Coca-Cola's New Coffee Strategy after large-scale acquisition of Costa China is still an important market

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style)

Following the alliance between Nestl é and Starbucks, Coca-Cola's large-scale acquisition of Costa has attracted a lot of attention.

I believe you also want to know, after Coca-Cola takes Costa into the bag, what will happen next? Snack Dai learned that shortly after the official announcement on Friday, Coca-Cola held a communication meeting for investors, and James Kunjie, the company's global CEO, responded to the question in detail.

In addition, he talked about Coca-Cola's overall coffee strategy and responded to many sharp questions from analysts about Coca-Cola's confidence in a retail format it has never set foot in, and whether the Costa valuation is too high.

Tonight, the snack generation will bring you to know more about it.

Coffee strategy

"this is a coffee strategy, not a retail strategy." Zhan Kunjie repeated this sentence at the meeting.

In Coca-Cola's view, on the one hand, the coffee category is growing rapidly around the world; on the other hand, its leading ready-to-drink coffee market segment can no longer satisfy its appetite. Like Nestl é, Coca-Cola is determined to increase its "coffee" business and its choice is to expand into more segments.

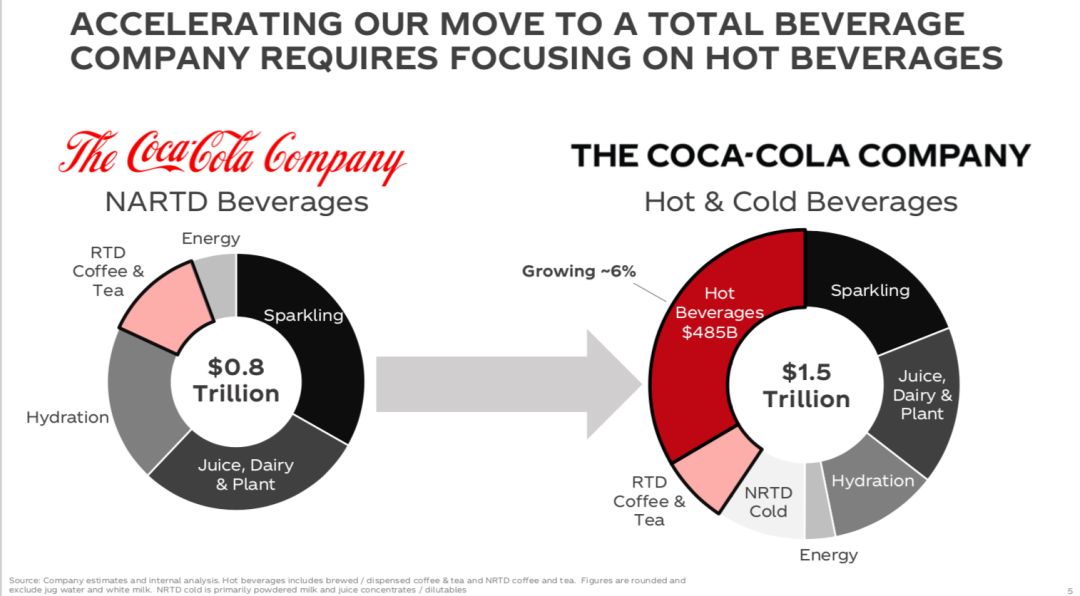

Zhan Kunjie said at the meeting that the size of the non-alcoholic ready-to-drink industry is $800 billion (about 5.46 trillion yuan), and Coca-Cola as a whole has a strong market share. When looking to the future, we can see that young millennials are interested in beverages, the commercial beverage market continues to grow, they are willing to spend money on the right beverages, and they want a greater variety of choices.

"so of course, we are expanding our vision beyond non-alcoholic ready-to-drink drinks, and the obvious logical next step is cold and hot drinks." "when you join this segment, the overall market size in which we can make a difference increases from $800 billion to $1.5 trillion (about 10.23 trillion yuan); the hot drinks market is large and revenue growth is about 6 per cent," he said. "

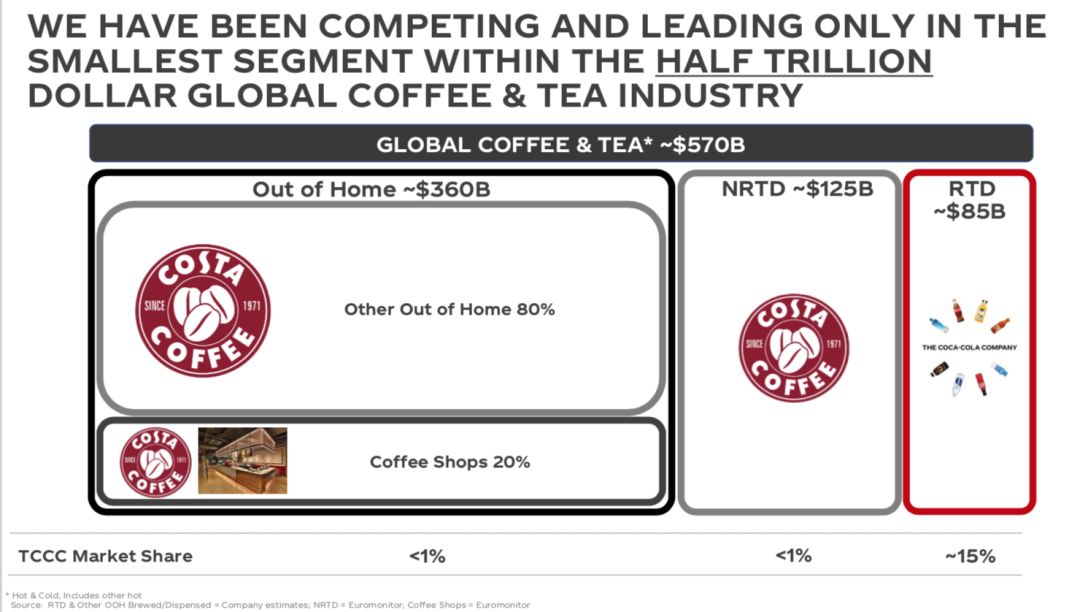

So how can Coca-Cola expand its coffee business? The company divides the coffee market into four formats, and what it wants to do is full coverage.

These four parts are: outdoor coffee business, of which about 20% are coffee shops; 80% are other outdoor instant consumption channels, representing most outdoor consumption channels; followed by non-ready-to-drink categories, mainly at home; and finally, ready-to-drink coffee. Coca-Cola accounts for about 15% of the total.

"simply put, coffee consumption can be divided into the above four styles. The reality is that we have been competing and taking the lead in a smaller segment of the entire coffee market. "

"We see an opportunity for global brands to reach these four segments of the coffee market, and they can work in synergy with each other." Zhan Kunjie said.

Costa platform

Coca-Cola has repeatedly stressed that Costa is a platform, not just a brand. So, as a platform, what can Costa bring to Coca-Cola?

Zhan Kunjie showed investors four models of concentric circles.

First of all, there is a coffee shop. "We need a brand and coffee expertise to build a brand while winning the coffee shop market. The point here is not to have the largest number of stores, but to have the right number of stores where we want, to create a profitable brand, and then to create synergy in the four coffee segments. " He said.

Coca-Cola plans to use retail stores to build its brand and promote the experience. "there has been a lot of discussion about the third space, and we think stores can be combined with membership systems and digitalization." Zhan Kunjie said.

The second is to provide better overall beverage solutions for Coca-Cola's existing customers and existing channels. Coca-Cola has a huge business in food services, convenience stores, retail, gas stations, cinemas and other channels, Costa's baking capabilities and vending machines and other products can access this market.

"having a coffee maker and coffee bean business can help us win direct consumption channels. For these customers, we will become a better full range of beverage partners. We can also expand our ready-to-drink supply capacity, whether hot or cold. " Zhan Kunjie said.

Finally, Coca-Cola is targeting new consumer situations at home. Zhan Kunjie believes that with Coca-Cola's existing market insight and capabilities, it is possible to launch ready-to-drink drinks, including cold and hot drinks, expand Costa's family solutions, and even expand the brand to adjacent categories.

"it can be combined with Coca-Cola's global operations to win all four parts of the coffee business." Zhan Kunjie said.

He added that Coca-Cola will not try to promote all four parts at the same time in all parts of the world, but will focus on it.

"therefore, Costa is a brand, a platform, and a set of capabilities that can expand on a global scale. By combining Costa's capabilities with Coca-Cola's marketing expertise and global influence, both sides have the opportunity to create great value. " Zhan Kunjie said.

Semi-independent operation

Snack Dai noticed that some analysts asked at the meeting that retail catering and ready-to-drink drinks are very different businesses. "what makes Coca-Cola confident that it can operate the retail business and compete with other operators?" especially when these competitors are really focused on retail. "

"first of all, we admit that the retail format is indeed completely different." Mr Zhan responded that retail might have a higher proportion of capital expenditure than soft drinks, but he said it was not a capital-intensive business because Costa stores were leased and leases were relatively short.

Operationally, he said, Coca-Cola's strategy is simple: to retain and set aside the right location for existing managers to run the retail format. "because they are doing very well in this respect and know what they are doing. If they need to recruit more talent in the process of expansion, they will also do a good job. "

This is also the M & An experience that Coca-Cola has gained over the years. In many cases, when the business it acquires is different from the underlying business, the company chooses to "connect but not integrate into one" (connected but not integrated).

"this is our core guiding principle." Zhan Kunjie said.

In other words, Coca-Cola does not try to integrate the acquired business into the general business, but focuses on keeping it growing and making a difference where it is connected to the underlying business. "this is where we will create the greatest value." Zhan Kunjie said that Coca-Cola deeply understands where the differences between the two sides are, and they need to be preserved and properly handled.

Subsequently, analysts asked whether Costa would operate independently. "as independent as Coca-Cola's VEB department? Or is it that the retail stores are independent and the brands themselves are integrated? "

Mr Zhan says the important thing is not to adapt Costa to the existing system, but what Coca-Cola should do to win the market it wants.

"the channel structure is different in different markets, so there will not be a common answer, and slightly different approaches are needed in different countries around the world. Overall, will it be integrated, will it be similar to VEB, or will it be somewhere in between? I would say it is somewhere in between. " He said.

Set foot in for the first time

Snack Dai pointed out last week that this is the first time in the history of the beverage giant Coca-Cola to enter the coffee chain catering industry. At the meeting, some analysts asked: "Why does Coca-Cola do retail now?" This is something your company has not explored in the past. I want to know what has changed and why now is the right time. "

Zhan Kunjie reiterated that this is a coffee strategy, not a retail strategy, although retail stores are part of the coffee strategy.

"I don't think it means that we didn't get involved in retailing before, but now we want to do it. This is a coffee strategic layout based on four pillars, and retail is part of it, and we will make sure that we bring in the right people to manage retail. " He said.

Zhan Kunjie said that sometimes, to provide consumers with a wide variety of drinks, it is necessary to introduce new capabilities, just as Coca-Cola did not make cold drinks before, but now it has widely distributed cold drinks.

While Coca-Cola thinks now is a good time to expand its coffee portfolio, it doesn't want to start with its first coffee shop. "We're not going to start from scratch," Mr. Zhan said. The best way for Coca-Cola to do is to acquire regional leaders in this category and expand it globally.

Overvalued?

However, the acquisition has also raised a lot of questions. For example, why doesn't Coca-Cola want to expand its coffee business by buying Costa instead of doing it itself? In addition, some analysts questioned the overvaluation of Costa at the meeting.

Zhan Kunjie explained that around the world, Coca-Cola has actually made some attempts in non-instant coffee. "but frankly, we don't have the ability and platform to do it well, which is why we want to buy Costa. It requires a wider range of capabilities than many other categories. " He said.

So Coca-Cola decided to find a business that is successful regionally and has global potential, and has all the capabilities it needs to win as a global platform, but it hasn't achieved it yet-- the company believes that this is the opportunity for the Coca-Cola system to create value that can help it go global.

"they can solve things that we can't do. We haven't been able to build this business successfully, or we don't have the patience, energy and dedication to do it, or we don't want to invest resources but lose money. We hope to do it all at once, and the acquisition of Costa is a shortcut to achieve it. " Zhan Kunjie said.

As to whether the valuation is reasonable, Mr Zhan said Coca-Cola had to pay a control premium to acquire assets and Whitbread would not sell it without a control premium. "No one would do that".

"in the end, it's a win-win for us and Webber." "of course, they got a lot of benefits, and I think they are satisfied with the valuation," Mr. Zhan said. What we need to do is to accept the price, although we need to pay a control premium and promote more synergies that we can do. "

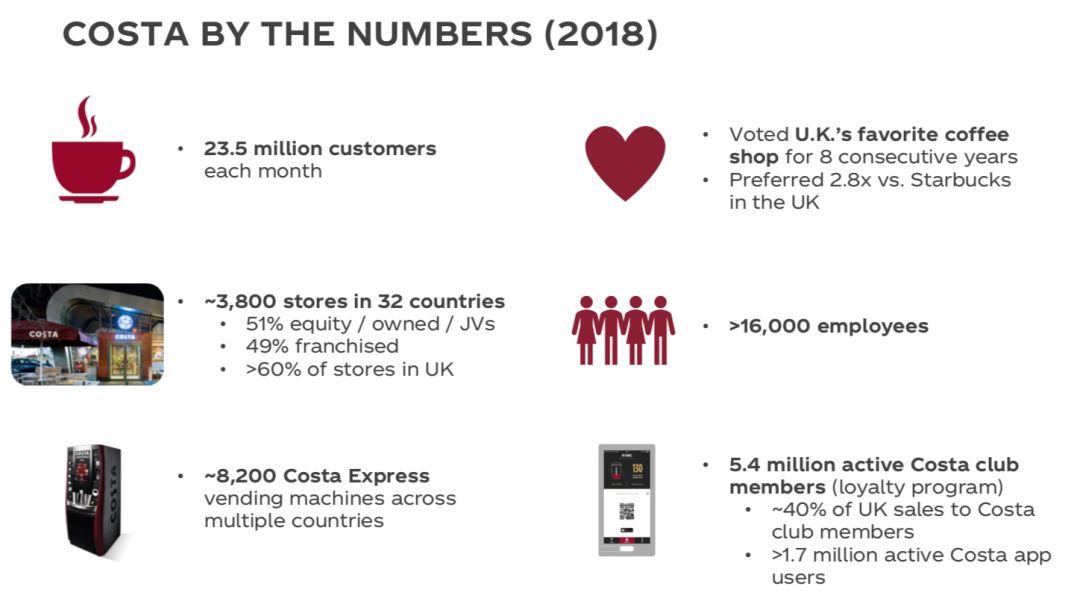

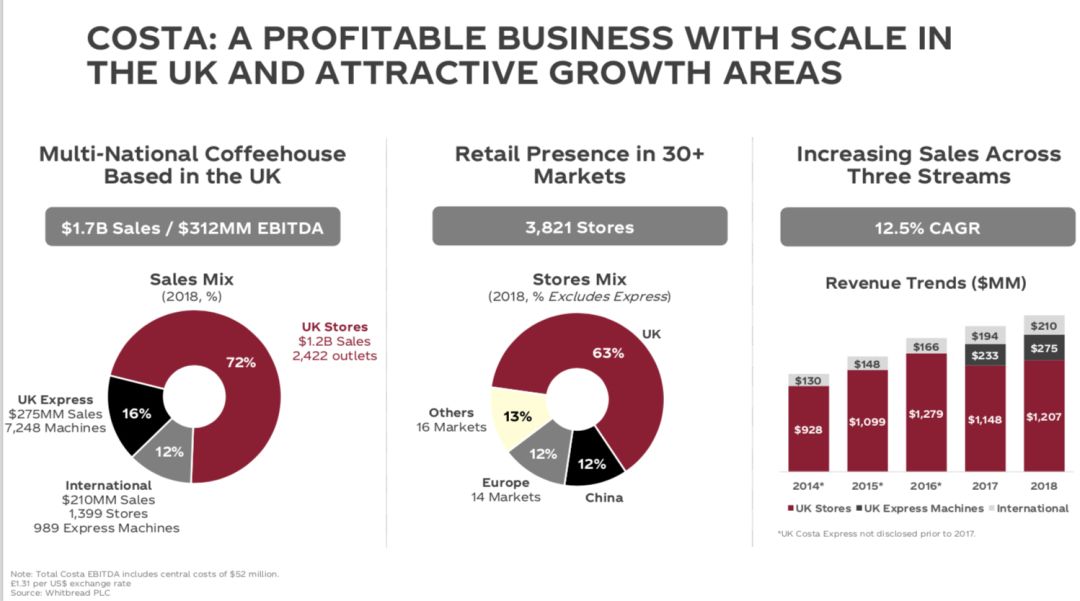

The snack generation has learned that Costa's income has grown by just over 12% in recent years. The coffee chain has identified China as its main international growth market.

Costa now has 449 stores in China, with a target of 1200 by 2022-well below Starbucks' target of 6000 stores in the same period, according to the 2017 results. However, considering that the enterprise value of Costa (based on the price paid by Coca-Cola) accounts for only 7% of Starbucks' market capitalization, this is still an ambitious goal.

Zhan Kunjie said that Coca-Cola has a global scale and the ability and place to expand Costa faster, while Webber cannot do so. With a premium on control, Coca-Cola's acquisition of Costa is still a worthwhile deal that can achieve more benefits around the world.

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

The price of coffee and raw beans fell sharply in 2018, reaching a new low of 10 years.

Professional coffee knowledge exchange more coffee bean information follow Coffee Workshop (Wechat official account cafe_style) as traders withdraw from commodity markets in search of safer assets, sugar and coffee prices have fallen to their lowest level in more than a decade. Sugar futures on the Interstate Futures Exchange fell 1.17% to 10.18 cents a pound on Friday, the lowest closing level since June 2008.

- Next

How about Hougu Coffee? does Hougu Coffee taste good? Hougu Coffee has suddenly entered the national market.

Professional coffee knowledge exchange more coffee bean information please follow coffee workshop (Wechat official account cafe_style) recently, Hougu Coffee announced in Kunming: in 2017, it will recruit 1500 sales elites across the country, and set up sales companies in major cities across the country to cooperate with local channels to formally enter the national coffee consumption market.

Related

- What brand of black coffee is the most authentic and delicious? what are the characteristics of the flavor of the authentic Rose Summer Black Coffee?

- Introduction to the principle and characteristics of the correct use of mocha pot A detailed course of mocha pot brewing coffee is described in five steps.

- Which is better, decaf or regular coffee? how is decaf made?

- How much is a bag of four cat coffee?

- How about four Cat Coffee or Nestle Coffee? why is it a cheap scam?

- Which is better, Yunnan four Cats Coffee or Nestle Coffee? How about cat coffee? is it a fake scam? why is it so cheap?

- How about Cat Coffee? what grade is a hoax? which instant coffee tastes better, four Cat Coffee, Nestle Coffee or G7 coffee?

- Process flow chart of coffee making-Starbucks coffee making process what coffee tastes good at Starbucks

- The top ten best coffee beans in the world Rose summer coffee or Tanzanian coffee tastes good

- Yunnan four cat coffee is good to drink?_four cat coffee is a big brand? four cat blue mountain coffee is fake?