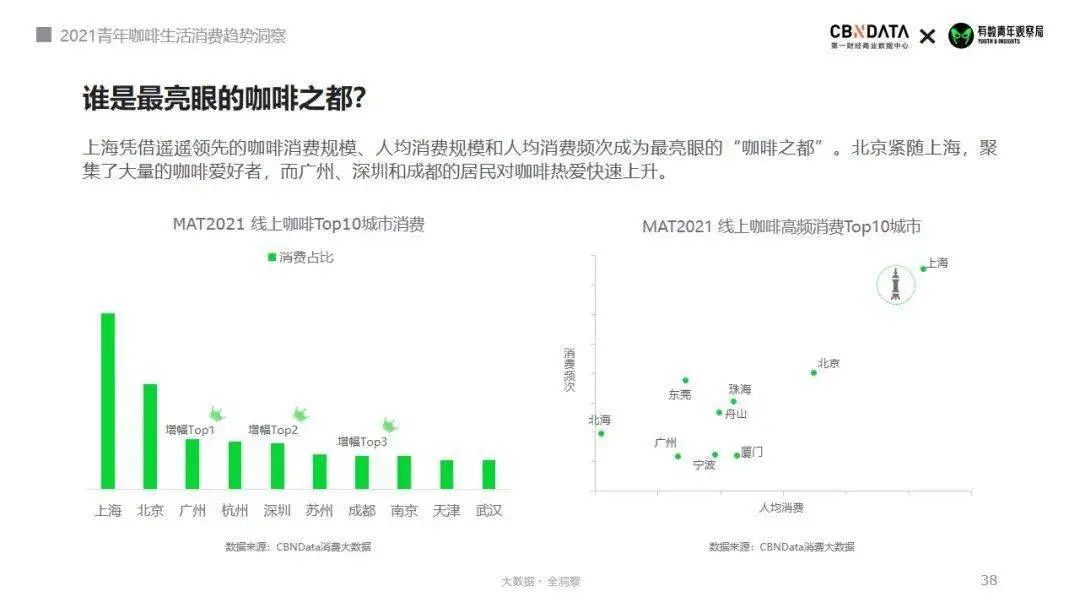

The Development Prospect of Coffee in China ranking of per capita Coffee consumption in Beijing, Guangzhou and Shenzhen

China's coffee market is in a stage of rapid development, and the consumption trend in recent years also confirms this. In addition, with the expansion of the coffee market, capital pays more and more attention to coffee brands, with the blessing of various factors, the coffee track is becoming more and more crowded.

On May 28th, the first Financial and Economic data Center (CBNData), together with the Youth Observatory, released a report entitled "Insight into the consumption trend of Youth Coffee Life in 2021".

The report shows that nearly 60% of white-collar workers drink three cups of coffee a week, and the per capita coffee consumption of Beijing, Shanghai, Guangzhou and Shenzhen is comparable to that of Japan and the United States.

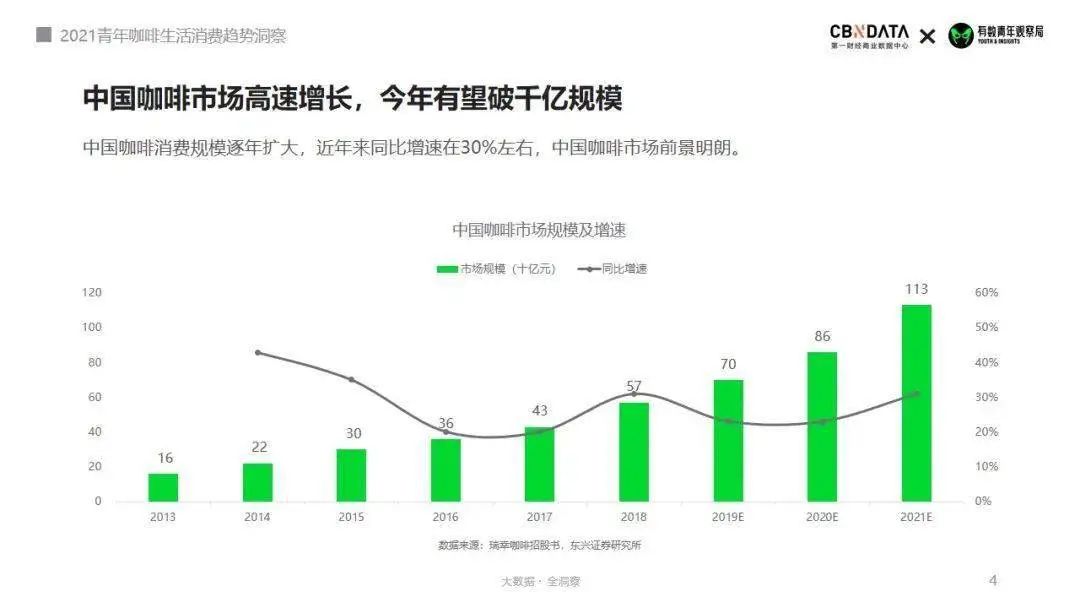

In addition, from the "2021 Youth Coffee Life consumption trend Insight" report shows that the prospect of China's coffee consumption market is clear.

The scale of coffee consumption in China is expanding year by year, with a year-on-year growth rate of about 30% in recent years, and consumers are concentrated in first-and second-tier cities.

Several data analyses on the report:

One /

In terms of per capita coffee consumption

First-tier metropolises like Beijing, Shanghai, Guangzhou and Shenzhen are already on a par with mature coffee markets such as Japan and the United States.

Relevant data show that Shanghai can be called the "capital of coffee", performing very well in the scale and frequency of per capita consumption, followed by Beijing, Guangzhou, Shenzhen and Chengdu. Guangzhou and Shenzhen are the new "coffee cities".

A previous report on the White Paper on China's freshly ground Coffee Industry also showed that by the end of 2020, the number of cafes in China had exceeded 100000, of which China currently has 108000 cafes, mainly in second-tier and above cities, accounting for 75% of the total. As of January 2021, Shanghai had 6913 cafes, making it the city with the largest number of cafes in the world.

Two /

In the consumer category

Coffee liquid, freeze-dried and capsule coffee are more popular.

In addition, the CBNData "report" shows that the proportion of cream consumption is declining year by year, although the business philosophy of black coffee milk in the market has not changed greatly, but some changes have taken place in black coffee milk, which is not as popular as oat milk. After the "plant milk hot wind", the cafe is constantly pushing through the old and bringing forth the new, with new oatmeal milk flavor coffee.

Three /

In the consumer crowd

More than 70% of women prefer coffee liquid, freeze-dried and capsule coffee, among which the consumers of coffee liquid are younger, and most of the supporters of freeze-dried and capsule coffee are cutting-edge white-collar workers and senior middle-class workers in first-and second-tier cities.

In addition, for "brick bearers", coffee also plays an important role in their daily life. Whether it is before, during or after moving bricks, "have a cup of coffee" is the norm.

The "2021 Youth Coffee consumption trend Insight" report shows that more than 70% of the offline coffee consumers are "brick bearers". Among them, exquisite brick bearers drink coffee more frequently, with nearly 60% drinking three cups or more a week. More than 70% said they drank coffee mainly on weekdays, and in the morning, noon and afternoon.

Similarly, in the past "White Paper on China's freshly ground Coffee Industry" reported on consumer group information, Chinese coffee consumers are mainly white-collar workers in first-tier cities between the ages of 20 and 40, and this trend is obvious in first-and second-tier cities. At present, the intake frequency has reached 300 cups per year, close to the level of mature coffee market.

Generally speaking, whether it is from the past "White Paper on China's freshly ground Coffee Industry" or the current "2021 Youth Coffee consumption trend Insight" report, the information points released behind these data tell us that China's coffee market has passed the stage of enlightenment, and the development trend of the future coffee market will usher in a stage of rapid development. Industry insiders expect China to develop into a strong consumer of coffee in the next five years.

According to the data of the forward-looking Industrial Research Institute, China's coffee consumption has grown at an average annual rate of 15%, and by 2025, China's coffee market will reach 217.1 billion yuan.

* part of data and image source: CBNData

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

The third financing process in five months New Coffee Brand MANNER gets a new round of financing of hundreds of millions of dollars

Four days ago, a number of media released news that MANNER, a new local coffee brand in Shanghai, had obtained financing again. Of course, for those who pay more attention to the trends of coffee brands, "coffee brand financing" is no longer a news worthy of a close-up. Today, it once again mentions the MANNER coffee financing incident because the brand mentioned it three times in just five months.

- Next

The reason why fashion brand FENDI launches coffee shop in Hong Kong and luxury brand opens coffee shop

Italian high-end fashion brand FENDI continues to cultivate the coffee market

Related

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?

- How to make butter American/butter latte/butter Dirty coffee? Is hand-brewed coffee good with butter?

- Is Dirty the cold version of Australian White? What is the difference between dirty coffee/decent coffee and Australian white espresso?

- Relationship between brewing time and coffee extraction parameters How to make the brewing time fall to 2 minutes?

- Got entangled?! Lucky opens a new store, Mixue Ice City, and pursues it as a neighbor!