The global oversupply will soon turn to a shortage. Coffee futures prices may rebound at the end of the year.

Professional coffee knowledge exchange More coffee bean information Please pay attention to coffee workshop (Weixin Official Accounts cafe_style)

Coffee prices have fallen below $1 a pound, near their lowest level in a decade, but the global glut that has depressed prices for the past two years could finally end in 2019.

John Caruso, senior market strategist at RJO Futures, said,"The coffee market is currently at war on several different fronts." Brazil's bumper 2018 harvest, which set a record 62 million bags of Arabica and Robusta coffee in 60 kg bags, pushed prices to multi-year lows, well below the production costs of most farmers, he said.

ICE futures closed Feb. 26 at 96.80 cents a pound, the lowest close for the most active contract since September, when it hit a daily settlement of 95.85 cents, the lowest since late July 2006. Prices have closed down over the past two years, closing Thursday at 98.50 cents, down 4 percent this year.

For now, Caruso said,"short-term weather expected to be favorable for off-peak coffee production is holding back price increases starting in 2019." After the previous year's abundance, the coffee tree needs to rest, and the next year's production will be slightly reduced. "The depreciation of the Brazilian currency against the US dollar is also putting pressure on the market because the two are highly correlated," he said. Coffee is priced globally in US dollars. When the Brazilian currency depreciates against the dollar, it encourages Brazilian farmers to export more coffee to global markets, he said. Brazil is the world's largest coffee producer.

Global commodities brokerage firm Marex Spectron estimates that total global coffee supply for 2018-19 is 172.3 million bags, and demand is estimated at 164.4 million bags, meaning a surplus of 7.9 million bags. Marex's early global production estimates suggest that by 2019-20, supply will decrease to 166.9 million bags, demand will increase to 168.1 million bags, and supply will be less than 1.2 million bags. Analysts at Marex Spectron also stressed that "underlying demand remains healthy, growing by 2 to 2.5 percent annually." The current price is lower than Arabica coffee "washed" by many coffee farmers, which will "have an impact on production levels."

Caruso said production costs for most farmers range from $1.20 to $1.50, so at current prices below $1, he also thinks supply shortages are likely in the future. "I like coffee from a value point of view," he said. "We think any small catalyst, whether it's weather, currency, or even short-covering its large net speculative short position of 63000 contracts, could trigger a buying spree among value investors." He thinks prices could rebound "effortlessly" to $1.20 this year.

But Jack Scoville, senior market analyst at Price Futures Group, noted that prices may still have room to fall further. He thinks midsummer prices could fall below 90 cents or above 80 cents,"but then they should start to recover," as the threat of reduced production creates short-covering at least temporarily.

Caruso said the price increases are likely to be passed on to consumers "eventually" but "there will be almost no immediate impact." Global coffee consumption is on the rise and supply shortages are likely by the end of the year, so "the price of a $3 morning cup of coffee will soon rise."

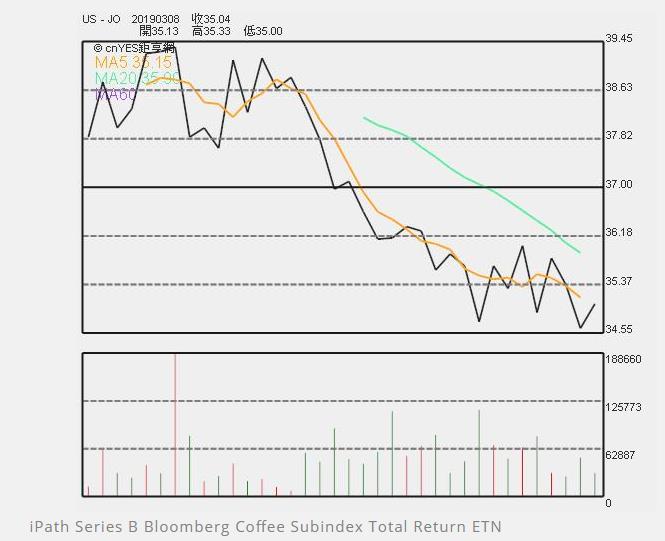

For investors, Caruso says he likes to trade ICE futures contracts, a global indicator of Arabica coffee. Investors may also consider iPath Series B Bloomberg Coffee Subindex Total Return ETN ( JO-US ) and iPath PureBeta Coffee ETN.

Article reproduced from: Juheng. com

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Can you still have a good cup of coffee? There are so many strange events in foreign coffee shops.

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style) because coffee is an imported product, we will naturally have a vision for foreign coffee and even coffee shops. Through the Internet, we know that there are so many coffee shops abroad that make people want to buy air tickets immediately to sign in or literary or innovative coffee shops. Our ideal

- Next

Soak a cup of coffee beans three times? This coffee shop can open for another 20 years at extremely high prices.

Professional coffee knowledge exchange more coffee bean information Please pay attention to the coffee workshop (Wechat official account cafe_style) famous coffee shops always have some interesting places to talk about, either the real coffee is good, or there is an eye attraction outside the coffee. And a particularly famous coffee shop in Taiwan, probably the first place that people notice is that it is frighteningly expensive.

Related

- What documents do you need to go through to open a coffee shop? coffee shop coffee shop certificate processing process

- How to purchase Coffee beans in small Cafe how to choose a suitable supplier for domestic Coffee supply Company

- How to drink Starbucks Fragrance White Coffee? how to make Australian White Coffee? what Italian coffee beans are recommended?

- The Story of Flora Coffee: the name of Flora Coffee Bean and the implication of the Flowers on Florna Coffee

- How much does a cup of coffee cost? How much is the profit of a cup of coffee? What is the profit of the coffee shop in a year?

- Yunnan small Coffee, known as "fragrant Coffee", introduces the characteristics of Alpine Arabica Coffee producing areas in Yunnan, China

- 2023 latest Starbucks full menu price list how much is a cup of Starbucks coffee what is better to drink the most popular hot and cold drinks recommended

- Starbucks different kinds of Coffee Price list Starbucks menu 2023 Top Ten Best drinks in Starbucks

- Starbucks Spring praise Comprehensive matching Coffee Bean theme Story Packaging implication and taste description

- The cost of a cup of coffee latte American coffee cost price and selling price