Starbucks COSTA routine: grab the hearts of consumers and immediately get rid of Chinese companies to make crazy profits.

For professional baristas, please follow the coffee workshop (Wechat official account cafe_style)

For a long time, COSTA, like its English ancestry, is stubborn, arrogant and traditional.

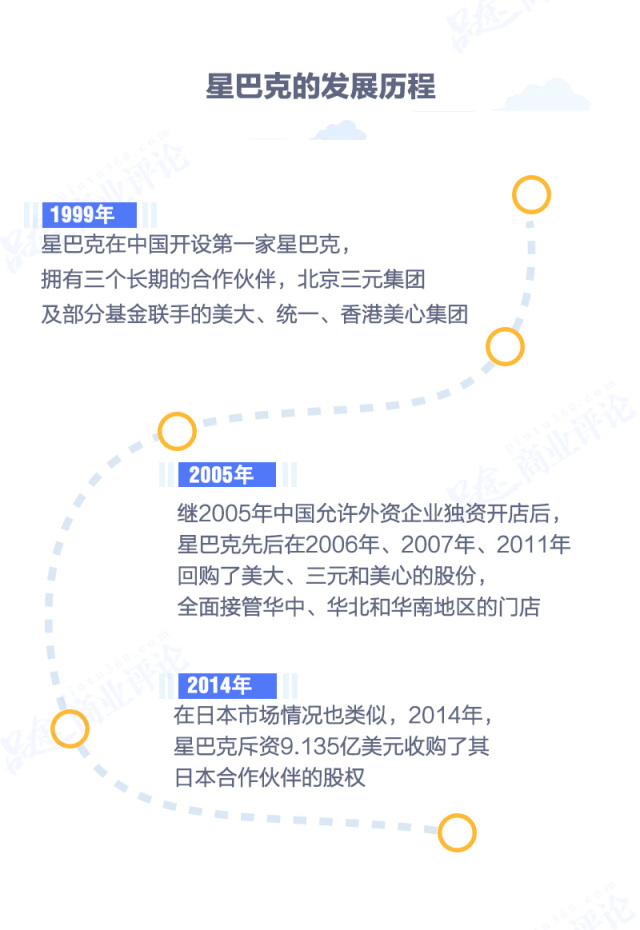

But in the face of the gratifying growth of the Chinese coffee market, the "stubborn" English gentleman finally got restless. After Starbucks spent nearly 8.8 billion yuan to own 1300 stores in East China in July, COSTA also began to move towards a wholly-owned operation path.

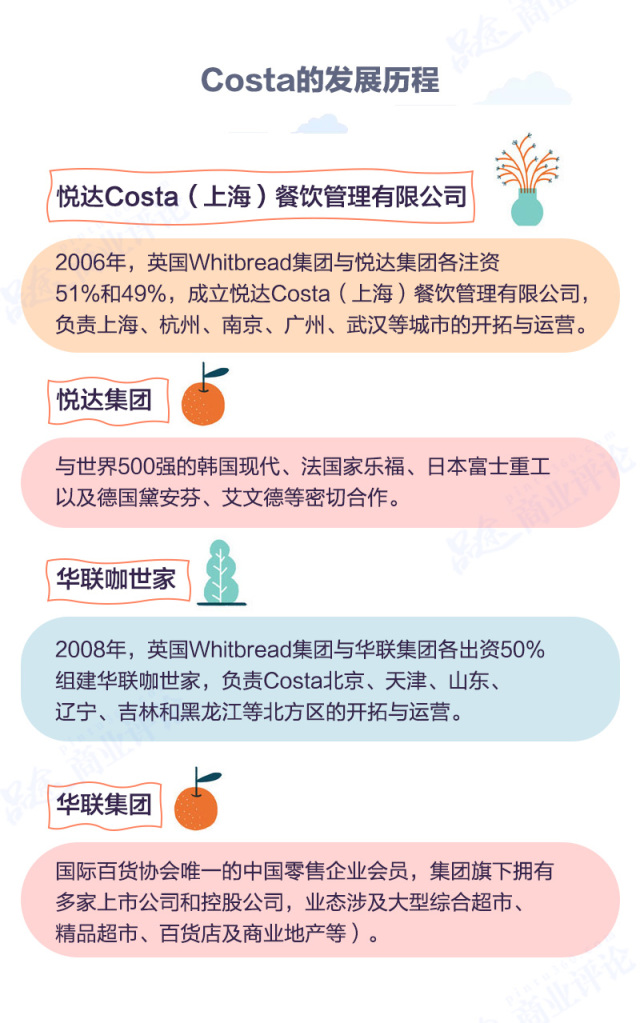

COSTA parent company Whitbread Group announced last week that it would buy the remaining 49 per cent of Yuedaga Shijia (Shanghai) Restaurant Management Co., Ltd for 310 million yuan, British media "Telegraph" reported. The company is a joint venture between COSTA and Jiangsu Yueda Group, and upon completion of the acquisition, COSTA will wholly own the southern Chinese market.

COSTA's "personal entanglement" strategy

The slow pace of COSTA's overseas expansion has been criticized. Although it was founded in 1971 as Starbucks, it was not until 1999 that COSTA opened its first overseas store in Dubai.

At the same time, Starbucks has opened stores in Beijing and officially entered the Chinese market. COSTA, which is a few beats behind, didn't set up its first store in China in Shanghai until 2007. This time, when Starbucks almost monopolized the Chinese coffee chain market, COSTA also embarked on the road of its wholly-owned operation.

Although COSTA's parent company has repeatedly stressed that "unlike Starbucks, we are the first international brand to bring top handmade coffee to the Chinese market", there is no doubt that from location to expansion strategy, COSTA is almost in a "hand-to-hand struggle" with Starbucks.

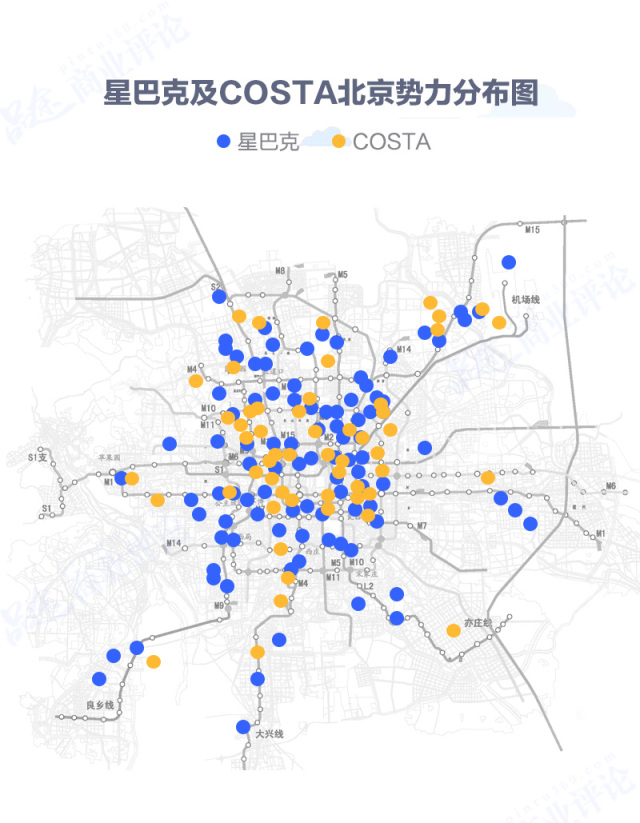

It is worth mentioning that almost every store in COSTA is close to Starbucks. This is very similar to the happy enemies of McDonald's and KFC. Personal tactics not only save the time and high cost of market analysis and investigation, but also take advantage of Starbucks' preconceived position in the hearts of consumers to improve its popularity.

The reason why COSTA dares to fight a personal battle comes not only from his confidence in his own quality, but also because he has found a backing that he can rest assured to rely on.

Ten years ago, Paul Smith, president of COSTA Asia, said: "finding strong local Chinese companies to cooperate is the best way to develop." Before entering the Chinese market in 2006, COSTA spent three years doing Chinese market research, in which, in addition to investigating consumer psychology and market conditions, the focus was to select a suitable partner.

Today, ten years later, COSTA launched a wholly-owned operation and cast off its backers wantonly. Once again, this practice of "turning a face and not recognizing others" coincides with that of Starbucks.

What on earth makes Starbucks COSTA so ruthless?

Interests, of course.

First of all, when entering an unfamiliar market, the franchise model has great advantages. For brands, as long as they export the brand and management ability, they can have stable sales share and more and more market space.

However, when the overseas market is mature and the profit scale is considerable, the advantage of franchise no longer exists for foreign-funded enterprises. It hopes to get back control, on the one hand, to improve the company's overall profitability and decision-making power; on the other hand, it is a maintenance of store quality and brand value.

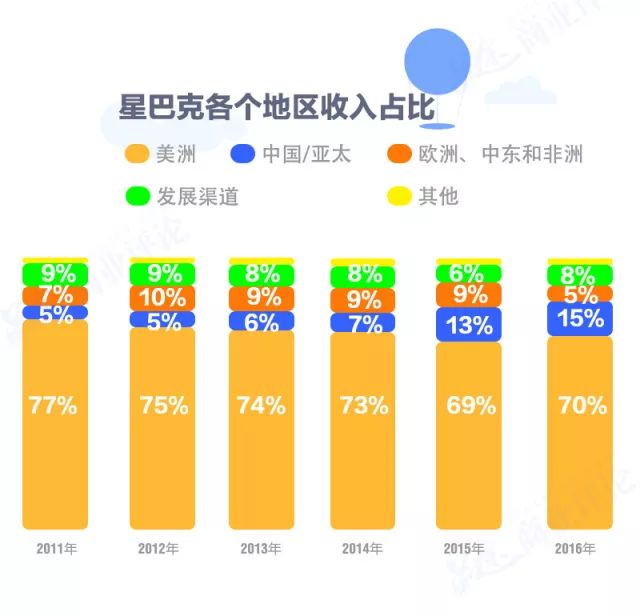

Second, the depression in overseas markets has made Starbucks and COSTA more determined to win in China. Since last year, sales in its largest US market have suffered bottlenecks, while the Chinese market is growing rapidly, according to Starbucks 2016 earnings.

In addition, according to Starbucks' 2016Q4 results, comparable store sales in China grew 6 per cent year-on-year, higher than in the US and 4 per cent globally; in terms of revenue, the Asia-Pacific region, including China, grew 9 per cent, making it Starbucks's second-largest market in the world.

After taking back the independent management rights of stores in such a strong Chinese market, all the profits will go to Starbucks' own pockets.

The same is true of COSTA. Although the Times tops the list of the UK's favorite coffee brands, COSTA's sales in the UK are not satisfactory.

According to public information, the growth rate of local performance of COSTA has declined significantly in recent years. COSTA's UK turnover grew by just 2 per cent in fiscal 2016, compared with 6.8 per cent in 2013.

Moreover, such a performance can only compete with little-known small cafes such as caf è Nero in the UK, which is really inconsistent with the identity of COSTA as "Big Brother in Britain".

But in China, COSTA's sales are sizeable. The company predicts that COSTA's 700 stores in China will reap operating profits of 12 million to 15 million pounds in 2022.

The core of this profit growth lies in the huge growth potential of China's coffee market. According to the London International Coffee Organization, compared with the global average growth rate of 2%, China's coffee consumption is growing at an astonishing rate of 15% a year. It is expected that by 2025, China will grow into a giant coffee consumption empire of 1 trillion yuan.

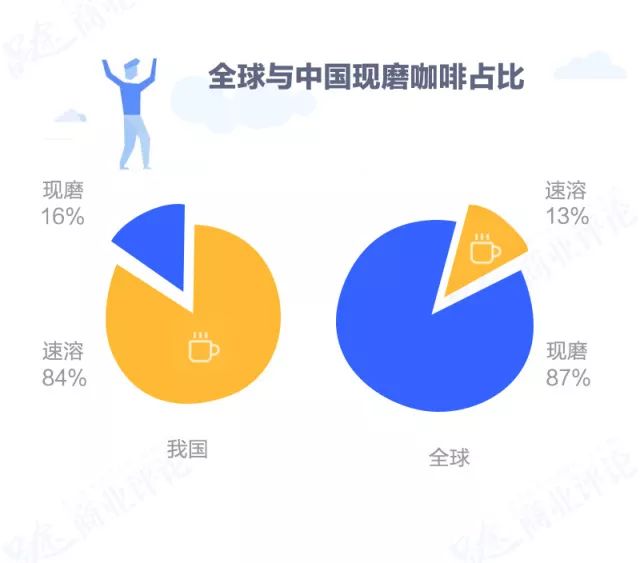

In addition, the average growth rate of instant coffee sales fell to 8.3 per cent between 2012 and 2017, due to changes in Chinese consumers' spending habits, according to the London International Coffee Organization. In the future, with the gap of freshly ground coffee consumption between China and developed countries in Europe and America gradually narrowing, Starbucks and COSTA will usher in greater market opportunities.

The tricks you can learn, but the tricks you can't learn.

According to Reuters, in the early domestic market, COSTA coffee was steadily expanding at the highest rate, with two or three new stores opening every week, so COSTA began to appear next to many Starbucks stores. Its shop assistants have the same young, sunny smiles as Starbucks clerks, and they can also shout out the names of regular customers.

But what is new to Chinese consumers is that they can talk face-to-face with baristas about the craft of handmade coffee and listen to the hiss of foam.

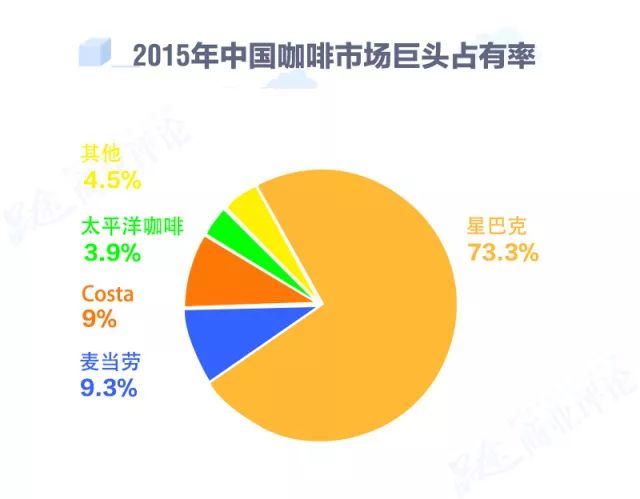

Judging from the current brand share of China's coffee market, COSTA has long lagged behind. Starbucks, which has a market share of 73.3%, lags behind COSTA (9%) by eight times.

As a result, COSTA may not even compete directly with its established rival Starbucks in the Chinese market. At the same time, the strength of McCoffee and Pacific Coffee, which carve up the Chinese coffee market, should not be underestimated.

In addition, from the development of COSTA in recent years, the expansion of its overseas stores is very slow. According to public data, by the end of 2016, COSTA had 420 stores in mainland China, while Starbucks had more than 2400.

By 2021, Chinese mainland plans to increase its number of stores to 5000, while COSTA plans to expand to 700 within five years after it wholly owns its stores in southern China. Morgan Stanley says this means that COSTA needs to open 80 new stores a year, which is a big challenge.

However, no matter whether COSTA can grow healthily after breaking away from the bosses, and whether the seemingly empty store opening plan can support its ambition to carve up the Chinese coffee market. Most importantly, in China, where the requirements for brand and experience are much higher than the taste and quality of coffee itself.

Starbucks, which sells both coffee and marketing, is obviously more able to capture the hearts of Chinese consumers than the quality-oriented but old-fashioned COSTA-"I just bought Starbucks, but the taste of the coffee doesn't seem to matter that much."

While shrugging off the frenzied profits of Chinese companies, it firmly grasps the hearts of Chinese consumers. Look at Starbucks, this is the real capital winner.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

The 10 most likely to be the next Starbucks chain of boutique coffee shops

Professional baristas Please follow the Coffee Workshop (official Wechat account cafe_style) although some big companies have entered the high-end coffee market, Starbucks' monopoly is still strong. Analyst John Glass said in a note: the importance of high-end chains such as Starbucks to the whole industry is self-evident, so both public and private investors are interested in this kind of company.

- Next

Five Tokyo Coffee shops with strict requirements for blending Coffee

For the exchange of professional baristas, please pay attention to the coffee workshop (Wechat official account cafe_style) there are many forms of coffee shops in Kyoto, such as Liuyao Club, Elephant Factory Coffee, Ertiao Cottage, Kurasu,ARABICA Kyoto Dongshan Store, and so on. This time, the editor of Matcha took you to Kyoto to visit five coffee shops that coffee makers will love.

Related

- What documents do you need to go through to open a coffee shop? coffee shop coffee shop certificate processing process

- How to purchase Coffee beans in small Cafe how to choose a suitable supplier for domestic Coffee supply Company

- How to drink Starbucks Fragrance White Coffee? how to make Australian White Coffee? what Italian coffee beans are recommended?

- The Story of Flora Coffee: the name of Flora Coffee Bean and the implication of the Flowers on Florna Coffee

- How much does a cup of coffee cost? How much is the profit of a cup of coffee? What is the profit of the coffee shop in a year?

- Yunnan small Coffee, known as "fragrant Coffee", introduces the characteristics of Alpine Arabica Coffee producing areas in Yunnan, China

- 2023 latest Starbucks full menu price list how much is a cup of Starbucks coffee what is better to drink the most popular hot and cold drinks recommended

- Starbucks different kinds of Coffee Price list Starbucks menu 2023 Top Ten Best drinks in Starbucks

- Starbucks Spring praise Comprehensive matching Coffee Bean theme Story Packaging implication and taste description

- The cost of a cup of coffee latte American coffee cost price and selling price