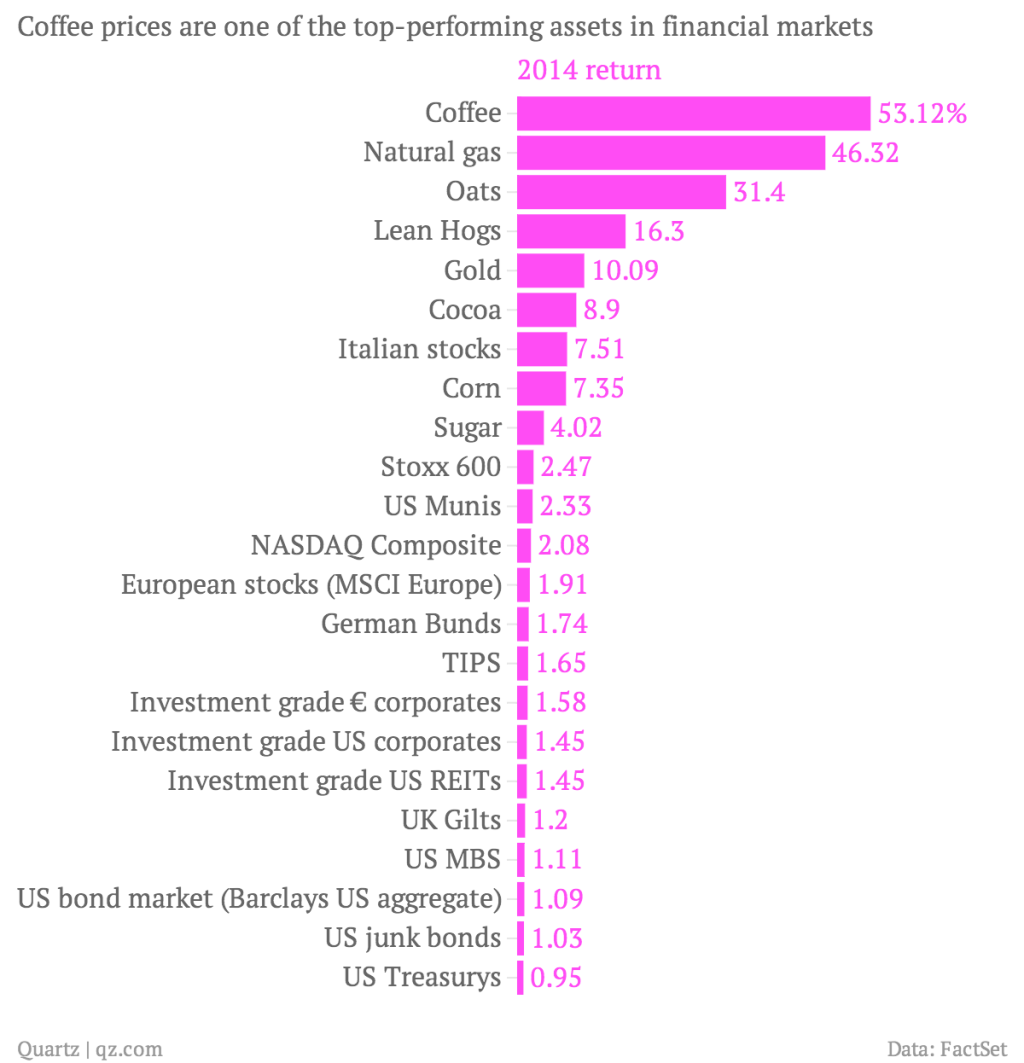

Agricultural ETF rebounds strongly Coffee Futures are up more than 50% this year

Maybe you drink coffee every morning, but you don't know you've drunk the best-performing financial asset so far this year, and coffee futures contracts are up more than 50% so far this year. It's really sad that people's love of coffee not only does not benefit them, but consumes more income.

Since the end of January, agricultural ETF has rebounded from a low of 24.4 to 26.6, rising by about 9%, mainly due to the worst drought in Brazil in 60 years, which has seriously affected the production of coffee and soybeans (4520,-17.00,-0.37%).

As shown in the chart below, ETF prices of agricultural products have been falling since 2010 and were at a phased bottom in 2013. In recent weeks, the ETF of agricultural products has continuously pulled out the big positive line (weekly K line), breaking through the 10-day, 20-day and 50-day index average (Exponential Moving Average,EMA). In addition, the location of the smooth moving average (Moving Average Convergence Divergence,MACD) Jiaqing Capital flow Index (Chaikin Money Flow,CMF) shows that there is still a lot of room to rise in the future.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Capsule coffee is a new favorite

Healthy drinking capsule coffee has become a new favorite

- Next

Kenyan coffee industry wants to break the monopoly of multinational corporations and introduce new buyers such as China.

Kenyan caffeine is well received in the global market for its aroma, taste and quality, but the industry has long been monopolized by Western multinationals.

Related

- Can lightly roasted coffee beans be used to extract espresso? How finely should you grind high-quality coffee beans to make Italian latte?

- What is the difference between the world's top rose summer coffee and Yejia Shefi? What are the flavor characteristics of Yega Shefi coffee and Panama rose summer?

- The ceremony is full! Starbucks starts to cut the ribbon at a complimentary coffee station?!

- A whole Michelin meal?! Lucky launches the new "Small Butter Apple Crispy Latte"

- Three tips for adjusting espresso on rainy days! Quickly find the right water temperature, powder, and grinding ratio for espresso!

- How much hot water does it take to brew hanging ear coffee? How does it taste best? Can hot water from the water dispenser be used to make ear drip coffee?

- What grade does Jamaica Blue Mountain No. 1 coffee belong to and how to drink it better? What is the highest grade of Blue Mountain coffee for coffee aristocrats?

- What are the flavor characteristics of the world-famous coffee Blue Mountain No. 1 Golden Mantelin? What are the characteristics of deep-roasted bitter coffee?

- Can I make coffee a second time in an Italian hand-brewed mocha pot? Why can't coffee be brewed several times like tea leaves?

- Hand-brewed coffee flows with a knife and a tornado. How to brew it? What is the proportion of grinding water and water temperature divided into?