Starbucks tea industry, but a full attack on the Chinese mainland market, this will be a big bet?

For professional baristas, please follow the coffee workshop (Wechat official account cafe_style)

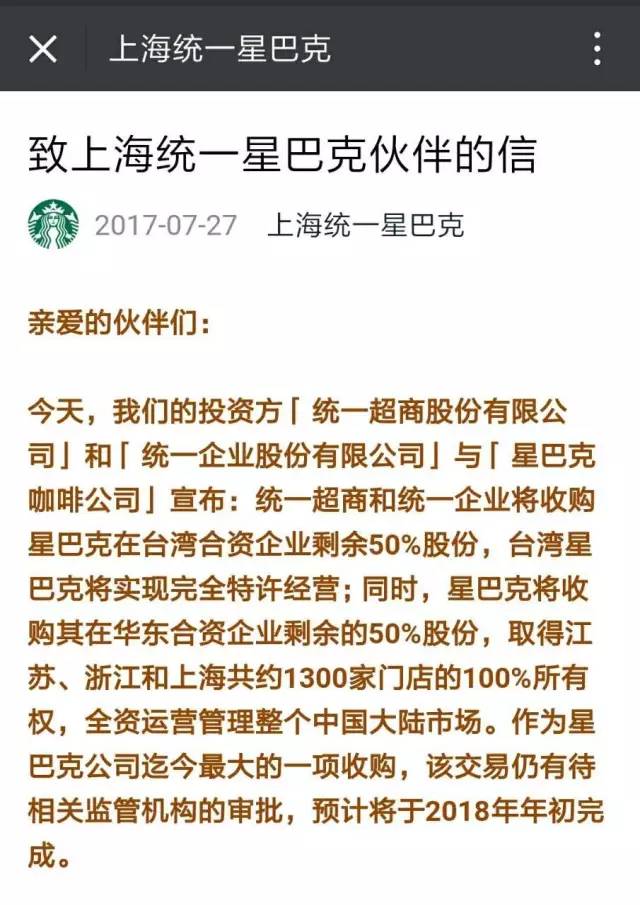

On the evening of July 27 yesterday, Starbucks announced that it had formally reached its largest acquisition agreement to date with its long-time joint venture partners Uni-President Enterprise Co., Ltd. ("Uni-President") and Uni-President Superstore Co., Ltd. ("Uni-President"). Take back the remaining 50% of Starbucks East China Market Joint Venture (Shanghai Unified Starbucks Coffee Co., Ltd.) with $1.3 billion in cash.

In other words, Starbucks Jiangsu, Zhejiang and Shanghai are gone. Starbucks has taken 100 per cent ownership of about 1300 stores in Jiangsu, Zhejiang and Shanghai, and will operate directly in the Chinese mainland market.

The reasons for the big acquisition of Starbucks

Last night, Starbucks reported 2017 Q3 revenue of $840 million in China / Asia Pacific, with 2800 stores, equivalent to one store earning $300000, while Starbucks had global revenue of $5.6615 billion, with a total of 21000 stores. a store earns $270000. In other words, the profitability of the Chinese market is higher than the global average.

With the mediocre performance of the domestic market in the United States and the market volatility after Brexit, Starbucks once fell into a rather passive situation. However, the consumption of Chinese mainland coffee market is expanding rapidly, so it has become a growth market with high hopes for Starbucks.

Starbucks in Sinan residence

That's why Starbucks made this big acquisition. In this future defined by Starbucks as the world's largest single market and the most important market, it is not surprising that Starbucks has repeatedly stressed its store opening plans and regained control.

After taking back the independent management rights of stores in such a strong Chinese market, all profits will go into Starbucks' own pockets, and Starbucks will have 100% decision-making power over Chinese companies' business structure and store expansion. you can push forward the plan to have more than 5000 stores in China in 2021 at your own pace.

Upon completion of the acquisition, Starbucks will wholly own about 1300 Starbucks in Shanghai, Jiangsu and Zhejiang (East China). At the same time, all 2800 stores in mainland China, including East, South and North China, have become Starbucks direct operations.

Among them, Shanghai alone has nearly 600 stores, making it the city with the largest number of Starbucks in the world. It is also the first city in Starbucks' overseas market to have a Starbucks baking plant. The importance Starbucks attaches to the Chinese mainland market is evident.

This is Starbucks' first bakery outside the United States! It's at Xingye Taiguhui on Nanjing West Road.

Covering an area of 2700 square meters, it is about twice the size of the first Starbucks bakery in Seattle headquarters.

Increased control = increased risk.

However, increasing control also means increasing risk.

It is a common practice for Starbucks to enter overseas markets to set up joint ventures and then gradually take back control when the time is ripe. By giving local companies control most of their operations and capital, Starbucks avoids a lot of risk while maintaining links between headquarters and overseas companies. As Starbucks learned more about the local market and, as policy permits, Starbucks gradually withdrew its control of its stores.

However, the Chinese market that Starbucks is facing now is far more complex than it was to rely solely on its expansion strategy to grow rapidly. Starbucks competitors not only include Costa, Pacific and other European and American coffee brands, although the limelight of Korean coffee has passed, but China's local boutique cafes are scrambling to chain large-scale operation and are rapidly laying out the Chinese market.

In addition, a wave of new casual fast food, cheap coffee and increasingly dense convenience stores are also coming.

Seesaw, which received 45 million financing from Hony Investment just last month.

Starbucks can no longer be as easy as it was in the early years to expand its stores in the Chinese market:

1. China's market continues to grow, but first-and second-tier cities are saturated, and third-and fourth-tier cities may not be enough to support excessive expansion.

2. China's policy is unstable, and Starbucks needs partners to help grasp the situation.

3. A series of prosperity of commercial real estate is not optimistic, and Starbucks, which depends on it, may be limited.

4. Whether the existing consumer groups will be diverted by new competitors.

Starbucks' entry into the tea industry failed.

In October 2013, Starbucks bought Teavana, a tea brand, for $620 million to diversify its product portfolio, with plans to open at least 1000 tea stores within five to 10 years. CEO Schultz at the time declared: "the acquisition of Teavana will allow us to break and lead the market, just as we did with espresso 30 years ago."

Unfortunately, Starbucks also announced last night that it would close all its 379 Teavana tea stores. Most of them will be closed by next spring, and the affected 3300 employees will be "given the opportunity to apply for positions in Starbucks stores."

This means that Starbucks' plan to enter the tea industry has failed.

Most of the 379 Teavana tea shops will be closed by next spring

As early as April this year, Starbucks announced that it would "evaluate strategic options" for troubled Teavana tea stores. Most of these tea stores are located in shopping malls across the United States, and many mall retailers have been affected by reduced traffic in recent years due to competition from e-commerce and discount retailers, and Teavana tea shops have not been spared.

Corresponding to the collapse of Starbucks in the tea industry, a new generation of tea chain in China is booming. They seem to be in different areas of competition from Starbucks, but they pose a threat to the diversion of customers in terms of consumer budgets and potential locations.

The new generation of tea chain in China is booming.

More importantly, this wave of tea chains is shaping a new consumer culture. Teavana and similar tea chains have not made great progress in China, and the vitality, speed of change and ability to grasp young consumers of street brands are precisely the shortcomings of Starbucks.

Where will Starbucks China go?

In the face of oncoming opportunities and challenges and difficulties, Starbucks dare not relax.

On the one hand, open more selected stores to further upgrade the customer experience

On the one hand, new products are introduced frequently to shorten the time difference between different markets.

In terms of products, Starbucks has been ploughing the power of products, represented by "air-cooled coffee", with its R & D strength with both professionalism and investment, leading the market trend.

In addition, the product line is also trying to diversify: Starbucks China has increased the proportion of lunches since last year, hoping to increase the proportion of food as a percentage of total revenue.

No matter how many people in the industry have been hacking Starbucks, no matter how Starbucks gradually loses its charm as a coffee educator, it is still a mountain on top of most of its peers.

Is it the hero in the twilight, the sunset, or the wind and waves, willows and flowers? Please wait and see.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

More than 6 million yuan was paid for opening a coffee shop for two years, and finally he was forced to sell box lunches.

How hard is it to open a coffee shop? Ah Jian, who is called a business genius by his friends, has done well in the four industries of fast consumption, building materials, home decoration and entertainment, but he has lost more than NT $6 million in the cafe for two years. From the small details of the bathroom to the operation and management, they are all stepping on the hole, hardly doing one thing right. Let's take a look at the lessons to be learned. One: Gao Lige management, but failed by fine decoration.

- Next

Raise money through crowdfunding! The first gay LGBTQ coffee bar in Los Angeles officially opened a few days ago.

Professional baristas exchange please follow the coffee workshop (Wechat official account cafe_style) comrades, take a picture! The first gay LGBTQ coffee bar in Los Angeles officially opened a few days ago, raising a dazzling rainbow flag in the Melrose business district. This small shop called Cuties Coffee Bar will be gay-based, and will ensure that door-to-door guests will get a job regardless of their sexual orientation.

Related

- What documents do you need to go through to open a coffee shop? coffee shop coffee shop certificate processing process

- How to purchase Coffee beans in small Cafe how to choose a suitable supplier for domestic Coffee supply Company

- How to drink Starbucks Fragrance White Coffee? how to make Australian White Coffee? what Italian coffee beans are recommended?

- The Story of Flora Coffee: the name of Flora Coffee Bean and the implication of the Flowers on Florna Coffee

- How much does a cup of coffee cost? How much is the profit of a cup of coffee? What is the profit of the coffee shop in a year?

- Yunnan small Coffee, known as "fragrant Coffee", introduces the characteristics of Alpine Arabica Coffee producing areas in Yunnan, China

- 2023 latest Starbucks full menu price list how much is a cup of Starbucks coffee what is better to drink the most popular hot and cold drinks recommended

- Starbucks different kinds of Coffee Price list Starbucks menu 2023 Top Ten Best drinks in Starbucks

- Starbucks Spring praise Comprehensive matching Coffee Bean theme Story Packaging implication and taste description

- The cost of a cup of coffee latte American coffee cost price and selling price