The price of Arabica is under temporary pressure. Robsta continues to rise.

Follow the caf é (Wechat official account vdailycom) and found that Beautiful Cafe opened a small shop of its own.

The coffee market was volatile, with Arabica prices plummeting and then returning to previous levels, while Robusta closed higher. Exports remained strong in June, reaching 10.9 million bags, up 8.8 per cent from last year, leading producing countries to hoard large inventories. As a result, the coffee market is in ample supply in July, while Brazil is still likely to suffer frost disasters.

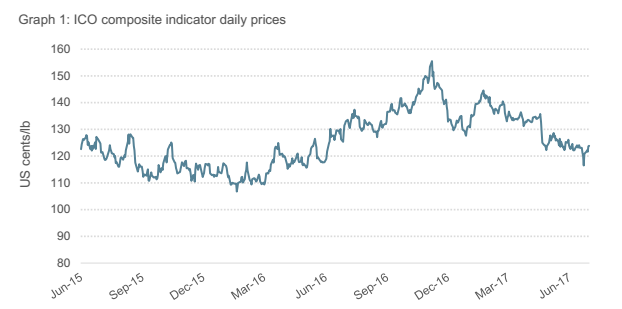

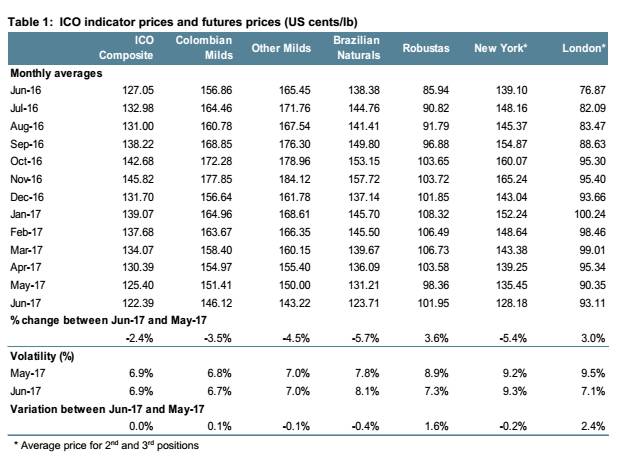

The coffee market in June was characterized by strong volatility, which eventually led to horizontal fluctuations in coffee prices. Although the average monthly composite benchmark price for ICO fell 2.4 per cent to 122.39 cents per pound, the price difference between the beginning of the month and the end of the month was negligible. In the first two weeks of June, daily composite indicator prices remained relatively narrow at 122.11 to 124.55 cents per pound. Prices then fell sharply, with the index falling to a low of 116.51 cents per pound on June 22nd. The rebound in prices made up for almost all losses and reached 123.83 cents per pound on June 30th, slightly above the level at the beginning of the month.

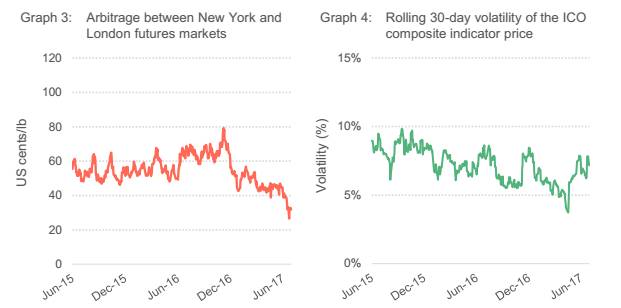

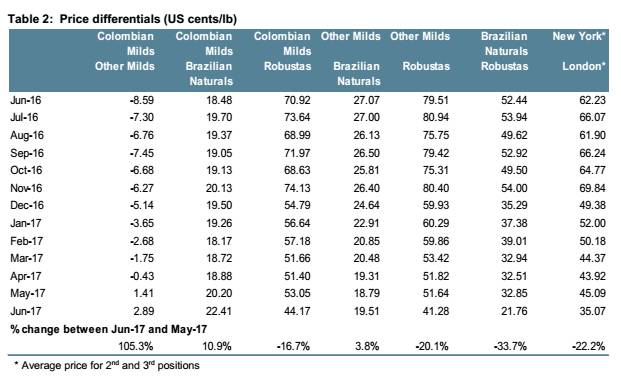

The rise in Robusta prices, especially in the second half of June, cushioned the fall in Arabica prices, thereby preventing a further decline in composite indicator prices. Lobustas is reported to have grown strongly, up 3.6% from last month and more than 100 cents per pound due to a decline in Vietnamese exports. Arabica prices fell sharply, with Colombian light coffee, other light coffee and Brazilian naturally dried coffee falling 3.5%, 4.5% and 5.7%, respectively. As a result of the opposite trend in Arabica and Robusta quotes, the carry trade in the new York and London futures markets fell sharply by 22.2% to 35.07 cents per pound, the smallest difference since April 2008. At the same time, the daily volatility of ICO composite index prices remained at 6.9%.

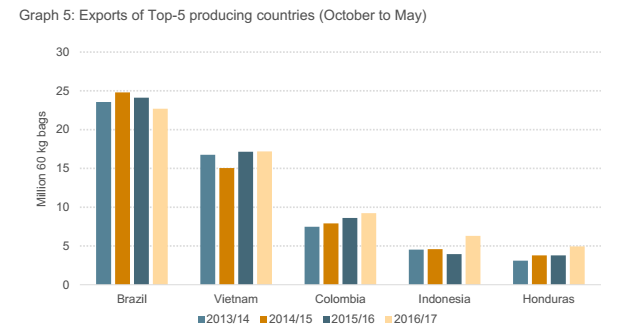

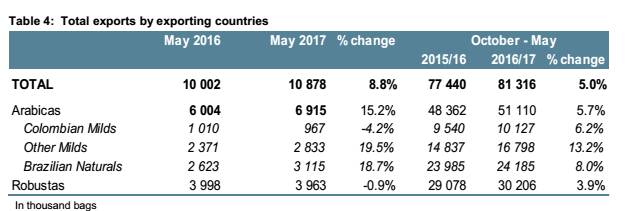

Exports totaled 10.9 million bags in May, an increase of 8.8 per cent over the same period last year. In the first eight months of 2016 / 17, total exports increased by 3.9 million bags over the same period last year to 77.4 million bags. Brazilian exports fell for the second year in a row to 22.7 million bags in 2016 / 17, down 5.9 per cent from the previous year. However, despite the relatively poor harvest, the decline was still lower than expected as exporters made heavy use of existing stocks. In addition, the decline in Brazilian exports can be made up for by other sources. It is worth noting that supply shortages are likely to occur in Colombia, Ethiopia, Honduras, Indonesia, Peru and Uganda.

As the innovative plans of the national authorities continued to bear fruit, Colombian exports increased by 9.2 million bags, an increase of 7.2 per cent over the same period last year. Compared with the previous year, Indonesia's exports increased by 2.3 million bags (60 per cent), while Honduras's exports increased by 30 per cent compared with 2015. It is estimated that Vietnam's exports fell by more than 1/4 from 2.5 million bags in April 2017 to 1.9 million bags in May. The report shows that the local supply of coffee exporters is now increasingly squeezed because of previous low production. Nevertheless, exports from 2016.10 to May 2017 are estimated to be slightly more than 17 million bags, about the same as last year.

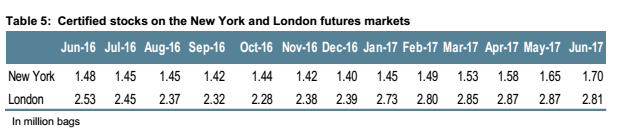

Due to the substantial increase in exports so far this year and the large inventory backlog in importing countries, the market is still in ample supply. The sudden drop in prices in the third week of June appears to have been triggered by a combination of coffee and other soft commodities.

However, in July, there is still a residual risk of frost in Brazil, which could affect next season's harvest. Similarly, coffee leaf rust could break out in Honduras and cause supply concerns in the market.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

The difference between Arabica and Robusta coffee species

Following Cafe Review (Wechat official account vdailycom) found that the coffee tree in the beautiful cafe opened a small shop of its own. The main types of coffee trees are Coffee Arabica and Coffee Robusta. The leaves of Arabica are about 15 cm long. Robasda's leaves are long, soft-oval or pointed, and bright green in color. The Liberian species are not tolerant because of their poor flavor.

- Next

Arabica (ARABICA) and Robusta (ROBUSTA) coffee beans

Following Cafe Review (official Wechat account vdailycom) found that the process of people drinking coffee in the world must have started with coffee beans, just like instant noodles invented after noodles. Before 1938, human beings had not yet mastered the technology of turning coffee beans into instant coffee powder. The Chinese in the era of the Republic of China always drank coffee beans.

Related

- Detailed explanation of Jadeite planting Land in Panamanian Jadeite Manor introduction to the grading system of Jadeite competitive bidding, Red bid, Green bid and Rose Summer

- Story of Coffee planting in Brenka region of Costa Rica Stonehenge Manor anaerobic heavy honey treatment of flavor mouth

- What's on the barrel of Blue Mountain Coffee beans?

- Can American coffee also pull flowers? How to use hot American style to pull out a good-looking pattern?

- Can you make a cold extract with coffee beans? What is the right proportion for cold-extracted coffee formula?

- Indonesian PWN Gold Mandrine Coffee Origin Features Flavor How to Chong? Mandolin coffee is American.

- A brief introduction to the flavor characteristics of Brazilian yellow bourbon coffee beans

- What is the effect of different water quality on the flavor of cold-extracted coffee? What kind of water is best for brewing coffee?

- Why do you think of Rose Summer whenever you mention Panamanian coffee?

- Introduction to the characteristics of authentic blue mountain coffee bean producing areas? What is the CIB Coffee Authority in Jamaica?