The reason why the British drink black tea the historical story of why the kind of black tea is loved by Europeans

Since it was introduced into the western world, tea has become more and more popular and is now the second most popular drink in the world after water. Throughout history, the demand for tea has been growing because of its good taste, health and medicinal properties, as well as increasingly efficient production and distribution channels.

For people who like to drink tea, perhaps the most important benefit of drinking tea is that it can bring good feeling and reduce stress to those who drink tea regularly.

Tea cultivation and distribution has become a big business around the world as entrepreneurial individuals and companies invest in tea gardens and distribution assets to meet the growing demand for tea. With the development of tea business, governments all over the world regard tea as a valuable source of income. However, government regulation and taxation often have a negative impact on free trade and customer satisfaction.

In Britain, a country with a deep-rooted tea culture, the popularity of tea is a good case study of the impact of society and finance on tea consumption.

In England in the 16th century, tea became a favorite drink for the upper class. Imports initially grew slowly based on unique tastes and the realization of tea health benefits, more efficient distribution channels and a growing understanding of the benefits of tea lifestyle. However, this growth accelerated into the 18th century.

During this period, taxation, smuggling and adulteration became important factors in British tea culture.

The British government believes that tea is a luxury in the tropics, so it sees an increase in tea revenue to finance military construction to support the expansion of the British empire.

By the 18th century, tea had become a very popular drink in Britain, but for ordinary consumers, the price of tea was also prohibitive. Tea smuggling has become a growing industry in the UK as smugglers ignore tariff oppression and profit from the demand for low-priced tea.

This has created a demand for cheaper tea in Britain, and when that demand cannot be met by legal means, there is a huge opportunity for those who are less worried about breaking the law. From the beginning of the eighteenth century, the trade of smuggled tea began to flourish.

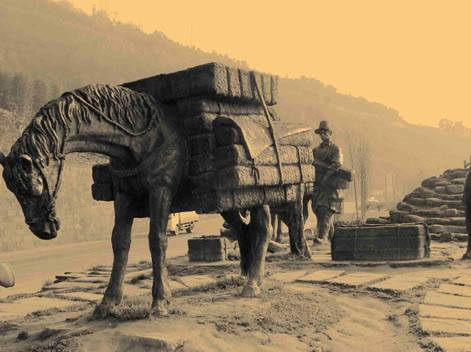

These are illegally imported tea, not imported by the East India Company, nor have they gone through customs. Because tea is light and easy to transport, it is a very profitable smuggled commodity-even more profitable than alcohol, and the smuggled trade in alcohol is healthy.

The country needs money.

Like other countries, England in the 18th century was no exception and needed to increase taxes. Mercantilism is a British policy. In order to support Britain's role in overseas colonies and territories, Britain needs a military presence. Expanding the interests of the world requires two things: a strong military force and funds to support military activities.

The state hopes to raise the necessary funds through import tariffs and excise taxes, but these taxes soon become too high. The government must legalize the tea tax and initially regard tea as a "luxury" to support what the public sees as high tariffs. Later, tea was correctly classified as a "necessity", supporting only a low tax level.

For example, before the tax Reform Act of 1784, the price of tea was subject to taxes and duties of 100% more than the pre-tax price.

In addition, although the supply of tea continues to increase with the increase in the production of tea gardens, tea prices remain high due to the artificial manipulation of supply by the East India Company (granted by the British government) to maintain prices.

High taxes and manipulated supply have led to smuggling as a growth industry

A pattern formed in the British tea trade. With the increase of tea import duty, smuggling activities are also increasing, which successfully meets the potential growth of tea demand. But there is a direct relationship between smuggling and high taxes. Smuggling has a negative impact on Britain's economy and population.

While taxes are important for tax increases, most economists know that high taxes encourage smuggling, and the amount of smuggled tea is directly related to the level of tariffs on legally imported tea. In Britain, in the early 18th century, the government needed to finance a war in Spain, which led to an increase in taxes on tea and a sharp rise in the price of tea.

This tax is outrageous and encourages the activities of tea smugglers. Later, Henry Pelham reduced his duties in 1745. This means more legally imported tea-more than double the number passing through customs-and an increase in imports of tea that pays tariffs has actually led to an increase in government revenue from tea.

But in the 1850s, due to the need to finance another war, the tea tax was raised again. This, in turn, led to a surge in smugglers' business, which continued to prosper in the third quarter of the 18th century.

Although illegal, smugglers have the support of millions of people who have no money to buy tea.

Much of the tea is smuggled in from continental Europe and shipped to England through the Channel Islands and the Isle of Man. Despite the prevalence of smuggling, many smugglers operated on a very small scale in the first decades of the 18th century. Many smugglers use their own boats, and smuggled tea is sold to private contacts and local shopkeepers.

So far, it has been widely believed that the only way to solve the problem of smuggling is to lower the price of tea-in effect, to lower tariffs on tea. So the East India Company, which has strong allies in the British Parliament, lobbied for lower tariffs. As a result, the strength of the business community has increased the general demand for permanent reform of the tea tax.

When William Pitt Jr. became prime minister in 1783, the work of the anti-tea volunteers finally achieved their goal. As a former chancellor of the exchequer, Peter is familiar with tax policy and the impact of high taxes on tax revenue. He understands that higher tax rates often lead to lower taxes.

Pitt cut the tea tax and made up for the loss by sharply increasing the window tax. This is a property tax that is easier to enforce. The tax reduction and exemption Act of 1784 reduced the tea tax from 119% to 12.5%. Smuggling tea is no longer profitable, and the smuggling trade disappears almost overnight. More importantly, tea is seen as a necessity rather than a luxury, which means lowering tea taxes in the long run.

The consumption of tea with low taxes has soared, so that even if the tax rate is lower, tea income will recover quickly, eventually exceeding the income before the tax cut. Just as important, tea has become the standard drink for most British people.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Coffee bean competition knowledge, what is TOH? Introduction of Ethiopian TOH champion coffee beans.

T.O.H (Taste of Harvest) is a harvest cup test contest initiated by the African boutique association (AFCA) in 12 coffee producing countries in Africa every year, which is similar to the C.O.E Excellence Cup competition. The tasting harvest is organized by AFCA (Fine Coffee Association of Africa) in its ten member countries. This year, the competition will only be held in Malawi, Ethiopia, Kenya, Congo, Uganda and

- Next

The definition and Development History of Fine Coffee beans how to brew Arabica Coffee beans

The boutique of modern coffee can be divided into three stages; the first wave (1940-1960): the key word of this stage is the creation of instant coffee. In 1890, New Zealander DavidStrang invented the earliest instant coffee and registered its patent. 1901, Japanese-American

Related

- Beginners will see the "Coffee pull flower" guide!

- What is the difference between ice blog purified milk and ordinary milk coffee?

- Why is the Philippines the largest producer of crops in Liberia?

- For coffee extraction, should the fine powder be retained?

- How does extracted espresso fill pressed powder? How much strength does it take to press the powder?

- How to make jasmine cold extract coffee? Is the jasmine + latte good?

- Will this little toy really make the coffee taste better? How does Lily Drip affect coffee extraction?

- Will the action of slapping the filter cup also affect coffee extraction?

- What's the difference between powder-to-water ratio and powder-to-liquid ratio?

- What is the Ethiopian local species? What does it have to do with Heirloom native species?