industry to first place.

For Yinlu and Xufuji, which were also acquired, Nestle tried to integrate them better in channels rather than let them operate independently like Wyeth. Nestle ready-to-drink coffee was handed over to Silver Heron for sale, indicating that Nestle planned to distribute ready-to-drink coffee products through Silver Heron's original channels.

Nestle is in a bind. Although Nestle still holds the top spot in China's instant coffee market, the decline in market acumen, new product launch and acquisition integration are all dangerous signals in the FMCG industry.

Nestl é China urgently seeks change

In 2014, the chairman and CEO of Nestl é (China) Co., Ltd. was held by a local manager for the first time.

Unlike his foreign predecessors, Zhang Guohua, from Hong Kong, once worked as a marketing executive at fast consumer goods companies such as Procter & Gamble and Coca-Cola, who led Wyeth to overtake its rivals.

Former colleagues describe Zhang Guohua as a professional manager who "treats foreign companies as start-ups". He also built Wyeth's management team in China. "as long as he thinks it's right, everyone on the team will work hard in that direction." But for Nestl é, what is more important is Zhang Guohua's insight into consumer demand.

In 2006, he was the first in the industry to hire "father" Jacky Cheung as the spokesperson for milk powder, rather than the usual image of a mother in the industry. For many years after the event, consumers whose children have grown up still remember the Wyeth brand because it understands that new mothers "actually want their fathers to be involved in taking care of their babies."

In addition, when Wyeth's competition emphasized the added DHA and the type and content of nutrients, Zhang Guohua was the first to communicate with consumers in terms of the similarity between the molecular structure of milk powder and breast milk.

However, the market is changing rapidly, and Zhang Guohua's reform has become more difficult. Nestl é's high-growth areas, milk powder and professional catering, are under pressure from local competitors. Foreign brands such as Wyeth, Abbott and Mead Johnson are becoming homogenized, while they are also facing pressure from local competitors such as Beinmei, Shengyuan and Synergy, which are more flexible in China.

Nestl é has the strictest compliance standards for foreign companies. This makes it passive in the face of "flexible" competitors in the Chinese market. In Europe, in order to encourage breast milk, milk powder companies are prohibited from advertising milk powder to children under the age of one, and all promotions such as contacting newborn mothers in hospitals and giving them samples will be severely fined. But Nestl é's Chinese rival brands still send more promotional messages to mothers of newborns under the age of one.

There is nothing wrong with commercial companies with clear social norms, but if most of their peers in the market do not abide by the same standards, it is bound to lead to unfair competition.

In April this year, Wyeth milk powder was selected by the Swiss headquarters to check compliance. Headquarters sent a number of employees to the Chinese market to check whether Wyeth milk powder violates Swiss headquarters standards in its business activities. In response to the inspection, Wyeth employees had to reduce the display area of the first and second stages of milk powder in supermarkets and maternal and infant stores, and the promotion stack was absolutely not allowed-but in the Chinese market, the first and second stages of milk powder are the key to catching the new mother and the main source of sales-which directly led to the failure of Wyeth milk powder sales target in April.

In addition to expanding local talent, Zhang Guohua also wants to increase Nestl é's nutrition business to make "previously unhealthy products healthier," according to Nestl é insiders. This adjustment is due to the fact that Nestl é's existing product structure can no longer keep up with the upgrading trend of consumption in China-which means the upgrading of existing products and the launch of new products.

The sales system is still a top priority. Zhang Guohua obviously did not want to repeat the same mistake. As soon as he took office, he promoted the building of the direct operation team. At present, Nestl é has reached a direct supply agreement with RT-Mart and Wal-Mart, and more stores will be added to Nestl é's direct supply list.

For Zhang Guohua, this is a "back-to-back battle". Foreign giants no longer hold the rules of the game in China's consumer goods market; internally, Zhang Guohua also has to face the influence of unshakeable foreign executives-the style of European companies will not change.

For Nestl é China and Zhang Guohua, 2015 will determine their future fate.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

The world coffee industry is shrinking, and small estates not only need market incentives.

Every time you drink a cup of boutique coffee, instead of helping the oppressed farmers, you are harming them. But please don't feel guilty. Where there is oppression, there is resistance. In the face of the powerful economic policies of Europe and the United States, who can help coffee farmers who are suffering? China! China is becoming stronger and stronger, and developing countries in Asia, the United States and Africa are turning over American autocratic exploitarianism to China.

- Next

None of Starbucks' four future development plans is directly related to coffee.

1. More professional pastry-Starbucks USA is gradually replacing traditional pastry products with pastries offered by La Boulange, a famous bakery in San Francisco (thank God! In addition, Starbucks is gradually implementing a new policy of heating all cakes in more cities, which is said to have received a good response, especially in coastal cities. two。 Drive-in takeout window Drive-thrus- today

Related

- What is the difference between Indonesian Sumatra Mantinin coffee and gold Mantinin? How to distinguish between real and fake golden Mantelin coffee?

- What does bypass mean in coffee? Why can hand-brewed coffee and water make it better?

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?

- How to make butter American/butter latte/butter Dirty coffee? Is hand-brewed coffee good with butter?

- Is Dirty the cold version of Australian White? What is the difference between dirty coffee/decent coffee and Australian white espresso?