What are coffee capsules? What are the advantages of Nespresso? How about coffee capsules?

In 2018, a staggering 59 billion coffee capsules were produced. In the same year, the global coffee pod market was worth nearly $1.3 billion. It is estimated that Nespresso alone produces about 14 billion pods a year and drinks hundreds of drinks every second.

It is almost impossible to recall an era when the capsule market did not exist. In today's coffee business, pods are immutable. They are permanent fixtures, and we all accept the amazing levels of growth they achieve year after year. But where do they come from? How did it all start?

The pods start slowly.

The coffee pod market began with Nespresso, which was launched in 1986 by Swiss multinational Nestlé. The idea was born in 1975 when Nestle engineer Eric Favre visited a particularly popular espresso bar in Italy. He observed that baristas kept pulling levers on espresso machines to increase pressure and change how coffee was extracted.

Over the next decade Favre came up with the idea, creating a simple brewing machine that mimicked the dynamics of coffee machines. The machine adds pressurized air to water and coffee powder to produce a beverage with a distinct crema layer. It was not until 1986 that Nestle registered and patented the trademark.

Nespresso initially marketed its machines as all-in-one, easy-to-use coffee machines for office buildings. But after they marketed four different capsule types to multiple offices in Switzerland and Japan, no one seemed interested.

Jean-Paul Gaillard joined Nespresso in 1988. He decided to change the way Nespresso machines were sold. Instead of targeting the product at businesses, he wants to sell it as a luxury item to home consumers. He even raised the price of each capsule by about 50 percent.

Sales began to take off. Around the same time, Gaillard founded Club Nespresso (Le Club) to make customers feel they were part of a unique coffee "lifestyle."

Andre Chanco is the co-founder of Yardstick Coffee in Manila, Philippines. He recently co-founded Morning, an online specialty capsule marketplace. "At first, Nespresso had a huge impact by allowing coffee drinkers to enjoy espresso at home without all the technical means of preparing this perfect espresso," he told me. "Convenience is the main attraction, plus elegance of the solution."

In the late 1980s and 1990s, Nespresso sales began to grow. But while coffee pods are becoming more popular in Europe, they struggle in the United States. Some attribute this to the high popularity of filtered coffee in the United States compared to Europe, where espresso has historically been more prevalent.

But as Nespresso became more successful in the 1990s, competitors began to emerge. In 1990, Green Mountain Coffee Roasters (now operating under the name Keurig Dr Pepper) founded the American single-serving capsule brand Keurig.

But while Nespresso has nestled huge profits behind it to fund its expensive advertising campaign and aggressive expansion, Keurig has not. The waiting game began: while Nespresso dominated, rival brands appeared and watched.

Market explosion

By 2006, Nespresso's revenues had exceeded £ 500m and many competitors, including Keurig, had entered the market.

"Their patents expired around 2012, which allowed other coffee producers to explore the format," Andre said. He explained that since capsule machines are already very popular, competitors can enter the market and offer only pods. No need to invest in developing your own expensive machines.

Nespresso initially registered about 1,700 patents, and they tried too late to sue companies that made similar products. By 2010, US-owned Sara Lee had launched its own capsule in France. Within months, they sold millions of dollars cheaper than Nespresso pods.

Today, there are about 400 competing capsule brands on the market. John Steel is CEO of Cafédirect, a British company specialising in coffee, tea and cocoa. He told me: "Cafédirect launched Nespresso compatible coffee packs in 2014. At the time, there were very few NC packages on the market."

John explains that capsule consumers often want to create a cafe experience in their own homes. He said that's what many coffee chains identify and want to exploit. "The growth in the market comes from existing Nespresso compatible pods and many new entrants," he said. "The most striking are brands like Starbucks and Costa."

Coffee capsule market today

The capsule market shows no signs of slowing down. Nespresso even recently announced plans to invest CHF 160 million in a factory in Switzerland.

John explains that the focus on quality and sustainability only drives the market further. "The quality of coffee has improved, but more significantly, the quality of packaging and the technology involved have also improved. In the early days, the failure rate of pods in the machine was high, and the presence of oxygen in the pods also made coffee obsolete.

Andre told me that nowadays, the capsules themselves are refocusing on freshness and innovation. "The aluminium capsule form is constantly being improved to make it brew better on existing machines.

"They also sometimes allow roasters to add more coffee to it. Recently, compostable capsules have been improved and the sealing of the capsules themselves has been improved, allowing coffee to stay fresh longer."

Today, individual Nespresso capsules retail for between $0.70 and $1.20. It is cheaper than a regular coffee shop. Such low prices are mainly due to the fact that each capsule contains 5 to 6 grams of coffee. That's about a quarter of the 18 to 21 grams that baristas typically use to make espresso.

However, in recent years, more and more capsules containing specialty coffee have appeared. This shows that some consumers are willing to pay more for quality. "Just like the broader coffee industry, the coffee capsule market is going through waves or phases." Andre said.

"When Maxwell Colonna-Dashwood put high-quality coffee into Nespresso capsules in 2016, it was a viable way to balance quality and convenience," he explains. "He was able to preserve the intrinsic quality of coffee while allowing the end user to enjoy it the way he wanted."

What's next for coffee capsules?

Specialty coffee pods have grown in recent years. Andre explains that this is the concept behind Morning. "We started the morning market in late 2019 with a strong hunch that more specialty coffee roasters would put their coffee in capsules.

"We observed top roasters like ST from all over the world. ALi from Melbourne, Papa Palheta from Singapore and Maxwell Colonna-Dashwood all use Nespresso compatible capsule formats.

However, with the demand for high-quality coffee, consumers are also seeking improved sustainability and transparency. "When you consume more, you become more aware of environmental impact and the pursuit of quality," Andre said.

"These two, combined with convenience, are the things customers are looking for in capsule coffee today. It's just that different consumers value each factor differently."

Sustainability is not a new topic in the capsule market discussion. In 2018 alone, about 56 billion capsules were landfilled, and less than 5% of them were recycled. In 2016, the local government of Hamburg banned the use of capsules in all government-owned organizations and offices.

Capsule companies have become more proactive in reducing their environmental impact. "Packaging recyclability has always been on the agenda. Many manufacturers are using aluminum coffee bags to reflect Nespresso products while also encouraging recycling." John said.

Nespresso aims to increase its recovery rate to 100% by 2020, establishing 14,000 global capsule recovery points in 31 countries. However, according to a 2018 report by UK compostable capsule manufacturer Halo, 42% of consumers in the UK simply throw them away.

The same report states that more than 50 percent of consumers don't know the difference between the words "recyclable,""biodegradable," and "compostable." Obviously, capsule manufacturers do not only need to provide recycling solutions, but can also provide various recycling solutions. They need to educate and empower customers to handle waste responsibly.

Andre believes that as the pod market evolves, there is an option to strike a balance between quality, sustainability and convenience. "I think all three goals can be achieved today, but probably not a few years ago. I hope there will be more eco-friendly formats in the future, as well as better local recycling capsule systems."

Despite obvious environmental concerns, the coffee capsule market is booming. Consumers still want to enjoy the ultimate convenience of coffee shop-style beverages in the comfort of their own homes. In addition, sustainability and quality are becoming a focus for capsule consumers worldwide. But the question remains: How will the major capsule manufacturers respond?

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

How about coffee in Bali? Is the coffee in Bali Manning? Balinese coffee flavor

Growers: traditional coffee producer varieties organized by farmers in the Bali Heights through Subak Abian (SA): bourbon (S795 and USDA 762) Typica and Catimor: harvest in Kintamani Heights, Bali, Central Indonesia: may-October height: 1200 1600 m Mud: volcanic loam treatment: full sun exposure, introduction to viaduct drying areas

- Next

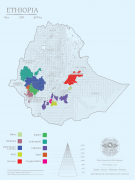

Introduction of Ethiopian Yega Sheffielia Solar G1 Flavor introduction Beloya treatment Station

Ethiopia Yega Sheffield Biloya Solar G1 producing country: Ethiopia producing area: Yega Sheffield Cochel treatment Station: Beloya Beloya altitude: 1870-2100m varieties: local native species Heirloom treatment method: sun treatment grade: G1 production season: 2020 production area introduces Yega Xuefei is a famous boutique coffee producing area in Ethiopia. In 1995, Ethiopia

Related

- Detailed explanation of Jadeite planting Land in Panamanian Jadeite Manor introduction to the grading system of Jadeite competitive bidding, Red bid, Green bid and Rose Summer

- Story of Coffee planting in Brenka region of Costa Rica Stonehenge Manor anaerobic heavy honey treatment of flavor mouth

- What's on the barrel of Blue Mountain Coffee beans?

- Can American coffee also pull flowers? How to use hot American style to pull out a good-looking pattern?

- Can you make a cold extract with coffee beans? What is the right proportion for cold-extracted coffee formula?

- Indonesian PWN Gold Mandrine Coffee Origin Features Flavor How to Chong? Mandolin coffee is American.

- A brief introduction to the flavor characteristics of Brazilian yellow bourbon coffee beans

- What is the effect of different water quality on the flavor of cold-extracted coffee? What kind of water is best for brewing coffee?

- Why do you think of Rose Summer whenever you mention Panamanian coffee?

- Introduction to the characteristics of authentic blue mountain coffee bean producing areas? What is the CIB Coffee Authority in Jamaica?