The cafe features the operation of a bank and becomes a cafe.

In response to consumer finance networking, banks in the United States have reduced their cashier manpower and even converted branches into cafes, but customer response to innovative marketing methods has been mixed.

■Firms across the country are tossing out their tellers, adding salespeople and remaking their drive-through lanes.

The Wall Street Journal reported that Capital One Financial Group is scheduled to open a new branch in Boston this summer, but this branch will not have any teller counters, but will operate as a coffee shop, like Starbucks selling various coffee drinks and providing free Wi-Fi.

The in-store staff are all Capital One business people, but their purpose is not to encourage customers to open accounts or apply for loans on the spot, but to introduce customers to the various functions of online banking and to answer customers 'problems in using the website.

In addition to Boston, Capital One coffee shop branches in other parts of the United States also offer "alcohol-free drinking hours" from time to time, which servers use to promote mobile apps launched by banks in partnership with local merchants.

Cashier replaced by PR

A spokesperson for Capital One said that this new type of cafe branch helps the company promote the brand and saves the staff cost of a large number of cashiers. Bank of America plans to do the same, replacing 9,000 tellers with "public relations service personnel." Rather than letting tellers handle business themselves, banks would rather use manpower to coach customers on ATM and mobile apps to improve customer service efficiency.

According to the Federal Deposit Protection Corporation, there were 95,000 bank branches nationwide last year, the lowest number since 2005. Despite the industry's ongoing downsizing, one-third of its branches are still losing money, forcing the industry to take extraordinary measures.

In addition to making change, the latest ATMs currently in use in the banking industry also allow customers to video chat with remote customer service personnel through screens, thereby reducing the personnel costs of physical teller counters. Some banks have even reduced or closed drive-thru lanes to encourage customers to switch to mobile phones for general financial business.

Wells Fargo recently launched a new online feature that allows customers to get a one-time authorization password online before leaving the house, and then quickly complete identification in the drive-through lane to shorten business processing time. PNC Bank launched an app that allows customers to enter a predetermined withdrawal amount on their mobile phone before leaving the house, and then scan the QR Code of the mobile phone directly in front of the ATM to receive cash.

However, the implementation of such cost-saving strategies has not been as smooth as the banks expected, and has sometimes been counterproductive. Robert Meara, an analyst at Celent Consulting, believes that "most banks lack clear direction for branch business strategies," leading to customer dissatisfaction caused by labor savings.

Take Grace Raymond, a 79-year-old grandmother, for example. When she went to the counter of Bank of America to pay the guarantee a few days ago, she got angry because of the shortage of service personnel. The lobby was crowded with customers, and she was first taken to the financial officer's line, and finally told to go to the cashier's counter when it was her turn, thus wasting an entire afternoon.

Banking services should focus on fast service

When Bank of America held its shareholder meeting in May this year, shareholders questioned that some branches had caused long queues for customers in order to save cashier manpower. Brian Moynihan, chief executive of Bank of America, said at the time that the company was still experimenting with new strategies to respond to changing consumer behavior.

Jennifer Oliver, a customer who recently walked past Capital One's New York branch on business, also said that while she liked the special coffee they offered, she admitted that she wouldn't go to the branch specifically for that.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Coffee health test, is your coffee knowledge enough?

Coffee: Are you drinking right? Coffee: Take out a pen and paper and write down your answers. Coffee: Coffee 1. Refreshing 2. Weight loss 3. Help defecation 4. Eliminate edema 5. Improve immunity 2. Is drinking coffee before or after breakfast to help lose weight? 1. Before breakfast 2. After breakfast 3. Drink coffee to refresh, which effect is better? 1.

- Next

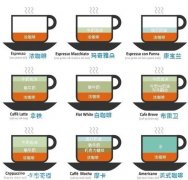

Little knowledge: a complete knowledge of coffee

Classification of coffee: coffee trees can be roughly divided into five types, of which Arabica and Robusta are more common. Arabica species, which account for more than 70% of the world's total output, are generally grown on slopes above 900 meters above sea level and are mostly found in tropical high-altitude areas such as Central and South America, East Africa, Southeast Asia and Hawaii. Its pleasant aroma, rich taste, and

Related

- Detailed explanation of Jadeite planting Land in Panamanian Jadeite Manor introduction to the grading system of Jadeite competitive bidding, Red bid, Green bid and Rose Summer

- Story of Coffee planting in Brenka region of Costa Rica Stonehenge Manor anaerobic heavy honey treatment of flavor mouth

- What's on the barrel of Blue Mountain Coffee beans?

- Can American coffee also pull flowers? How to use hot American style to pull out a good-looking pattern?

- Can you make a cold extract with coffee beans? What is the right proportion for cold-extracted coffee formula?

- Indonesian PWN Gold Mandrine Coffee Origin Features Flavor How to Chong? Mandolin coffee is American.

- A brief introduction to the flavor characteristics of Brazilian yellow bourbon coffee beans

- What is the effect of different water quality on the flavor of cold-extracted coffee? What kind of water is best for brewing coffee?

- Why do you think of Rose Summer whenever you mention Panamanian coffee?

- Introduction to the characteristics of authentic blue mountain coffee bean producing areas? What is the CIB Coffee Authority in Jamaica?