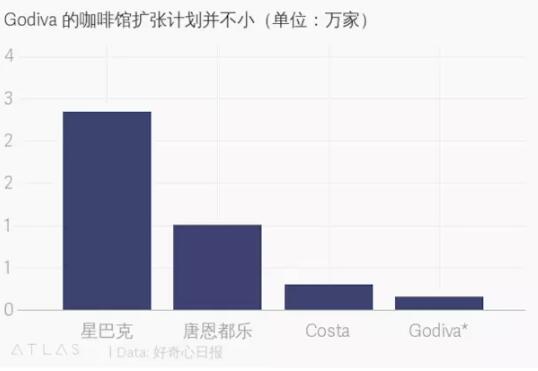

Chocolate brand Godiva has its eye on the coffee industry and plans to open 2000 new cafes

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style)

Godiva will launch 2000 cafes in the future, and analysts say many large beverage companies will see coffee as an important area to strengthen their product portfolio, which is not just a new coffee line for the company, but also an opportunity to achieve its profit target as soon as possible at a variety of prices and packaging types.

Godiva is going to enter the coffee market to grab money.

Belgian chocolate brand Godiva, which has been acquired by the Turks, will launch 2000 cafes in the future as part of a six-year plan to increase revenue fivefold, according to the Financial Times. The Godiva Cafe, with an area of 139 to 232 square meters, will appear in major cities around the world from next spring, while the first coffee shop will open in New York.

Jim Watson, a senior beverage analyst at Rabobank, has previously said that "many large beverage companies see coffee as an important area to strengthen their product portfolio". "for companies, this is not just a new coffee business line, but also an opportunity to achieve profit targets at a variety of prices and packaging types, building a luxury brand image, from coffee bags to high-end coffee shops."

The media further said that Godiva had begun to raise money aggressively to expand its coffee business in North America, Asia and other countries and that Morgan Stanley had been in talks with several potential strategic investors on a deal that could exceed $1 billion. If a deal is struck, the buyer could take over the Japanese business, one of the company's largest and fastest-growing markets, and retain Godiva's control of the brand.

In fact, Yildiz, the parent company of Godiva, has been considering selling Godiva's Japanese business.

The Nippon Keizai Shimbun reported last month that Godiva had now started the process of selling its Japanese business and that Mitsubishi and a number of investment funds had offered it an olive branch that could exceed 100 billion yen. According to Euromonitor International, Japan is the sixth largest chocolate market in the world. Godiva's retail sales are expected to reach $5.2 billion in 2018, with Japan accounting for nearly 5 per cent of global sales.

Non-coffee-born Godiva is ambitious to enter the coffee market, while the "big brothers" of the coffee industry have accelerated the pace of their expansion.

Turin-based Lavazza Coffee announced in October that it had acquired Mars's coffee business; Italian coffee company Illy and industry giant JAB also reached a licensing agreement; and Bill Ackman, a hedge fund manager at Pershing Square Capital, had previously revealed that it would invest $900 million in Starbucks, an American coffee chain.

A "war" caused by coffee is also escalating.

However, due to the collapse of the Turkish lira, Yildiz is stepping up efforts to reduce foreign currency-denominated debt. In June, Bloomberg reported that Yildiz was in talks to sell Kumas Manyezit Sanayi, a mining and brick business worth about $500m. This makes the acquisition battle around Godiva, a high-quality brand, likely to intensify in the future.

Yildiz, a family business that originated in a cookie shop founded by two brothers in Istanbul in 1944, has grown into a multinational with western partners including Kellogg and McCormick.

In 2007, the company bought not only Godiva for $850 million, but also McVitie's United Biscuits for $2.63 billion, and Flipz chocolate pretzel maker DeMet's for $221 million in 2014.

END

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Belgian chocolate brand Godivan Godiva is about to join the coffee industry scuffle.

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style) Belgian chocolate brand Godivan Godiva is going to enter the coffee market

- Next

Win-win Cooperation between Yunnan Coffee and Nestle: Nestl é joined hands with Yunnan Agricultural University to improve coffee varieties

Professional coffee knowledge exchange more coffee bean information please follow Coffee Workshop (Wechat official account cafe_style) on the 17th, Nestl é Coffee Center and the Tropical crops College of Yunnan Agricultural University signed a memorandum of understanding on coffee variety improvement program in Pu'er City. This cooperation aims to improve the output and quality of coffee beans, increase the competitiveness of Yunnan coffee cultivation and sustainable development ability.

Related

- Workers collapse! Lucky suspects that it will introduce freshly cut fruits?!

- 1-point subsidy recipients wear thousand-yuan watches?! Local response: For low-income households

- Can lightly roasted coffee beans be used to extract espresso? How finely should you grind high-quality coffee beans to make Italian latte?

- What is the difference between the world's top rose summer coffee and Yejia Shefi? What are the flavor characteristics of Yega Shefi coffee and Panama rose summer?

- The ceremony is full! Starbucks starts to cut the ribbon at a complimentary coffee station?!

- A whole Michelin meal?! Lucky launches the new "Small Butter Apple Crispy Latte"

- Three tips for adjusting espresso on rainy days! Quickly find the right water temperature, powder, and grinding ratio for espresso!

- How much hot water does it take to brew hanging ear coffee? How does it taste best? Can hot water from the water dispenser be used to make ear drip coffee?

- What grade does Jamaica Blue Mountain No. 1 coffee belong to and how to drink it better? What is the highest grade of Blue Mountain coffee for coffee aristocrats?

- What are the flavor characteristics of the world-famous coffee Blue Mountain No. 1 Golden Mantelin? What are the characteristics of deep-roasted bitter coffee?