The largest chain of catering companies is about to give way. Why did Starbucks overtake McDonald's after more than 30 years?

In 1940, the brothers Richard McDonald and Maurice McDonald opened a hamburger restaurant in California and named it after themselves. In 1955, Ray Kroc introduced a franchise and started running McDonald's. 62 years ago, McDonald's has 30, 6889 stores worldwide.

In 1971, three coffee lovers opened a store in downtown Seattle that sold only premium coffee beans, named Starbucks. In 1987, Howard Schultz, who used to work here, raised money to buy out all the shares in the company and transform Starbucks according to the idea of a chain of Italian coffee shops, bringing the total number of Starbucks stores worldwide to 20, 5734 30 years ago.

Mark Kalinowski, an analyst at Nomura, predicted at the beginning of this year that Starbucks, with its expansion thinking that has been going on for several years, will not only successfully meet its goal of opening 37000 stores in 2021, but then exceed 40, 000 stores, or even reach 50, 000 stores in the long term-no retail brand has ever reached such a scale in business history, and McDonald's is the closest to 40, 000 stores.

In other words, Starbucks will overtake McDonald's to become the world's largest restaurant chain. If all according to our current cognitive sense of Starbucks, McDonald's, this time is less than 40 years.

McDonald's certainly doesn't want to stop expanding, but in its efforts to reattract young consumers and save performance over the past few years, McDonald's has done more to adjust.

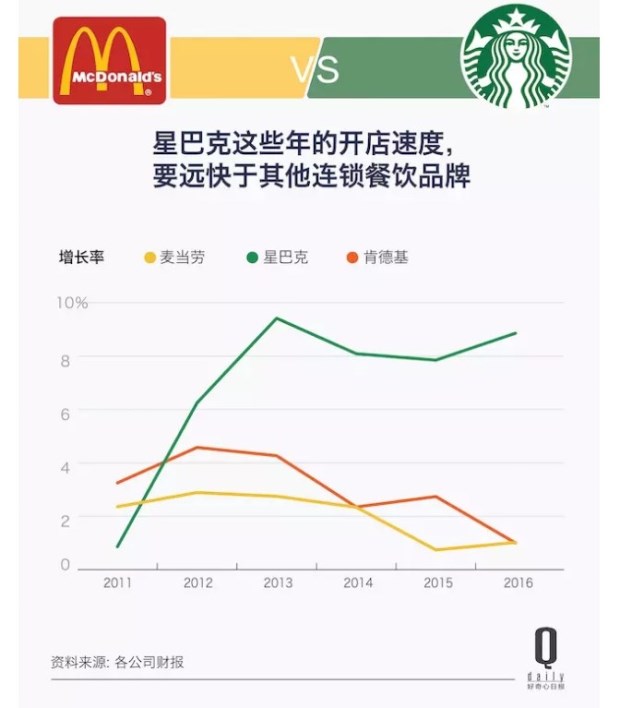

Starbucks, which is popular among young people, has entered a golden era. in the past decade, the total number of stores around the world has grown by more than 10,000, serving more than 85 million consumers a week. In China alone, it opened more than 300 stores in 2016, almost at the pace of a new store a day.

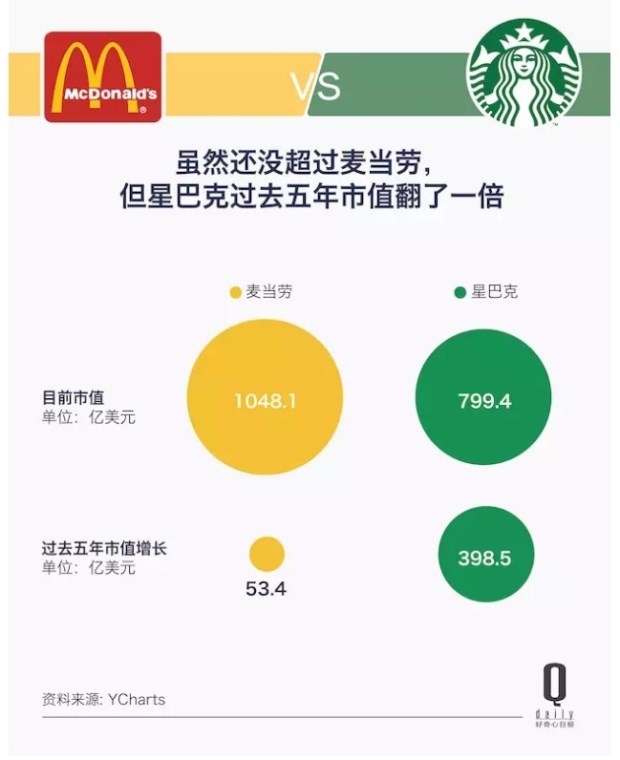

The performance of the stock market is the same, as long as the company can maintain the "red line" of global same-store sales growth of 5% a year, surpassing McDonald's, which currently has a market capitalization of hundreds of billions of dollars, will be a matter of time. Judging from the growth curve of its stock, Starbucks' momentum can be compared with that of Coca-Cola, and the stock price has risen nearly 170 times since its listing.

Judging from the future growth trend, Starbucks is far better than McDonald's.

In many ways, Starbucks and McDonald's are similar: standardizing as many links as possible to provide stable and high-quality products and services; transforming the supply chain and production links to improve efficiency. The most important thing is that McDonald's does not sell hamburgers, but a chain service system, and Starbucks also sells not coffee, but the "third space" concept.

In Everthing but the coffee, written by Bryant Simon, a history professor at Temple University in 2009, he mentioned that Starbucks' brand significance in the United States in the 1990s was still a mild luxury, but in 2008, he cited a market survey report as saying, "many people have the same perception of Starbucks as McDonald's."

Not long ago, Starbucks announced at its annual shareholders' meeting that it would make lunch seriously and planned to double its food sales within five years. Well, does it sound more like McDonald's?

In fact, McDonald's also planned to re-build the McCoffee brand at the end of last year, upgrade coffee machines, launch low-cost coffee and other measures to seize the coffee market. The purpose couldn't be more obvious.

In any case, they have become de facto competitors. And what did Starbucks do more and what did it do right than McDonald's over the years?

In other words, what skills have Starbucks represented by the star catering company evolved compared with the former McDonald's?

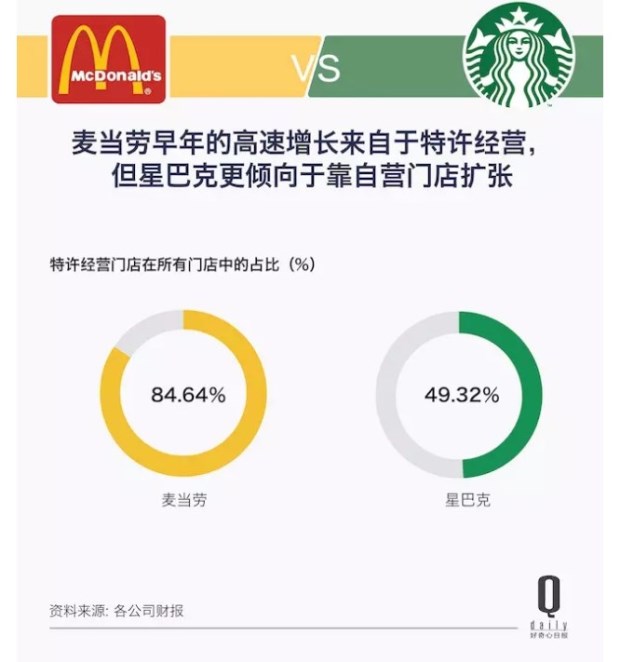

McDonald's relies on franchise, while most of Starbucks' tens of thousands of stores are self-owned.

The McDonald's family got rich in a highly efficient roadside restaurant that offered only a few foods such as hamburgers, French fries and milkshakes, but it was Ray Crocker who designed the franchise expansion model to maximize the value of its business model and accelerate its flow to the national and global markets.

At present, more than 80% of McDonald's restaurants in the world are franchises, and up to 90% in its headquarters in the United States. McDonald's China, which used to be mainly based on the direct operation model, also turned into a franchise through the capital injection of Citic and Carlyle at the beginning of this year.

The advantages of franchising are obvious: franchisees provide property, are responsible for day-to-day operations, and ensure stable cash flow; brands only need to export brands and management capabilities to receive stable sales shares and growing market space. But the drawback is also prominent. The biggest headache for Ray Crocker in the early stages of business expansion is how to ensure that all franchise outlets meet his high standards.

But there is one feature that brands can't resist-franchising was once the best option when the company pursued rapid expansion to achieve scale.

Starbucks, on the other hand, abandoned its franchise model and operated almost all its own stores. At present, among its nearly 30,000 stores around the world, the vast majority of stores represented by the United States are brand-owned, and overseas markets also like to operate in the way of local joint ventures.

McDonald's has about 300 franchisees behind its 10, 4000 franchises in the United States, and the largest has only 69. Starbucks has 6764 stores in the United States. This undoubtedly puts forward higher requirements for the operation and management ability of the brand and the way in which the capital flow is used.

McDonald's wants to buy land, and Starbucks is leased, which allows Starbucks to expand rapidly as well.

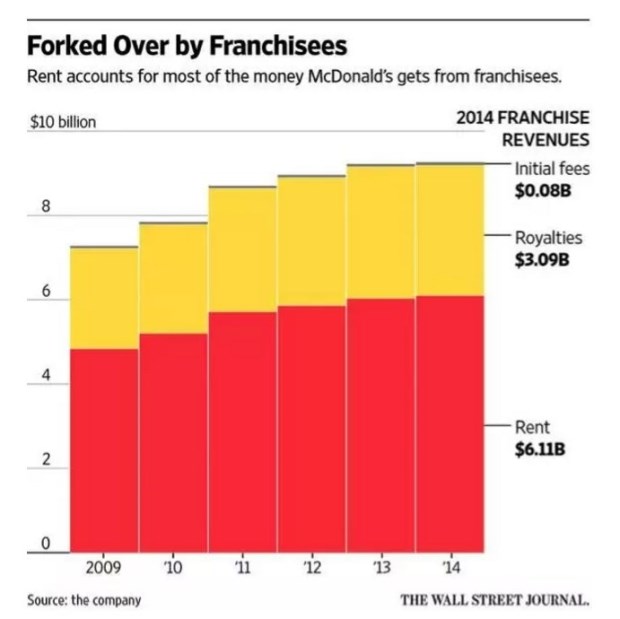

If we take a look at McDonald's revenue from franchisees over the years, we can see that when the company's performance is in decline, it can also basically maintain the secret of making money: the share of store sales and the proportion of the initial franchise fee paid by new franchisees are not high, but the most is rent income.

This is a unique feature left by Ray Crocker when he designed McDonald's franchise model in the early days: in order to strengthen control, all the land and properties needed in the store had to be acquired by McDonald's headquarters and sublet to franchisees, buying rents at a slightly lower than the market price every year. When the real estate market continues to climb, rental income will rise, and franchisees can be kicked out at any time if they do not perform well.

Some hedge fund managers who own McDonald's shares have even thought of splitting McDonald's catering and real estate businesses into two parts to manage assets more effectively.

Huang Hai, vice president of Fengrui Capital: McDonald's franchise will take control from a series of links such as property acquisition, food supply chain, IT system, management model, etc., and the early training management is also the responsibility of the headquarters. only decoration and management business after the store is mature will there be less intervention after getting on track.

Starbucks owns most of its stores around the world, but all properties are leased and can get relatively low rents because of its brand advantage. In this way, the investment in decoration and equipment when opening a new store can be recovered quickly by relying on stable cash flow. Buying land and leasing land, as well as the speed of expansion of these two models, is the fundamental difference between McDonald's and Starbucks' current store growth gap. "

They also choose places with high traffic to open stores, but Starbucks aggressively covers an area with multiple stores.

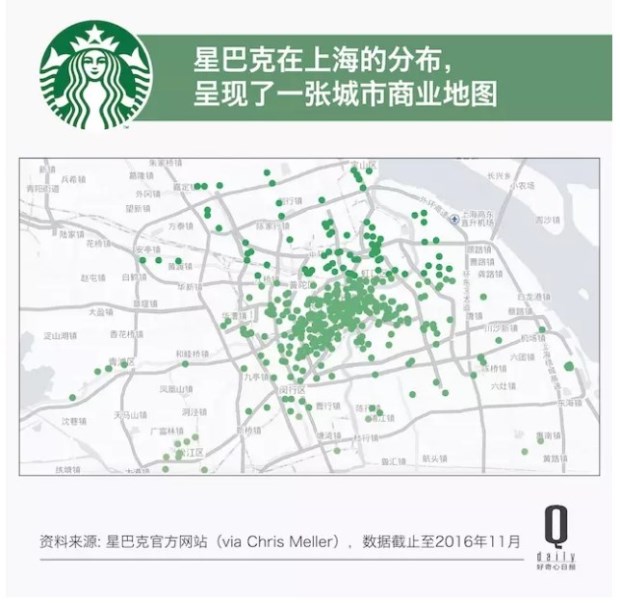

If you live in first-tier cities such as Beijing and Shanghai, it is easy to feel the density of Starbucks in the same area. But you rarely see two McDonald's on a smaller scale.

In the book Category Killer: the impact of the Retail War on Consumer Culture (Category killers), American retail researcher Robert Spector commented on Starbucks' store opening strategy: "Starbucks has adopted a simple expansion strategy, that is, to aggressively cover an area with a large number of stores. This helps companies reduce transportation and management costs, while dispersing customer flow to other nearby stores, reducing customer queues in each independent store. "

On the most economically developed island of Manhattan in New York City, Starbucks has a density of more than six per square mile, with an average of one Starbucks for every 15000 people.

Take Shanghai, one of Starbucks' densest cities in the world, as an example: at present, nearly 500 stores have covered the entire city center, as well as several sub-centers developed later.

In the late 1980s, Schultz formed a real estate team at his Seattle headquarters to specialize in coffee industry siting. According to statistics, Starbucks early stores were distributed in office buildings, community shopping centers in Urban area or suburbs, airports, university towns, etc., especially office buildings (business areas) and community centers (shopping areas) accounted for the highest proportion.

In the business district and shopping district, the former is opened on the ground floor of the office building, with small storefront and high proportion of outside; the latter can meet the chat and social needs of community residents when shopping daily. The advantage of doing so is that it can bring more traffic and sales revenue with smaller store space.

Starbucks 'store space is generally smaller than McDonald's, which also allows Starbucks to be more flexible when looking for property.

McDonald's is more efficient than Starbucks, but Starbucks generates more revenue per employee than McDonald's.

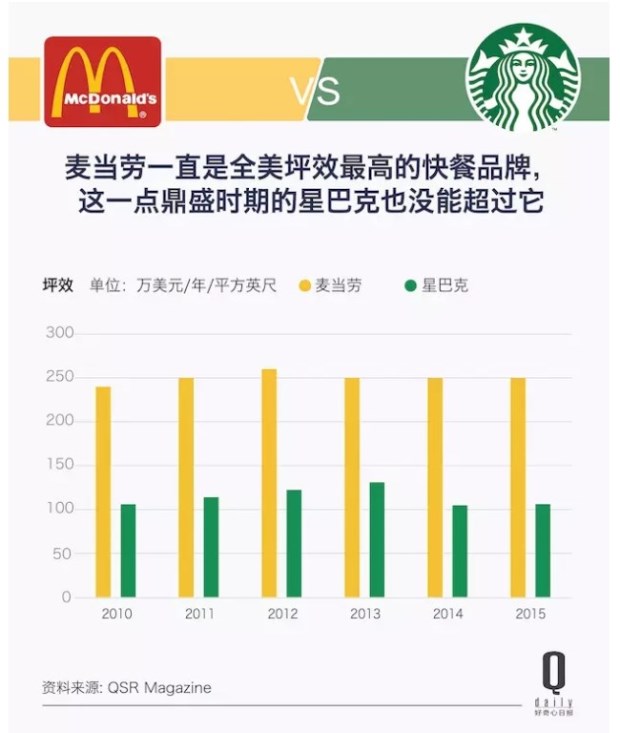

Without enough stores to support it, Starbucks, which has a relatively low unit price, will not be able to achieve the single-store profitability of McDonald's. In fact, mcdonald's has almost always been the nation's highest-performing restaurant brand in terms of sales per square foot in industry group QSR's annual list, only briefly overtaken by fried chicken brand Chick-fil-A in 2010.

But according to the figures disclosed in the annual report, each Starbucks employee in the world can generate four times as much revenue for the company in a year as McDonald's. It may already be one of the most efficient companies in the industry.

Lower labor costs mean higher efficiency.

Go public faster and expand overseas markets earlier, allowing Starbucks to make better use of globalization opportunities

In the United States, where McDonald's and Starbucks families have become rich, the catering industry is an industry with annual income of $709.2 billion and 14 million employees. It is also the largest catering market in the world. The rapid growth of this market also depends on changes in residents' consumption habits: currently, 43% of Americans eat out at least once a week; by 2015, the income of the US catering industry accounted for 47% of residents' food consumption.

Because of the huge potential of the local market, McDonald's basically devoted itself to this for the first 50 years, and did not begin to expand its overseas markets until the 1990s.

But at several critical moments of IPO and globalization, Starbucks' CEO Schutz pushed the company to make decisions faster.

When Starbucks went public in 1992, it had only 165 stores, and four years later it began to expand its overseas business on a large scale, while McDonald's did not go public until it had more than 700 stores, and expanding overseas markets was not done until 50 years after the company was founded.

The earlier listing also means that Starbucks can make effective use of a series of financial means, such as financing, issuing bonds, and buying stocks, to flexibly solve the capital problems that the company may face in the process of expansion, and gradually regain control in mature overseas markets. The brand value and market value of the company have also been gradually promoted in this process, showing a strong leverage effect.

At the end of the 20th century, McDonald's was recognized as a model of fast-growing multinational corporations and a symbol of the brilliant victory of American capitalism in the world. However, from the actual growth situation, Starbucks is the company that really makes good use of this opportunity and has a huge room for growth.

Starbucks is more sensitive to future market trends than McDonald's, and digitization is the most typical.

In a report by Mark Kalinowski, an analyst at Nomura Securities, Starbucks and Chick-fil-A were named as the two most technology-focused restaurant chains in the industry-from store Wi-Fi systems, company websites, App to social website accounts. Starbucks has long used these digital means to understand consumer demand and make adjustments to products and services.

On the other hand, McDonald's is serious about implementing digital business throughout the company until 2015. So by 2016, you can see them intensively testing self-service stand-alone, App ordering, mobile payment, third-party platform takeout. In short, there are all kinds of online channels.

In addition, Starbucks has put more consumer data in its own hands in the process of digitalization. Take the Chinese market as an example, whether you enter Tmall flagship store or cooperate with WeChat mobile payment, you will see Starbucks cautious. McDonald's takeout business, which McDonald's wants to develop vigorously, will leave more user data on third-party takeout platforms. As we analyzed in previous articles, this may allow McDonald's to capture good sales figures but lose sensitivity to changes in the consumer market.

But for both Starbucks and McDonald's, it will take a long time to become a data-driven company. This process may also be accompanied by some pain. Starbucks 'action orders and payments in 1200 stores in the United States, for example, have pushed transaction volumes to their highest levels in the past 18 months, but invisible orders in the food preparation area through App orders and long queues in the food delivery area may drag down the most important efficiency of the store. McDonald's has the same problem.

Starbucks 'short-term solution is to add more people to its stores. In the long term, Starbucks plans to change the design of its store spaces. McDonald's wants to design a dedicated App feature to track users 'location, ensure orders are in the right restaurant and ready at the right time, and avoid food being left too long.

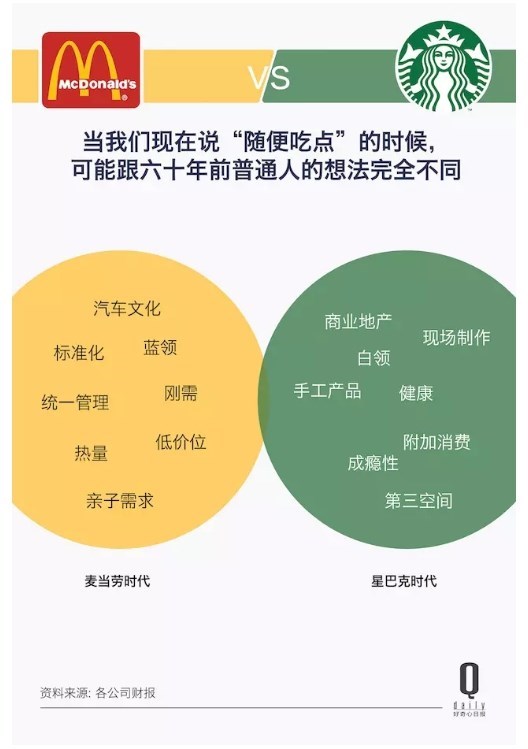

Starbucks evolved, ultimately because of changes in market demand

McDonald's breaks people's concept of meal form, with clean environment, standardized products, fast, efficient and high-quality service, and finally meets people's basic needs for food. The so-called fast food is to get energy quickly.

Starbucks offers an experience that is part of the space concept beyond food: consumers come to the store and are more looking for a third space outside their home and office to relax and socialize, and coffee drinks are just additional services.

It's harder to reach consumers than McDonald's, by comparison. In that sense, it's more evolved than McDonald's. You can also see what this means in the picture below.

What it ultimately adapts to is the change in our needs as consumers for "what to eat"-whether it's a more convenient, healthier, more diverse coffee choice, or a desire to meet the genetic need for sweets and fats. Can be achieved in Starbucks stores.

Starbucks' standardization transformation may also learn from the experience of McDonald's.

You may also have heard of McDonald's double-sided baking trays and V-shaped French fries specially designed to improve the efficiency of meal preparation-another kind of innovation that the big company has created in the industry.

In order to ensure that almost the same level of products and services can be sold in tens of thousands of stores, such a standardization process is indispensable. Even raw material suppliers have to accept similar quantitative management, because once the processing raw materials are relatively stable, when the processing process is stable, the product quality is also stable, which reduces the uncertainty in the service process; the process can be combed in a more planned way to improve service efficiency.

Although there are equally strict quantitative indicators in terms of production standards and speed, Starbucks did not pay much attention to the transformation of the equipment level. Due to the promotion of Italian coffee culture, Starbucks used to use Italian brand La Marzocco coffee machines in the past. This semi-automatic machine needs to control variables such as Espresso extraction time and pressure, and baristas need to manually fill and press coffee powder.

But since Starbucks introduced the fully automatic coffee machine Thermoplan in 1999, things have become much simpler: the clerk only needs to fill the beans regularly and press a button on the machine to quickly get an espresso, making the entire assembly line roll faster.

It is undeniable that McDonald's, as the largest catering company in the world, has accumulated a lot of business operation experience or inspiration for the whole industry.

It's still a long time away from 40,000 homes, but Starbucks' challenge is already here.

Between 1965 and 1991, McDonald's averaged 42 per cent of its annual revenue growth in the US, largely due to the performance of new outlets; during its heyday overseas expansion in the 1990s, McDonald's was able to open 2000 new stores a year.

However, as the number of McDonald's stores around the world has increased to more than 35000 in recent years, how to operate these stores well with franchisees to prevent them from going bankrupt in the fierce market competition has become a matter of more concern than opening stores. By contrast, it may take some time for Starbucks to actually arrive.

But Starbucks' challenge has also come. Starbucks' same-store sales fell short of wall street expectations in the last five quarters, and growth slowed to 3%, the worst since 2009.

Make lunch seriously and double food sales in five years. Isn't the intention obvious?

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Surrounded by the aroma of forest and coffee, the seven most healed tree house coffee in Japan

When I was a child, I always fantasized about building a wooden house on a tree, which was a secret base with my friends. Even when I grow up, I still can't help yearning for the tree house. There are seven tree houses in Japan, the comfortable environment surrounded by forest trees, with a slightly bitter aroma of coffee, is the most healing. ① / Yokohama / Yokohama (Yokohama) / Yokohama (Yokohama)

- Next

200000 can open a shop, the post-Starbucks era equipped with sharp weapons, bicycles and coffee better.

If you are a deep coffee fan, you must have heard of Wheelys. Since August last year, small red cars full of cars have appeared in various public areas of Shanghai one after another. In the past, people liked to buy a cup of coffee, take a book and sit at Starbucks all afternoon. With the acceleration of the pace of life, people have less and less time, and many people prefer to take out coffee rather than eat in the restaurant.

Related

- What documents do you need to go through to open a coffee shop? coffee shop coffee shop certificate processing process

- How to purchase Coffee beans in small Cafe how to choose a suitable supplier for domestic Coffee supply Company

- How to drink Starbucks Fragrance White Coffee? how to make Australian White Coffee? what Italian coffee beans are recommended?

- The Story of Flora Coffee: the name of Flora Coffee Bean and the implication of the Flowers on Florna Coffee

- How much does a cup of coffee cost? How much is the profit of a cup of coffee? What is the profit of the coffee shop in a year?

- Yunnan small Coffee, known as "fragrant Coffee", introduces the characteristics of Alpine Arabica Coffee producing areas in Yunnan, China

- 2023 latest Starbucks full menu price list how much is a cup of Starbucks coffee what is better to drink the most popular hot and cold drinks recommended

- Starbucks different kinds of Coffee Price list Starbucks menu 2023 Top Ten Best drinks in Starbucks

- Starbucks Spring praise Comprehensive matching Coffee Bean theme Story Packaging implication and taste description

- The cost of a cup of coffee latte American coffee cost price and selling price