The Red Sea crisis intensifies! The attack on 16 merchant ships last month affected the global coffee trade

Recently, although coffee futures prices have risen and fallen, they have still remained high, especially in Robusta, which soared to more than US$4000/ton at the end of May and have remained so far. Due to production cuts in the world's three major coffee-producing countries, Vietnam previously reported on coffee exports in the first half of the year. Due to extreme temperatures and drought, production decreased, and exports fell by 10.5%.

High temperatures and drought also affect Brazil. Although previous reports pointed out that Brazil's output is on the rise, in June, the Brazilian coffee harvest season officially entered. However, in terms of actual harvest, the performance of the production area is not as good as ideal. The actual output is lower than market expectations.

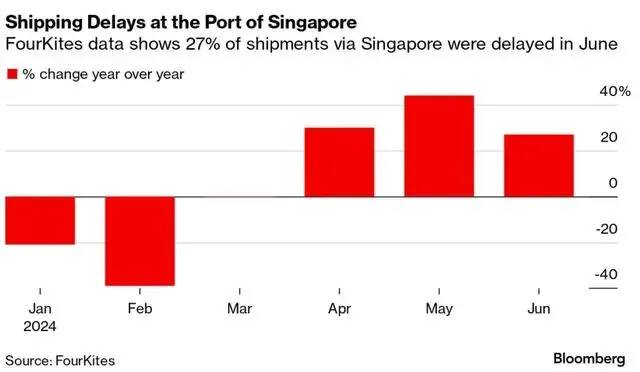

In addition, there is also a bigger problem at present, that is, shipping problems. Recently, it has been reported that shipping prices have soared close to levels during the epidemic in many Asian trading ports due to tight transportation capacity, port congestion, shortage of empty containers and the Red Sea crisis.

Some busy trading ports in Asia report congestion at many ports now and may persist into August. Among them, the transshipment port of Singapore has experienced particularly serious congestion in recent weeks, and the waiting time for container parking at the port has been extended from less than one day to two to three days.

Moreover, according to shipping consulting firm Linerlytica, due to congestion in Singapore ports, ships choose to go to other adjacent ports, and freight Asia is transferred to Malaysia's Port Klang and Jongpalapas Port. As a result, congestion problems have occurred in many ports in Asia.

In addition, the Red Sea crisis still shows no signs of stopping, and according to relevant statistics, the number of attacks on ships by Yemen's Houthi armed forces in June hit a record this year.

In early May, the Houthis issued a new statement, once again expanding the scope of the strike to strike all ships of companies that had dealings with Israel in the past few months, regardless of the nationality of those ships and the target port, in the Red Sea, Arabian Sea, Indian Ocean and Mediterranean Sea.

According to data released by navies operating in the area, there were 16 confirmed attacks on ships in June, the largest number of attacks in a single month since 2024 and the second highest number in a single month since the attacks occurred, with the highest being December 2023.

For the coffee trade, shipping is the main transportation route, and the Red Sea is an important Eurasian route, affecting the coffee exports of some coffee-producing countries. Moreover, according to Xeneta data, freight rates from Asia to Europe have soared from US$1200 to nearly US$7000, and the increase in freight rates will also keep coffee transaction prices high.

Shipping giant Maersk said the next few months will be challenging for shipping companies and companies, as disruptions in container shipments via the Red Sea will continue into the third quarter of this year. Maersk's CEO stressed that Maersk would return to the Red Sea route only if the safety of seafarers, ships and cargo was guaranteed.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Eating watermelon while cutting?! COCO shop assistants accused of being unsanitary!

▲ Click to pay attention| Daily Boutique Coffee Culture Magazine Coffee Workshop Yesterday, Star Video released a video saying that some netizens saw employees cutting watermelons while eating them in the process of preparing materials at the Coco milk tea shop. From the video, it can be seen that this employee is an important ingredient in preparing the recently launched watermelon drink. according to

- Next

Too old? The 26-year-old interview for Ruixing Coffee was rejected!

▲ Click to pay attention| Daily Boutique Coffee Culture Magazine Coffee Factory Yesterday, Gongfu Financial reported that a job seeker posted that he was asked about his age during an interview with Ruixing. After learning that he was 26 years old, the store manager said that the age did not meet the requirements and needed to be young and energetic. People, afraid of a generation gap when talking to them. This post was released

Related

- What grade does Jamaica Blue Mountain No. 1 coffee belong to and how to drink it better? What is the highest grade of Blue Mountain coffee for coffee aristocrats?

- What are the flavor characteristics of the world-famous coffee Blue Mountain No. 1 Golden Mantelin? What are the characteristics of deep-roasted bitter coffee?

- Can I make coffee a second time in an Italian hand-brewed mocha pot? Why can't coffee be brewed several times like tea leaves?

- Hand-brewed coffee flows with a knife and a tornado. How to brew it? What is the proportion of grinding water and water temperature divided into?

- What is the difference between Indonesian Sumatra Mantinin coffee and gold Mantinin? How to distinguish between real and fake golden Mantelin coffee?

- What does bypass mean in coffee? Why can hand-brewed coffee and water make it better?

- Unexpected! Ruixing Telunsu lattes use a smoothie machine to foam milk?!

- % Arabia's first store in Henan opens into the village?! Netizen: Thought it was P's

- Does an authentic standard mocha coffee recipe use chocolate sauce or powder? Mocha Latte/Dirty Coffee/Salty Mocha Coffee Recipe Share!

- What is the difference between Vietnam egg coffee and Norway egg coffee? Hand-brewed single product coffee filter paper filter cloth filter flat solution!