India's coffee production is stable, but there are still many crises such as weather and shipping that affect production and exports in the new season.

Recently, the United States Department of Agriculture released the annual report on coffee in India, which pointed out that the annual coffee production in India is expected to be about 6 million bags of 60 kg coffee beans during the marketing year of 2024 Coffee 25, of which Arabica is estimated to be 1.4 million bags of 69 kg coffee. Robusta estimated 4.6 million bags of 60 kg coffee.

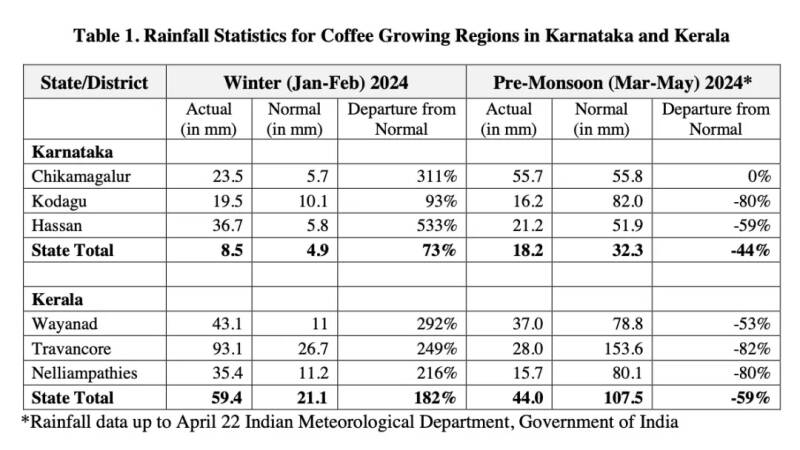

Due to Indian weather reports, after heavy rains in January and February, there was insufficient rainfall in many parts of India between March and May, and India, which used to have intermittent water shortages due to factors such as overuse of groundwater and climate change, is now in a serious water shortage crisis.

Rainfall statistics of coffee growing areas in Karnataka and Kerala, India

In addition, it had a negative impact on coffee production, resulting in a significant decrease in fruit setting rate (the proportion of successful fruit trees after flowering) in the main planting areas due to lack of water.

At present, Robusta accounts for more than 70% of India's coffee production, while the new harvest season is from December to February, so the current rainfall between March and May is crucial to determining Robusta production.

Recently, due to the impact of bad weather in large producing countries such as Brazil, Vietnam and Indonesia, coffee stocks in many countries are tight and production is expected to decline during the production season, and the pressure on global coffee supply pushed up the price of Robusta coffee in late April and supported the price of Arabica coffee. Although the price has fallen, it is still higher than in the past few years.

This pushed up the price of Arabica in India by 13% in April, while the price of robusta coffee rose by 15%. As the global demand for coffee is still large, India's exports are expected to remain at about 6.3 million bags. But at present, there is a strong demand for instant coffee in India, and domestic coffee consumption will increase by 2% to 1.3 million bags.

Although, at present, the Indian government has planned to increase the planting area of coffee to increase the yield, the planting area of 2024swap 25 has increased to about 475000 hectares. However, due to the current shortage of Rain Water and dry weather, the yield per hectare will be slightly reduced, the yield of Arabica will be reduced by 3%, and the yield of Robusta will be reduced by 2%.

Statistics on planting area and yield of Coffee in Robusta, India

In addition, the current plight of Indian coffee, in addition to the weather, there are shipping and price issues, the Red Sea situation continues to be tense recently, while India's main exporters are mainly European countries, so they are greatly affected.

According to traders, the current high price restricts international buyers from placing more orders. after all, compared with the coffee price in October 2023, Arabica is up 45% and Robsta is up 66%. The price of Indian coffee is also the highest in a decade, and the current price is higher than the target price of the International Coffee Organization (ICO).

In the Red Sea, it is reported that a spokesman for the Houthi forces in Yemen recently said that the Houthi forces will attack a number of ships related to Israel. And will carry out attacks in the Indian Ocean and the Arabian Sea.

Due to the short-term accumulation of European cargo volume and the low possibility of resumption of shipping in the Red Sea, shipping companies' European routes will usher in a price increase, with the original price of $2755 / TEU (20-foot standard container unit) rising by $6-1000 / TEU, with an average price of $2900-5000 / TEU.

In addition, during the peak shipping season for Asia-Europe routes in August, the freight rate is generally higher than the present. If the situation in the Red Sea continues, there may be room to continue to rise. Higher transportation costs could further push up the price of coffee.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Blue Bottle Coffee loses the lawsuit in trademark lawsuit!!

▲ Click to pay attention| Daily Boutique Coffee Culture Magazine Coffee Workshop A simple little blue bottle has made countless coffee lovers remember the "Apple of the coffee industry" Blue bottle coffee, and has also made many consumers like various utensils with blue and white colors, such as Blue Bottle's thermos, filter cups, etc. have become powder due to their high appearance

- Next

2024 Nicaragua COE results are released! Introduction to the Parainem Variety of Parainema

COE, whose full name is "Cup of Excellen", translates to the Cup of Excellence. It is the first coffee event held in Brazil in 1999 by the non-profit organization Excellence Coffee Organization (ACE). It is also the first Internet auction platform for global award-winning coffees. And every country can bid for C.

Related

- What grade does Jamaica Blue Mountain No. 1 coffee belong to and how to drink it better? What is the highest grade of Blue Mountain coffee for coffee aristocrats?

- What are the flavor characteristics of the world-famous coffee Blue Mountain No. 1 Golden Mantelin? What are the characteristics of deep-roasted bitter coffee?

- Can I make coffee a second time in an Italian hand-brewed mocha pot? Why can't coffee be brewed several times like tea leaves?

- Hand-brewed coffee flows with a knife and a tornado. How to brew it? What is the proportion of grinding water and water temperature divided into?

- What is the difference between Indonesian Sumatra Mantinin coffee and gold Mantinin? How to distinguish between real and fake golden Mantelin coffee?

- What does bypass mean in coffee? Why can hand-brewed coffee and water make it better?

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!