Ruixing Coffee Latest News: Ruixing obtains financing of US $250 million from Dazheng Capital and Pleasure Capital

Luckin Coffee has some good news.

After the financial scandal, Capital chose to trust Luckin Coffee.

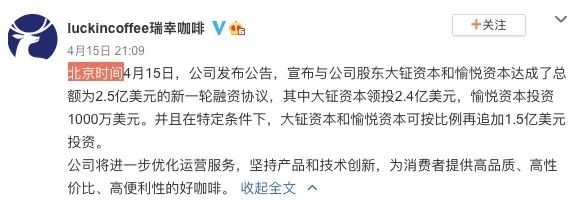

On the evening of April 15, Luckin Coffee received his first round of financing after the financial scandal, with two major shareholders coming from Daqing Capital and pleasure Capital.

On the evening of March 16, Luckin Coffee announced on his website that he was conducting exclusive negotiations with trusted investors on financing of at least 250 million US dollars. As soon as the news came out, everyone immediately attracted everyone's attention. At that time, Luckin Coffee said that the other party was an PE institution and there was more than one investor, but the investment was only a 30-day internal discussion, and there was no specific information about the detailed investment amount, that is to say. We won't know whether investors are really willing to pay for Luckin Coffee until 30 days later.

On the evening of April 15, Luckin Coffee announced the news of "exclusive negotiations with trusted investors" as scheduled.

Ruixing announced that it had signed an investment agreement with Dawei Capital and Joy Capital.

From this point of view, the so-called "trusted investors" are Dawei capital and pleasure capital.

According to the investment agreement, Dazhi Capital agreed to buy Luckin Coffee's advanced convertible preferred shares through private placement, of which Dazhuang Capital led the investment of US $240 million and pleasure Capital invested US $10 million. In addition, under certain conditions, Dazhuang Capital and pleasure Capital can invest an additional US $150 million proportionately.

However, the announcement also mentioned that the delivery of the deal depends on several delivery conditions, including the completion of a debt restructuring arrangement between Luckin Coffee and holders of convertible bonds of $460 million.

Anyone who knows Lucky knows that Dawei Capital and pleasure Capital have a deep binding relationship with Luckin Coffee. This time, the two major institutions took the initiative to save Luckin Coffee. According to an investor told the media: "I guess that on the one hand, Lu is out, on the other hand, the fundamentals of Lucky should be good, and it is normal for these institutions to re-participate, because they know more about Lucky." Shareholders contribute again, but also for the enterprise to survive, after all, at this time, survival is Luckin Coffee's first priority. "

Dawei Capital and pleasure Capital are the leading private equity firms in China. They have previously participated in round An and round B financing of Ruixing. Dawei Capital is also the earliest and largest external institutional investor of Lucky, with a total investment of nearly US $180 million. Liu Erhai, executive partner of pleasure Capital, began to invest in Shenzhou rental car in 2006, later invested in Shenzhou chauffeured car, and later Luckin Coffee. Now Dawei Capital and pleasure Capital are the existing shareholders of Luckin Coffee.

Before Luckin Coffee's scandal, Li Hui, chairman of Dawei Capital, and Liu Erhai, managing partner of pleasure Capital, worked closely with Lu Zhengyao in three projects, namely, car rental in China, chauffeured car in China and Luckin Coffee. Outsiders even called them an "iron triangle". Until Lucky's financial fraud and delisting crisis, the interests of Lu Zhengyao, Li Hui and Liu Erhai began to become inconsistent. Leading to the "iron triangle" turned against each other, at that time, the relevant media said: Lu Zhengyao wants to protect himself, while Li and Liu are more concerned about the survival of Lucky and the interests of investment institutions, and then Luckin Coffee's board of directors is mired in an infighting war.

Luckin Coffee said on the acquisition of a new round of financing that the conclusion of a new round of financing agreement will help to further optimize the company's financial structure to promote the development of core business and achieve long-term growth goals. Ruixing will use this investment to make a good overseas debt restructuring plan and fulfill its obligations under the settlement agreement with the Securities and Exchange Commission (SEC).

In addition, Luckin Coffee also stressed on the official Weibo that the company will further optimize its operational services, adhere to product and technological innovation, and provide consumers with high-quality, cost-effective and convenient coffee.

In addition, Luckin Coffee also changed his independent auditor while getting the investment.

Luckin Coffee has appointed Zhongzhengda Accounting firm to replace Mak Kai Boping as its independent auditor.

Mackay Bopping was appointed by Ruixing as an independent auditor in September 2020, and Ruixing said that McKay Bopping believes that because of the general control of information technology in 2019, it did not collect enough independent third-party data or implement sufficient audit procedures to complete the audit.

There is no difference between the company and Macpherson on accounting principles or practices, disclosure of financial statements, audit scope or procedures, and plans to cooperate with Zhengda to submit annual reports for 2019 and 2020 as soon as possible.

Last,

From the initial establishment of Ruixing to its listing, financing can be wave after wave, it can be said that it is inseparable from the promotion of capital. Now Luckin Coffee, who is "ripe" by capital, has returned to the line of sight of capital. In other words, it also shows that the capital chooses to believe in Lucky again. Lucky to rebuild the great cause may be hopeful!

* Image source: Internet

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Starbucks special store Japan opens the first Starbucks sign language store nonowa national store

On June 23, 2020, Starbucks announced on its website that it would open its first sign language store, nonowa, in Japan. Judging from the promotional pictures on Starbucks' official website, the environment of this national sign language store called nonowa is no different from that of ordinary Starbucks stores. The only difference is that this sign language store has a series of obvious sign language symbols on the sign.

- Next

Suzhou Matrix Coffee is a direct-sale store? On behalf of mathematicians coffee brand won tens of millions of yuan A round of financing!

The coffee field is getting stronger and stronger, and another new coffee brand has received tens of millions of yuan in Series A financing. According to 36 krypton reports, the cutting-edge chain coffee brand "Dai Mathematician Coffee" founded in Suzhou completed tens of millions of yuan in Series A financing by the end of 2020. Its investor is Yuansheng Capital, and Qingtong Capital serves as the exclusive financial adviser for this round of financing. However, this is not the first time the brand has received financing.

Related

- The ceremony is full! Starbucks starts to cut the ribbon at a complimentary coffee station?!

- A whole Michelin meal?! Lucky launches the new "Small Butter Apple Crispy Latte"

- Three tips for adjusting espresso on rainy days! Quickly find the right water temperature, powder, and grinding ratio for espresso!

- How much hot water does it take to brew hanging ear coffee? How does it taste best? Can hot water from the water dispenser be used to make ear drip coffee?

- What grade does Jamaica Blue Mountain No. 1 coffee belong to and how to drink it better? What is the highest grade of Blue Mountain coffee for coffee aristocrats?

- What are the flavor characteristics of the world-famous coffee Blue Mountain No. 1 Golden Mantelin? What are the characteristics of deep-roasted bitter coffee?

- Can I make coffee a second time in an Italian hand-brewed mocha pot? Why can't coffee be brewed several times like tea leaves?

- Hand-brewed coffee flows with a knife and a tornado. How to brew it? What is the proportion of grinding water and water temperature divided into?

- What is the difference between Indonesian Sumatra Mantinin coffee and gold Mantinin? How to distinguish between real and fake golden Mantelin coffee?

- What does bypass mean in coffee? Why can hand-brewed coffee and water make it better?