Why don't the capital bosses of 70 billion yuan coffee market like it?

According to statistics, the scale of China's coffee consumption market reached 70 billion yuan in 2015, and it is breaking out at an annual growth rate of 15%, reaching trillion yuan by 2025. With a market size of 70 billion yuan and a market growth rate of 15%, why is capital dismissive of such a "thriving" industry?

Why does Capital look down on Coffee Industry

The development of the industry is distorted and deviated from the commercial track.

"at present, there is no particularly sexy object in the category of coffee." Zeng Fanhua, vice president of Tiantu Capital, said. Tiantu Capital focuses on consumer investment and has invested in Ganqi Food, Tangcheng Chef, Zhou's Black Duck and other catering brands.

What is "sexy object"? In Zeng Fanhua's view, there are differentiated brands. "Brand tonality, target customer groups and other aspects of differentiation and innovation can be".

Carving time coffee once entered the capital field of vision with differentiation. In 2011 and 2012, Trustbridge Partners injected two funds into carving time Coffee.

Zheng Qingsheng, director of Trustbridge Partners, who decided to invest in sculpture time, has now joined Sequoia Capital. At that time, his main consideration was the difference between the carving time and Starbucks. There are business opportunities for its maverick.

Obviously, in the eyes of the capital side, the reason why the coffee industry is left out has a lot to do with the overall quality of the coffee people themselves in business. It is mainly shown in these aspects:

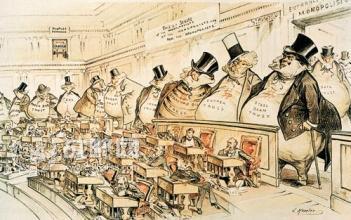

Indulge in coffee technology and almost abnormal worship of flavor; blindly believe in technical indicators, but ignore the taste of coffee that local consumers are willing to accept in the market The rise of boutique coffee should have evolved from the mass market of coffee, but in fact, the whole industry is pursuing niche boutiques, even cursing instant products, treating coffee as a luxury and reading coffee culture as the Bible. The road can only become narrower and narrower. The worship of rival craftsmanship and the rejection of new technology, in the eyes of investors, these distorted behaviors have been led into the atmosphere of the whole industry, regard self-feelings as a treasure, and have long deviated from the track of commercial capital.

Lack of pioneering talents and few innovative enterprises

In addition to the above reasons, the lack of pioneering talent in the coffee industry has also deterred capital. Tiantu Capital attaches more importance to people when deciding to invest in a certain area. A good product manager should have great ambition and excellent leadership. "if there is a great entrepreneur in the coffee industry, I will certainly pay attention to it." Zeng Fanhua said.

Wang Caihua, founder of the Cafe Industrial Fund, said that the coffee unicorn enterprises expected by the capital have not yet appeared in the view of the capital side. "in fact, Capital has been expecting the emergence of a coffee unicorn for the past two years. We have been paying attention to the innovative model of the coffee industry, the breakthrough of the coffee shop brand and the renewal of the coffee business model. However, the atmosphere of the coffee industry, everyone amuses themselves, self-comfort, there has not been a dark horse-type enterprise or innovative, technology-based benchmark enterprise. " "it's just that there is a lack of pioneering talent in the coffee field right now." Zeng Fanhua sighed.

There is a bubble in the data and the scale of the industry is too small.

At present, China's coffee market is about 70 billion yuan-far away from neighboring South Korea and Japan, and there is still a huge market space for the trillion yuan scale of the mature market.

Although the consumption data is rising, this volume is not enough to attract the attention of industrial capital. Wang Caihua said that capital is highly concerned about the volume of the market. Generally speaking, the stage of 100 billion-150 billion yuan is the best time for capital intervention. You know, profit-seeking capital is best at calculating the timing to get a better return, and they tend to be only half a step ahead of the market. "the domestic coffee market is still a relatively weak and small niche market, worth tens of billions of yuan, which is really not worth mentioning."

In addition, many people in the industry believe that there are a lot of bubbles in the data we see at present. The figures we have seen over the years are actually an indicator of imports and exports. The real data should include three aspects: import and export data; electronic transaction data of e-commerce such as Taobao; business and tax data of cafes and consumption data of instant channels such as Nestl é and Maxwell. Generally speaking, the coffee industry data is still lack of standard, professional and authoritative.

Therefore, the rise in industry data does not mean that the number of people who go to cafes for coffee is on the rise compared with the same period last year. If the data is not clear and the industrial capital does not understand, it will not enter hastily.

The potential of the industry is huge, and the management is not in place.

In the view of the capital side, there is no opportunity in the field of instant coffee, while the cafe has low threshold, low degree of industrialization, overweight assets, poor profitability and irregular management. This makes the coffee industry a contradiction and makes the capital both love and fear. "We know very well that the reason why it is really difficult to form a time node for involvement in the coffee industry is that cafes are unstable, opaque, and high staff costs." Wang Caihua said. For example, if there is no financial transparency and invoicing, there will be no audit basis for income; if employees do not hand in social security, there will be large staff mobility; and the degree of standardization is low, especially fine coffee, and the input-output ratio is low.

Which coffee brands have Capital embraced?

In fact, capital has not abandoned the coffee industry. As far as coffee brands are concerned, at least some of them have been invested. These investments are roughly divided into two stages.

Invest in traditional brands, falling short of capital expectations

Cross-strait coffee, Shangdao coffee and carving time are the representatives of this period. In 2007, Carlyle invested $21 million in Dior Coffee; in 2008, Goldman Sachs Capital and Watson Capital invested $30 million in cross-strait coffee; and in 2011 and 2012, Trustbridge Partners injected two funds into Sculpture time. At that time, both Diou and cross-strait coffee brands had corresponding Hong Kong or A-share listings, but now it seems that the two investments were actually unsuccessful and did not meet capital expectations.

Try a new business model and sow Internet coffee

The second stage focused on 2015-2016, when capital abandoned the traditional coffee industry and turned to the new ways of coffee brought by the mobile Internet.

But combing carefully, these coffee brands favored by capital have two characteristics. First of all, most of them are non-traditional cafes, relying on technology and mobile Internet. Compared with traditional cafes, these less orthodox cafes have a complete business model and profitable design. Another feature is that the amount of investment is relatively small.

The new business model means both opportunities and risks. Mad coffee, for example, is forced to declare O2O business failure and be forced to transform.

So, to some extent, it is not that the capital is not interested in coffee, but in the business model of traditional cafes.

Are you ready to embrace capital enterprises? coffee industry is broken, integration, opening up and win-win.

To promote the popularization and popularization of the coffee market. Make coffee a mass consumer product rather than a luxury packaged in cultural coats. Fortunately, more and more people in the industry are beginning to realize this.

The promotion of new technology, new technology and new business model in the industry. It is important to see that not only Starbucks is launching meals, but Chinese food companies are also introducing coffee. It doesn't matter what people in the traditional coffee industry think, but it's more important to be accepted by the wider market. Success is when the market is willing to pay for your coffee.

The enterprises in the industrial chain of the coffee industry should have the mind of integration, openness, integration, cross-border and win-win, and maximize the market, market value and profits.

At a time when capital is pouring in and when the industry is reshuffling

In fact, in the coffee industry, capital has begun to take action quietly: this year, industrial capital such as Chongqing Coffee Financial Trading Center and Coffee Industry Fund Coffee has entered the coffee field, and coffee finance will intervene in coffee futures and trading from the source, and boost the coffee industry from planting.

For the industry, there is no future without the advantage of scale.

Large-scale capital influx is the best time for superior brands to expand rapidly, improve team building, strengthen product research and development, establish scale advantages, and complete category occupation. Unprepared coffee brands will be attacked and even shuffled out.

Wang Xingshi, vice president of source capital, reminded that capital is an external force and a catalyst, and that a good job of the coffee company itself is fundamental. Source: internal ginseng of catering boss

Coffee joins "reducing fever"

The joining craze led by Korean coffee is gradually "reducing fever" in the domestic market. At the China franchise Exhibition held this year, the number of hot coffee brand exhibitors dropped by more than half last year. Korean coffee brands, which were once favored by investors, are even more rare at the exhibition. The declining momentum of Korean coffee brands has become a fact, but for the overall coffee market, it is not without opportunities to rise. In the eyes of people in the industry, when coffee joins the market to fade away impetuosity, it means a greater opportunity for brands that still stick to it.

The format of the coffee shop has declined somewhat.

Retail, catering and service industry are still the main part of the franchise exhibition in China, but in the catering industry, the form of cafes that once led the trend in the past appears to be declining. The coffee craze brought about by the trend of South Korean TV dramas in the past is gradually fading. Hao Yongqiang, deputy director of the convention and exhibition department of the China chain Management Association, said that after the initial market explosion, both brands and investors in the coffee market are gradually becoming rational.

The "fever" in the coffee market has something to do with the frequent problems of domestic franchisees in the past year. Since June last year, it has been revealed that the capital chain of coffee with you is tight, and there is a lot of news that stores are closed and run away, while zoo coffee, which is also a Korean coffee brand, has been more or less impressed by the storm. For coffee brands, through the liberalization of joining, we can quickly achieve the purpose of withdrawing funds and expanding the scale of the brand, but it is difficult to manage.

At this year's China franchise Exhibition, Pacific Coffee, which is as famous as Starbucks and COSTA, was unveiled for the first time. It is understood that Pacific Coffee is looking for franchisees through city agents, and each city is looking for a franchise agent. Industry insiders said that compared with the individual joining model, the joining model of urban agents has higher requirements for franchisees, and it may be difficult for coffee brands to expand rapidly in the short term, but they can maximize the consistency between self-owned stores and franchisees.

Industry differentiation is becoming more and more obvious.

The domestic coffee market share is expanding year by year, and the differentiation of the coffee industry is becoming more and more obvious. The coffee brands represented by Dior and both sides of the strait have promoted the "coffee + simple meal" model in the market, which is mainly for business people, and has formed a certain brand awareness in recent years. Coffee brands that focus on fashion, trend and leisure concepts such as coffee accompany you and diffuse coffee have been laid out very quickly in the past two years, but they have entered an adjustment period since last year because of some loopholes in the previous joining mode. From this year's coffee market point of view, such as Pacific Coffee, CAFFE PASCUCCI and other coffee brands that focus purely on coffee products will reoccupy the tuyere.

Ji Ming, the first president of the China Coffee Association, once said that coffee shop operation is always a slow process, and it needs to train consumers, which is a long process. It is understood that the operating efficiency of the cafe depends to a large extent on the location. Choosing to open in shopping malls and other places can enjoy sufficient mobile passenger flow resources, but it also means that they need to bear more rental pressure.

In addition, as the format of coffee has gradually become standard in shopping malls, the competition among brands is becoming more and more fierce. A coffee practitioner said that if a coffee shop is opened near an office building or community, it usually takes a "business period" of 3-5 years to cultivate the brand awareness and consumption habits of the people in the store.

Master rhythm and control quality

The key to control the quality of service is to master the rhythm of opening up and joining. Take Pacific Coffee as an example. China Resources Group bought Pacific Coffee in 2010 and opened its first mainland coffee shop in Shanghai in 2011. After more than five years of development, Pacific Coffee currently has more than 300 stores in the mainland market and has recruited only three franchisees.

Pacific Coffee will evaluate the franchisee's rental strength, network resources and the situation of the existing company, and make real-time feedback on the operating status of the franchisee store through the background and payment system, so as to ensure the franchisee's profitability. In addition, franchisees and direct stores enjoy a common commodity database, raw material suppliers and after-sales service, and membership cards can be used in both direct stores and franchise stores to ensure the consistency of services.

Industry experts believe that whether it is a coffee chain brand or a coffee franchise, it takes time to precipitate the brand, and enterprises are not eager to expand rapidly, but to form a benign profit model that can win-win with franchisees.

According to the National Coffee format Analysis report of first-and second-tier cities, the domestic coffee market is polarized, with 77% of brands with less than 10 stores and less than 1% of brands with more than 10 stores. The number of stores can be seen as one of the factors that distinguish emerging brands from mature brands, but the road from emerging brands to mature brands is full of ups and downs.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Shanghai Free Trade Experimental Zone Coffee Trading Center

The coffee trading center of the Shanghai Free Trade Experimental Zone, which arises at the historic moment from Yunnan-Shanghai business cooperation, has been checked and accepted by the Municipal Commercial Commission, the Municipal Finance Office, the Free Trade pilot Zone Management Committee, and other units. In the near future, it will trade and display from offline to online to the whole world. Since the coffee trading center of Shanghai Free Trade Experimental Zone has been accepted by relevant departments for business cooperation between Yunnan and Shanghai for one year, the two sides have established interconnection.

- Next

Exposing the cat poop coffee industry chain: Civets are widely enslaved and abused

The world's most expensive coffee can sell for $100 a cup, but producing it comes at a hidden price: the happiness of a cat that lives in the jungles of Southeast Asia. The US quartz financial website published on July 24 entitled "The most expensive coffee in the world is for the animals that produce this coffee."

Related

- What grade does Jamaica Blue Mountain No. 1 coffee belong to and how to drink it better? What is the highest grade of Blue Mountain coffee for coffee aristocrats?

- What are the flavor characteristics of the world-famous coffee Blue Mountain No. 1 Golden Mantelin? What are the characteristics of deep-roasted bitter coffee?

- Can I make coffee a second time in an Italian hand-brewed mocha pot? Why can't coffee be brewed several times like tea leaves?

- Hand-brewed coffee flows with a knife and a tornado. How to brew it? What is the proportion of grinding water and water temperature divided into?

- What is the difference between Indonesian Sumatra Mantinin coffee and gold Mantinin? How to distinguish between real and fake golden Mantelin coffee?

- What does bypass mean in coffee? Why can hand-brewed coffee and water make it better?

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!