On-site visit to Starbucks Coffee takeout: sales are pitifully small, even worse than running errands.

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style)

On Nov. 2, Beijing time, Starbucks reported fourth-quarter earnings of $6.3 billion in fiscal 2018, up 11% from $5.7 billion in the same period last year, and earnings per share of $0.62. An increase of 13% compared with the same period last year, exceeding analysts' expectations. But the industry found that its fourth-quarter net profit was $755.8 million, down 4.1% from $788.5 million in the same period last year. Perhaps under the pressure of slowing growth, Starbucks announced that it would open about 2100 new stores around the world.

In the Chinese market, Starbucks has also begun to make frequent adjustments under various pressures, one of which is to launch a takeout business. perhaps in Starbucks' view, Chinese competitors have waded out of an emerging market. as the leader of the traditional coffee retail business, no matter what the consideration, I want to come and have a taste.

In the twinkling of an eye, Starbucks has been in the takeout business for more than a month, what is the sales volume and market response? In order to get close to the real data, we specially visited two stores that support Starbucks takeout business in Beijing's core business district, and the results were unexpected.

On October 18, Starbucks announced that its stores in Beijing and Shanghai had basically realized coffee takeout coverage throughout the city. a few days ago, Starbucks was stationed in Guangzhou, Shenzhen, Chengdu, Hangzhou, Tianjin, Nanjing, Wuhan, Ningbo and Suzhou. It is expected to expand to more than 2000 stores in 30 cities by the end of this year.

Starbucks is menacing the battle of coffee takeout.

But when you open ele.me App, there is a huge gap between reality and ideal. The monthly sales of 34, 176 and 323 orders sold by the three Starbucks specialty stars in the neighborhood are far less than those of some unofficial purchasing agents.

Ideal ≠ reality

The industry selected two Starbucks stores in Sanlitun SOHO and Beijing Guomao to record how many takeout riders came to pick up food and the number of takeout riders during the two-day survey.

Just look at the data. A total of five takeout riders entered Sanlitun SOHO Starbucks from 9 a.m. to 6 p.m., gathered around lunch. From 12:00 to 3 p.m., four riders picked up a total of 11 takeout bags.

Industry Fengyunhui on-site squatting data, and ele.me App shows that the store "monthly sales of 338 orders" is roughly the same. It can be seen in the evaluation area that only 76 reviews have been received by Sanlitun SOHO Starbucks. It also included a bad comment that the user said, "it's been almost two hours since the order was placed." The ice is melting away. "

Bustling Beijing International Trade is the first choice for Starbucks after entering China, and the first store is opened in Beijing International Trade. There are a large number of foreign enterprises near ITC, which has become the meeting place of fashion and commerce, and many businessmen also choose to set up shop here. There is a Starbucks store on the second floor of International Trade Phase III in Beijing. On October 25, the industry chose to squat here. A day later, the industry was surprised to find that the store did not sell a cup of take-out coffee, and the Starbucks "Star delivery" courier dressed in the iconic blue dress did not show up at the store once. The industry collects views in ele.me APP, and the Starbucks store has only 16 reviews.

Some of the bad reviews should be extreme cases, but the problem of low sales in Starbucks coffee takeout is common.

Site visit to Starbucks takeout: sales are pitifully small

The result is reminiscent of the grand press conference held by Starbucks and Ali a few months ago when they announced a comprehensive strategic cooperation. At that time, Starbucks had high hopes for the upcoming takeout business and did not hesitate to spend ten times the high price to design a special hot drink cup lid.

Ele.me, which is in charge of distribution, has also organized a dedicated team of riders, equipped with newly developed take-out delivery ice bags and other equipment. In addition, it is reported that a special test and distribution team has conducted closed tests for more than 3 months.

Everything was ready, and Starbucks sent Starbucks to Beijing and Shanghai for trial operation on September 19. On the day of the "full moon", Starbucks China announced that Beijing and Shanghai had basically completed the coverage of stores sent by special stars throughout the city. At the same time, another special delivery channel jointly created by Hema Xiansheng is also in trial operation in Shanghai and Hangzhou. In addition, it is also mentioned at the beginning of the article that Starbucks plans to promote special stars to stores across the country by the end of this year.

All these are the compromises and efforts made by Starbucks, a coffee giant, for its takeout business in the Chinese market. How did it turn out? Are consumers willing to pay for it? The sales data from the survey speak for themselves.

Takeout ≠ New Retail

Starbucks, which has dominated coffee retailing for many years, has almost become a symbol of coffee culture. Why did Starbucks report a 2% drop in same-store sales in the third quarter of this year, handing over its "worst report in nine years"? I believe that even Starbucks itself is constantly reflecting on this issue.

As a giant, Starbucks, which entered China in 1999, has not put coffee takeout on the agenda for 19 years. Even when the takeout business is booming in the Chinese market, young people agree that it has been a takeout for nearly two years. Starbucks also did not launch a takeout service.

Even with the launch of takeout now, Starbucks is already uncomfortable in this new competition.

For example, price is the most sensitive factor for most consumers. When using takeout App to order food, the platform or merchants will attract consumers with discounts, discounts, seconds kill and other preferential activities. But Starbucks, which wears a crown, is determined to Say No all this.

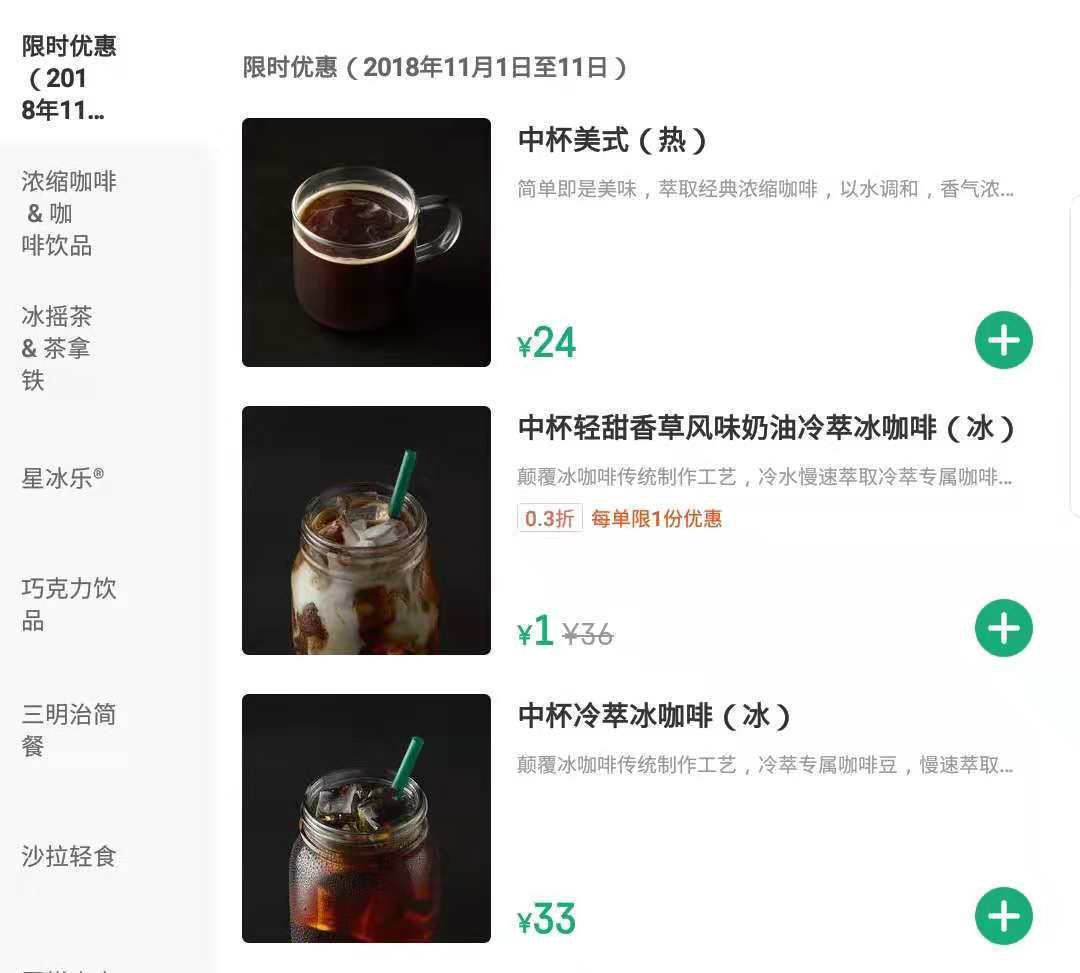

Take Sanlitun SOHO Starbucks as an example. Ele.me App shows that the price of its take-out coffee is in line with the retail price in the store. On this basis, there will be an additional distribution fee of 9 yuan per order. In addition to the first-order discount policy for new users of ele.me, Starbucks offered "time-limited discounts" to users from November 1 to 11, but at present, two types of coffee in the discount area are still priced at the same price as the store.

Some users have complained about the price of Starbucks coffee takeout before, "it's too high, it's better to choose another brand." In fact, the reason why the price of Starbucks coffee takeout does not come down has a lot to do with the cost. Starbucks store layout is mostly in accordance with the traditional business model, choose in the first floor of the mall or the corner of the business district, coupled with its adhere to the concept of the third space, "big store" has become one of the typical characteristics of Starbucks, store rental costs remain high. In the transformation of the takeout business, the cost not only has not been reduced, but also new links such as operation and distribution have been added, which will eventually be reflected in the price, charging a distribution fee of 9 yuan per takeout to let consumers pay the bill.

Takeout, which is supposed to be a new aggressive business in Starbucks China, is designed to compete head-on with its competitors, but Starbucks still hopes to make a high profit on every order through this new business. This also confirms once again that Starbucks does not have Internet thinking at all.

Such a conservative financial strategy also shows that the 47-year-old Starbucks is really old in the mobile Internet era. No wonder young people are abandoning Starbucks in favor of other younger Internet retail coffees.

The first ≠ in the future

China is now the fastest-growing coffee market in the world and is recognized as the "second home market" by Starbucks. Starbucks CEO Johnson even believes that China will overtake the United States to become Starbucks' largest market in the future.

However, in the Chinese coffee market, Internet coffee represented by Luckin Coffee and Lian Coffee, unattended coffee machines represented by Friendship Coffee and Coffee Zero Bar, and many small chain coffee brands are grabbing the market.

In addition to the growing external threat, Starbucks has more and more intractable internal worries. Starbucks' third-quarter report showed that in the year to June, Starbucks' largest growth point in the world, the Chinese market performance fell, same-store sales fell 2%. Last year, the figure was an increase of 8%. In the worst earnings report in history, Starbucks also cut its full-year sales growth forecast and expects to close about 150 underperforming stores in 2019. On Sept. 24, Kevin Johnson, CEO of Starbucks, sent an email to employees about the layoff plan.

In view of this, outsiders are saying that Starbucks has ushered in a midlife crisis. As CNBC reports, "the Starbucks executive team is working with executives to find faster ways to innovate in the new retail environment." Takeout is one of Starbucks' ways to break through.

Takeout is really a big market in China. According to the China Food and Beverage report 2018, desserts and drinks were the fastest growing categories of takeout products ordered by users in 2017. The number of orders increased by 195%, and the amount of orders increased by 208%.

However, the field survey of the industry shows that Starbucks has not yet grasped the new business of takeout. This has cast a shadow over Starbucks' transformation.

END

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Starbucks localizes coffee beans in China and upgrades domestic coffee supply chain

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style) November 4, Starbucks launched China's native coffee beans in the first session of China International Import Expo. It is understood that Starbucks chose Yunnan to try to build a supply chain from cultivation, production to baking. It is worth noting that despite the rapid development of coffee cultivation in Yunnan, and

- Next

Pacific Coffee localization unfavorable launch upgrade brand to enter the "boutique coffee" market

Professional coffee knowledge exchange More coffee bean information Please pay attention to coffee workshop (Weixin Official Accounts cafe_style) repeatedly tried to introduce local elements such as national wine and tea into the products, but the results were not good. Pacific Coffee tried to enter the boutique market, opened the boutique coffee shop Brew Bar to the International Trade Mall, and marked the growth altitude, processing method, processing station and roasting of coffee beans in hand.

Related

- What documents do you need to go through to open a coffee shop? coffee shop coffee shop certificate processing process

- How to purchase Coffee beans in small Cafe how to choose a suitable supplier for domestic Coffee supply Company

- How to drink Starbucks Fragrance White Coffee? how to make Australian White Coffee? what Italian coffee beans are recommended?

- The Story of Flora Coffee: the name of Flora Coffee Bean and the implication of the Flowers on Florna Coffee

- How much does a cup of coffee cost? How much is the profit of a cup of coffee? What is the profit of the coffee shop in a year?

- Yunnan small Coffee, known as "fragrant Coffee", introduces the characteristics of Alpine Arabica Coffee producing areas in Yunnan, China

- 2023 latest Starbucks full menu price list how much is a cup of Starbucks coffee what is better to drink the most popular hot and cold drinks recommended

- Starbucks different kinds of Coffee Price list Starbucks menu 2023 Top Ten Best drinks in Starbucks

- Starbucks Spring praise Comprehensive matching Coffee Bean theme Story Packaging implication and taste description

- The cost of a cup of coffee latte American coffee cost price and selling price