Threaten to surpass Starbucks "Little Blue Cup" how long can Luckin Coffee burn money?

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style)

At the end of 2017, Luckin Coffee, a newly established Chinese coffee brand, had more than 2, 000 exhibition stores in less than a year. The founder even announced that the bottom market and sales volume in 2019 will fully surpass Starbucks, Luckin Coffee, what on earth can he do?

"two ○ by the end of 2019, we will overtake Starbucks in an all-round way!"

Qian Zhiya, founder of China's new coffee brand Luckin Coffee, announced in a high profile on January 3 that Ruixing will become the largest chain coffee brand in China by the end of 2019. At that time, more than 2500 stores will be added, and the total number of stores will exceed 4500, leading Starbucks in an all-round way.

Ruixing, founded at the end of 2017 and headquartered in Xiamen, has become a hot topic in China's new business circle over the past year with its rocket-like rise and store expansion. It was first put into operation in 2018 and officially opened in May, but by the end of 2018, 2 ○ 73 direct stores have been opened in 22 cities in China, which simply translates to an average of 5.5 new stores a day. The cumulative number of consumer customers has exceeded one or two thousand ○○.

In contrast, Starbucks, the industry leader that has been deeply cultivated in the Chinese market for 19 years, has no more than 3300 households in China as of the middle of last year, while Costa, the second largest foreign coffee chain, has only 449 stores after 12 years of hard work.

In July last year, Ruixing completed round A financing of US $200 million, valued at US $1 billion after investment, and became China's first "coffee unicorn." In December of the same year, it received another $200 million in round B financing, and the post-investment valuation doubled to $2.2 billion. How can Ruixing, nicknamed "Little Blue Cup" by the investment bank Goldman Sachs, be able to "run over" Starbucks?

The founder is addicted to coffee.

Vows to solve the two "pain points"

"I'm going to make better coffee than Starbucks." In November 2017, Qian Zhiya, then the COO of China's largest car rental chain, nicknamed Shenzhou "Operation first Sister", announced that he would leave his job to start a business. To everyone's surprise, Qian Zhiya's new business has nothing to do with his own business. What she wants to sell is coffee.

Qian Zhiya, who is herself a heavy lover of coffee, points out that with the changes in consumption patterns in China in recent years, she has observed a growing demand for business drinks such as coffee. Data show that China's coffee consumption is growing at an annual rate of 15% to 2% ○. In the global market, the average growth rate of coffee consumption is only 2%. " She said.

However, in the course of his research, Qian Zhiya also found that the reason why coffee has not been popularized in China lies in two major pain points: the high price and the inconvenience to buy. Therefore, at the beginning of its establishment, Ruixing targeted the "office white-collar takeout" market, which is highly driven by price and convenience and has grown rapidly in recent years. On the other hand, combined with the new retail wave in China in recent years, Ruixing is also trying to build a "data coffee" that integrates both online and offline business.

Because it specializes in takeout, unlike ordinary coffee shops, Lucky does not have a cashier or cashier, and all orders and payments are done online: users place an order through App, choose their favorite taste, and then choose delivery or pick it up at a scheduled time. Lucky's offline "quick pick-up shop" has only a simple pick-up counter, and there are even no seats in the store.

Ordering and buying all depend on App.

Help to optimize marketing and cost

After each consumption and distribution, Lucky can analyze its possible preferences based on the user's data footprint and satisfaction feedback, which can be used as the basis for future product recommendation, marketing and new product development. And this is also the key to why the capital market is optimistic about Ruixing.

"Direct distribution is Lucky's advantage. Compared with the specific commodity sales, it is more imaginative to obtain the information of the target customers through sales and design the follow-up business model. " Chen Yongwei, a researcher at the Market and Network economy Research Center of Peking University, explained to reporters.

In addition, in order to ensure the quality of coffee, Lucky's partners are all carefully selected, including the world's top coffee maker Schaerer and Franka, the world's century-old syrup brand Fabbri 1905, and the core coffee beans are exclusively supplied by Yuanyou, a well-known coffee roaster in Taiwan.

"Lucky has only two requirements for suppliers, one is whether the scale of production capacity meets the needs of Lucky's rapid expansion of stores, and the other is that the customers delivered by suppliers must be well-known chain brands, such as Starbucks." Zhu Maoheng, associate manager of Yuanyou boutique division, pointed out.

Through the application of big data, Ruixing has also been able to greatly simplify the operation process. For example, its system can automatically adjust the order volume between stores to avoid the situation that one store has too many orders while another is idle. According to the average order status of each branch, the system can also design the most appropriate staff schedule.

However, big data's cost optimization is only a necessary condition for Lucky to expand rapidly. Another "sufficient condition" lies in its near-"crazy" large-scale subsidy policy.

Looking at the lucky price list, the price of a cup of coffee is about 24 yuan, which is not much different from the price of Starbucks. However, if we take a closer look at the annual estimated financial figures disclosed by Ruixing in December last year: about 85 million cups of sales and 763 million yuan in sales, in translation, the actual price of each cup of coffee is only about 8.9 yuan, which is 1/3 of the nominal price.

In fact, market analysts believe that the reason why Ruixing was able to capture cities and land in Chinese cities in just a few months is actually caused by its large-scale advertising and promotion strategy, and the promotion of spending subsidies such as giving away and buying five free five for more than one cup. "I remember that when I was on a business trip to Beijing, the elevator of the hotel I stayed in was full of advertisements for Ruixing." Zhu Maoheng recalled.

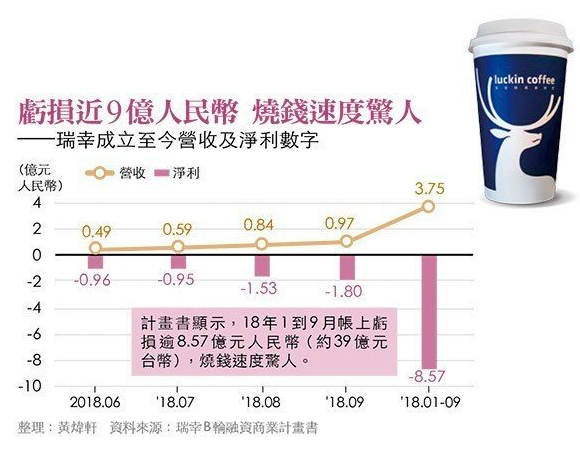

How deep is the hole in which Lucky continues to burn money? On December 21, 2018, the "Lucky B financing Business Plan" revealed by CareerIn, a financial job search and training service, gave the answer.

The market is worried to follow in the footsteps of ofo.

Rui Xing said: I am not afraid.

According to the plan, Lucky's cumulative income in the first nine months of 2018 was 375 million yuan, but the market was more concerned about the next figure: a net loss of 857 million yuan. In other words, from January to September last year, Lucky lost an average of about 100 million yuan a month.

Higher-than-expected losses, coupled with the recent collapse of bike-sharing ofo in China's capital markets, make it hard for some not to see Ruixing's aggressive expansion strategy as an overly crazy bet.

"Lucky is now laying out relatively fast, and the supporting business has not yet been carried out. For example, the surrounding income accounts for a large part of Starbucks' revenue composition, compared with much less around Ruixing. " Chen Yongwei observed. However, in the eyes of Ruixing, it does not think that the loss at this stage is such a big deal. "the loss is fully in line with expectations, and it is Lucky's established strategy to quickly occupy the market through subsidies." Yang Fei, co-founder and CMO of Ruixing, said at the group's annual strategic communication meeting after the December results were revealed.

In addition to the red net profit, another concern of the market is that Starbucks, a rival that Ruixing has vowed to surpass, has lost money for nine years since it opened its first store in Beijing in 1999. Ruixing's model of blindly emphasizing performance-to-price ratio will certainly have an effect on attracting customers in the short term, but will consumers still pay after the subsidy is over?

In this regard, Yang Fei stresses that Lucky's subsidies will not end in the next three to five years. "there are always competitors waiting for us to stop subsidies, so don't look forward to it!" Yang Fei spoke with confidence. What is interesting, however, is that the strength of lucky subsidies has quietly slowed down. On January 2 this year, Ruixing adjusted its value-added policy on its official Wechat, canceling the original buy five get five free, 50% discount for light snacks to 6.60% discount, and raised the threshold for free distribution in Beijing and Shanghai.

It is an obvious fact that rising operating costs, low-cost strategies that are difficult to sustain in the long run, the risk of losing users, and possible exit capital are all dark clouds that hover over Lucky and cannot be erased.

Lucky "Super run", which is trying to rewrite China's retail coffee landscape, has filled up with gas, and recently it has been reported that IPO is coming to Hong Kong. However, at the moment, the market may only hope that the supercar, which is ready to step on the throttle to the end, should not forget the significance of the existence of "brakes".

END

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Nestl é launched a new flavor of coffee partner Snickers VS Dev which flavor do you like?

For more information on coffee beans, please follow the coffee workshop (Wechat official account cafe_style) Nestl é Coffee-Mate USA has expanded its coffee companion line with two 32-ounce new flavors: Snickers and Dove Almond Dark Chocolate. Nestl é said that Snickers Chocolate Coffee partner has the taste of peanuts and caramel, the product is Xiangmei

- Next

The world's top ten coffee bean brands in 2019, the world's top ten boutique coffee bean producing countries ranked 2019

Professional coffee knowledge exchange more coffee bean information Please pay attention to the coffee workshop (Wechat official account cafe_style) many areas will have a variety of TOP rankings, such as the world's top 10 symphony orchestras, the world's top 10 wonders, the world's top 100 universities, the coffee field has also been listed as the world's top ten coffee beans, the ranking based on those conditions or indicators is not known, but determined

Related

- What brand of black coffee is the most authentic and delicious? what are the characteristics of the flavor of the authentic Rose Summer Black Coffee?

- Introduction to the principle and characteristics of the correct use of mocha pot A detailed course of mocha pot brewing coffee is described in five steps.

- Which is better, decaf or regular coffee? how is decaf made?

- How much is a bag of four cat coffee?

- How about four Cat Coffee or Nestle Coffee? why is it a cheap scam?

- Which is better, Yunnan four Cats Coffee or Nestle Coffee? How about cat coffee? is it a fake scam? why is it so cheap?

- How about Cat Coffee? what grade is a hoax? which instant coffee tastes better, four Cat Coffee, Nestle Coffee or G7 coffee?

- Process flow chart of coffee making-Starbucks coffee making process what coffee tastes good at Starbucks

- The top ten best coffee beans in the world Rose summer coffee or Tanzanian coffee tastes good

- Yunnan four cat coffee is good to drink?_four cat coffee is a big brand? four cat blue mountain coffee is fake?