What should Nestl é, the world's largest food retailer, do when it is stuck in China?

With slow growth in the instant coffee market, lack of brands with high growth potential and difficult integration with local companies, what should the world's largest food retailer do?

Nestle, the world's largest food company, has tasted the bitterness of coffee in the Chinese market.

After a lapse of five years, Nestl é has replaced the full package of instant coffee. The classic brown color was replaced with bright red, so the salesman piled the new products in the shape of a hill in the supermarket and played the usual promotion card.

With the packaging change, Nestl é hired star Angelababy as the new spokesperson and filmed four video commercials. Unlike in the past, these ads don't appear on TV-you can only see them on social networks and video sites.

To tie in with the launch of the new product, Nestl é also destroyed 400 tons of instant coffee at a coffee factory in Dongguan. "about 30% of the products are recycled for packaging." A former employee of Nestl é told reporters. This happened in March this year.

When Nestl é launched new products, it may have realized that it had set excessively high sales targets. Most of the 4 million tons of coffee destroyed were those pressed by sales staff to meet performance targets.

In the warehouse of a major seller in Nestle China, there is also a backlog of more than 20 million yuan of Nestle coffee gift box inventory, which is specially tailor-made for this year's Spring Festival sales. "the head of Nestle in the supermarket is very beautiful, but the performance has not changed much." The staff of the dealer said.

According to the order cycle, the goods should have been produced in the middle of last year. The sales department places an order with the factory according to the sales estimate and usually gives the order to the factory four months in advance, and the quota can be increased or reduced next month to make adjustments. The final order is determined under the sales estimate that "can be sold".

A salesman who has worked at Nestl é for many years told reporters that this is a common situation in retail, usually because the sales place an order with the channel, that is, the dealer. "if the target given to me by my boss is 10 million yuan and I can only do 5 million yuan, what about the remaining 5 million yuan? For the bonus, I will also choose to put another 5 million yuan of goods into the channel. "

Nestl é is stuck in China.

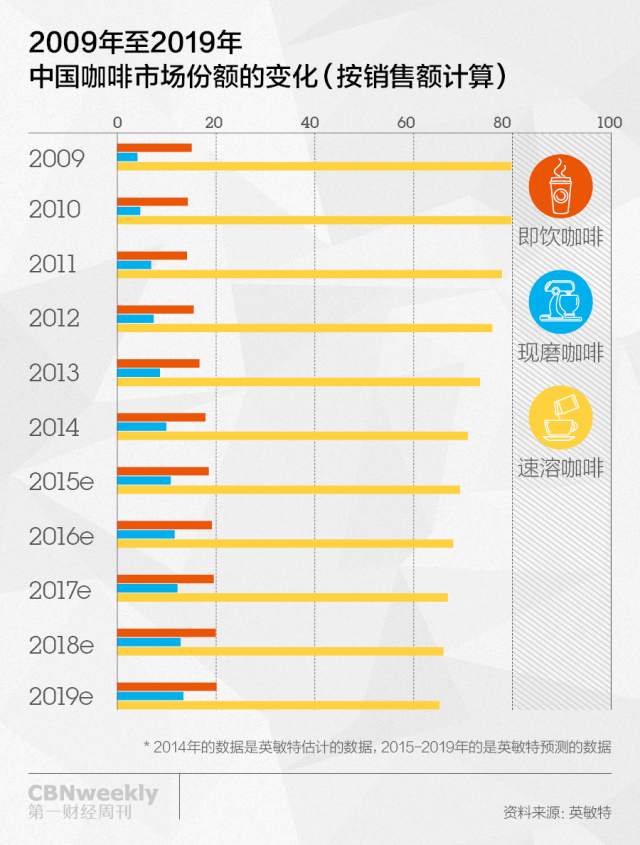

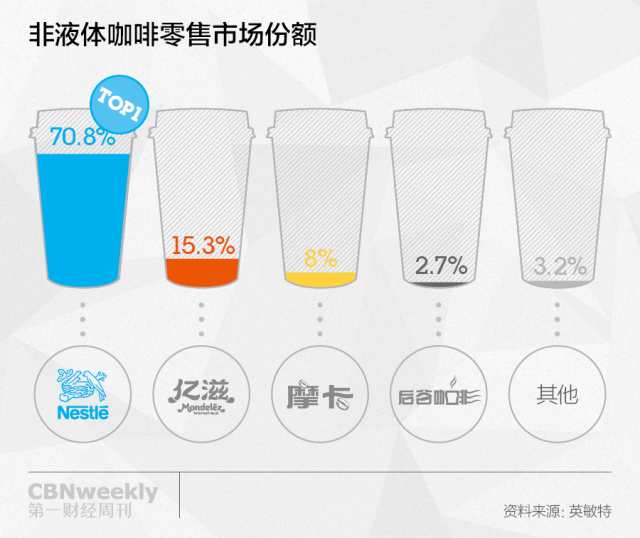

A bigger headache for Nestl é than inventory is that the growth of the instant coffee market is slowing significantly. According to a report by Mintel Consulting, instant coffee has grown at a compound annual growth rate of only 13.5% over the past five years, with its market share falling from 80.7% in 2009 to 71.8% in 2014, a trend that will continue in the future. Mintel predicts that the market share of instant coffee will fall to 66%. In 2013, Nestl é instant coffee sales accounted for 70.8% of the instant coffee market at that time.

Yes, Nestl é was the inspiration for the Chinese coffee market, and "delicious" sparkled in the burgeoning business world of the 1980s. But since then, Starbucks introduced freshly ground coffee on this basis, which in turn spawned the cafe culture. Over the past five years, this market segment has grown at a compound annual growth rate of 38.6%-Chinese consumers hungry for new things clearly believe that Starbucks represents a more global way of life.

Not only instant coffee, but also instant coffee, chocolate waffle, confectionery, cooking products, pet food, as well as the acquired Yinlu and Xu Fuji and other Nestl é businesses in China have declined to varying degrees. In the fast-changing consumer goods market, Nestl é failed to foresee that e-commerce has rapidly broadened consumers' horizons and shopping radius.

Nestl é's performance has reflected this passivity. In 2014, its sales in China were 660 million Swiss francs (4.448 billion yuan), up 0.3% from a year earlier, compared with 29% the previous year.

The performance of the Chinese market even affects the overall performance. According to Nestl é's first-quarter 2015 results, organic revenue fell 0.2 per cent and real internal growth fell 2.3 per cent in the Asia, Oceania and sub-Saharan Africa business segment where Greater China is located. This is mainly due to the "slow" growth of business in China, the report said.

Most of the foreign consumer goods giants who cultivated the Chinese market in the early days experienced a similar experience. Procter & Gamble and Unilever also failed in the face of accelerated consumer upgrading and diversified brand demand.

Nestl é is clearly aware of the problems with its Chinese business. In its 2014 earnings report, Nestl é specifically mentioned that "in China, we need to readjust our product line to adapt to fickle Chinese consumers." For a large, century-old European company, this is not easy.

The operation mode of financial companies is not suitable for the Chinese market.

Nestl é from Switzerland is a "financial" company, in order to ensure that there are enough profits to return to shareholders, Nestl é is as large as every strategic layout, as small as each new product listing will be detailed accounting of financial returns and profit space. This approach is commendable in mature markets, where it has a centuries-old brand foundation in Europe, but it appears passive in the Chinese market, where new brands emerge in endlessly, are good at price wars, and where consumers are less loyal to brands.

Nestl é once launched a boxed milk with a price of 1.9 yuan, which is the same as that of Guangming's similar products. Later, due to rising costs, Nestl é had to adjust its price to 2.2 yuan and 2.9 yuan successively, while Guangming's price has never changed. The difference in price gradually led to the difference in sales, and Nestle milk finally withdrew from the market. "Nestl é requires a high gross profit margin for brands, and European companies cannot understand China's small profits and quick turnover." A former Nestl é salesman told. "but Nestle's products are not luxury goods, and consumers can't accept such a high price difference."

Roland Decorvet, Nestl é's predecessor in Greater China, increased the proportion of expatriate staff among middle and senior managers during his tenure, adding to labor costs. Chinese employees mainly work in the sales team, while management and other functional departments are mainly foreigners. In addition to high salaries, these foreign managers enjoy company-equipped housing, chauffeured cars and the cost of their children attending international schools-on average, the company has to pay 3 million to 4 million yuan a year in labor costs for a foreign executive above the director level, which is equivalent to the wages of 10 to 20 front-line sales.

However, it is almost impossible for an European to gain an in-depth understanding of the Chinese market and the subtle psychology of consumers during his two or three years in office. "FMCG needs consumer insight most, and the most valuable insight comes from conversations in local life situations such as elevator shafts and bus stops, rather than gathering a group of consumers in a room and asking pre-designed questions." The person who left said.

Under this management approach, Nestl é underestimates the aging rate of established brands-instant coffee, ice cream and chocolate candies-categories that were once considered fashionable by Chinese consumers and are now mostly classified as "unhealthy foods". Especially in the past five years, Chinese consumers have shown great enthusiasm for healthy food and high-end imported new brands.

The original distribution system makes Nestl é far away from consumers.

Over the past decade, Nestl é has been an active introducer of fresh products: it usually decides when to introduce which products to China based on experience in other markets. One of them is Kit Kat, a delicious chocolate waffle that is popular in Japan but has experienced twists and turns in China.

In many cases, Nestl é has a bad time to launch. In the 1990s, Nestl é introduced Kit Kat for the first time, setting a sales target of several million yuan for China. But at that time, Chinese consumers had limited acceptance of high prices, and Kit Kat withdrew from the Chinese market because of poor sales. A few years later, Nestl é launched Kit Kat for the second time, "opening several production lines", but it came to an end again because sales did not meet expectations. "at that time, Nestle would apply the successful template of foreign countries to calculate how much production and sales should be invested at the beginning, and so on. This practice is not localized enough in China and will not work." The above-mentioned dealer said.

The misjudgment of the market is the beginning of Kit Kat's failure, while the long-standing sales system that relies on distributors slows Nestl é's perception of market changes.

Dealer system is a commonly used distribution method in the retail industry. Fast consumer goods companies such as Nestl é and Procter & Gamble all manage channels in this way. When the market is in the seller's market, that is, when supply is less than demand, Nestl é, through large dealers and next-level dealers, can smoothly make products reach consumers without having to build their own distribution system. Nestl é is able to free up the cost and energy to do more research and development, marketing, nurturing new brands and other work.

However, with the expansion of the market, Nestl é has gradually lost its keen sense of smell to the market in the long chain of outsourced distribution.

For Nestl é, the payback time and bargaining power of retailers and dealers are different. There is a three-month account period for supplying goods to retailers like Wal-Mart, and whether the repayment can be received on time depends on whether the retailer is well-funded and properly deployed at that time. But it is different to supply to dealers, who need to settle their accounts with Nestl é as soon as they restock.

Therefore, the dealer system not only means the savings of pre-distribution costs, but also brings cash flow. This is a factor that financial companies value more.

About 10 years ago, fast consumer goods companies such as Procter & Gamble and Unilever changed their channel strategy and adopted a direct supply strategy to large retailers such as Wal-Mart to grasp first-hand terminal data, leaving only small sales channels to dealers. Nestl é did not follow the change.

No one dares to shake up Nestl é's distribution system easily, and its successive CEO needs a good financial report. Channel change means that bad debts may not be recovered, as well as an increase in employment costs. With Nestl é's size in China, making similar changes may require a team of 10 people to directly dock with Wal-Mart, who will replace dealers to complete the procurement management, logistics and distribution, sales negotiations, bill settlement and other work of Wal-Mart. In addition, nearly dozens of sales representatives are needed to manage Wal-Mart stores across the country.

On the other hand, the sales team managed by themselves can carry out in-store execution in the terminal better than dealers, and can feedback the voice of consumers to the company more quickly.

Nestl é's "finance first" management idea strengthens the original distribution system, but it also makes Nestl é farther away from consumers. At the same time, the lack of competitors for a long time has also eroded Nestl é's sense of competition. In the instant coffee category, Nestl é has long left Maxwell far behind and firmly ranked first. After Maxwell was spun off by parent company Mondelez International at the end of 2014, Nestl é's sales team became even less motivated. "if Maxwell still exists as a competitor, Nestl é will certainly follow up on brand and channel promotion." The Nestle dealer said. Without a close competitor, it is difficult to assess whether a regional salesman invests enough energy in low-line cities, and it also increases the cost of market education for instant products.

The unfavorable integration of new product launch and acquisition aggravates Nestl é's predicament.

For large multi-brand companies, independent brand operation can also maintain a channel of direct communication between brands and consumers. Nestl é is not without this experience, due to different sales channels, Wyeth, professional catering, Nespresso and other brands report directly to the global headquarters, the sales system also operates independently.

But for other brands, especially the non-global brands acquired by Nestl é, they are contained in the sales system of Nestl é China. The system assigns instant coffee, cereal, candy and pet food as dry goods to a sales team, and allocates a sales team to professional catering such as catering and office buildings.

This is the practice of minimizing the cost of sales, but brands with small sales, especially new ones, are also difficult to grow. "Coffee is a 10 billion yuan business. Why should I spend so much time thinking about the 100 million yuan cereal business?" As a salesperson, sales volume means a bonus.

Pet food brand pet you was once one of Nestl é's most successful business units in China. Liu Qianzong, then head of China business from Taiwan, worked out differentiation strategies for Mars, such as paying more attention to emerging subdivision channels such as pet stores. In 2007, Chong you's sales in China reached 300 million yuan, with a higher market share than Mars's pet food.

But then, the executive was replaced by a foreigner who believed that Nestl é did a very good job of dry food and should "lean against big trees to enjoy the cool" and merge the favored sales system into the dry food system. At that time, the sales volume of pet you only accounted for 1% of Nestl é's sales of dry goods, and the sales staff of practical goods simply did not have the energy to take special care of you, and the competitive advantage gradually disappeared. Today, Nestl é has been semi-withdrawn from pet you, and the annual sales of the brand have dropped to tens of millions of yuan.

Without introducing successful new brands, Nestl é has expanded through localized mergers and acquisitions-as it has always done in the global market. Since 2011, Nestl é has acquired local beverage brand Yinlu and confectionery brand Xu Fuji. But in China, integration is not going well. In addition to instant coffee, the two main businesses that will drag down Nestl é's overall revenue in the future are Yinlu and Hsu Fu Chi.

The slump of Xu Fuji and Yinlu has been blamed by Nestl é on a "slowdown in consumption in China's gift market"-most of their business takes place in third-and fourth-tier cities, and sales are mainly concentrated in the Spring Festival market.

Sales of silver herons declined in 2014. The shortage period should be one month, that is, the products sold on the shelves this month should be products with a production date of last month. However, at the end of last year, Yinlu sold the same products in Beijing market in August and September of that year. It was not until early 2015, when the Shandong factory stopped production for half a month, that Yinlu gradually digested its inventory during the crisis.

Yinlu first made some achievements in the sub-field of peanut milk, but because the profits of the beverage category were higher and the volume was larger than that of the food category, including competitors such as Master Kang, Dali Garden, and Jinmai Lang, they forcibly opened the market with a very low price plus some extra admission fees.

At the terminal, Yinlu can only increase sales promotion efforts to fight back. In the wholesale market, the original 41.5 yuan per carton of peanut milk was reduced to 40.5 yuan or 40 yuan, and Nestle sacrificed about 1 yuan for the handling of secondhand goods per box.

Competition in this market segment is becoming increasingly fierce. More imported and regional commodities have joined the national market with the help of the Internet. This does not include successful new brands based on e-commerce platforms. A sales representative at Yinlu Northern Market said his sales target for this year has been reduced by 200000 yuan, but it is still difficult to achieve.

Nestl é launched an e-commerce platform in 2012, but its focus is on transferring products it sells offline to an e-commerce platform, rather than trying to launch new products through it-which clearly does not take full advantage of the opportunities offered by e-commerce.

In fact, after the acquisition, the autonomy of Yinlu and Hsu Fu Chi in marketing has been weakened. Nestl é not only connects its IT system and supply chain, but also uniformly manages in accordance with Nestle's production process and quality standards, and sends brand management personnel, and the brand input fee also complies with Nestl é standards.

Nestl é has been trying to strike a balance between maintaining the independence of the acquired brand and managing it effectively. There was no integration of Wyeth after the acquisition of Wyeth in 2012, and even Nestl é has a milk powder business. Because Nestl é headquarters believes that "Wyeth can do today's business because of its own DNA", Nestl é is a peaceful European culture, while Wyeth's culture is American: enterprising and results-oriented.

The two milk powder businesses are still in a competitive relationship, and ordinary employees are not even allowed to call each other's companies except for high-level communication. As a result, Wyeth's performance climbed from fourth to first in the milk powder industry.

For Yinlu and Hsu Fu Chi, which are also acquired, Nestl é is trying to better integrate them in the channel, rather than allowing them to operate independently like Wyeth. Nestl é ready-to-drink coffee was handed over to Yinlu for sale, indicating that Nestl é plans to use the original channels of Yinlu to distribute ready-to-drink coffee products.

Nestl é is caught in a dilemma. Although Nestl é still occupies the top spot in China's instant coffee market, the decline in market acumen and the disadvantage of new product launch and acquisition integration are dangerous signals in the fast consumer industry.

Nestl é China urgently seeks change

In 2014, the chairman and CEO of Nestl é (China) Co., Ltd. was held by a local manager for the first time.

Unlike his foreign predecessors, Zhang Guohua, from Hong Kong, once worked as a marketing executive at fast consumer goods companies such as Procter & Gamble and Coca-Cola, who led Wyeth to overtake its rivals.

Former colleagues describe Zhang Guohua as a professional manager who "treats foreign companies as start-ups". He also built Wyeth's management team in China. "as long as he thinks it's right, everyone on the team will work hard in that direction." But for Nestl é, what is more important is Zhang Guohua's insight into consumer demand.

In 2006, he was the first in the industry to hire "father" Jacky Cheung as the spokesperson for milk powder, rather than the usual image of a mother in the industry. For many years after the event, consumers whose children have grown up still remember the Wyeth brand because it understands that new mothers "actually want their fathers to be involved in taking care of their babies."

In addition, when Wyeth's competition emphasized the added DHA and the type and content of nutrients, Zhang Guohua was the first to communicate with consumers in terms of the similarity between the molecular structure of milk powder and breast milk.

However, the market is changing rapidly, and Zhang Guohua's reform has become more difficult. Nestl é's high-growth areas, milk powder and professional catering, are under pressure from local competitors. Foreign brands such as Wyeth, Abbott and Mead Johnson are becoming homogenized, while they are also facing pressure from local competitors such as Beinmei, Shengyuan and Synergy, which are more flexible in China.

Nestl é has the strictest compliance standards for foreign companies. This makes it passive in the face of "flexible" competitors in the Chinese market. In Europe, in order to encourage breast milk, milk powder companies are prohibited from advertising milk powder to children under the age of one, and all promotions such as contacting newborn mothers in hospitals and giving them samples will be severely fined. But Nestl é's Chinese rival brands still send more promotional messages to mothers of newborns under the age of one.

There is nothing wrong with commercial companies with clear social norms, but if most of their peers in the market do not abide by the same standards, it is bound to lead to unfair competition.

In April this year, Wyeth milk powder was selected by the Swiss headquarters to check compliance. Headquarters sent a number of employees to the Chinese market to check whether Wyeth milk powder violates Swiss headquarters standards in its business activities. In response to the inspection, Wyeth employees had to reduce the display area of the first and second stages of milk powder in supermarkets and maternal and infant stores, and the promotion stack was absolutely not allowed-but in the Chinese market, the first and second stages of milk powder are the key to catching the new mother and the main source of sales-which directly led to the failure of Wyeth milk powder sales target in April.

In addition to expanding local talent, Zhang Guohua also wants to increase Nestl é's nutrition business to make "previously unhealthy products healthier," according to Nestl é insiders. This adjustment is due to the fact that Nestl é's existing product structure can no longer keep up with the upgrading trend of consumption in China-which means the upgrading of existing products and the launch of new products.

The sales system is still a top priority. Zhang Guohua obviously did not want to repeat the same mistake. As soon as he took office, he promoted the building of the direct operation team. At present, Nestl é has reached a direct supply agreement with RT-Mart and Wal-Mart, and more stores will be added to Nestl é's direct supply list.

For Zhang Guohua, this is a "back-to-back battle". Foreign giants no longer hold the rules of the game in China's consumer goods market; internally, Zhang Guohua also has to face the influence of unshakeable foreign executives-the style of European companies will not change.

For Nestl é China and Zhang Guohua, 2015 will determine their future fate.

Source: first Business Weekly

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Not every kind of coffee can cheer you up quickly.

How can ability quickly refresh oneself, wake up doze off? A lot of people think of drinking coffee. However, can coffee really boost one's spirits and eliminate drowsiness immediately? Recently, the Chongqing Morning Post and Consumer report magazine examined seven prepackaged lattes of Brown, Nestle, Qiaoya, Yaha, Yali, Yushi and Kirin Firecup, as well as Starbucks, Kopi Luwak and Lavazza S

- Next

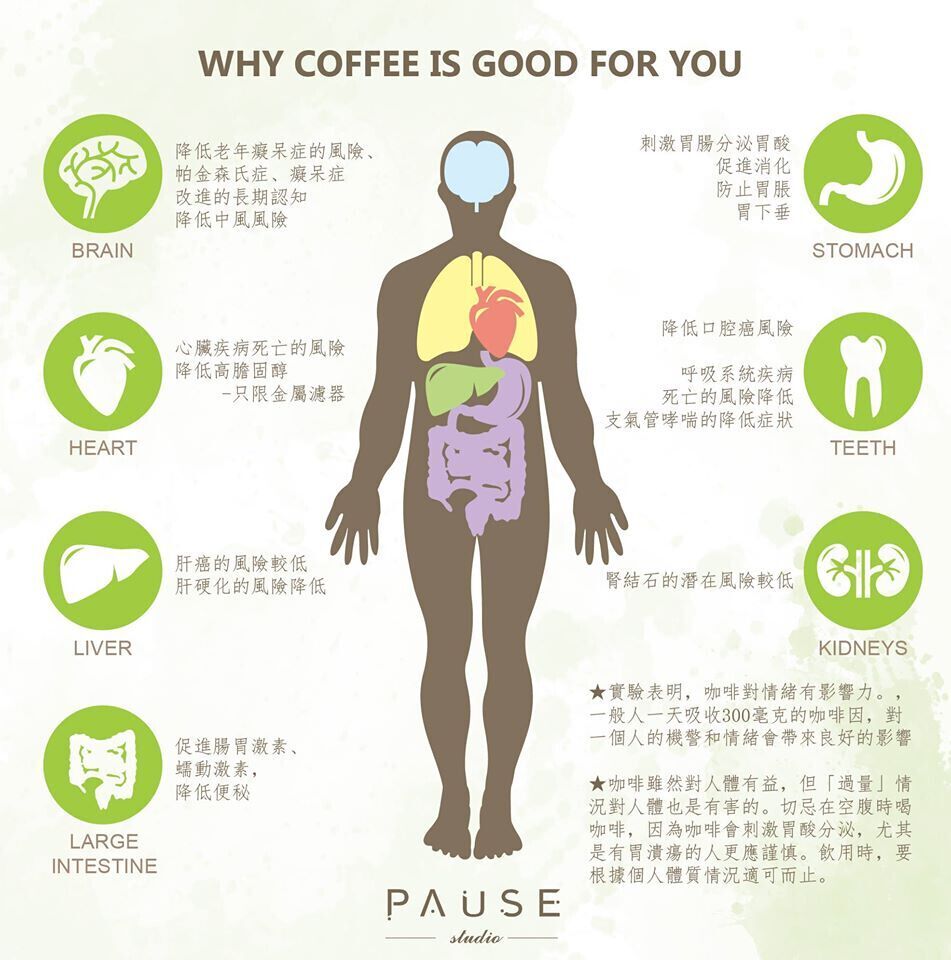

Coffee is healthy, it can not only refresh us but also make us happy.

Coffee, let many people stay in it, taste a good cup of coffee, not only can make the morning energetic, but also a taste of life. But you know what? Enjoy a cup of delicious coffee at the same time, but also have unexpected benefits to your health! Now while you are drinking coffee, Pause studio will introduce to you how coffee can help our bodies! ★ enhances body sensitivity.

Related

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?

- How to make butter American/butter latte/butter Dirty coffee? Is hand-brewed coffee good with butter?

- Is Dirty the cold version of Australian White? What is the difference between dirty coffee/decent coffee and Australian white espresso?

- Relationship between brewing time and coffee extraction parameters How to make the brewing time fall to 2 minutes?

- Got entangled?! Lucky opens a new store, Mixue Ice City, and pursues it as a neighbor!