China's freshly ground coffee market is expected to exceed 100 billion yuan in 2019, with Luckin Coffee accounting for 4% of the market share.

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style)

From the point of view of the type of coffee consumption, coffee consumption is divided into instant, instant and fresh grinding. In the 1960s, instant coffee was widely sold on store shelves, leading to the first wave of coffee consumption. After that, the emergence of coffee chains fueled a second consumption boom, and Starbucks opened its first coffee shop in Seattle in 1971.

From a worldwide point of view, the global traditional coffee consumption market still refers to the United States, Canada, the European Union, Japan and other developed countries / regions. Compared with it, China is a non-traditional coffee consumer.

Throughout the course of coffee consumption in China, at first, instant coffee represented by Nestl é entered China, opening the entrance to Chinese coffee consumption; then Starbucks entered China in 1999, promoting the development of economies of scale in cafes with the mode of standardized production and quality control, educating the almost blank Chinese coffee market at that time.

At present, many freshly ground coffee brands represented by Luckin Coffee stand out. They efficiently meet the immediate consumption demand. The reduction of the unit price of coffee is due to the price subsidy on the one hand and the enhancement of infrastructure and delivery service capacity on the other hand. Generally speaking, the penetration rate of coffee consumers and the growth of user base are the most fundamental driving force for the development of the whole coffee industry, while the improvement of consumption power, the popularization of coffee culture, and the convenience of infrastructure such as technology and payment speed up the process of coffee consumption.

In order to enable us to take a more rational view of the development prospects of new brands such as Luckin Coffee, and to have a more comprehensive grasp of Chinese coffee consumption data, Yiou think tank calculates the scale of China's freshly ground coffee market, with a view to fully restoring the face of China's coffee consumption market.

The logic of measuring the scale of China's freshly ground coffee market

In this paper, the logic of calculating the scale of China's freshly ground coffee market is to calculate the number of cups of freshly ground coffee sold in China a year according to the consumption of Chinese coffee beans, multiplying the unit price of each cup of coffee (assuming three scenarios of high, middle and low). Calculate the size of China's freshly ground coffee market.

In addition, we provide you with two feasible ideas: ① starts from the B side to think-- the B side of the coffee supply, and calculates the number of coffee cups provided to Chinese consumers according to the B-end volume of coffee consumption in the Chinese market. ② thinks from the C side-- the C side of coffee consumption, and calculates the number of coffee cups that Chinese consumers can consume in a year according to the number of people consuming coffee in the Chinese market.

In view of the latter two ideas, we can not get specific and accurate data, at the same time, the diversification of coffee supply and consumption market will bring a certain degree of difficulty and inaccuracy to the measurement work. Therefore, in the calculation, we choose to start from the raw material side, and the latter two ideas as the auxiliary method of accuracy testing.

The "long tail supply" Market of freshly ground Coffee in China

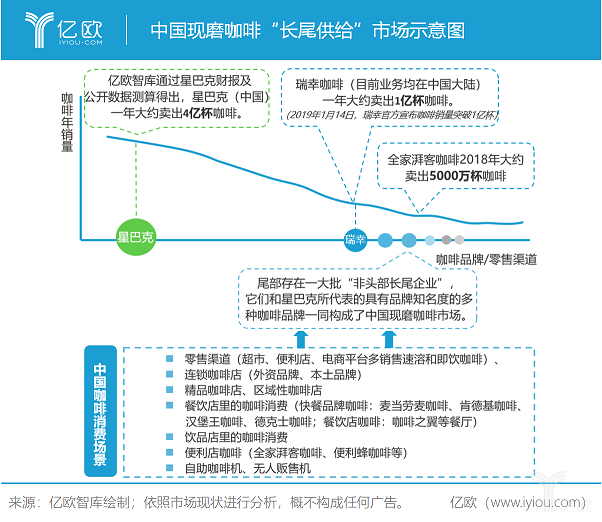

From the point of view of the store structure of the B end of the current ground coffee supply, the long tail market refers to China's head ground coffee brands / retailers-mostly chain coffee brands, which have high brand awareness, reach a wide range of people and large coffee sales. it has a certain voice and influence in China's freshly ground coffee consumption market. However, such brands / retailers account for a smaller proportion of the total market share, and a larger proportion is the tail of a large number of "small brands" and "small stores".

The service forms of these small brands or stores include coffee consumption in non-chain cafes and restaurants (fast food brand coffee: McDonald's McCoffee, KFC coffee, Burger King coffee, Dex coffee; restaurant coffee: coffee wings and other restaurants), coffee consumption in beverage stores, convenience store coffee (family coffee), cafeteria coffee machine, etc.

In terms of the number of freshly ground coffee supplied at the B end, the number of cafes in China exceeded 100000 in 2016, according to the "data report on the Survival condition of Caf é s in China" released by Jiamen and Meituan Dianping in 2017. According to figures released by CCTV Finance, the number of cafes in China exceeded 140000 at the end of 2018, while Starbucks had only more than 3700 stores in China, accounting for only 2.6 per cent of the number of cafes in China, while Luckin Coffee had 2073 stores at the end of 2018, accounting for only 1.5 per cent.

Yiou think tank: market diagram of "long tail supply" of freshly ground coffee in China

Calculation of the scale of China's freshly ground coffee market: it is expected to reach 100 billion yuan in 2019.

From the "four-volume" data and analysis of the current situation of China's coffee market, we calculated that China's 2017 coffee consumption = domestic production + imports-exports 150000 tons of ≈.

When calculating the size of China's freshly ground coffee market, it is necessary to point out the following key information:

a. Coffee beans are used as coffee consumption in three scenarios: instant, instant and freshly ground. Through in-depth interviews with coffee practitioners, currently ground coffee accounts for about 20% of coffee bean consumption. In order to restore a more real freshly ground coffee consumption market and prevent the proportion from being too high, a think-tank has also calculated the order of magnitude of the market size when the proportion is 15%.

b. When we switch from the consumption of coffee raw materials to the number of coffee cups, we use a common equation in the industry: a cup of coffee consumes an average of 12g coffee beans, which is obtained by Yiou think-tank through desktop research and interviews with industry experts.

c. According to the pricing of freshly ground coffee in the market, Yiou think tank assumes three average coffee unit prices, which are divided into three scenarios: 35 yuan / cup, 30 yuan / cup and 25 yuan / cup.

Calculation of the scale of China's current Mill Coffee consumption Market

According to the above calculation logic, Yiou think tank calculates that under the condition that freshly ground coffee accounts for 15% of coffee bean consumption, the variable range of China's freshly ground coffee consumption market in 2017 is 46.9 billion yuan to 65.6 billion yuan. The International Coffee Organization estimates that the consumption of China's coffee market will grow by 15% and 20%, so the size of China's freshly ground coffee market is expected to exceed 100 billion yuan in 2019.

Under the condition that freshly ground coffee accounts for 20% of coffee bean consumption, the variable range of China's freshly ground coffee consumption market in 2017 is 62.5 billion yuan to 87.5 billion yuan. Assuming a growth rate of 15% mi 20%, it is optimistically expected that the size of China's freshly ground coffee market is expected to sprint 150 billion yuan in 2019.

What is the share of Starbucks vs Luckin Coffee in China's freshly ground coffee market?

Based on the above projections and growth rates, we estimate that China will sell about 2.8 billion cups of freshly ground coffee a year in 2018, with a variable range of 2.5 billion-3 billion cups of freshly ground coffee.

Starbucks' business model is more mature. According to Starbucks' financial report, Starbucks (China) has an annual operating income of 19 billion yuan in fiscal year 2018, and Starbucks (China) sells about 13.9 billion yuan in current coffee sales. Starbucks (China) sells about 400 million cups of coffee a year, accounting for about 15% of China's freshly ground coffee market.

Starting from December 5, 2017, Luckin Coffee's official account shows that there are already stores open. On January 14, 2019, Luckin Coffee officially announced that coffee sales had exceeded 100 million cups. If we calculate on the basis of 100m cups sold in a year, Luckin Coffee accounts for at most 4 per cent of the market share.

END

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Fresh coffee scam! Fresh coffee = fresh coffee? You don't understand the tricks behind freshly ground coffee!

Professional coffee knowledge exchange More coffee bean information Please pay attention to coffee workshop (Weixin Official Accounts cafe_style) With the further deepening of consumption upgrading, consumers are becoming more and more mature and picky. Quality replaces price as the most important factor for some consumers. Consumers are increasingly demanding freshness, juice needs to be freshly squeezed, bread needs to be freshly baked, coffee

- Next

The World Coffee producers Forum calls for immediate and serious action on coffee prices

For more information on coffee beans, please follow the Coffee Workshop (official Wechat account cafe_style) recently, the World Coffee producers' Forum issued an official declaration calling for immediate and serious action on historically low international coffee prices. The declaration lists 13 groups of coffee producers, including the National Coffee Federation of Colombia (FNC). Send it in Colombia

Related

- What brand of black coffee is the most authentic and delicious? what are the characteristics of the flavor of the authentic Rose Summer Black Coffee?

- Introduction to the principle and characteristics of the correct use of mocha pot A detailed course of mocha pot brewing coffee is described in five steps.

- Which is better, decaf or regular coffee? how is decaf made?

- How much is a bag of four cat coffee?

- How about four Cat Coffee or Nestle Coffee? why is it a cheap scam?

- Which is better, Yunnan four Cats Coffee or Nestle Coffee? How about cat coffee? is it a fake scam? why is it so cheap?

- How about Cat Coffee? what grade is a hoax? which instant coffee tastes better, four Cat Coffee, Nestle Coffee or G7 coffee?

- Process flow chart of coffee making-Starbucks coffee making process what coffee tastes good at Starbucks

- The top ten best coffee beans in the world Rose summer coffee or Tanzanian coffee tastes good

- Yunnan four cat coffee is good to drink?_four cat coffee is a big brand? four cat blue mountain coffee is fake?