Ruixing coffee successfully listed in the United States, burning money mode can continue?

Professional coffee knowledge exchange More coffee bean information Please pay attention to coffee workshop (Weixin Official Accounts cafe_style)

SHANGHAI-There's one way to compete with Starbucks for coffee: Pay customers.

As an unprofitable startup, Luckin Coffee offers lots of freebies and deep discounts, and only emerged less than two years ago in China's coffee market, which has long been dominated by Starbucks. With the help of smartphone apps that order coffee with a few clicks, it has gained nearly 17 million customers and opened 2370 stores.

On Friday, U.S. equity investors had a chance to buy into this fast-growing, but also fast-burning, model. Luckin rose 20 percent on its first day of trading on the New York Stock Exchange after an initial public offering valued the company at about $4 billion.

Luckin is proof that there is still some old-fashioned glamour in china's flagging tech start-up landscape.

In recent years, new Chinese companies have emerged, raising and burning capital at a pace that Silicon Valley is ashamed of. Bike-sharing startups emerged overnight, flooding cities with tens of millions of colorful pile-free bikes. The boom in online dining and retail delivery has swarmed the streets of Beijing and Shanghai with uniformed delivery workers wearing beet-yellow or blue helmets, the colors of the two biggest takeout companies.

As china's economy slows and tech companies start to run out of cash, many have scaled back and some have collapsed.

"It takes time for these companies to turn a profit," said Ringo Choi, managing partner in China at EY, a consultancy. "Not all companies can be the next Amazon, and not all companies have the infrastructure to survive."

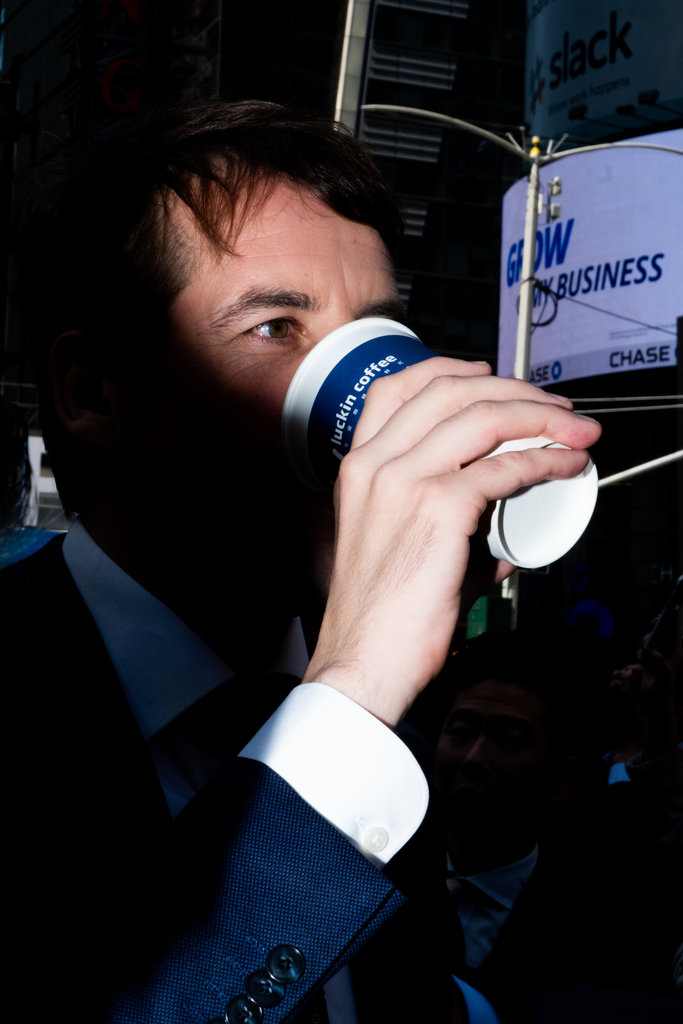

Luckin Coffee's IPO values the company at about $4 billion. LUCIA BURICELLI FOR THE NEW YORK TIMES

Lucky hopes to break this trend and challenge Starbucks to become the hegemon in this tea drinking country that started enjoying coffee relatively late. Seattle-based coffee chain starbucks accounts for more than half of china's coffee and specialty tea market, according to Euromonitor International, a market-research firm. Euromonitor estimates that by the end of 2018, Luckin's market share was just over 2%.

But the growth opportunities are enormous. In just four years, euromonitor says, china's specialty tea and coffee market has grown from $2.7 billion to $4.8 billion in revenue. The market remains fragmented. Starbucks is followed by McCafe, owned by McDonald's, which has just 5 percent of the market.

Ruixing has developed rapidly since its establishment at the end of 2017. It was founded by entrepreneur Qian Zhiya and backed by several Chinese, US and Singapore investment firms, including BlackRock. Luckin plans to add stores by the end of this year to become China's largest coffee chain network, surpassing Starbucks, which has 3600 stores in China.

Maintaining that growth depends largely on Luckin retaining customers. On social media, some rave about its cheap and convenient coffee. They praised Luckin for introducing a variety of specialty drinks catering to Chinese consumers, such as a tea concoction called guava cheese ruby tea.

Others scoff at its taste, saying its coffee is just a pricey version of convenience store poor-quality coffee.

Liu Zhiyan, 34, walks to Ruixing near her office several times a week for a cup of coffee. "Lucky is a little lacking, and the taste is somewhat less intense than Starbucks," Liu said. She used to drink Starbucks once a week, but now buys coffee more often because Lucky's coffee is cheaper.

Beijing lucky coffee delivery. To compete with Starbucks in China, Lucky focuses on home delivery and deep discounts. WANG ZHAO/AGENCE FRANCE-PRESSE - GETTY IMAGES

"After all, the price is there," Ms. Liu said. "You get what you pay for."

A spokesman for Lucky declined to comment ahead of the company's Nasdaq listing, citing a quiet period ahead of the listing.

Luckin Coffee is priced similar to Starbucks coffee, but offers significant discounts. Most espresso based coffees cost between $3.50 and $4, but with daily discounts of 50 percent or more, customers rarely pay full price. Lucky gives new subscribers to its app their first cup of coffee for free, and recommends the app to friends to get another free cup of coffee.

Lucky also attracts coffee drinkers with big promotions, so a lot of money goes back into consumers 'wallets.

A current promotion encourages customers to consume seven or more products per week, either individually or in groups, so they can be grouped into a group of similar customers. By the end of the week, each group member has a chance to share 5 million yuan ($723,000). The company says each team member who participated in the event the previous week received $4. During the 10-week campaign, Lucky said it would give back $7 million to customers.

These offers will offset Luckin's profits, if any. Capital investment in growth resulted in a net loss of $475 million for 2018. The company has accumulated losses of $85 million so far this year.

Although both sell coffee, Luckin and Starbucks have different marketing approaches in China. Lucky relies mainly on takeout and home delivery, a popular choice in a country that likes to order food on smart phones. Luckin also operates small storefronts where customers can pick up coffee, check out the latest discounts or learn about their offers.

If Luckin's plan to sell shares in the U.S. succeeds, the unprofitable, untested company could be worth as much as $4 billion. ROMAN PILIPEY/EPA, VIA SHUTTERSTOCK

Starbucks, by contrast, often offers spacious storefronts that are perceived as comfortable places to hang out, escape inquisitive parents or crowded family quarters. Its green and white logo carries a sense of good living in China and has won many loyal Chinese customers.

"I've never been to Lucky," said Mr. Zhang, a recent college graduate who drinks coffee three times a week. "I'm loyal to Starbucks because they have great loyalty rewards programs."

advertising

Starbucks has expansion plans of its own, aiming to nearly double the number of stores in China by 2022. But in response to new competitors, Starbucks announced a partnership last year with e-commerce giant Alibaba to provide coffee delivery services through Alibaba subsidiary Elimeo. Starbucks representatives did not respond to requests for comment.

Lucky's next big question is how to start making money. Once the discount is removed, it is unclear whether customers who prefer Luckin's discounted coffee will be willing to pay full price.

For Owen Sun, 31, who works in product placement for a luxury company, Lucky provides instant coffee when he is too busy to get away. But he's not a dedicated consumer. He was waiting in a long line outside a Shanghai cafe called Manner the other day.

"To be honest, Starbucks is probably a little better in all aspects of packaging," Sun said. "If [Lucky] was 27 bucks, I might buy Starbucks."

END

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Cuban coffee Cubita Amber Coffee unique Caribbean flavor coffee

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style) Cuban coffee in 1748, coffee was introduced to Cuba from Domiga, since then Cuba began to grow coffee. As an important social tool, Cuban coffee is common in American coffee, but Cuban coffee with typical exotic island flavor is not really ancient.

- Next

Little blue cups are cursed? Ruixing Coffee, which soared 50% on its first day of listing, fell below its issue price!

Professional coffee knowledge exchange More coffee bean information Please pay attention to coffee workshop (Weixin Official Accounts cafe_style) listed less than a week Ruixing coffee, Beijing time 22 evening fell below the issue price. According to 21st Century Business Herald 21 Financial Client, shares of Ruixing Coffee (NASDAQ: LK) listed in NASDAQ were reported at $16.61 per share, down 4.1% on the day, falling below its hair.

Related

- What brand of black coffee is the most authentic and delicious? what are the characteristics of the flavor of the authentic Rose Summer Black Coffee?

- Introduction to the principle and characteristics of the correct use of mocha pot A detailed course of mocha pot brewing coffee is described in five steps.

- Which is better, decaf or regular coffee? how is decaf made?

- How much is a bag of four cat coffee?

- How about four Cat Coffee or Nestle Coffee? why is it a cheap scam?

- Which is better, Yunnan four Cats Coffee or Nestle Coffee? How about cat coffee? is it a fake scam? why is it so cheap?

- How about Cat Coffee? what grade is a hoax? which instant coffee tastes better, four Cat Coffee, Nestle Coffee or G7 coffee?

- Process flow chart of coffee making-Starbucks coffee making process what coffee tastes good at Starbucks

- The top ten best coffee beans in the world Rose summer coffee or Tanzanian coffee tastes good

- Yunnan four cat coffee is good to drink?_four cat coffee is a big brand? four cat blue mountain coffee is fake?