Is there really a trillion-dollar coffee market in China? Three great opportunities for the coffee market in the future!

Professional coffee knowledge exchange More coffee bean information Please pay attention to coffee workshop (Weixin Official Accounts cafe_style)

Interpretation: At present, the scale of China's coffee market is about 110 billion yuan, which is far from the total market volume of one trillion yuan. In response to the old saying, the take-off of China's coffee market has a long way to go.

Author/Pintu Think Tank

China's coffee market is big enough, the profits are amazing enough, the pressure is high enough, enough to support platform thinking, the above conditions are also enough to "lead countless heroes to compete", everyone is crazy for this market.

The progress of coffee industry and the improvement of coffee quality make the demand growth of coffee inevitable, reflecting the exploration and consideration of unknown market under the big words such as consumption upgrading and consumption structure adjustment.

Coffee is an ancient business, but it still lasts for a long time today. Starbucks was born in 1971 and listed on NASDAQ in 1992. Since then, its sales have maintained an average annual growth rate of 20%, and the average profit growth rate has reached 30%. The stock returns are higher than those of General Electric, Pepsi, Microsoft, etc. at that time.

Because of this, China's emerging coffee market entrants regard Starbucks as a goal of transcendence, which is not shouting slogans, waving numbers, and getting through strategic planning and operation logic suitable for Chinese consumers.

China's coffee market has huge potential, with many entrants and challengers. Pintu Business Review (ID:pintu360) believes that there must be a war between Chinese and foreign coffee brands. Old players believe that the future coffee market still needs to judge the way out from the essence of retail and the integration ability of supply chain, while newcomers rely on technological innovation advantages and believe that it is necessary to subvert the original market pattern with Internet logic and cognition.

The gathering of contestants in this challenge has obviously attracted the attention of many business tycoons and capital tycoons. The outcome is unknown. Perhaps the scale of the war is far beyond the current imagination. What will happen in the future?

The think tank of Pintu Group deeply analyzes the future development of China's coffee market from the perspective of capital investment, coffee market structure and consumption potential, coffee enterprise core competence competition and other dimensions.

The coffee market has great potential, but there is no simple beauty.

With the strong entry of Luckin Coffee's 1 billion valuation, China's coffee market has made waves again, and the coffee and tea market has become the investment and incubation track most concerned by the capital market after convenience stores.

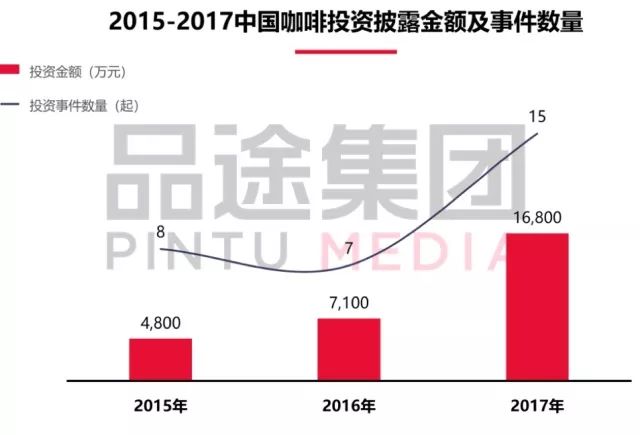

According to the statistics of Pindu think tank, the popularity of China's coffee venture capital market continues to increase from 2015 to 2017, and it shows a high growth trend in 2018. As of May this year, the amount of venture capital in China's coffee market has reached 322 million yuan, twice the total financing of 2017.

Source: analysis of Enterprise name Film and Pindu think Tank

However, do not over-optimistically estimate that a coffee feast is coming. According to a study by the Pintu think tank, the cumulative financing amount of China's coffee market is 609 million in 2015-2018, of which even coffee is 218 million. Accounting for 36% of the total financing, starting a business in China's coffee market is not as simple as imagined.

Behind the rapid growth of China's coffee market, what needs to be considered is: has the best era of China's coffee market and coffee consumption really arrived?

When conducting research on China's coffee market, many people saw an exciting figure of 1 trillion yuan, which is the estimated size of China's coffee market in 2025. According to statistics, the annual per capita coffee consumption in China is 5 cups, while that in the United States and Japan is 350 cups. The difference is the future scale of China's coffee market.

In the face of attractive figures, we need to look at it calmly. In the environment in which Chinese coffee culture has not yet been formed, does China's coffee consumption market really have such a good potential for development?

In fact, the calculation of the scale of China's coffee market in the future is generally composed of three parts: first, the number of effective consumers of coffee (20-45 years old, urban range); second, single consumption price; third, consumption frequency.

First of all, from the perspective of effective consumer population, although China's urbanization rate is increasing, the growth rate of consumer population is not significant due to the aging of the overall population structure.

It is estimated that in 2017, the effective coffee consumption population in China is 206 million, but by 2025, the consumption population is only 229 million. According to the data, the growth of the effective consumption population will not directly promote the explosive growth of the coffee market.

Secondly, as far as the unit price of coffee consumption is concerned, according to the 2017 report on the Survival condition of China's Coffee Industry released by Meituan Dianping, latte is the most popular coffee drink, with an average unit price of 30.30 yuan per cup. At the same time, the average unit price of the most popular coffee products in the country is in the range of 23.8-35.3 yuan. It can be seen that the average unit price of 30 yuan for coffee is basically stable.

Thirdly, looking at the consumption frequency, according to the survey of Beijing, Shanghai and other first-tier consumer markets conducted by Pindu think tank, the main users of coffee consumption are post-80s and post-90s office white-collar workers.

Among the respondents, consumers with 2-3 cups of coffee per week accounted for about 32%, consumers with 1 cup per day accounted for about 30%, and consumers with 2-3 cups per day accounted for about 18%. Based on this, it is estimated that the annual per capita coffee consumption of white-collar consumers in Beijing, Shanghai and other metropolises has reached 100-150 cups. It can be inferred that the main coffee consumption market in China is becoming saturated.

In addition, let's figure out another data. at present, Starbucks has nearly 4000 stores in China, which accounts for about 50% of the market share of chain coffee brands based on the average annual turnover of 5 million individual stores. According to this, the overall market share of chain coffee brands is about 40 billion yuan.

At the same time, Pintu think tank interviewed several small regional coffee stores, affected by location factors, the overall revenue is quite different.

With annual revenue of 800000, there are about 90, 000 small, independent coffee brand stores in China, with a market size of about 72 billion yuan. To sum up, the current size of China's coffee market is about 110 billion, which is far from the overall market volume of 1 trillion. According to the old saying, the take-off of China's coffee market has a long way to go.

Why should China's coffee market take off?

Reality is the best reference and the starting point. Under the circumstances that the effective consumer population and the unit price of consumption will not change significantly, and the coffee consumption market in first-tier cities tends to be saturated, what can support the take-off of China's coffee market from hundreds of billions to trillions?

Many people may say that the coffee consumption potential of the second-and third-tier market is huge, and driven by the upgrading of overall consumption, a market explosion is just around the corner. Isn't pinduoduo an example of offline consumer market?

The analysis of this problem can be carried out from two aspects: one is whether the concept of coffee consumption is recognized, and the other is whether the basis of coffee consumption is available.

The recognition of the concept of coffee consumption has a long way to go.

Looking at the evolution of coffee consumption in China from the perspective of coffee consumption concept, it is well known that China is dominated by tea culture, and the attraction of bitter coffee to Chinese people is far lower than that of consumers in Europe and the United States.

At present, coffee consumption in China as a whole is educated and influenced by two major brands, one is Nestl é, the other is Starbucks.

When coffee first entered the Chinese market, the price was relatively high. At that time, a cup of Nestle coffee was worth more than 20 yuan, while a university professor's monthly salary was about 200 yuan. In people's eyes, coffee is a symbol of "fashion" and "elegance". People are more curious about coffee.

Since then, Nestl é has developed rapidly in the Chinese market, and instant coffee with relatively low prices has been welcomed by the market. "refreshing and sleepy to have a cup of coffee". For Chinese consumers, the consumption of coffee is based on the basic functions of coffee.

Therefore, in the 1990s and early 2000, it was favored by students and workers. During that period, instant coffee entered the fast lane of development in China.

In 1999, with the opening of Starbucks' first store in mainland China at ITC in Beijing, marking its official entry into the Chinese market, Chinese consumers' awareness of coffee has improved again. The "third Space" advocated by Starbucks soul Schultz began to take root in China.

The scene and experience attributes of coffee have been further explored, and the social and leisure functions of the cafe have made it a place for modern people to meet, relax and negotiate with each other.

In addition, more and more consumers take drinking coffee as a hobby, and coffee is a carrier to gather people who have the same lifestyle or hobby. Consumers began to taste coffee, not limited to the taste of coffee, the choice of coffee bean origin and flavor, as well as roasting skills, but also related to coffee culture, brand concept and so on.

With the growth of China's coffee market, the post-70s and 80s have begun to pursue coffee quality even more. They will choose a coffee shop with a good environment to taste a cup of freshly ground coffee, or even buy a coffee machine and make a cup by hand. The quality of coffee has become the development trend of the coffee market.

It can be said that it has taken nearly three decades to educate coffee consumers in first-tier cities from curiosity to functionality and then to coffee culture. Compared with the offline cities where the overall pace of life is slow and the outflow of young people, consumer education and training will be much more difficult than expected.

The basis of coffee consumption is weak and immature.

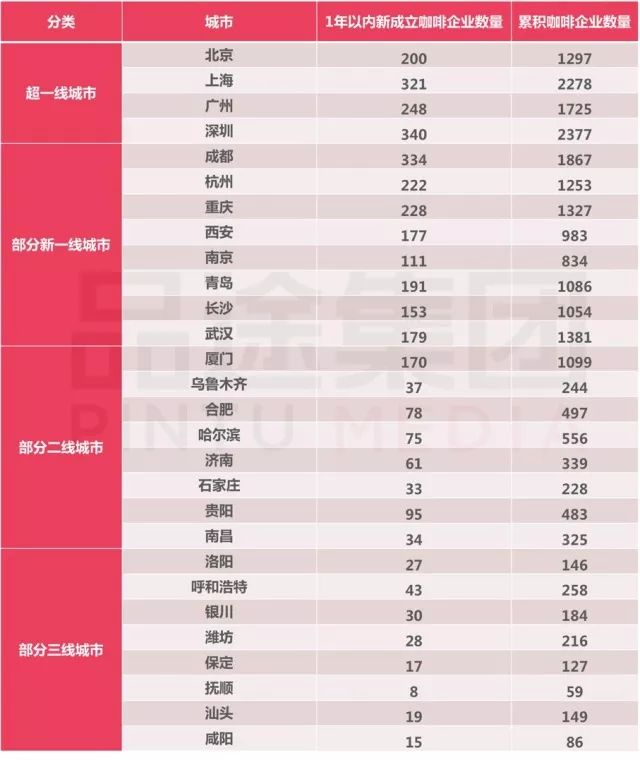

For the basis of coffee consumption, let's take a look at a set of materials. The development of the overall coffee consumption region in China is uneven. Through the comparison of the data, we can see a very interesting phenomenon that the number of coffee enterprises in southern China is much higher than that in the northern region.

Source: Qixinbao and Pindu think tank analysis

According to the city data, according to the latest city division, except for Xi'an and Nanjing, the number of coffee enterprises in China's super-first-tier cities and some new first-tier cities has exceeded 1000, with an average of about 1500. Among them, Shanghai, Guangzhou, Shenzhen and Hangzhou are important areas for coffee enterprises.

The average number of coffee enterprises in second-tier cities is about 300, and that in third-tier cities is about 150, which is only 1/10 of that in first-tier cities. The basis and supporting conditions of coffee consumption in offline cities are not mature, and there is no possibility of rapid growth in the future.

Source: Qixinbao and Pindu think tank analysis

Based on the above, the basic judgment of Pindu think tank is that China's mega-cities have encountered the bottleneck of coffee consumption growth, the consumption foundation of offline cities is weak, the penetration rate of consumption concept is slow, and the possibility of market outbreak in the next three years is very small.

In addition, at present, the main consumers of coffee are still post-70s, post-80s and post-90s, while for the post-00s who pursue more personalization and uniqueness, in the face of diversified product choices, there are still many uncertainties in their recognition of coffee culture.

Win the core battle of the coffee market

In the face of the ever-changing market environment in the future, the Pindu think tank believes that the competition in the future coffee market will mainly focus on the battle of several core competencies:

01, the battle of traffic entrance

Judging from the overall situation, the traffic entrances based on coffee consumption scenarios such as offline stores, Internet, offices, convenience stores, merchant supermarkets, catering and bookstores have been basically saturated.

First of all, let's take a look at offline stores. in May 2018, Chinese mainland unveiled a plan to accelerate the Chinese market. By 2020, the number of stores in Starbucks is expected to reach 6000, entering 100 cities, covering a total of 230. the total revenue of the Chinese market will more than triple compared with the 2017 fiscal year, and the operating income will more than double.

Source: public information, quality think tank analysis

Starbucks' strong investment in the Chinese market will accelerate the scramble for store resources at the core of the regional market, thus driving up costs. For players with small capital, they will face more fierce competition.

Secondly, looking at the Internet level, Luckin Coffee relies on the Internet, based on large data of users and "simple and rough" methods of getting visitors, detonating disruptive community marketing.

Luckin coffee has inherent digital genes, builds its own DMP system, analyzes and manages user behavior through multi-tags, and based on APP, Luckin Coffee's marketing methods can be more diverse and flexible, and the sharing of each user has become an automatic and spontaneous source of new traffic, thus realizing the rapid detonation of traffic and users.

Luckin Coffee's essence is the Internet: heavy_plus_sign: coffee store model, its core is the traffic war, the result is to snatch the demand and traffic of super-large and mature coffee users. Judging from the downloads of brand coffee APP, Luckin Coffee reached Starbucks 1/10 in less than half a year, greatly surpassing traditional established coffee brands.

Source: cicada Master, Pindu think Tank Analysis

Third, look at the coffee business in convenience stores. Coffee sales in convenience stores have their own system. The coffee sales of 7-ELEVEn in Taiwan are equivalent to 1/3 of those of Starbucks on the mainland.

Because the convenience store's food system is highly compatible with the consumption scene, and the convenience store covers a relatively wide range, on the one hand, it can meet the needs of office white-collar workers for quality coffee; on the other hand, it can also meet the convenience requirements of high-paced work and life.

However, 7-ELEVEn has spent nearly 10 years to cultivate convenience store users' coffee consumption habits. Due to the development of convenience stores in China, convenience store coffee consumption still needs a long cultivation period in the future.

Next, let's take a look at coffee consumption patterns based on various consumption scenarios, such as coffee + supermarket, coffee + bookstore, coffee + clothing and so on.

In essence, coffee is a supplement and improvement of the combined format, as well as a tool to share and reduce operating costs, and the consumer group is relatively small, which is not enough to constitute the driving force to promote the growth of coffee consumption.

Finally, looking at the unmanned coffee machine market, in 2017, with the help of the new retail concept, unmanned retail has become a hot spot of development, with unmanned shelves, unmanned convenience stores, unmanned coffee machines and so on pouring out. We believe that unmanned coffee machines are still in the early stage of exploration. there is still a long cycle of technological maturity and model commercialization.

02. Battle of the supply chain

As a consumer retail enterprise, supply chain is a topic that can never be bypassed. Supply chain is the core link of rapid expansion of store suite and optimization of cost efficiency.

Taking the Starbucks Chinese market as an example, Starbucks introduced coffee varieties in the upper reaches of the supply chain. In 2012, in cooperation with Yunnan Academy of Agricultural Sciences and Pu'er Municipal Government, Starbucks established the sixth coffee grower support center in Yunnan and the first coffee grower support center in Asia. It not only provides strong technical support for local farmers to grow coffee and produce high-quality coffee beans, but also strengthens China's local coffee bean supply chain management. Control the quality and growth from the source of the product.

In the lower reaches of the supply chain, in 2018, Starbucks reached a strategic cooperation agreement with Nestl é, which will be responsible for the global sales and distribution of Starbucks packaged coffee and packaged tea containing Starbucks, Seattle's Best Coffee, Starbucks Reserve, Teavana, Starbucks VIA and Torrefazione Italia.

Relying on Nestle's mature market channels, Starbucks can strengthen the channel sinking ability on the one hand and form mutual supplement with brand stores; on the other hand, it is also very important to take the lead in seizing the minds of consumers in the current market.

03. Battle of Chain Management Ability

Starbucks expands at an average speed of 15 hours to open a store in China, while Ruixing Coffee opens three new stores a day on average. Behind the rapid expansion, on the one hand, capital support, on the other hand, is a huge challenge to its chain management ability. Take Shangdao Coffee as an example. As the biggest competitor of Starbucks once entering the Chinese market, Shangdao Coffee Store once expanded its suite to more than 3000 stores relying on chain franchise mode, but at present it shrinks to more than 500, withdrawing from the competition of first-line coffee brands early.

The root cause lies in that Shangdao Coffee adopts stocking system for stores after charging franchise fees, lacking effective follow-up service support, resulting in weak profitability of franchised stores and even large losses. At the same time, Shangdao Coffee lacks brand management standards, each franchisee freely plays, does not form a reasonable brand, brand image overall decline.

For example, Korean coffee brand coffee accompanies you. In 2012, it entered China by joint venture and rapidly expanded the market by means of "joining + direct sales + cooperative operation". "No one refused" to join the policy, in the rapid expansion of the same time, but also for the operation buried hidden dangers. In 2015, the operation control of coffee company headquarters was unfavorable, and messages such as arrears of wages and debt collection by franchisees continued to emerge, resulting in large-scale closure of terminal stores.

04. Battle of product innovation iteration ability

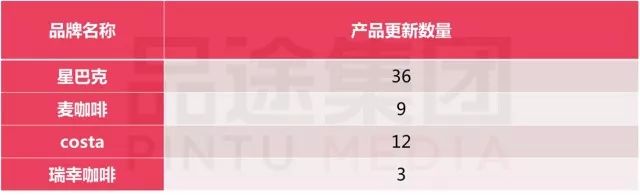

In the face of a new generation of consumers, rapid iterative innovation of products will be the key to capturing the hearts of post-00 consumers. On the one hand, the iteration of products depends on the R & D ability of brands and accurate grasp of consumer demand; on the other hand, the above-mentioned supply chain system is also an important guarantee. Pintu think tank took stock of several core brands. In the past six months, Starbucks took the lead with 36 new products, while Ruixing Coffee updated only 3 new products.

Source: Pinway think tank

For the future of the coffee market, the Pindu think tank believes that there are three major development opportunities.

1. Empowering and integration opportunities for small, independent coffee shops

At present, there are nearly 90,000 small and independent coffee shops in China, whose management level is uneven, small batch procurement does not have the advantage of supply chain, baristas vary greatly, product iteration ability is weak, digital operation ability needs to be improved, and so on. There is an urgent need for standardization and professional empowerment in finance, digitization, supply chain and management in order to survive in the fierce competition. At the same time, in the face of the loose regional market, the future can be carried out through brand integration of regional small, independent coffee stores, and the battle for grabbing the 70 billion market has just begun.

two。 The big capital of new brands and new chains has entered strongly.

Through the above analysis, it is certain that there are still great development opportunities in China's coffee market, and the possibility of outbreak in the past three years is relatively small. In order to get a share of the 100 billion yuan market, it will take at least five to ten years of brand layout and market cultivation in the future. China's coffee market is basically a game with long cycle and large capital, so for some cross-border industries with big capital, there are still good opportunities to seize the market.

3. The consumption scene of coffee + catering is reliable.

With the rise of the younger generation of consumers in China, the dietary structure and habits of teenagers who grew up eating KFC and McDonald's have changed significantly with their parents. At present, China's catering industry is facing an important node of consumption upgrading. The population of post-80s and post-90s has exceeded 400 million, accounting for nearly 1% of the country's total population. It pays more attention to efficiency and health, and light meals are becoming more and more popular.

At the same time, the number of Chinese students studying in the United States exceeded 350000 in 2017, ranking first in the world for eight years in a row, and more and more groups began to receive Western education and experience Western culture. In the future, the integration of new catering formats such as coffee and light meals will become another important breakthrough in the coffee market.

Finally, I would like to make a pertinent suggestion: the coffee consumption market is not as good as expected, the coffee market is very lively, but profit is the king. The overall industry investment in the coffee market is heavier, and there are many risks and uncontrollable factors, so it is not suitable for VC to get up early because of the long exit cycle.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Coffee Bean Baker: the Flavor Guardian of the connecting Link

Professional coffee knowledge exchange more coffee bean information Please follow the coffee workshop (Wechat official account cafe_style) the concept of the third wave put forward by the American bean baker: coffee is becoming more and more focused on roasting and is gradually moving towards a line of refinement, high quality and distinctive features. Coffee farmers, importers, bean bakers, baristas and consumers all play important roles in the coffee chain. Among them, with

- Next

The cafe in the new coffee era will be "unrecognizable". How to operate the cafe

Professional coffee knowledge exchange More coffee bean information Please pay attention to coffee workshop (Weixin Official Accounts cafe_style) In the eyes of Qi Ming, founder of Platinum Coffee College, 2010 was a turning point in the development of coffee shops in China. Since then, this business seems to be no longer good. Also during this period, some coffee practitioners will coffee and coffee shops mix up unclear, business loss

Related

- What brand of black coffee is the most authentic and delicious? what are the characteristics of the flavor of the authentic Rose Summer Black Coffee?

- Introduction to the principle and characteristics of the correct use of mocha pot A detailed course of mocha pot brewing coffee is described in five steps.

- Which is better, decaf or regular coffee? how is decaf made?

- How much is a bag of four cat coffee?

- How about four Cat Coffee or Nestle Coffee? why is it a cheap scam?

- Which is better, Yunnan four Cats Coffee or Nestle Coffee? How about cat coffee? is it a fake scam? why is it so cheap?

- How about Cat Coffee? what grade is a hoax? which instant coffee tastes better, four Cat Coffee, Nestle Coffee or G7 coffee?

- Process flow chart of coffee making-Starbucks coffee making process what coffee tastes good at Starbucks

- The top ten best coffee beans in the world Rose summer coffee or Tanzanian coffee tastes good

- Yunnan four cat coffee is good to drink?_four cat coffee is a big brand? four cat blue mountain coffee is fake?