Luyin Pavilion plans to increase the number of stores to 300 to launch sub-brand "G Coffee" in 2014.

Chinese catering has a long history, but unfortunately there are only two catering enterprises that have succeeded in IPO in the A-share market: Quanjude and Hunan and Hubei. Since then, Jingya, Guangzhou Restaurant, GouBuLi and other catering chains have also submitted A-share listing applications, but are stuck in the "sustainability of profitability". It is also widely rumored that China's securities regulators plan to raise the annual profit standard of catering enterprises IPO from 30 million yuan to 50 million yuan.

We don't know who is swimming naked until the tide recedes. The little fat sheep was "sold", and South Beauty was "hung". The backdoor listing of "Tanyutou" failed. In this bloodshed, the Guangzhou local brand "Green Pavilion", which insists on no shortage of money, does not blindly follow, and does not shrink the "three noes principle", has become the protagonist and representative.

The reporter learned that the Green Pavilion is launching a new "G Coffee" chain to build it into the first brand of Chinese coffee. At the same time, a large amount of money has been invested in the construction of software and hardware facilities such as machining centers and SA P information systems, comprehensively realizing the transformation from single-store standardized management to group information chain management, empirical management to professional manager management mode, single-brand to multi-brand development side by side, and expansion and acceleration, and plans to increase the number of stores in the country to 300 by 2014, steadily sprinting forward to "IPO".

Between the difficulty and ease of listing

The CSRC plans to raise the listing threshold for catering chains to 50 million yuan a year, mainly because there is no reliable measurement of revenue and costs in catering companies' accounting statements, according to industry analysts. "for example, if you buy raw materials from a farmer's market with cash, it is difficult to verify the sales bill without invoices." A CSRC official, who spoke on condition of anonymity, pointed out that many catering brands were once popular, but the sustainability of profits has always been a problem. "now the average life expectancy of catering enterprises is 2.3 years, which is even shorter than that of small and medium-sized enterprises."

But the Green Pavilion is trying to rewrite this business bottleneck.

It has been more than 20 years since the first western restaurant was opened on Xihu Road in Guangzhou in 1989, and more than 100 branches have been opened all over the country. "if 50 million is spread to 100 stores, in fact, the profit target of a single store is only 500000." Huang Tao (not his real name), the franchisee of Luyin Pavilion, said that Luyin Pavilion can sell more than 1000 pickles a day, and the revenue of individual stores has been "high consolidation."

In the process management of procurement, sales and distribution, "Green Pavilion focuses on purchasing from professional suppliers at first-hand prices, such as the Australian Beef Association, the Alaska Seafood Market Association, and so on. We have also invested a large amount of money in the construction of processing centers, central kitchens and SA P information systems. All sales and procurement orders are irrevocable, and the financial system has long been standardized. " Lin Xin, president of Luyin Pavilion, told Nandu reporter that Luyin Pavilion had introduced 20 million venture capital as early as last year, "but the purpose of our introduction of investment is not to go public for listing, but to improve the company's modern management model." to inject a new concept of capital into the sustainable development of the Luyin Pavilion brand, so as to promote the rapid development of the company and maximize the efficiency and potential market of supporting the chain scale system. Such as banquet reception, online food ordering and other business. "

This performance is worth looking forward to in the eyes of investors. "if we follow the routine development, the Green Pavilion will not be short of funds. But if you want to achieve the scale of Starbucks, KFC, Green Pavilion to choose listing is very necessary. " Li Jianxin, managing partner of Cigna Capital, made such comments.

Increase the share of direct operation

In this way, franchisees from all over the world flocked to come with money, but the Green Pavilion politely declined.

Lin Xin explained to reporters, "after more than 20 years of accumulation, Luyin Pavilion has ushered in a stage of its own national expansion. This year, it will set up camp in Shanghai, the other pole of China's catering market (one pole is in Guangzhou). It is planned that by 2014, the number of branches nationwide will increase to 300, and the ratio of direct stores to franchise stores will be adjusted from the current 4:6 to 6:4."

"the difference is mainly in the background, and the direct stores are invested by the headquarters themselves. To join, the ownership of this store is owned by the franchisee, and the money earned by the operation is mainly reserved for the owners themselves. " Pei Liang, secretary-general of China chain Management Association, analyzed that joining is the speed of enterprise expansion in exchange for the lack of initial profits.

In other words, the revenue and profit of the franchise store itself are not included in the enterprise's financial statements, "and if there is a problem with the franchise store, the threat is the whole brand." Lin Xin believes that it is right for the Green Pavilion to increase its direct marketing efforts now, but it will not use tough measures to stop joining. "We are more willing to use the way of share buyback to turn the franchise stores into stores controlled by the Green Pavilion, while it is difficult to cover the fourth-and fifth-tier cities. The Green Pavilion will still open the joining model to integrate counterfeiters."

This is a road of Nirvana rebirth. In contrast, other catering enterprises are more in the industrial agitation, using to join the way, rapid expansion. After VCs cash out, blindly expanding stores will become a burden for catering companies, such as the Little Sheep who chooses to sell its controlling stake to Yum International.

"the more critical question is whether the supply chain construction of catering chain brands is industrialized and whether the management is standardized and refined behind the expansion of outlets." Lin Xin told reporters that the competitiveness of the Green Pavilion is actually vertical and horizontal integration. specifically, the steak, sauces and other products provided by the processing center, in addition to supplying the enterprise, will also try to enter the super circulation through the distribution network in the future.

In addition, the Green Pavilion has formed an alliance with Shenguotou, Dalian Wanda, Guangzhou Guangbai and other well-known domestic real estate developers to offset the pressure of rising rent costs through "sales sharing".

G Coffee Brand surfaced

For the time being, the sustained growth of the Green Pavilion has not yet reached its limit. But it is too simple to infer that its basic industry is evergreen.

In fact, "because of the large area of stores and the high requirements of the business area, we can choose a narrow business area, which belongs to slow food, and can not expand rapidly like McDonald's, True Kung Fu, Weiqian and other fast food enterprises." In order to make up for this defect and deeply meet the needs of different consumers, so as to fully integrate the advantages of the brand resources (brand, product, management, etc.) of the Green Pavilion, G Coffee has naturally become an important part of the rapid expansion of the Green Pavilion Group. " Lin Xin told Nandu reporters that Luyin Pavilion has opened a sub-brand store "G Coffee" in Guangzhou South Railway Station, which targets young white-collar workers. It takes "green coffee" as its carrier and uses "experience authentic, low-calorie and healthy" to interpret a fashionable and healthy lifestyle of "not in the cafe, on the way to the cafe."

"just like McDonald's dessert station will guide the mother store, the Green Pavilion will also be bundled with G coffee in the future. And plans to achieve the scale of 500 stores within 5 years. " Lin Xin said.

Under this grand layout, the road to listing of the Green Pavilion is still a long way off, and whether its subsequent growth can still be strong can be regarded as an inflection point for investment in this field.

data

Coffee chain giants such as Starbucks have opened stores in first-tier cities at a rate of 25 per cent a year, and coffee consumption in the mainland has increased by 35 per cent in the next three years to 45900 tons in 2014, according to authoritative data. The addition of G coffee brand is not only a natural extension of Luyin Pavilion brand resources, but also can form a benign complementarity with Luyin Pavilion restaurant.

(responsible Editor: Leo)

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

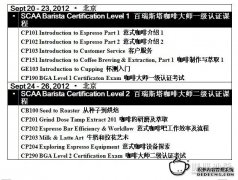

SCAA Brista Coffee Master (Barista) first-and second-level certification courses [September 20-26

The SCAA Brista Coffee Master (Barista) first-and second-level certification courses have begun! From September 20 to 26, 2012, the Beijing SCAA Coffee Master Professional Certification course finally started in the mainland! Want to know how the international Brista coffee master is made? Come and study! You will be tomorrow's Barista star! Under the expectation of the vast number of friends, the authorized country of SCAA

- Next

It is controversial that coffee shops in Jinan charge minimum consumption.

Once you step into a coffee shop, you can't leave without paying. Is this a reasonable rule? Recently, at the British Royal Coffee Restaurant on Sunshine New Road, Mr. Zhang and several colleagues sat for 15 minutes, during which they drank eight glasses of water without any consumption, and were charged a service charge of 30 yuan. After visiting several coffee shops in Jinan, the reporter found that charging for guests entering the door has almost become the rule of the coffee shop. According to the price department, coffee

Related

- Can I make coffee a second time in an Italian hand-brewed mocha pot? Why can't coffee be brewed several times like tea leaves?

- Hand-brewed coffee flows with a knife and a tornado. How to brew it? What is the proportion of grinding water and water temperature divided into?

- What is the difference between Indonesian Sumatra Mantinin coffee and gold Mantinin? How to distinguish between real and fake golden Mantelin coffee?

- What does bypass mean in coffee? Why can hand-brewed coffee and water make it better?

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?