Foreign media: Luckin Coffee or Starbucks' best assists in China?

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style)

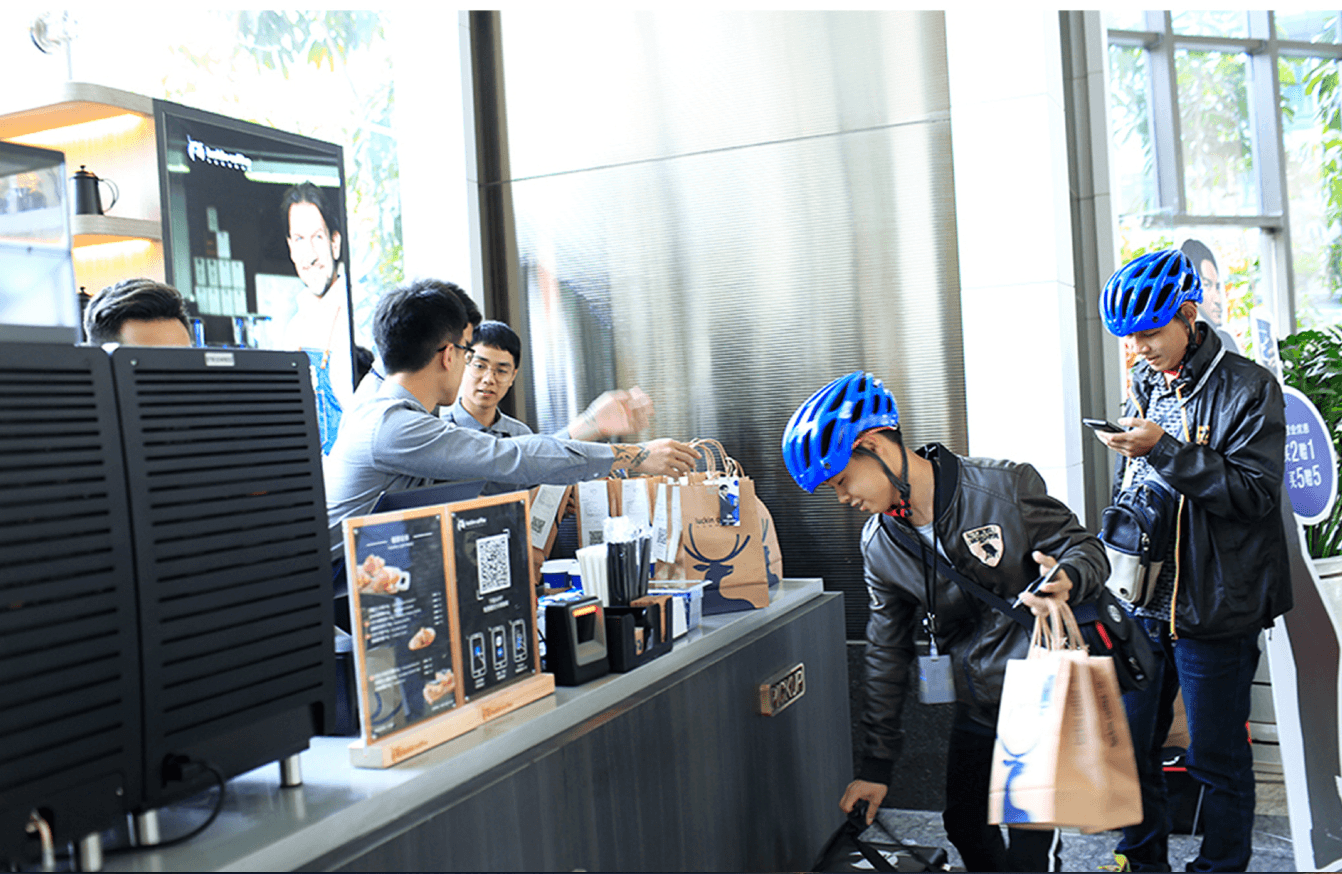

Luckin Coffee (Luckin Coffee) is a new retail coffee brand that has become popular in China, probably the fastest in history. It only started trial operation in January 2018. With a heavily subsidized and convenient APP delivery business model, coupled with viral media marketing, Luckin Coffee became the most famous coffee brand in China overnight.

In addition to the brand, Ruixing has expanded very fast, opening more than 2073 stores in just one year, selling 89.68 million cups of coffee to 12.54 million consumers, and officially claiming that the repurchase rate is more than 50% in three months. it is generally believed that Lucky has indirectly brought up the trend of coffee culture in China.

Lucky CEO Qian Zhiya even said that at the current rate of expansion, Luckin Coffee, who was founded more than a year ago, is expected to overtake Starbucks, which has been "deeply cultivated for 20 years" in China, in 2019, forcing the Starbucks CEO to respond in a conference call (Earnings Call): "it is unlikely to be surpassed by Lucky." ── currently has 3700 outlets in 158cities in China, with a growth rate of about 18% compared with 2017.

Although Starbucks responded calmly to Ruixing's threat, there was a lot of pressure in the short term. Last year, it began to work with Alibaba (Alibaba) to break the 20-year-old brick-and-mortar store strategy in China and began to launch delivery services.

Luckin Coffee's rapid expansion is accompanied by round after round of foreign fundraising. since its establishment in January 2018, it raised $200m in round An in July of the same year, valuing it at $1 billion. Lucky raised another $200m in round B in December, with a valuation rising to $2.2 billion, while rival Starbucks now has a market capitalization of about $78 billion.

To make matters worse: foreign media have revealed that Luckin Coffee plans to conduct an IPO in the United States in the first half of this year with a valuation of about 3 billion US dollars. This is really a unique business legend in China. The valuation from 0 to 3 billion US dollars took only more than a year. Given that Starbucks has made China the core of its growth strategy, many investors worry that the rapid rise of Luckin Coffee will pose a strong competition for the world coffee giant.

However, counterintuitive as it sounds, part of the view of foreign media now is that Luckin Coffee's rapid growth may actually improve the development of Starbucks in China, rather than competitive exclusion.

China's coffee market is far from realizing its potential.

Historically, Starbucks has dominated the coffee business in China. In 2018, Starbucks had 58. 5% of the Chinese coffee chain market. 6%, far exceeding its market share in the United States.

However, although China's population is four times that of the United States, Starbucks' income in China is only a fraction of that of the United States. The main reason is that China is still a country with tea as the main consumer beverage. It is true that coffee is becoming more and more popular, but even Starbucks management has repeatedly admitted that it will take years for Chinese consumers to get into the habit of drinking coffee regularly.

In fact, according to the European Monitoring Organization, China's annual per capita coffee consumption in 2016 was only 0.4 cups. In the same period, the per capita coffee consumption in the United States was 300 cups per year, 750 times higher than that in China. Even though coffee has never been as popular in China as it is in the United States, it is clear that there is still huge room for growth in China's coffee consumption market.

Compared with the United States, China's coffee consumption is still very low.

Luckin Coffee can accelerate the growth of China's coffee market.

This is the opportunity for Luckin Coffee to show his talents! Luckin focuses on online transactions and relies heavily on user data, although fission marketing and frenzied store opening have largely attracted the attention of new users. However, low-price subsidies are still the main driving force for Luckin Coffee's sales data to grow at an excessive speed.

The way that new customers can buy 1.5 cups of coffee at one time at a price of 0.5cup ── can increase the number of new customers and the repurchase rate at the same time, but it is tantamount to sending money to customers, and it has nothing to do with the operating ability of the enterprise itself.

An enterprise that delivers coffee everywhere for free and spends a lot of money on fame, of course, every time you go to a city, you can attract a large number of consumers: everyone is here to get free coffee, no matter what your quality is, there is free coffee, of course, there is no threshold, it is not difficult to achieve "giving" nearly 90 million cups of coffee a year, but the supply chain behind Luckin Coffee should also keep up.

To put it bluntly, at present, Luckin Coffee is just a capital enterprise that runs stores everywhere and delivers free coffee. Those exquisite figures are deliberately thrown out with capital: "the first cup for new customers is free, and 50% discount coupons are given." how perfect this strategy is to strike a balance between sales volume and buyback rate! But Luckin Coffee lost more than $100m last year alone, and according to Luckin Coffee CEO Qian Zhiya, he will stick to the strategy of subsidizing users for at least the next few years, which means Luckin Coffee will continue to lose money. So far, Lucky has raised hundreds of millions of dollars in venture capital and plans to conduct an IPO at a valuation of about $3 billion in the first half of this year, so it can continue to burn money to drive performance and market share growth.

Luckin Coffee's low price, takeout and fission marketing are all ideal market forces that can help more Chinese people develop the habit of drinking coffee regularly. While Lucky grabs customers from Starbucks, it also promotes the rapid growth of China's coffee market.

But this will enable Starbucks to maintain a high-quality image. Because the reason why a considerable number of consumers choose Luckin Coffee is "greedy for bargains". On the other hand, the Chinese psychology generally has the habitual thinking of "cheap but not good". Many consumers who enter the "pit" of coffee because of luck will eventually try to switch to the Starbucks formation because of Starbucks' brand influence. Because Starbucks pays more attention to the experience of "the third space" than Luckin Coffee, it has a greater advantage in the image and added value of the brand.

In short, Starbucks can wait and see, letting Luckin Coffee "foolishly"burn money to buy users" to promote the growth of coffee consumption in China. Five or 10 years from now, Starbucks may be the biggest beneficiary as consumers flock to its more expensive coffee products.

So far, everything is fine.

Some investors point out that Luckin Coffee's comparable sales growth in China has slowed over the past year, proving that Starbucks is causing losses to the coffee giant. However, Starbucks' worst sales performance in China over the past year was in the third quarter of fiscal 18, when overall sales in China fell 2 per cent.

As two quarters have passed, Starbucks' sales in China have returned to comparable growth, growing by 1% for the second time in a row. Although during this period, Lucky continued to increase the number of stores at a crazy rate. Although Starbucks achieved comprehensive strategic cooperation with Alibaba only in December last year, it still achieved this result.

In addition, the number of Starbucks stores in China rose 18 per cent year-on-year by the end of the last quarter, driving strong double-digit growth in total sales. So so far, Luckin Coffee's rapid growth doesn't seem to have done much harm to Starbucks. In the long run, Luckin Coffee's strategy of subsidizing and burning money has quickly opened up China's coffee market. consumers who were not used to drinking coffee in the past gradually began to develop the habit of ordering coffee takeout after they came into contact with Luckin Coffee, changing the habit of drinking only tea in the past. ── China will only start drinking coffee in the future.

If Luckin Coffee finally ends the subsidy, the coffee market returns to normal, and brands begin to compete with each other, but the overall size of the market has grown several times, Starbucks may be the ultimate beneficiary and winner. New customers who drink coffee are most likely to become Starbucks customers.

Photo Source: Internet

END

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Starbucks in the United States has revised its member benefits and has more options to redeem points from April.

Professional coffee knowledge exchange more coffee bean information follow the coffee workshop (Wechat official account cafe_style) super-loyal customers who use the Starbucks membership program account for about 40% of the company's sales at its US stores. Now, the measures taken by Starbucks are believed to make the plan more attractive. Starting from April 16, the reward members of coffee companies in the United States and Canada will begin to

- Next

Red Cherry Project, Red Cherry Project

Speaking of the Red Cherry Project, many friends are no stranger to this name. So what kind of project is the Red Cherry Project? Maybe only a few people can tell. Ethiopia, which is known as the birthplace of coffee, has a large area of fine traditional coffee trees. We know that Ethiopia is not a developed country with rich people's income.

Related

- What documents do you need to go through to open a coffee shop? coffee shop coffee shop certificate processing process

- How to purchase Coffee beans in small Cafe how to choose a suitable supplier for domestic Coffee supply Company

- How to drink Starbucks Fragrance White Coffee? how to make Australian White Coffee? what Italian coffee beans are recommended?

- The Story of Flora Coffee: the name of Flora Coffee Bean and the implication of the Flowers on Florna Coffee

- How much does a cup of coffee cost? How much is the profit of a cup of coffee? What is the profit of the coffee shop in a year?

- Yunnan small Coffee, known as "fragrant Coffee", introduces the characteristics of Alpine Arabica Coffee producing areas in Yunnan, China

- 2023 latest Starbucks full menu price list how much is a cup of Starbucks coffee what is better to drink the most popular hot and cold drinks recommended

- Starbucks different kinds of Coffee Price list Starbucks menu 2023 Top Ten Best drinks in Starbucks

- Starbucks Spring praise Comprehensive matching Coffee Bean theme Story Packaging implication and taste description

- The cost of a cup of coffee latte American coffee cost price and selling price