"Leaf Rust" attacks Coffee production capacity reduces, but Coffee Futures fall to a New low

For professional baristas, please follow the coffee workshop (Wechat official account cafe_style)

For urban "rookies" who visit coffee chains such as Starbucks and COSTA every day, they tend to pay close attention to the prices of various cup-shaped lattes, mochas and cappuccinos they often drink. As everyone knows, although the price of these cups of coffee does not change often, the price of coffee beans, the raw material used to make these coffee, has risen by a considerable proportion so far this year, and an important reason is "coffee leaf rust".

According to the estimates of Mexican agricultural scientist Carlos Guadarrama and others, half of the world's coffee will be extinct by 2050. The main culprit is "coffee leaf rust", a disease that grows in a warming climate. It is spreading in Mexico and Central America. Diseased coffee plants will lose nutrients and eventually wither and die, while Arabica coffee beans, the world's main coffee variety, are vulnerable to the disease. The output of this variety of coffee beans usually accounts for about 60% of the total output.

Coffee has always been a major cash crop in Mexico's Guadalupe region, but last year was the worst harvest of coffee beans in the past 20 years, when almost all coffee plants died of leaf rust. In 2014, leaf rust destroyed 70% of coffee production in Mexico and Central America, where total production was only about 10% of that in 2013 until last year.

The reduction in production capacity has directly led to a rise in prices. The price of coffee beans on the local market in Madagascar has tripled recently, from 8000-8500 Ariari / kg ($2.70) a month ago to 21000-22000 Ariari / kg ($6.50), according to the Commerce Office of the Chinese Embassy in Madagascar. Wholesale and retail prices are about the same, and there is no clear explanation for the price increase. Not only are prices rising, but the number of coffee beans on the retail counter is also beginning to decline, with only wholesalers still in stock. These conditions have had an impact on the price of coffee in small restaurants and mobile vendors, and the current price of a cup of coffee is no less than 300 Ariari (about 0.1 US dollars).

This is also happening in Kenya, a big coffee exporter. Kenyan coffee exports rose 7.8 per cent to $206 million in 2016, 85 per cent of which were auctioned through the Nairobi Coffee Exchange (NCE) and the rest sold directly overseas, according to the website of China's Ministry of Commerce. Coffee sales in Kenya rose 63 per cent to $90.97 million in February from a year earlier, while sales rose 30 per cent to 16.9tonnes, while the price of a bag of 50KG beans rose 25.61 per year to $268, according to NCE, mainly because many buyers were actively hoarding for later sale.

There are always people who are happy and others are sad. Affected by diseases and insect pests and drought, for the first time in history, the world's largest coffee producing country imports a considerable amount of coffee from competitors to make up for the gap in market demand. According to local media reports, coffee production in the Brazilian state of Espiritu Santo fell by 7.99 million bags in 2016, a drop of as much as 30 per cent. Affected by supply shortages, the price of Brazilian instant coffee has risen by 14.9% in the past 12 months, while the price of coffee powder has risen by as much as 20% over the same period. As a result, the Brazilian government has allowed the import of robusta coffee, mainly from Vietnam.

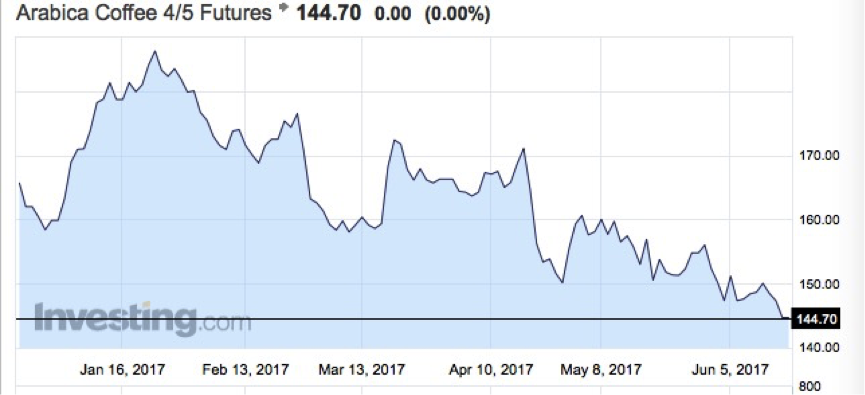

However, China Business reporter also noted that this change in production capacity does not seem to be immediately reflected in the performance of the futures market. As of June 17, the prices of two major coffee futures in the world, Arabica 4Coffee Futures and American Type C Coffee Futures, have fallen to new lows this year. Since the beginning of this year, US type C coffee beans have fallen from US $156.7 to the current US $123.9, an annual decline of 11.18%. The futures price of Arabica 4x5 coffee has fallen from a peak of US $186.25 at the beginning of the year to the current US $144.7, an annual decline of 7.65%.

Relevant industry analysts believe that although the price of coffee beans will "decrease and increase" due to the influence of diseases and insect pests, weather and other factors, the change in production has not been reflected in the price of coffee futures in previous years due to the existing overcapacity of coffee beans.

However, our reporter also noticed that coffee processing enterprises with coffee as raw materials have made a lot of money due to the decline in coffee futures prices. According to Starbucks' latest financial results, the company made a profit of $1.405 billion in the first half of fiscal 2017, up 11.27% from a year earlier. The company's operating income in the first half of fiscal year 2017 was 11.027 billion US dollars, an increase of 6.37 percent over the same period last year. Shares have also benefited, with SBUX.O (Starbucks) shares up 9.6% to $60.14 so far this year.

Also benefiting coffee makers is Nestle SA, whose shares have risen continuously this year, closing at 83.45 Swiss francs, up 15.2 per cent in half a year.

The analysis points out that the price of international coffee beans will increase by about 20% a year in the next few years. These coffee processing enterprises have obviously begun to worry about adverse factors such as natural climate, diseases and insect pests, and began to resolve them. Earlier, Starbucks (China) announced in Beijing that the first coffee beans from a single producing area in China would be introduced into Chinese stores, the first "achievement demonstration" since Starbucks launched its self-built coffee farm in Pu'er, Yunnan Province in 2012. naturally, it is also to meet the growing demand of the Chinese market. Nestl é has also said that between now and 2020, Nestl é will invest 500 million Swiss francs (3.36 billion yuan) to create shared value for raw materials, manufacturing and product consumption in the coffee supply chain.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Shenyang Bajing Coffee Culture Festival: cool summer in the depths of the alley

For the exchange of professional baristas, please follow the tea performance at the opening ceremony of the coffee workshop (official Wechat account cafe_style). Chinanews.com, Shenyang, June 19 (Reporter Shen Diancheng)-visit the former residence of the Republic of China and taste the gluttonous culture. On the evening of June 19, in the humanistic streets of Bajing Street, Heping District, Shenyang, the first Bajing Coffee Culture Festival in 2017 was unveiled.

- Next

Xi'an Venture Coffee Block: Let "Shuangchuang" boil from 99 degrees to 100 degrees

Professional barista exchange please pay attention to coffee workshop (Weixin Official Accounts cafe_style ) Our reporter Li Zhengfen reports in Xi'an High-tech Zone, a business coffee block belonging to Xi'an makers is quietly taking shape. Before this, Xi'an High-tech Zone Pioneer Park inspection and negotiation activities were in full swing, with footprints all over Beijing, Hangzhou, Shenzhen and other places. IC Coffee, Garage Coffee

Related

- What is the difference between Indonesian Sumatra Mantinin coffee and gold Mantinin? How to distinguish between real and fake golden Mantelin coffee?

- What does bypass mean in coffee? Why can hand-brewed coffee and water make it better?

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!

- What is the difference between sun-cured and honey-treated coffee? What are the differences in the flavor characteristics of sun-honey coffee?

- How to make Italian latte! How much milk does a standard latte use/what should the ratio of coffee to milk be?

- How to make butter American/butter latte/butter Dirty coffee? Is hand-brewed coffee good with butter?

- Is Dirty the cold version of Australian White? What is the difference between dirty coffee/decent coffee and Australian white espresso?