Luckin Coffee's financial results for the new quarter are eye-catching, and his income is close to that of Starbucks!

For a long time, people's impression of Luckin Coffee is "China's Starbucks". Since Luckin Coffee turned a profit for the first time in the first quarter of this year, the number of stores has surpassed that of Starbucks in China, and Luckin Coffee has become the largest coffee chain in China. A quarter has passed, Luckin Coffee's performance is still dazzling.

Luckin Coffee announced his financial results for the second quarter of 2022 on the evening of August 8.

Due to the arrival of the epidemic, some cities have taken more stringent epidemic prevention measures, which has brought a painful experience to the catering industry. Starbucks' third-quarter results released a week ago (Aug. 2) showed that Starbucks' same-store sales in China plunged 44% and net income fell 40%, reflecting the impact of the epidemic on the catering industry.

However, Luckin Coffee announced a "counterattack" in the second quarter, which further narrowed the income gap with Starbucks in the previous quarter, and turned operating profit into profit.

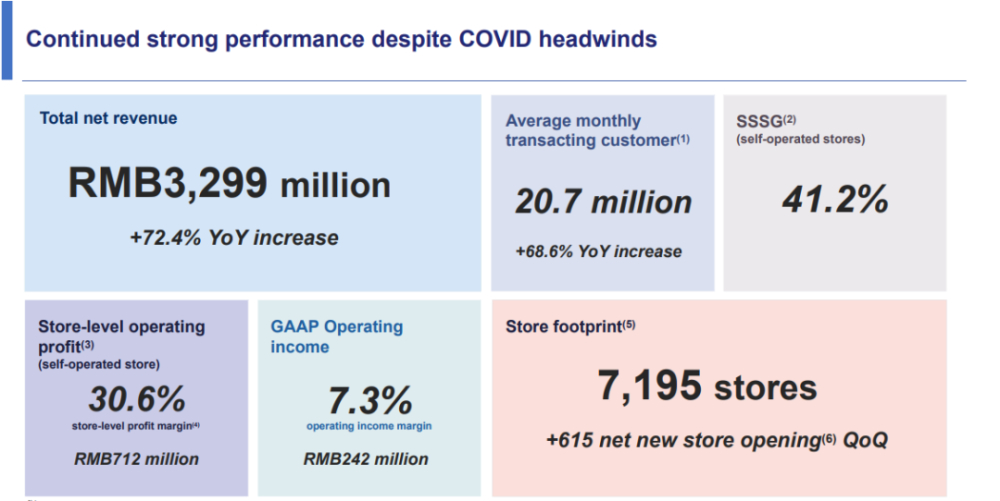

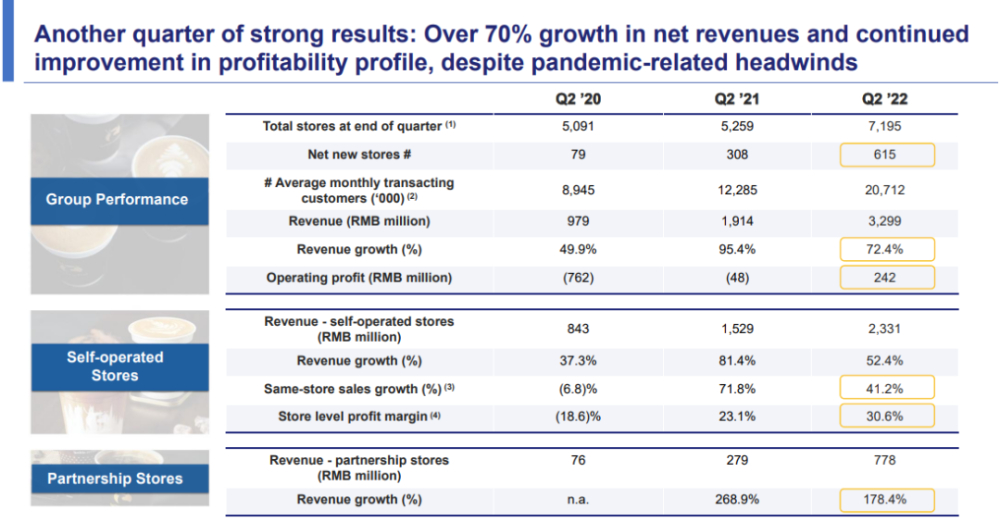

Luckin Coffee's new financial report pointed out that Lucky's performance indicators continued to grow steadily last quarter, with total net income reaching 3.2987 billion yuan, an increase of 72.4% compared with 1.9137 billion yuan in the same period in 2021; net opening of 615 new stores; operating profit margin continued to improve; same-store sales in self-operated stores increased by 41.2%, and profit margins at store level in self-operated stores reached 30.6%.

In terms of store size, Luckin Coffee had 7195 stores by the end of the second quarter. Among them, the number of self-operated stores is 4968 and the number of joint venture stores is 2227. Lucky added a net 615 stores in one quarter, beating the speed at which China's Starbucks opened 107 stores last quarter.

In terms of revenue, despite the adverse factors related to the epidemic during the second quarter, the average number of monthly trading customers in that quarter was 20.7 million, an increase of 68.6% over the same period in 2021; revenue from self-owned stores was 2.3311 billion yuan, up 52.4% over the same period; same-store sales increased by 41.2% The profit at the store level of proprietary stores was 712.2 million yuan ($106.5 million) in the second quarter, with a profit margin of 30.6% at the store level, compared with 353.2 million yuan in the same period in 2021 and 23.1% at the store level.

Second, the revenue of joint venture stores was 777.5 million yuan in the second quarter, an increase of 178.4% compared with 279.3 million yuan in the same period in 2021.

Operating profit was 241.6 million yuan ($36.1 million) in the second quarter under US accounting standards (GAAP) and 7.3 per cent under US accounting standards (GAAP), the report said. The loss for the same period in 2021 was 47.5 million yuan. Operating profit under non-American accounting standards (Non-GAAP) was 342.6 million yuan ($51.2 million) in the second quarter after adjusting for share compensation fees, compared with 10.4 per cent under non-US accounting standards (Non-GAAP).

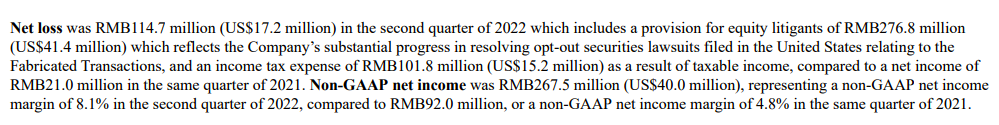

Luckin Coffee's performance data improved by leaps and bounds, but the debt owed by financial fraud had to be repaid. According to the financial report, Lucky paid 276.8 million yuan in equity litigation reserves and 101.8 million yuan in income tax charges for taxable income in the second quarter. Some people said that expenses such as equity litigation are one-off. Therefore, it has little impact on Lucky's overall business.

From the perspective of financial results, it is basically possible to determine that Ruixing's main business is on the right track, and the market is more concerned about the problem of Luckin Coffee turning board. Some people in the industry said in an interview with the media that the basic conditions for the turnaround are to meet the requirements of net assets, market capitalization, outstanding shares, a minimum share price of US $4 in 90 trading days, more than 300 shareholders, and more than three market makers. Luckin Coffee has now met these basic conditions.

In addition, Ruixing announced the change of senior management at the same time as the release of the report: the position of CFO will be held by Ms. Jing. Guo Jinyi said in a subsequent conference call that he hoped that quiet participation would push Ruixing's development to a new level.

It is true that the space of China's coffee market is very huge, but the domestic coffee market education is gradually mature, and domestic coffee brands, large and small, are rising rapidly. Luckily, the competitors are no longer limited to Starbucks, Tims, Costa and other established competitors, but also need to "grab food" with established coffee brands such as Manner and Seesaw.

Photo Source: Internet

For more information about coffee beans, please follow the coffee workshop (Wechat official account cafe_style) and exchange professional coffee knowledge. Please add Wechat account kaixinguoguo0925.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Be careful when opening a shop! Manner caffeine was fined for making ice pier caffeine.

Baristas who open shops and pull flowers should be careful. If they are not careful to make a creative pull flower, they will be in the position of Shangguan Fei, and the salary of every minute and month is not enough. According to the official website of Tianyan Cha, the Zhongjiang Road store of Manner Coffee affiliate Shanghai Yinhe Industrial Co., Ltd. is responsible for using the Olympic logo for goods, commodity packaging or

- Next

Luckin Coffee rushed out of the country and appeared on the streets of Thailand?! Lucky official clarification: Thai leave!

Luckin Coffee, who has successfully made a comeback, has become a national coffee brand since he was labeled as a disgrace to Chinese stocks at that time. As a wanderer, in a foreign land, if you see the brand of your hometown, you will certainly feel proud and even moved. Recently, a picture of Luckin Coffee in Thailand has been circulated on the Internet. Official Luckin Coffee solemnly declared:

Related

- Workers collapse! Lucky suspects that it will introduce freshly cut fruits?!

- 1-point subsidy recipients wear thousand-yuan watches?! Local response: For low-income households

- Can lightly roasted coffee beans be used to extract espresso? How finely should you grind high-quality coffee beans to make Italian latte?

- What is the difference between the world's top rose summer coffee and Yejia Shefi? What are the flavor characteristics of Yega Shefi coffee and Panama rose summer?

- The ceremony is full! Starbucks starts to cut the ribbon at a complimentary coffee station?!

- A whole Michelin meal?! Lucky launches the new "Small Butter Apple Crispy Latte"

- Three tips for adjusting espresso on rainy days! Quickly find the right water temperature, powder, and grinding ratio for espresso!

- How much hot water does it take to brew hanging ear coffee? How does it taste best? Can hot water from the water dispenser be used to make ear drip coffee?

- What grade does Jamaica Blue Mountain No. 1 coffee belong to and how to drink it better? What is the highest grade of Blue Mountain coffee for coffee aristocrats?

- What are the flavor characteristics of the world-famous coffee Blue Mountain No. 1 Golden Mantelin? What are the characteristics of deep-roasted bitter coffee?