2017 Colombia Coffee Degree Report

Main points of the report

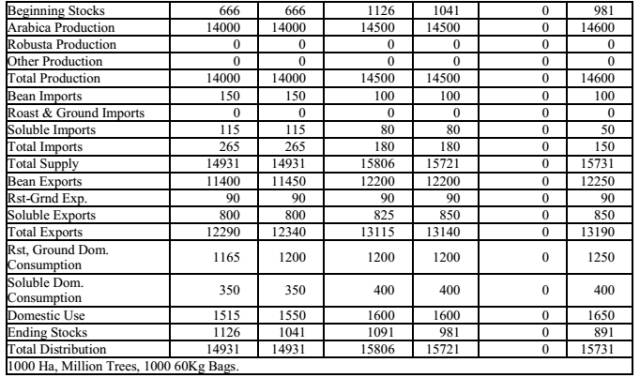

In Colombia, production has peaked due to newly planted coffee trees, and coffee production has remained strong in good weather. Production estimates for 2016 / 17 are revised to 14.5 million bags (60kg per bag), 3.6 per cent more than the previous estimate of 14 million bags. If weather conditions are normal, production is expected to increase slightly to 14.6 million bags in 2017 / 18.

Content summary

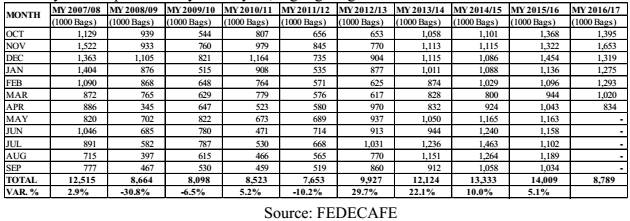

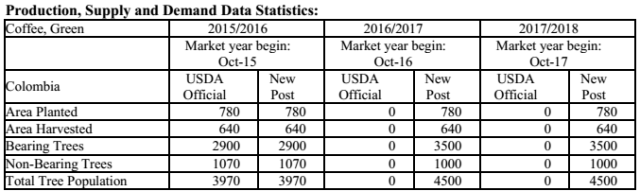

Production in 2016 / 17 (October 2016-September 2017) is estimated at 14.5 million bags, more than the previous estimate of 14 million bags. If weather conditions are normal, production is expected to increase slightly to 14.6 million bags in 2017 / 18. In 2016, the National Federation of Colombian Coffee growers estimated the average yield per hectare at 17.8 bags, 29% higher than the average yield of 13.8 bags over the past decade. This is a direct result of the replanting program, which has reduced the average age of coffee trees from 15 to 7 and increased planting density. With the rust-resistant variety conversion plan and good weather conditions, production remained strong in the first seven months of 2016, up 5.1% from the same period last year.

Due to the increase in production, the corresponding export volume was revised to 13.1 million bags in 2016 / 17 and is expected to increase slightly to 13.2 million bags in 2017 / 18.

Merchandise

Coffee, raw beans

Output

As a result of the great success of the conversion to rust-resistant coffee varieties and good weather conditions, coffee production in Colombia has set a record since the early 1990s. Production estimates for 2016 / 17 are revised to 14.5 million bags (60kg per bag), 3.6 per cent more than the previous estimate of 14 million bags. The replanting plan and good weather conditions keep coffee production strong. In addition, fertilizer incentives provided by the Government of Colombia and the National Federation of Colombian Coffee growers to coffee farms affected by drought in 2015 will increase production. Production is expected to increase to 14.6 million bags in 2017 due to a return to stable production and normal weather.

The following figure provides annual and monthly production data for nearly 10 years.

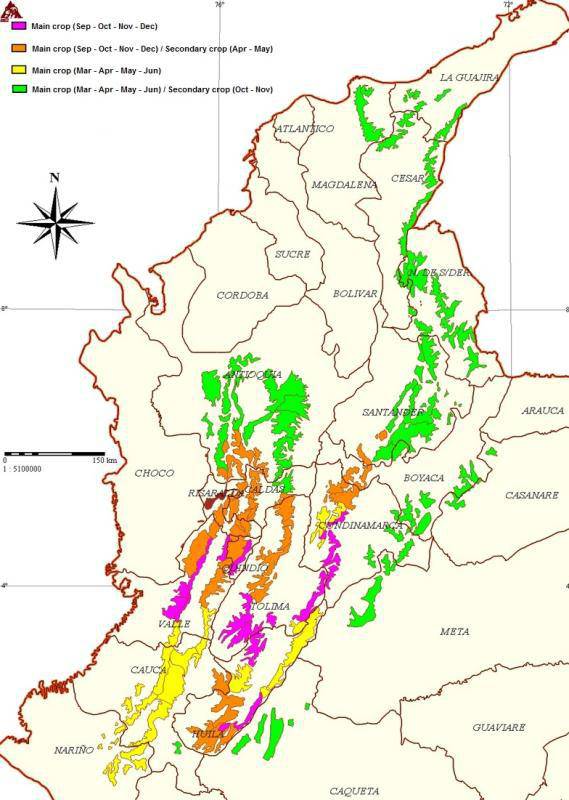

The map below shows the coffee-growing areas of Colombia, which has unique geography and topography. Three north-south mountains create a variety of microclimates and ideal conditions for coffee cultivation. In addition, Colombia is close to the equator, the growing season is abundant, and coffee can be harvested almost all the year round. There are two harvest peaks between dry and wet weather in the calendar year.

The average size of Colombian coffee farms is 4.5 hectares of land. The National Federation of Colombian Coffee growers estimates that there are 560000 coffee farmers in Colombia, with small farmers growing less than 5 hectares contributing 69 per cent of the country's production. Colombia has an area of 940000 hectares of coffee but only 780000 hectares of technologically modified crops, which means that only some varieties of coffee have been improved, such as rust-resistant trees, dense plantations and less than 12 years of age. The National Federation of Colombian Coffee growers points out that 74% of coffee-growing areas have anti-rust trees, compared with 35% in 2010.

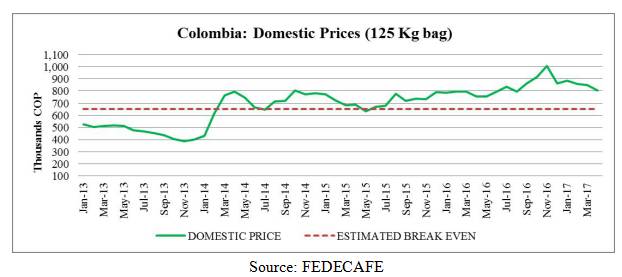

Despite the resumption of production, agricultural labour shortages and the increase in the minimum wage have increased production costs for medium and large growers, mainly in the central region. However, the flowering and first harvest in 2017 / 18 has been more dispersed than in previous years, which will lead to a dispersion of labour demand and reduce the pressure on high wages. The National Federation of Colombian Coffee growers estimates that the average production cost of a bag of 125kg is 600000 COP (US $207).

In December 2016, domestic coffee prices reached a high historical level. However, due to the recovery of Colombian peso prices and the reduction of international coffee prices, prices have shown a downward trend in 2017. In the first four months of 2017, the domestic average monthly price reached 849369 Colombian pesos per 125kg/ bag, an increase of 8.5 per cent over the same period last year.

The following picture shows the monthly domestic price of each bag paid to the grower. For reference, the red dotted line indicates the trigger price of the farmer's income (PIC) protection subsidy program.

Consumption

Driven by the increasing number of cafes to meet the preferences of young professionals and the creation of new coffee products, domestic consumption is expected to reach 1.6 million bags in 2016 / 17 and further increase to 1.65 million bags in 2017 / 18.

Growing Juan Valdez, which provides high-quality coffee or boutique coffee in consumer-oriented coffee stores, has boosted local coffee consumption. Juan Valdez is the leading brand in the coffee shop market, with a market share of 22.6%, followed by OMA (12.5%), McCaf é (4.6%), Illy, Segafredo, Cafe Tostion, and Starbucks. Starbucks entered the Colombian market in 2014, and despite sales behind Juan Valdez and OMA, it grew by 19.4% in 2016, higher than other competitors (Juan Valdez (14.6%), OMA (11.4%) and McCaf é (10.4%).

Trade

The latest forecast is that exports will reach 13.1 million bags in 2016 / 17, and the revised increase in export figures is due to high production. Exports are expected to increase slightly to 13.2 million bags in 2017 / 18. With the recovery of production since 2013, exports have increased significantly. The United States is the most important export destination for Colombian coffee, importing 40% of Colombia's total exports, followed by the European Union, Japan and Canada.

As part of the quality difference and improvement policy, Colombia continues to increase the export of high-quality coffee in order to meet cup testing and grading certification expectations to achieve more added value. Boutique coffee exports are close to 40% of total Colombian coffee exports, certified Colombian boutique coffee is popular, and organic coffee has a significant premium, usually higher than traditional coffee exports. Coffee cups from specific areas of Colombia, such as the southern provinces of Uila, Cauca and Nari ñ o, are getting more and more international recognition. Colombian boutique coffee growers produce coffee under numerous international programs that provide fair trade and organic certification, such as the United States Department of Agriculture, UTZ certification, 4C and the Rainforest Alliance. Agreements between growers and intermediaries, including the National Federation of Colombian Coffee growers, to ensure quality, meet foreign certification standards and buyer / consumer expectations.

In order to promote direct transactions and increase the income of small-scale producers the National Federation of Colombian Coffee growers launched an initiative to allow registered exporters to ship coffee in small quantities. Up to 60 kg of coffee raw beans, roasted coffee, instant coffee and coffee extracts are authorized to be transported by private transport companies.

Despite the increase in coffee production, the El Ni ñ o weather phenomenon has increased the impact of coffee borer on coffee quality. Although Colombia claims to export only the best coffee beans, in May 2016, the National Federation of Colombian Coffee growers revised export standards to help growers sell low-quality coffee beans in line with international standards. In addition, the increase in the number of inferior particles led to an increase in the export of instant coffee.

Inventory

There is no policy of the Government or the National Federation of Colombian Coffee growers to support large-scale carry-over of coffee stocks. Taking into account the expansion of production and the inability of coffee to be shipped from its origin due to a strike by truck drivers, the total inventory at the beginning of the 17th period in 2016 is estimated at 1.04 million bags. The stock at the beginning of 2017 / 18 fell to 981000 bags, and taking into account the lack of policy incentives and infrastructure to maintain long-term inventory, the inventory at the end of 2017 / 18 is expected to drop to 891000 bags.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

A brief introduction to the Flavor treatment of Coffee beans in Lemon Manor in Nicaragua

Following caf é (Wechat official account vdailycom) found that Beautiful Caf é opened its own shop Lemon Tree Manor EL Limoncillo is located in the Matagalpa Plateau, this area is also one of the well-known coffee producing areas in Nicaragua. The manor is located on a steep ascent and is rich in water. Walking into the coffee forest, the terrain gradually rises and steepens, and the forest phase changes from open forest to coniferous leaves.

- Next

Annual report on Ugandan Coffee 2017

The report stresses that Nairobi forecasts a small increase in Ugandan coffee production in 2017 / 2018 as a result of the harvest of newly mature coffee from the plantation. Exports are expected to remain stable, leading to a small increase in clearing inventories. The Uganda Coffee Development Authority (UCDA) continues to implement a funding scheme from the Government of Uganda (GOU), which aims to increase improved varieties and expand acreage.

Related

- Detailed explanation of Jadeite planting Land in Panamanian Jadeite Manor introduction to the grading system of Jadeite competitive bidding, Red bid, Green bid and Rose Summer

- Story of Coffee planting in Brenka region of Costa Rica Stonehenge Manor anaerobic heavy honey treatment of flavor mouth

- What's on the barrel of Blue Mountain Coffee beans?

- Can American coffee also pull flowers? How to use hot American style to pull out a good-looking pattern?

- Can you make a cold extract with coffee beans? What is the right proportion for cold-extracted coffee formula?

- Indonesian PWN Gold Mandrine Coffee Origin Features Flavor How to Chong? Mandolin coffee is American.

- A brief introduction to the flavor characteristics of Brazilian yellow bourbon coffee beans

- What is the effect of different water quality on the flavor of cold-extracted coffee? What kind of water is best for brewing coffee?

- Why do you think of Rose Summer whenever you mention Panamanian coffee?

- Introduction to the characteristics of authentic blue mountain coffee bean producing areas? What is the CIB Coffee Authority in Jamaica?