China's epidemic prevention policy should be liberalized! Starbucks shares are up!

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style)

For more boutique coffee beans, please add private Qianjie coffee on Wechat. WeChat account: qjcoffeex

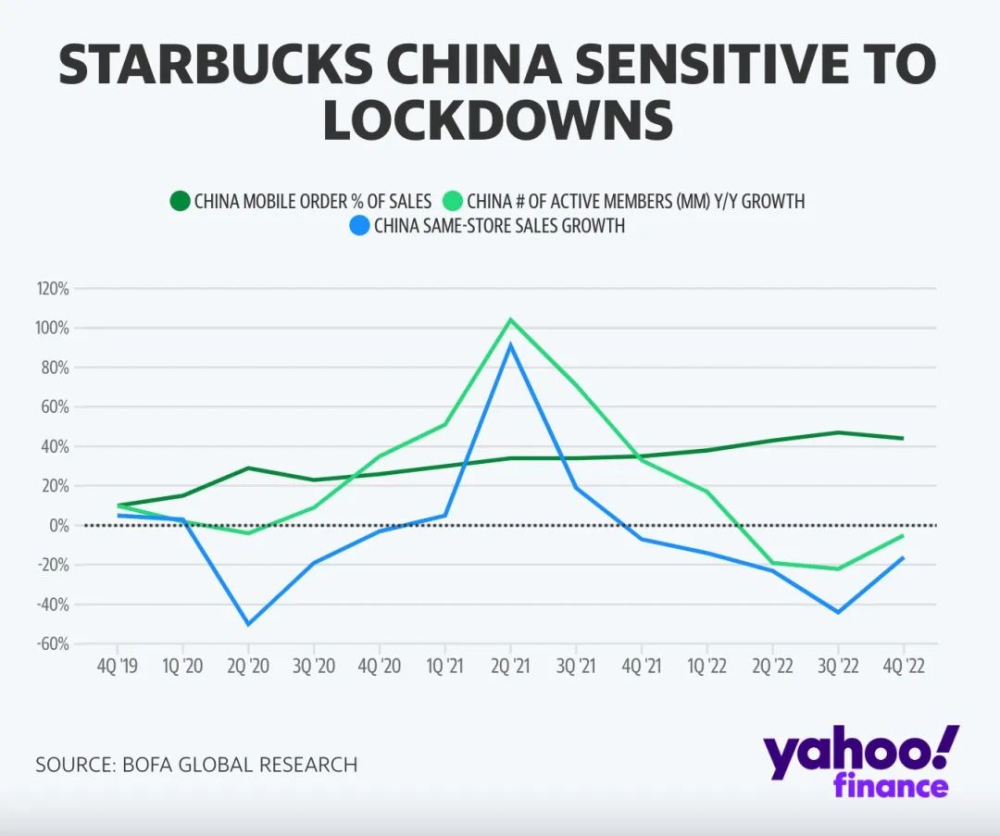

As the global epidemic situation has been alleviated to varying degrees, China has ushered in a new epidemic prevention policy. After opening up, production and life in various Chinese cities have gradually returned to normal, and economic vitality has gradually recovered. The optimization of China's policies has also enabled many foreign enterprises to benefit from it. Coffee chain giant Starbucks is one of them, the company has been affected by the epidemic again and again, as the economy recovers, Starbucks shares will rise again!

Recently, Bank of America (BAC) raised its target share price of SBUX (Starbucks) to $125 from $109, and reiterated its buy rating on the stock to start the new year, according to Yahoo Finance. SBUX shares closed at $104.46, up $3.63 from yesterday's close of $100.83, with a price-to-earnings ratio of $119.9 billion and a price-to-earnings ratio of $119.9 billion, according to stock market data today. Starbucks had a 12-month low of $68.39 and a 12-month high of $117.05.

Although affected by the epidemic earlier, Starbucks continued to expand its business. By the end of the fourth quarter of fiscal 22, the Seattle-based coffee chain brand giant had a total of 35711 global stores (including proprietary and licensed), an increase of 1878 over the same period last year, including 6021 stores in China, an increase of 663 over the same period last year. That's up from 4700 at the start of the epidemic three years ago, and Starbucks' global revenue rose 11% year-on-year to a record quarterly record of $8.4 billion.

In the fourth quarter, Starbucks reported earnings per share of $0.81, $0.08 higher than the consensus estimate of $0.73. Starbucks had a net profit margin of 10.18% and a return on equity of 39.85%. Starbucks' average earnings per share for the current fiscal year was 3.41.

Thus, Starbucks has maintained a very strong growth trend. Starbucks China's special star delivery sales increased by 35% year-on-year, accounting for 24% of total sales, and mobile orders also accounted for 44% of sales. The number of active members of the Star Club increased by 29% over the third quarter, rebounding by more than 1700, close to an all-time high.

At present, Starbucks's expansion in China is still in its infancy. At a global investor exchange meeting in September 2022, Starbucks announced its strategic vision for the next three years, launching a new value-oriented growth plan to increase the size of the Chinese market. It is expected to have 9000 stores in China by 2025. In order to achieve this goal, it will open one store every nine hours in the next three years.

This rapid expansion has also affected Starbucks' revenue far more than other food service chains such as MCD and Yum. But Senator Brands (YUM) said that "Starbucks' revenue this year should reach 60% to 70% of its pre-pandemic level and will achieve its long-term goal without any problem."

Bank of America believes that this optimistic picture is largely related to the reopening of China, with evidence that people are returning to work, consumers are returning to the model before COVID-19 and increased population mobility. Starbucks will have more orders.

As more and more Chinese consumers get used to drinking coffee in the morning, Starbucks is increasingly seen as a "luxury" within reach in China. In China, Starbucks is seen as an overseas competitor. It is cheaper than coffee brands such as GREYBOX and Peet's, but also higher than Costa Coffee, Tim Hortons and Luckin Coffee, which may be a pricing point somewhere in between for consumers.

Photo Source: Internet

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Luckin Coffee rushed out of the country to open a shop in Singapore?! The development of coffee market in Southeast Asia remains to be seen.

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style) more boutique coffee beans please add private Wechat Qianjie coffee, WeChat account: qjcoffeex for Luckin Coffee's development, many overseas friends often ask: when can

- Next

Traceable fresh milk is very popular in coffee shops! What kind of milk should I use for coffee in boutique cafes?

"Ah?! Is there any milk that is not from a single producing area? " I believe that when most friends see the topic, the first reaction is like this, because the code clerk before writing this topic, when chatting with friends and colleagues, their first reaction is so unified. At present, most of the milk on the market

Related

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?

- How to make butter American/butter latte/butter Dirty coffee? Is hand-brewed coffee good with butter?

- Is Dirty the cold version of Australian White? What is the difference between dirty coffee/decent coffee and Australian white espresso?

- Relationship between brewing time and coffee extraction parameters How to make the brewing time fall to 2 minutes?

- Got entangled?! Lucky opens a new store, Mixue Ice City, and pursues it as a neighbor!

- How long is the shelf life of high-quality hand-brewed hanging ear coffee? Why is the taste period of hanging ear coffee ground into powder only one month?

- Why does hand-brewed espresso smell good but taste bitter? Is the flavor of high-quality hand-brewed coffee aroma or taste?