Annual report on Ugandan Coffee 2017

The report emphasizes:

Nairobi forecasts a small increase in Ugandan coffee production in 2017 / 2018 as a result of the harvest of newly mature coffee from the plantation. Exports are expected to remain stable, leading to a small increase in clearing inventories. The Uganda Coffee Development Authority (UCDA) continues to implement a funding scheme from the Government of Uganda (GOU), which aims to increase production by increasing improved varieties and expanding acreage.

Output:

As a result of the harvest of newly mature coffee on the plantation, Nairobi forecasts a small increase in coffee production in Uganda in 2017 / 2018, which have been replanted since 2011 / 2012. The renovation of plantations is a programme implemented by the Uganda Coffee Development Authority (UCDA) to increase yields through farmers planting improved varieties, increasing the efficiency of agricultural inputs, and improving agricultural extension services. Robusta coffee accounts for about 80% of Uganda's coffee production, and the rest is Arabica coffee.

Market:

The coffee market in Uganda is fully liberalized and active producer organizations collect coffee from small farmers. Locally registered companies can, on behalf of international coffee trading companies, purchase coffee from producers' organizations or directly from farmers for processing and export.

Although most of the coffee is exported to markets outside the East African Community, some Robusta coffee is processed and packaged at an instant coffee factory in Bukoba, neighbouring Tanzania, and sold in the local market. In addition, Uganda has 12 registered coffee factories that bake Arabica coffee for the domestic market.

Consumption:

In Uganda, domestic coffee consumption is very low, currently accounting for an estimated 3 per cent of the country's total output, due to low purchasing power and a deep-rooted tea drinking culture. With the support of the Government of Uganda, the Uganda Coffee Development Authority has been implementing plans to increase coffee consumption in urban and rural areas.

Policy:

The Ugandan government's policy on the coffee industry is implemented by a statutory regulatory body, the Uganda Coffee Development Authority. Currently, the Ugandan coffee industry is guided by the national coffee policy launched in 2013. Key components of the policy are to increase productivity, expand coffee-growing areas and improve the coffee business environment. The policy also aims to diversify the coffee market, promote the promotion of sustainable production systems, increase added value, increase domestic consumption and improve coffee research capacity in Uganda.

The Ugandan government does not tax Ugandan coffee exports, but the Uganda Coffee Development Authority levies a 1% local tax on coffee in all markets.

Table of production, supply and distribution

Remarks on the form:

As a result of the ongoing replanting plan of the Government of Uganda, it is predicted that the planting area of coffee will increase.

As a result of the harvest of newly mature coffee on the plantation, Nairobi forecasts a small increase in Ugandan coffee production in 2017 / 2018.

L the yield for 2016 and 2017 has been revised upwards due to the harvest of newly mature coffee from the plantation.

Production in 2017 / 2018 is expected to be in line with forecasts, resulting in a slight increase in clearing inventories.

Trade:

In Uganda, nearly 97% of coffee is exported directly through more than 30 companies. However, only 10 companies control 80 per cent of the business. Italy and Germany remain the main export destinations for Ugandan coffee.

Major exporters of Ugandan coffee

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

2017 Colombia Coffee Degree Report

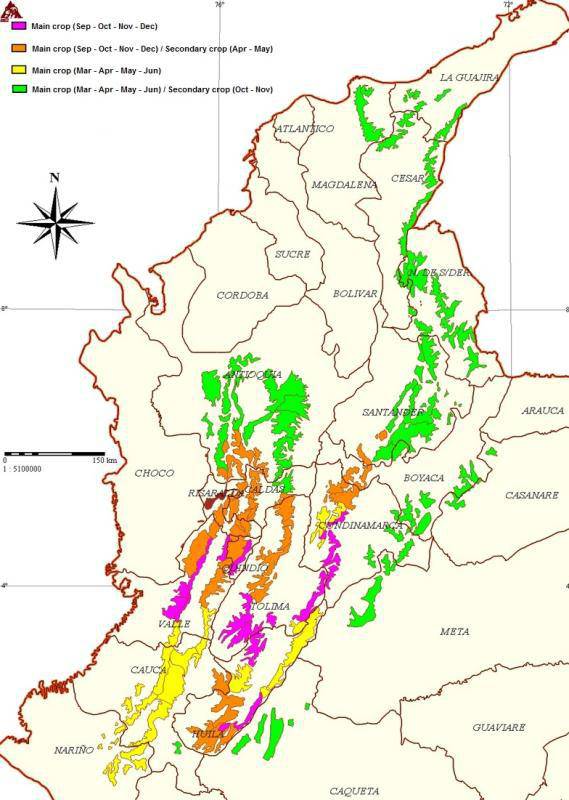

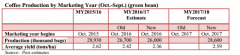

Colombia coffee production peaked thanks to new species and good weather. The 2016/17 production estimate was revised to 14.5 million bags (60kg each), 3.6% more than the previous estimate of 14 million bags. If weather conditions are normal, production is expected to increase slightly to 14.6 million bags in 2017/18. Executive Summary 2016

- Next

Vietnam Coffee Annual report 2017

Main points of the report Vietnam coffee production in 2016 / 17 was revised from 26.7 million bags to 26 million bags due to abnormal rainfall during the harvest season, resulting in a smaller than expected yield. The weather conditions were good in the first half of the year, with an estimated production of 28.6 million bags, an increase of 10 per cent over the 17th of 2016. The abundant rainfall from January to March makes the coffee tree send out more branches and bloom.

Related

- Detailed explanation of Jadeite planting Land in Panamanian Jadeite Manor introduction to the grading system of Jadeite competitive bidding, Red bid, Green bid and Rose Summer

- Story of Coffee planting in Brenka region of Costa Rica Stonehenge Manor anaerobic heavy honey treatment of flavor mouth

- What's on the barrel of Blue Mountain Coffee beans?

- Can American coffee also pull flowers? How to use hot American style to pull out a good-looking pattern?

- Can you make a cold extract with coffee beans? What is the right proportion for cold-extracted coffee formula?

- Indonesian PWN Gold Mandrine Coffee Origin Features Flavor How to Chong? Mandolin coffee is American.

- A brief introduction to the flavor characteristics of Brazilian yellow bourbon coffee beans

- What is the effect of different water quality on the flavor of cold-extracted coffee? What kind of water is best for brewing coffee?

- Why do you think of Rose Summer whenever you mention Panamanian coffee?

- Introduction to the characteristics of authentic blue mountain coffee bean producing areas? What is the CIB Coffee Authority in Jamaica?