Vietnam Coffee Annual report 2017

Main points of the report

Vietnam's 2016 / 17 coffee production was revised from 26.7 million bags to 26 million bags due to abnormal rainfall during the harvest season, resulting in a smaller than expected yield. The weather conditions were good in the first half of the year, with an estimated production of 28.6 million bags, an increase of 10 per cent over the 17th of 2016.

Content summary

The abundant rainfall from January to March caused the coffee trees to send out more branches and bloom earlier. In addition, the rise in local coffee prices has helped coffee farmers have the funding to invest in 2017 / 18 production, such as branches and nutrients and fertilizers actually needed for fruit.

In the past two or three years, in order to earn a higher income, more and more farmers have switched from growing coffee trees to cash crops such as black peppers, avocados and passion fruits. This reduces coffee acreage, especially in Dak Lak province, where arable land is limited. In provinces where arable land reserves such as Dak Nong and Lam Dong are still available, new arable land is being used to grow more black pepper and avocados. All in all, the coffee industry faces strong competition from the black pepper industry, which affects the expansion of coffee acreage in Dak Nong and Lam Dong.

Recently, the situation has changed as the price of black pepper began to fall in 2016. The price of black pepper has halved compared with the previous 2-3 years. As a result, the price of black pepper is no longer attractive, and farmers are reluctant to change coffee to black pepper. It is expected that the coffee planting area in 2017 / 18 will be the same as in 2016 / 17, and the area will increase next year. This does not mean that black pepper will no longer be planted, but it is most likely that farmers will continue to grow and pepper, low-risk and low-input coffee as a second cash crop.

Merchandise

Coffee, raw beans

Output

2016 / 17:

According to local traders, abnormal rainfall from October to November 2016 delayed the harvest. Coffee farmers usually pick coffee cherries from October to January, and the rainfall from October to December 2016 not only slowed down the picking and drying process, but also caused physical damage to many coffee beans. This also reduces the quality of coffee.

Production in 2016 / 17 is expected to be revised from 26.7 million bags to 26 million bags, 2.6 per cent lower than USDA's forecast.

2017 / 18:

Sufficient rainfall in the non-rainy season from January to March 2017 contributed to an increase in production. Production is expected to recover in 2017 / 18 and increase by 10% compared with 2016 / 17.

Good weather and possible adverse weather

According to the Water Conservancy Bureau of the Ministry of Agriculture and Rural Development (MARD), the rainy season in the central areas of Vietnam's main coffee producing areas will come early this year, and the rainy period will end early. In addition, the mild El Ni ñ o phenomenon is likely to return in the second half of 2017, if so, the quality of coffee cherries in the new season will be affected.

Change coffee producing areas-reduce competition from other cash crops

In recent years, Vietnam has become the world's leading producer and exporter of black pepper, and farmers earn higher profits by growing black pepper. This situation induces farmers to switch a large part of their land to growing black pepper, which threatens the production of high and low coffee in the central government, where black pepper is the main competitive cash crop. That is changing because the price of black pepper has fallen sharply over the past year. With the decline in the price of black pepper at home and abroad, farmers are no longer willing to change coffee to black pepper. Overall, Vietnam's black pepper industry has faced serious challenges in terms of price, quality and quality control, and farmers are aware of the disappointing returns of black pepper as an alternative cash crop for coffee. This situation heralds the future of coffee production. The new coffee nursery will help increase the acreage of coffee production in the near future.

Consumption

Domestic coffee consumption is projected to be 2.5 million bags in 2016 / 17 and 2.55 million bags in 2017 / 18 due to the increasing number of coffee shops. Vietnamese coffee drinkers prefer roasted and ground coffee that is rich and authentic. Vietnam's domestic coffee market will be a place of fierce competition for foreign coffee brands, including Dunkin Donuts, Coffee Beans and Tea Leaves and Gloria.

Jeans, My Life Coffee, McCafe, and many Korean coffee chains. However, many local coffee chains have traditional coffee drinks, which help local chains remain invincible in the fierce competition. This paper believes that the domestic coffee market in Vietnam is growing moderately, because Vietnamese coffee needs more coffee value-added products to expand the market.

Instant coffee will grow as more and more foreigners from western countries live in Vietnam's big cities, and drinking coffee in foreign cafes has become a fashion throughout Vietnam.

Trade

Exit

Coffee bean exports are expected to increase, with the total export volume of coffee beans, roasting, grinding and instant coffee revised from 26.05 million bags to 26.55 million bags in 2016 / 17. Based on production restrictions and carry-over inventory, exports are expected to be 26.65 million bags in 2017 / 18.

Raw bean export

According to the trade data, this paper estimates that Vietnam exported 24 million bags of raw beans in 2016 / 17, due to the increase of 500000 bags in Robusta exports than USDA predicted, but less than 29.5 million bags in 2015 / 16 due to production restrictions. The export volume of raw beans is expected to be 24 million bags in 2017 / 18 because of the low carry-over inventory in 2016 / 17.

Instant and roasted coffee outlet

In this paper, it is estimated that the export volume of roasted coffee will still be 550000 bags in 2016 / 17. The export of instant coffee is expected to be 2.1 million bags in 2016 / 17 due to the expansion of investment by enterprises exporting to China.

As of April, approximately 14.28 million bags of various types of coffee have been exported so far this year, compared with 15.25 million bags in the same period in 2015 / 16. There are about 13.45 million bags of raw beans and 14.42 million bags in the same period in 2015 / 16.

Import

Vietnam continues to import small amounts of raw coffee beans from Laos, Indonesia, Brazil and the United States, as well as roasted and instant coffee. Viet Nam's imports of roasted / ground coffee from the United States have increased over the past few years due to the expanding coffee retail sector. American brands such as Starbucks, McCoffee, and Donndole and PJ coffee, including several Korean coffee brands, have widely expanded exports in Vietnam's big cities.

Due to the rapid expansion of Vietnamese cafes, imports are expected to increase from 640000 bags to 1 million bags in 2016 / 17. Of these, 160000 bags are instant coffee, 340000 bags are roasted / ground coffee, and 500000 bags are raw beans. Total coffee imports are expected to be 1.06 million bags in 2017 / 18.

Price

Export price

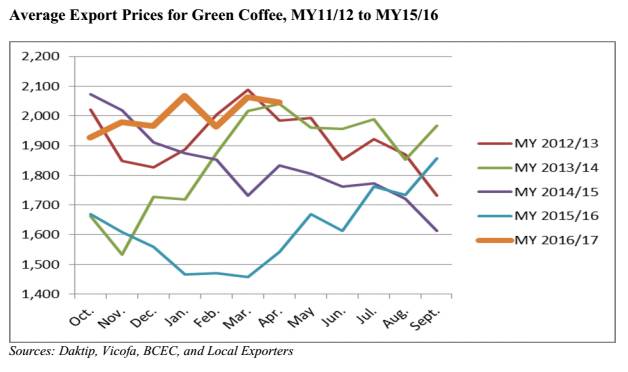

The common non-gradual mung bean Robsta (Ho Chi Minh City FOB) monthly export price for the first seven months of 2016 / 17 has been the highest in the past five years and has always been above $1900. This is caused by production and inventory shortages in Brazil and Vietnam.

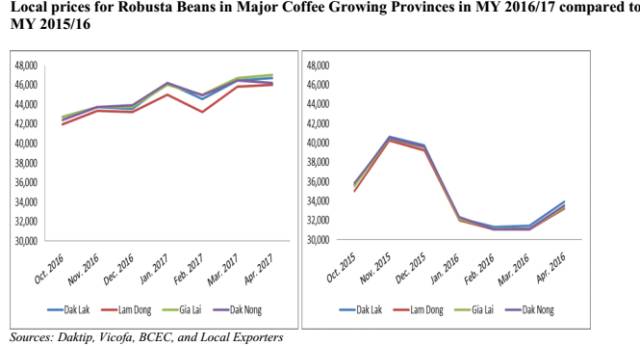

Domestic price

The price of the average ungraded Robsta rose steadily in the first seven months of 2016 / 17, unlike in other years, which fell all the way to March and April after harvest in November and December.

Inventory

As a result of the increase in exports, it is estimated that the stock at the end of the 17-year period in 2016 fell from 2.25 million bags to 1.38 million bags, representing 30 per cent of the stock at the end of the 16-year period in 2015. Inventory at the end of the 18-year period in 2017 is expected to remain low at 1.46 million bags.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Annual report on Ugandan Coffee 2017

The report stresses that Nairobi forecasts a small increase in Ugandan coffee production in 2017 / 2018 as a result of the harvest of newly mature coffee from the plantation. Exports are expected to remain stable, leading to a small increase in clearing inventories. The Uganda Coffee Development Authority (UCDA) continues to implement a funding scheme from the Government of Uganda (GOU), which aims to increase improved varieties and expand acreage.

- Next

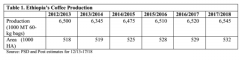

Annual report on Ethiopian Coffee 2017

Ethiopia's coffee production is expected to remain at 6.545 million bags in 2017 / 18. The export is expected to be 3.31 million bags. In June this year, in order to stimulate exports, the government plans to reform the coffee marketing and trading system, one of the most anticipated is that coffee will no longer have to go through the Ethiopian Commodity Exchange (ECX) (ECX trading process and system principles are described in the next article.

Related

- Detailed explanation of Jadeite planting Land in Panamanian Jadeite Manor introduction to the grading system of Jadeite competitive bidding, Red bid, Green bid and Rose Summer

- Story of Coffee planting in Brenka region of Costa Rica Stonehenge Manor anaerobic heavy honey treatment of flavor mouth

- What's on the barrel of Blue Mountain Coffee beans?

- Can American coffee also pull flowers? How to use hot American style to pull out a good-looking pattern?

- Can you make a cold extract with coffee beans? What is the right proportion for cold-extracted coffee formula?

- Indonesian PWN Gold Mandrine Coffee Origin Features Flavor How to Chong? Mandolin coffee is American.

- A brief introduction to the flavor characteristics of Brazilian yellow bourbon coffee beans

- What is the effect of different water quality on the flavor of cold-extracted coffee? What kind of water is best for brewing coffee?

- Why do you think of Rose Summer whenever you mention Panamanian coffee?

- Introduction to the characteristics of authentic blue mountain coffee bean producing areas? What is the CIB Coffee Authority in Jamaica?