The coffee shop pays for bitcoin? Paid the startup Flexa crowdfunding to get $1410.

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style)

In the early morning, the sun shines on your bed, grooming and going out. Then go to the coffee shop near the company, order a cappuccino and check out in bitcoin. Through the film on Flexa's official blog, it can be seen that the company is committed to achieving such a scene.

Although the scene in the film is Starbucks, a Starbucks spokesman made it clear that they are not working with Flexa.

In terms of token sales, at present, the more popular way of fund-raising is to use STO, the way of selling equity tokens. However, Flexa's private placement in the past six months has been conducted in the form of tokens rather than equity, which is rare in the current market. Similar to its fund-raising model, there are market forecast start-up Numerai.

TJ Abood, a partner at Access Ventures, said that while he was interested in Flexa's stake, he was also satisfied with the way he invested in Flexacoin because he thought Flexacoin could help his company.

Flexa co-founder Tyler Spalding (Tyler Spalding) declined to disclose the types of goods that could be purchased with the company's payment system in the future. Another foreign co-founder, Trevor Filter, stressed:

"the long-term goal is to provide payment services to merchants through the Internet. "

Payment service builds trust bridge with PoS

Flexa will operate the network in the form of equity mortgage certificates (Proof of Stake), and from capital such as Access Ventures to merchants like Starbucks, Flexacoin can be mortgaged online. In this way, enterprises and merchants can join the network and act as "class nodes" to gain the benefits of transaction fees.

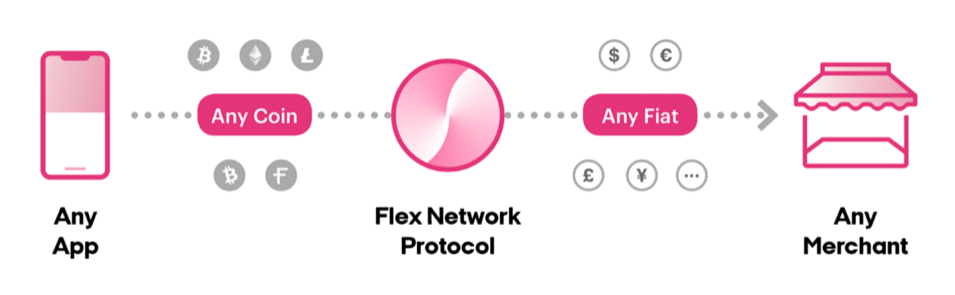

However, Flexa's network is not a blockchain, but a payment system compatible with the ethernet network, which is an agreement. The protocol allows cryptographic currency to be converted into legal tender through this protocol. At present, Bitcoin, Ethernet coin, Lettercoin and Bitcoin cash are supported. Spalding describes it as an "elegant passage":

Flexa plans to launch a password currency escrow wallet App on the Internet, where users can scan with QR code similar to Apple Pay and pay in password currency.

"We hope that the total supply of Flexacoin is the money flow of this system. The network will be launched on May 13, and it is hoped that all participants will benefit. "said Spalding.

This is in line with the investment strategy of TJ Abood, a partner at Access Ventures. TJ then said:

"We appreciate the idea that it is both a user and a node. Any company we invest in will become a user of this system. "

On the other hand, Lasse Clausen, co-founder of 1kx, says his company also plans to become a node. He thinks this for-profit token network is better than traditional business. Referring to the symbiotic commercial acquisition strategy of Flexa, he added:

"in the traditional payment service provider model, if one day the payment service provider has a sufficient number of users, resulting in a network effect, what if they raise the service charge? How can merchants trust them? "

". That's why Flexa uses this to make merchants nodes. "

TJ goes on to say that this business-oriented structure can attract large brands that are interested in Bitcoin but do not want to bear its high risk. Separately, Spalding, co-founder of Flexa, said Flexa would work with exchange platforms to provide them with liquidity. In case there is a problem with the blockchain at the time of settlement, Flexacoin as collateral will become a compensation mechanism.

What is special about Flexa's payment agreement is that, compared with the operation of Coinbase's financial card as previously reported in the moving area, because the Crypto wallet is used in the process, the payment process does not disclose the user's personal capital.

Spalding of Flexa said that Flexa's agreement is a bridge between traditional mainstream merchants such as Starbucks and cryptographic currencies, and will also support other cryptographic currencies and stable currencies in the future. Before that, the company was working with exchanges and merchants to make the entire ecosystem more sound.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

A survey of China's coffee market: the new bright spot of convenience store coffee is still latte.

Professional coffee knowledge exchange more coffee bean information Please follow the hot coffee war in the coffee workshop (Wechat official account cafe_style). Since last year, the new retail coffee that has emerged as a new force in the field of take-out coffee has always been the most eye-catching player, but in fact, as an emerging product, the penetration rate of new retail coffee in the domestic market is still low.

- Next

Du Jianning, the first world coffee champion in mainland China, won the 2019 World Coffee Brewing Competition.

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style) every year, the coffee industry ushered in a major event, that is, the World Coffee Association (WorldCoffeeEvents, hereinafter referred to as WCE) organized by the World Barista Competition (WorldBaristaChampionship, hereinafter referred to as WBC), which also includes World Coffee

Related

- Can lightly roasted coffee beans be used to extract espresso? How finely should you grind high-quality coffee beans to make Italian latte?

- What is the difference between the world's top rose summer coffee and Yejia Shefi? What are the flavor characteristics of Yega Shefi coffee and Panama rose summer?

- The ceremony is full! Starbucks starts to cut the ribbon at a complimentary coffee station?!

- A whole Michelin meal?! Lucky launches the new "Small Butter Apple Crispy Latte"

- Three tips for adjusting espresso on rainy days! Quickly find the right water temperature, powder, and grinding ratio for espresso!

- How much hot water does it take to brew hanging ear coffee? How does it taste best? Can hot water from the water dispenser be used to make ear drip coffee?

- What grade does Jamaica Blue Mountain No. 1 coffee belong to and how to drink it better? What is the highest grade of Blue Mountain coffee for coffee aristocrats?

- What are the flavor characteristics of the world-famous coffee Blue Mountain No. 1 Golden Mantelin? What are the characteristics of deep-roasted bitter coffee?

- Can I make coffee a second time in an Italian hand-brewed mocha pot? Why can't coffee be brewed several times like tea leaves?

- Hand-brewed coffee flows with a knife and a tornado. How to brew it? What is the proportion of grinding water and water temperature divided into?