Current Status of Ruixing Coffee Ruixing implements equity incentive plan for directors and employees

Since Luckin Coffee's financial fraud of 2.2 billion yuan, Luckin Coffee's board of directors has fallen into an "infighting" dispute, senior management has also undergone a large-scale change of blood, and Luckin Coffee, who has lost faith, has been "squeezed out" by the outside world. Luckin Coffee still did not give up "self-help."

Industry experts put forward: "Luckin Coffee is, after all, a legal entity, and if all the responsible executives of the company are replaced in the future, and the company can produce sustained profit growth, or there are new conditions to meet the conditions for listing, we do not rule out its re-listing."

Luckin Coffee said on January 26th that the "2021 Equity incentive Plan" will be implemented, with a maximum of 223 million Class A common shares awarded to employees and directors.

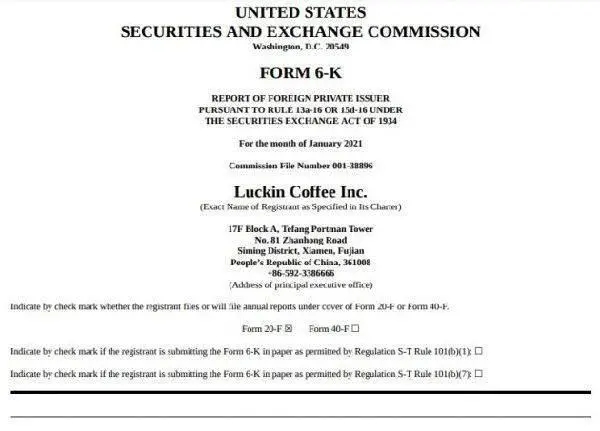

Luckin Coffee announced in FORM 6murK filing with the Securities and Exchange Commission (SEC) that the 2021 Equity incentive Plan will be implemented to retain, attract and motivate employees and directors by providing equity to them.

According to the Baidu encyclopedia explanation:

The meaning of "equity incentive plan" refers to a kind of incentive system that enables operators to obtain a certain amount of equity in the company, so that they can enjoy the economic benefits and rights brought by equity, and participate in corporate decision-making, share profits and bear risks as shareholders, so as to encourage them to diligently and dutifully serve the long-term development of the company. This is also one of the methods of human resource allocation to attract special talents and professionals.

Luckin Coffee also said that the 2021 equity incentive plan has a duration of 10 years and rewards up to 222769232 Class A common shares to employees and directors, equivalent to 27846154 American depositary shares (ADS). Luckin Coffee may grant options, restricted stocks, restricted stock units and other forms of awards under the 2021 equity incentive plan.

On December 17, 2020, Luckin Coffee announced that he would pay 180 million US dollars (1.175 billion yuan) to settle accounting fraud charges brought against him by the Securities and Exchange Commission (SEC).

According to other relevant media reports, Luckin Coffee's class action case in the United States has appointed the lead plaintiff and law firm. In the view of some people in the industry, the impact of Luckin Coffee's financial fraud will last for at least two to three years. In addition, Luckin Coffee announced last week that he had received notice from the "Company Joint liquidator" (JPL) that the second GPL report submitted to the Grand Court of the Cayman Islands would be circulated on January 29th, 2021. Later than January 15th, which was previously announced.

It is worth noting that on January 18, Luckin Coffee also released a recruitment plan for new retail partners on platforms such as the official Wechat account, which also means that Lucky will speed up shop opening and increase the layout of the sinking market. As for why it was reopened to join, Luckin Coffee said: hope to regain the trust of investors with better data performance.

Obviously, Luckin Coffee is still trying his best to make up for his mistakes.

So, can Luckin Coffee retain people by implementing an equity incentive plan?

* Image source: Internet

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

In 2021, Starbucks' latest earnings report revenue of $6.7 billion fell short of expectations, and the chief operating officer announced his resignation.

On January 27th, Starbucks released its latest fiscal year figures for 2021. Starbucks reported net revenue of $6.75 billion in the first quarter of fiscal 2021, below market expectations of $6.92 billion. In the first quarter, earnings per share were $0.53, compared with market expectations of $0.51, compared with $0.74 in the same period last year. Same-store sales fell 5% in the first quarter, and the market is expected to decline 4.2%. At the same time

- Next

Starbucks sign language store Starbucks China has opened its first sign language store in Shanghai.

Starbucks opens another sign language store! Starbucks opened its first sign language store in Shanghai today, the company announced on its official Weibo account today. It is understood that this sign language store is Starbucks' first sign language store in Shanghai and the fourth sign language store in Starbucks China. Shanghai's first sign language store, located in Huangpu Green City, has been officially opened to the public, with a total of 12 partners.

Related

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?

- How to make butter American/butter latte/butter Dirty coffee? Is hand-brewed coffee good with butter?

- Is Dirty the cold version of Australian White? What is the difference between dirty coffee/decent coffee and Australian white espresso?

- Relationship between brewing time and coffee extraction parameters How to make the brewing time fall to 2 minutes?

- Got entangled?! Lucky opens a new store, Mixue Ice City, and pursues it as a neighbor!