Luckin Coffee pays a fine of 1.2 billion! Lu Zhengyao influenced investors to raise money for Ruixing.

According to a filing with the US Securities and Exchange Commission (SEC) on Feb. 4, Luckin Coffee has met the conditions of a previous settlement agreement with SEC at the price of paying a fine of 187.5 million US dollars (1.2 billion yuan) in exchange for SEC not holding Luckin Coffee accountable, which may put an end to Ruixing's financial fraud.

187.5 million US dollars is the legal settlement reached by Luckin Coffee and SEC in accordance with the legal procedures formulated by US laws, which is a judicial feature of the United States. This means that Luckin Coffee admits to some of the charges but no longer needs a long judicial process and SEC costs to sue, which is not a small sum of money. At that time (before the price increase) Ruixing APP coffee drink average price of about 15-16 yuan per cup to calculate, need to sell about 75 million coffee to earn back, but this number does not exclude the cost price.

Putting aside the cost and price, Ruixing at that time often gave out discount coupons, that is, the price of a cup of coffee was 5-6 yuan, which required about 200 million cups of latte to be sold. If you really want to "earn back", you still need to eliminate all kinds of costs, how many cups do you have to wash? Of course, Ruixing certainly didn't earn the settlement money by selling coffee alone.

The reconciliation between Luckin Coffee and SEC may pave the way for Luckin Coffee's re-listing, although it was revealed that Luckin Coffee was studying plans for re-listing in the United States, but was later denied by Ruixing.

In fact, if Luckin Coffee does not settle with SEC, in addition to being unable to trade on the stock market, SEC will still sue Ruixing. The settlement provides a stage for both sides to conclude the investigation as soon as possible, first, to "save face" and maintain their credit in the capital market; second, Luckin Coffee's development will continue to need a large amount of financing from the market to expand its business. Lucky still needs to pay attention to the financing value of American investors and end the game according to the rules.

Lu Zhengyao first completed the listing of his first company through Shenzhou car rental, using this listing experience and contacts in the financial circle to create the myth of lucky again. Qian Zhiya, executive vice president of Shenzhou car rental, founded Luckin Coffee alone. After only a few years from its founding to the market, his appearance seems to have a relationship with Shenzhou car rental and Lu Zhengyao. It is precisely because of capital that Luckin Coffee has the capital to subsidize and expand crazily, which once became a capital myth.

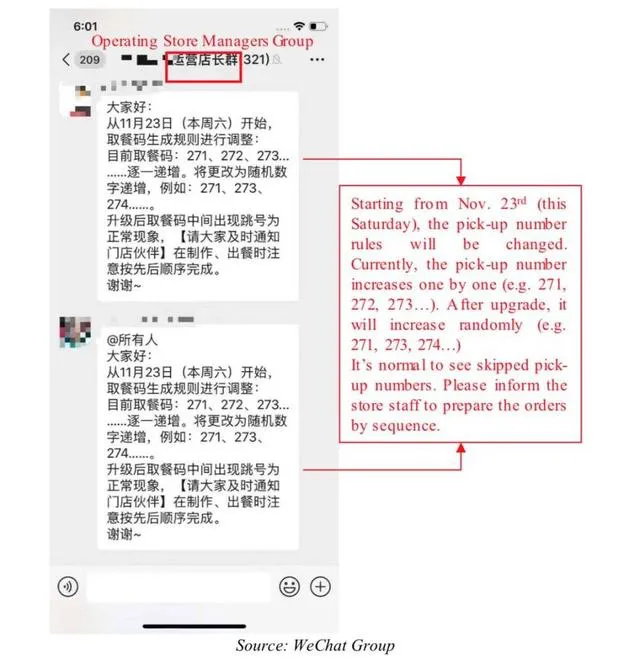

On January 31, 2020, Muddy Waters, a short seller of Chinese stocks, released an 89-page report on the actual turnover of Luckin Coffee's store, believing that Ruixing gained a large number of customers through subsidies and falsified its financial losses. Muddy Waters used 92 full-time and 1200 part-time jobs, collected 25000 shopping tickets, and concluded that Lucky's order volume, customer unit price and advertising expenditure were seriously exaggerated, deceiving the majority of investors. In other words, the money of most investors has become Lucky's cheap coffee.

On February 3, 2020, Ruixing denied the fraud and said the Muddy Waters report was unfounded and misleading.

After the revelation of Ruixing's financial fraud, from the statements of the parties, management adjustments, and capital changes, all the limelight after the incident was directed at Lu Zhengyao, which also shows that Lu Zhengyao was the ultimate manipulator of the incident, and the Muddy Waters report also confirmed that this is a business model that cannot stand the test.

2022 will be a year for Lucky to start anew. On January 27th, Daqing Capital announced that its leading group of buyers had completed the acquisition of part of the shareholders' shares of Luckin Coffee, which meant that Lu Zhengyao's former management had been completely out of business from the perspective of shareholding relationship.

Photo Source: Internet

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style)

For more boutique coffee beans, please add private Qianjie coffee on Wechat. WeChat account: kaixinguoguo0925

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Starbucks Coffee announced another price hike CEO: several price increases this year to cope with inflation and rising costs

Before the Spring Festival, I was still lamenting how miserable this Korean coffee lover was. First, Starbucks in South Korea reported an increase in the price of American coffee, and then there was a further "dilemma" caused by the "plastic ban" in South Korea, which caused the domino effect in major coffee shops in South Korea to increase the price of American coffee, which "obliterated" the American style of Korean coffee.

- Next

The most expensive coffee! The production of fermented Coffee in wooden Coffee barrels recommended by Japanese Coffee Shop

Once again, I was shocked by the Japanese pursuit of coffee! They are willing to spend an hour waiting for the extraction of a cup of coffee for a mouthful of full-bodied, extremely sweet coffee, or decades for a cup of coffee to be ripe. The name of a company in Bawei City, Osaka, Japan is called "TheM."

Related

- What is the difference between Indonesian Sumatra Mantinin coffee and gold Mantinin? How to distinguish between real and fake golden Mantelin coffee?

- What does bypass mean in coffee? Why can hand-brewed coffee and water make it better?

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?

- How to make butter American/butter latte/butter Dirty coffee? Is hand-brewed coffee good with butter?

- Is Dirty the cold version of Australian White? What is the difference between dirty coffee/decent coffee and Australian white espresso?