Luckin Coffee hand in hand with Luidafu to promote the fruit juice brand, why can't Ruixing sell coffee well?

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style)

Starting with coffee, to create a new tea drink brand "Little Deer Tea" and operate independently, Lucky's new goal is on fruit juice. Luckin Coffee, who has been listed in the United States for less than half a year, has made another big move.

On September 26th, according to media reports, Luckin Coffee announced that he and LDC had signed a strategic cooperation agreement in Singapore. The two sides have reached a joint venture, a production and processing plant focusing on NFC (non-concentrated reduction) juice in China, and the launch of a juice co-brand.

At that time, Louis Dreyfus will supply fruit juice raw materials, and the joint venture factory will carry out juice bottling processing and production. The factory will not only supply goods directly to Luckin Coffee, but also sell in other more channels in the country.

It is reported that Louis Dreyfus, founded in 1851, has more than 160 years of experience in the agricultural trade and processing industry, and is one of the largest fruit juice production and trade enterprises in the world. High-quality fruit juice products are produced from high-quality fruits from Brazil and other global sources. Luckin Coffee has been committed to providing customers with high-quality, cost-effective and convenient products through in-depth cooperation with top suppliers in various fields.

NFC fruit juice is very popular in China in recent years. Since Zero Fruit Farm first promoted and sold in the whole country in 2012, many beverage companies such as Huiyuan, Weiquan, Uni-President and so on have developed their own NFC fruit juice products, with the largest market scale approaching 2.3 billion yuan. However, compared with foreign NFC juice popularization rate is higher, China's pure fruit juice market share is only about 3.5%, while NFC juice share is even lower, less than 1%, the market potential is huge.

Guo Jinyi, co-founder and senior vice president of Luckin Coffee, said, "China is the fastest growing NFC juice market in the world. The cooperation between Luckin Coffee and Louis Dreyfus has a strong synergistic effect. The joint venture plant will help Luckin Coffee extend to the upstream manufacturing link, help control product quality, and further meet the needs of users."

Of course, it's not the first time Rui Xing has sold juice. As early as November 2018, when Luckin Coffee launched the light food series, it included several fruit juice drinks, but Lucky was still at the peak of "money burning" at that time, and of course it was impossible to distract juice production. Fruit juice drink-related products are supplied and sold by domestic suppliers, so fruit juice drinks have never been included in the scope of "money burning" subsidies. And its price which is obviously higher than the average level of the market naturally makes consumers not interested. It is precisely because of the cost of sales that despite the astonishing increase in recent financial reports, Ruixing has never been able to constitute its core competitiveness in this respect.

This time, the juice production and processing plant and co-brand launched in cooperation with Louis Dreyfus can reduce the cost of fruit juice products to a certain extent, while enriching their own product line and reducing the overall proportion of coffee categories. And let the brand value of the products sold in the joint venture, rather than entirely belong to the supplier, so as to enhance the core competitiveness of the brand.

In addition, this is not the first time Rui Xing has worked with Louis Dreyfus.

According to media sources, before Lucky went public in the United States, Rui Lucky's prospectus revealed that Louis Dreyfus and Rui Lucky had reached an agreement to set up a joint venture to build and operate a coffee roasting plant in China. In addition, as a prerequisite for completing this cooperation, after Luckin Coffee completes the IPO, Louis Dreyfus will pay the same price as the public offering. The purchase of Class A common shares with a total amount of $50 million through a targeted offering.

Why can't Ruixing sell coffee well?

Judging from the current data, the growth of China's coffee consumption market is still high, but the competition in the industry is becoming more and more fierce, which makes Lucky's growth in the coffee category reach a bottleneck period, relying solely on coffee category. Has been unable to support Lucky this "sustained loss" behemoth to carry forward. And due to the long-tail state of the coffee market, most consumers have a wide range of drinks preferences, scattered demand, unified and standardized products and stores may be difficult to meet the diversified market demand.

Luckin Coffee's future business growth will inevitably rely largely on raising customers' unit prices and increasing customers' sales of other products while buying coffee, so as to achieve business and profit growth. In addition, Ruixing keeps retroactively advancing from the downstream to the upper reaches of the industrial chain, which also shows that Ruixing begins to pay attention to product quality, hoping to improve product quality and innovation control by improving the proportion of the product supply chain.

Why did Ruixing choose NFC juice?

Because Fresh Juice needs to use fresh fruit, it is difficult to control effectively in taste (uncertainty of fruit sweetness), cost (fluctuation of fruit price caused by season), logistics and agricultural residue. moreover, fruit storage has a large demand for refrigerated space and a short shelf life, so how to use standardized, low-cost, safe and controllable ways to meet consumers' demand for Fresh Juice has always been a difficult problem in the industry. Therefore, most domestic coffee shops, including Starbucks, generally only sell bottled fruit juice drinks because of safety and wear and tear problems.

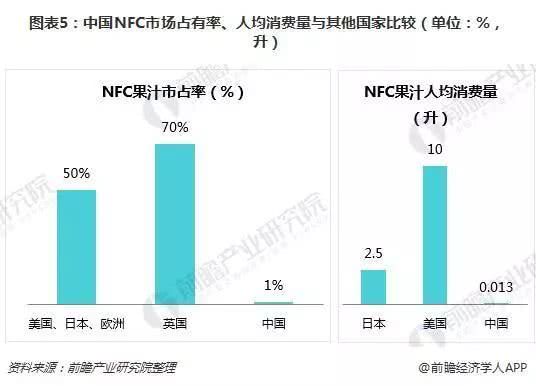

With the gradual rise of consumers' health awareness, the requirements of healthy diet are getting higher and higher in recent years. In the beverage market, NFC juice, which focuses on weight loss, health preservation and detoxification, has become a new favorite in the juice market. According to foresight data, in the United States, Japan and other countries, the market share of 100% fruit juice has reached 70%, and 80% of the market share of dint NFC juice is also about 50%, while in China, the market share of 100% fruit juice is 3.5% and the share of the juice is less than 1%. China's NFC juice market has not yet ushered in a full-scale outbreak.

Photo Source: forward-looking Industrial Research Institute

Even in terms of per capita consumption, the per capita consumption of NFC juice reached 10L in the United States in 2016, about 2.5L in Japan, while less than 0.013L in China, and the market is only in the early stages of development. Although Huiyuan, Nongfu Springs, Weiquan, Chu Orange, Zero Fruit Fruit and other enterprises have joined the NFC juice market, it has not formed a dominant trend, so there is still a huge room for growth in China's NFC juice market. Ruixing chose to join the NFC juice at this time, which can be regarded as a kind of market counterattack for quick change.

END

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

NetEyun Music and Ruixing opened a coffee shop on the island.

Professional coffee knowledge exchange more coffee bean information Please follow the coffee workshop (Wechat official account cafe_style) in the bustling city of Shanghai, we can see the literary coffee shops everywhere, drinking coffee is not only to refresh the mind, more and more has become a style of life. On August 5th, NetEase Yun Music and Luckin Coffee jointly opened an island music theme.

- Next

The Imperial Palace has opened a coffee shop! You can get in without buying a ticket!

The Imperial Palace has gone further and further on the road of online celebrities in recent years. After hundreds of years of being dignified and calm, the Imperial Palace has put down its idol burden and let go of itself more and more. "on the New Imperial Palace" hit, lipstick, beauty makeup detonated all over the network. Not long ago, the Imperial Palace is new again! A cafe was opened directly under the walls of the Imperial Palace: coffee in the Imperial Palace's turret. As soon as it opened, People's Daily and CCTV News competed to report for it.

Related

- Introduction to hand-brewed coffee: Why do you need to make coffee in stages? What do you think of the height of manual water injection?

- How to taste the balance and aroma of hand-brewed coffee? Differences between deep-roasted coffee and lightly roasted coffee

- Tims first store in Nanning will be closed permanently! Netizen: Breakfast is gone!

- Piye's new product "pistachio cocoa latte" hits Tianjin noodle tea?!

- Can't you buy it?! Bawang Tea Jiduo Store quietly removed preferential drinks!

- Sudden! Ruixing's major shareholder Dazheng Capital acquires Blue Bottle Coffee!

- What does 1shot and double shot mean for espresso? How much coffee powder is used to make one and two espresso coffees?

- Which high-quality hand-brewed coffee beans will have strawberry and peach flavors? What water temperature grinding parameters can be used to break out the berry flavor in coffee?

- What is PB level? Will PB Blue Mountain coffee beans taste better than Blue Mountain No. 1? What are coffee male beans, female beans, round beans and flat beans?

- What is the most suitable water temperature for hand-brewed light to medium deep coffee? How much water temperature should I use when brewing Ethiopian Huaqui coffee and how finely ground it?