Research report on the Development trend of Korean Coffee shops in China

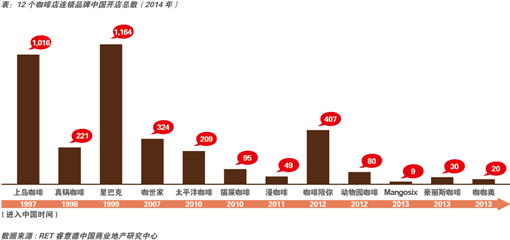

In the traditional impression, Starbucks, a European and American coffee shop brand, has been a "cafe landscape" in major cities for a long time, but in recent years, similar to popular film and television dramas, fashion clothing and other fields, there has also been a "Korean wave" in the coffee shop field. On August 18, RET Ruiyide China Commercial Real Estate Research Center released the first Research Report on the Development Trend of Korean Coffee Shop in China. The report tracks the development trajectory of 12 representative coffee shop chain brands in China in the past 17 years, and makes a comprehensive analysis of the expansion of Korean coffee shops. Data show that Korean coffee shops have expanded rapidly, opening nearly 600 stores in the last two years alone.

Shi Jin, chief analyst of RET Ruiyide China Business Research Center, pointed out,"At present, Korean coffee shop chain brands are developing rapidly in China. What is particularly noteworthy is its layout in the core business circle of second-tier and third-tier cities, as well as flexible cooperation mode, so that the overall market pattern is changing."

Korean coffee shops opened momentum from behind

In recent years, Korean coffee shop brands represented by coffee accompany you and diffuse coffee are gradually covering every corner of many cities in China. The statistics also reflect the growing "Korean Wave" in the coffee shop sector. RET Ruiyide China Commercial Real Estate Research Center statistics show: Starbucks in Europe and the United States coffee shop brand expansion is the fastest, currently there are 1,164 in China, an average of 77 stores per year; Taiwan coffee shop brand leader is Shangdao coffee, currently there are 1,016, with an average annual expansion rate of 59; Among the Korean coffee shop brands, coffee accompanies you most prominently. In just two years after entering China, 407 coffee shops have been opened, and they are still expanding at a high speed. Their expansion momentum even exceeds Starbucks.

Rich product mix to achieve differentiated competition

In terms of product richness, the average number of products of Korean coffee shop brands is 76, almost double that of 41 European and American coffee shop brands. In addition to coffee, tea, smoothies, cakes, sandwiches and other common coffee shop brands, Korean coffee shop brands have also added product lines such as smoothies, soda, ice cream, cereal lattes, muffins and toast. At the same time, unlike European and American coffee shop brands, Korean coffee shop brands also focus on non-coffee drinks in their product structure, accounting for 49% of all products, facilitating differentiated competition.

More flexible cooperation mechanisms

In terms of business model, different from the high proportion of direct sales of European and American coffee shop brands and the multiple agency mechanism of Taiwanese coffee shop brands, RET Ruiyide China Commercial Real Estate Research Center found in the survey that Korean coffee shop brands weighed the proportion of different business modes well in the process of expansion, and the proportion of direct sales and franchising was 19% respectively. 60% and 21%? It is the proportion of cooperative operation, that is, the management party and franchisees jointly participate in the operation. Both parties have part of the equity. Take coffee accompany you as an example. The minimum investment for joining is only 500,000 yuan. In addition to the cooperative store with 49% equity, coffee accompany you also cooperates with China Merchants Bank to provide franchisees with credit as financial products to attract franchisees to the maximum extent. These business models balance the relationship between equity allocation, post-management and quality control of coffee shops. In the expansion strategy, Korean coffee brand avoided the direct conflict with European and American coffee shops and Taiwanese coffee shops.

Site selection strategy adapted to local conditions

Because Korean coffee shop brands enter the first-tier cities late, urban resources are seized, and the rental area of single stores is larger, so as many as 69% of stores in first-tier cities are located in suburbs. On the other hand, community commerce in first-tier cities has developed relatively mature, and the low rental cost and stable regional flow in suburbs provide a foundation for Korean coffee shop brands to enter the suburbs.

With the rapid development of economy and consumption in second-tier and third-tier cities, Korean coffee shop brands have seen the market potential of leisure cafes in these cities. Therefore, most brands choose to enter urban areas more, and their urban location accounts for 87%. In the urban area where the traffic is most concentrated, excellent store resources and open display surface help Korean coffee shop brands known for their environmental layout to attract strong traffic with optimal image display, rapidly expand their popularity, and then contribute to their rapid expansion.

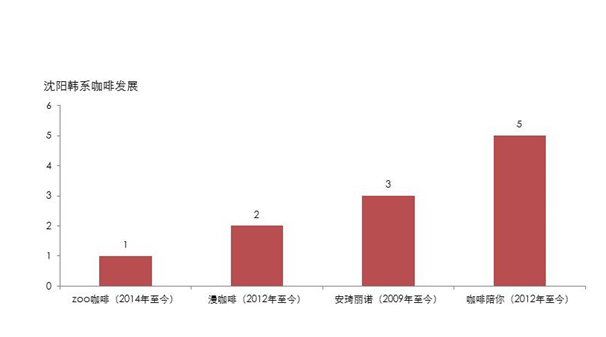

The latest data shows that since the first Korean coffee shop Anqi Linuo entered Shenyang in 2009, Shenyang has 11 Korean coffee shops, among which coffee accompanies you to open the most vigorous momentum. After entering Shenyang in 2012, there have been 5 shops, which is the Korean coffee shop with the most stores in Shenyang.

Liang Weihua, director of RET Ruiyide and general manager of Shenyang Company, said that Shenyang Korean coffee shops are more popular in the area where young people gather; Korean pop elements are added to the decoration style, which is more fashionable; in addition, Korean drama, Korean current and other related factors also make Korean coffee shops popular among Shenyang young people.

Brand implantation diversified promotion

In order to shake the traditional position of Starbucks and Shangdao Coffee in China, Korean coffee shop brands have also invested a lot in marketing means, including brand implantation by virtue of the high ratings of Korean idol dramas in China, and hiring popular stars as spokesmen to maximize star effect. At the same time, the Korean coffee shop brand also injected O2O, trying to bring more functional elements to the coffee shop. It is reported that coffee company you have planned to cooperate with Shunfeng, through mobile phone positioning after ordering, realize take-out service "coffee house delivery". The development of this new field not only caters to the consumption habits of young people O2O to enhance customer stickiness, but also covers the areas where physical stores have not yet set foot with the help of logistics network.

Shi Jin pointed out that "at present, China's coffee shop market is still broad, with flexible cooperation methods and diversified marketing promotion advantages, especially Korean dramas and stars in China's vast urban audience, Korean coffee shops in the second and third tier cities penetration will be more in-depth." Including new brands such as Mangosix, although the number of stores is not large at present, it is expected that 2015-2016 will usher in a new round of store opening peak."

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

The Truth of Fair Trade in a Cup of Coffee

Fair Trade is a social movement launched by developed countries to provide fairer terms of trade through a number of international aid organizations to protect the rights and interests of workers and producers in poor countries. Some economists believe that "fair trade" is essentially a form of subsidy, which hinders economic development and cannot eradicate the problem of poverty.

- Next

More than half of the coffee shops in China do not make money from coffee.

A few days ago, a "profiteering door" news that the price of Starbucks coffee in the Chinese market is fully higher than that in the United States, causing widespread debate in the society. There are doubts that Starbucks' differential pricing is contrary to the principle of fairness, but there is also a view that calculating only the cost of raw materials while ignoring other operating costs obviously lacks economic common sense, coffee belongs to a non-monopoly industry, and its pricing power should be vested in the market and

Related

- The ceremony is full! Starbucks starts to cut the ribbon at a complimentary coffee station?!

- A whole Michelin meal?! Lucky launches the new "Small Butter Apple Crispy Latte"

- Three tips for adjusting espresso on rainy days! Quickly find the right water temperature, powder, and grinding ratio for espresso!

- How much hot water does it take to brew hanging ear coffee? How does it taste best? Can hot water from the water dispenser be used to make ear drip coffee?

- What grade does Jamaica Blue Mountain No. 1 coffee belong to and how to drink it better? What is the highest grade of Blue Mountain coffee for coffee aristocrats?

- What are the flavor characteristics of the world-famous coffee Blue Mountain No. 1 Golden Mantelin? What are the characteristics of deep-roasted bitter coffee?

- Can I make coffee a second time in an Italian hand-brewed mocha pot? Why can't coffee be brewed several times like tea leaves?

- Hand-brewed coffee flows with a knife and a tornado. How to brew it? What is the proportion of grinding water and water temperature divided into?

- What is the difference between Indonesian Sumatra Mantinin coffee and gold Mantinin? How to distinguish between real and fake golden Mantelin coffee?

- What does bypass mean in coffee? Why can hand-brewed coffee and water make it better?